$BTC: Few experiments with @glassnode's liquidity-supply metrics that were recently published, shown below (as of Jan. 3).

1/ A brief thread...

1/ A brief thread...

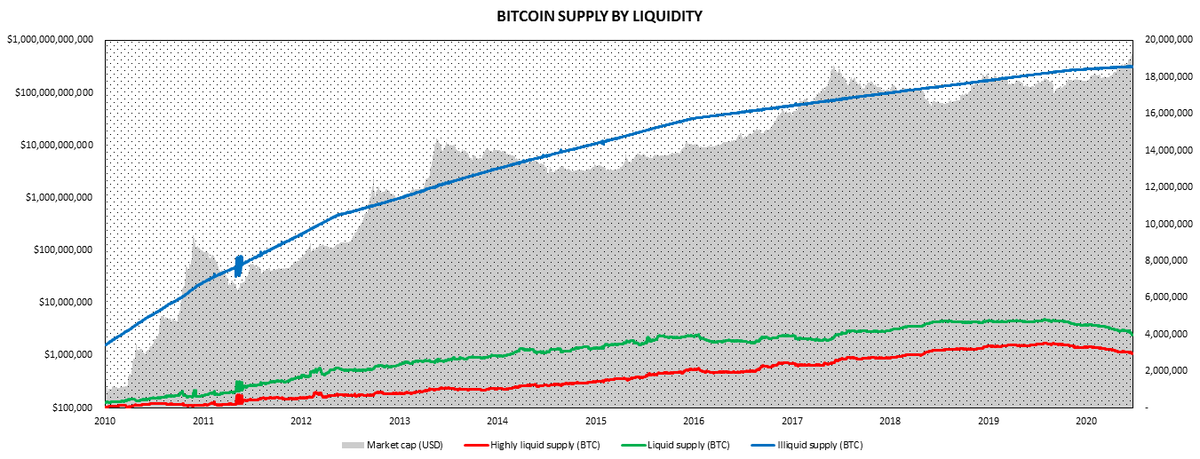

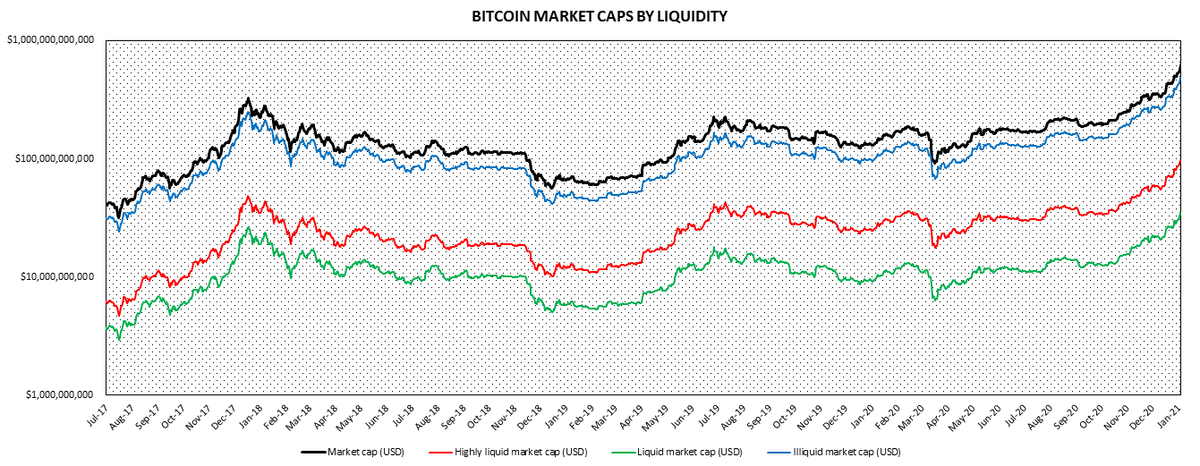

2/ First, a look of market caps by liquidity, which serve as different versions of @coinmetrics's free-float market cap, based on alternate heuristics.

Market cap: 610 billion.

Illiquid market cap: 487 billion.

Liquid market cap: 34 billion.

Highly liquid market cap: 97 billion

Market cap: 610 billion.

Illiquid market cap: 487 billion.

Liquid market cap: 34 billion.

Highly liquid market cap: 97 billion

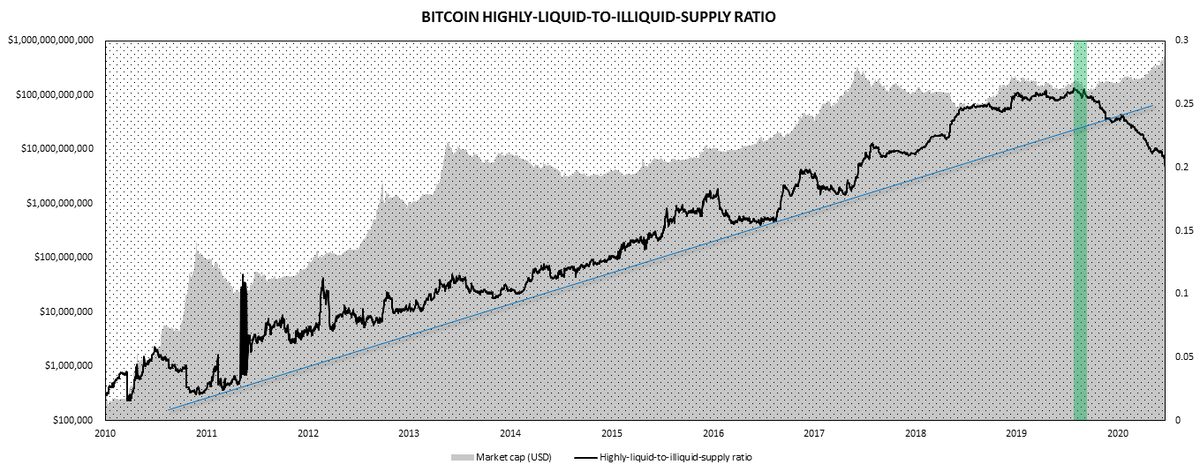

3/ Next, a ratio dividing highly liquid supply by illiquid supply, showing a major inflection point after the COVID panic. Since then, the number of illiquid coins relative to the most liquid coins has increased to an extent never seen before in the history of Bitcoin.

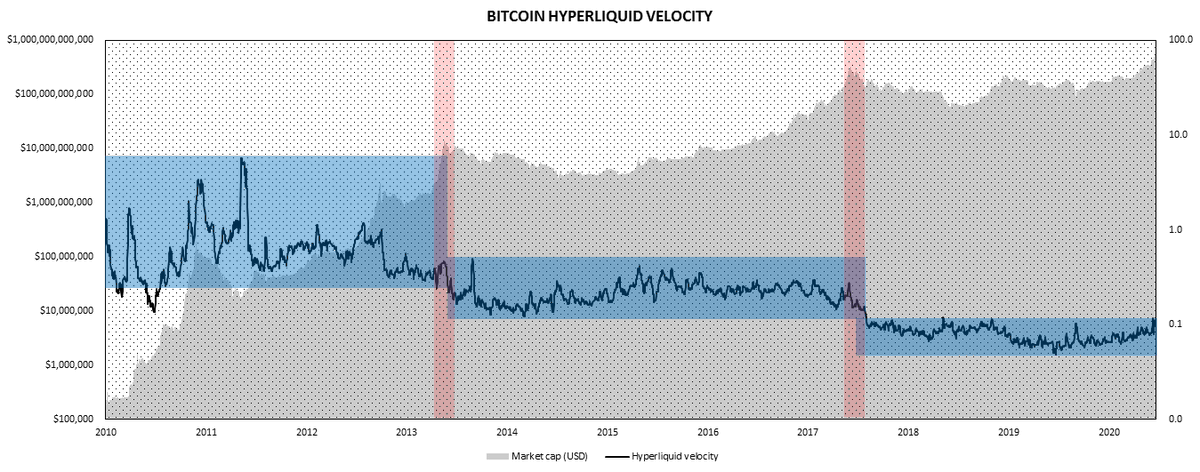

4/ Hyperliquid velocity, calculated by dividing entity-adjusted volume by highly liquid supply. Notice how it has consistently gone down since Bitcoin's inception, with significant drops after every cycle top.

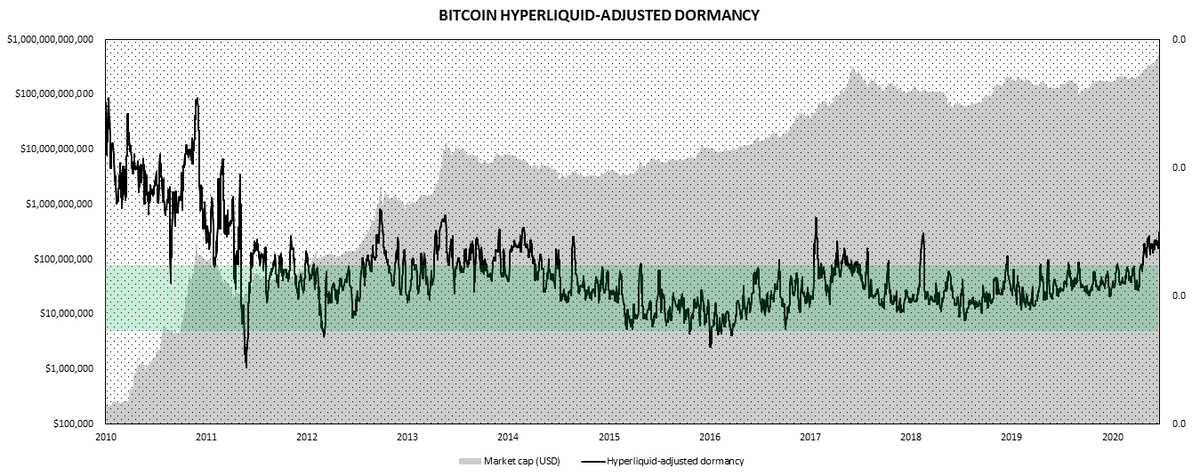

5/ Finally, hyperliquid-adjusted dormancy, calculated by dividing entity-adjusted dormancy by highly liquid supply. Current spike denotes that the bull market is in full effect.

Read on Twitter

Read on Twitter