Time for 2021 predictions !

!

2021 is certainly starting with a bang with #BTC above $30k and #ETH crossing $1k. Some macro trends are emerging and will play out in 2021. Thread below

above $30k and #ETH crossing $1k. Some macro trends are emerging and will play out in 2021. Thread below

!

!2021 is certainly starting with a bang with #BTC

above $30k and #ETH crossing $1k. Some macro trends are emerging and will play out in 2021. Thread below

above $30k and #ETH crossing $1k. Some macro trends are emerging and will play out in 2021. Thread below

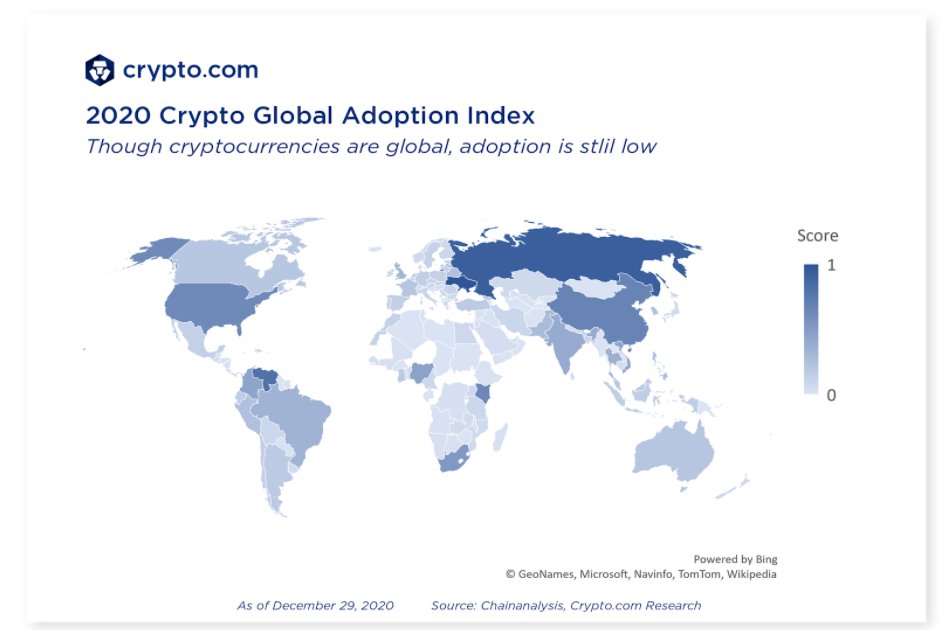

1/ Crypto Mass Adoption: It did not take many new entrants to send #bitcoin  to all-time high in 2020. With trillions of dollars

to all-time high in 2020. With trillions of dollars  sitting on the sidelines from retail and institutional investors alike, it is really just the beginning for #crypto #adoption!

sitting on the sidelines from retail and institutional investors alike, it is really just the beginning for #crypto #adoption!

to all-time high in 2020. With trillions of dollars

to all-time high in 2020. With trillions of dollars  sitting on the sidelines from retail and institutional investors alike, it is really just the beginning for #crypto #adoption!

sitting on the sidelines from retail and institutional investors alike, it is really just the beginning for #crypto #adoption!

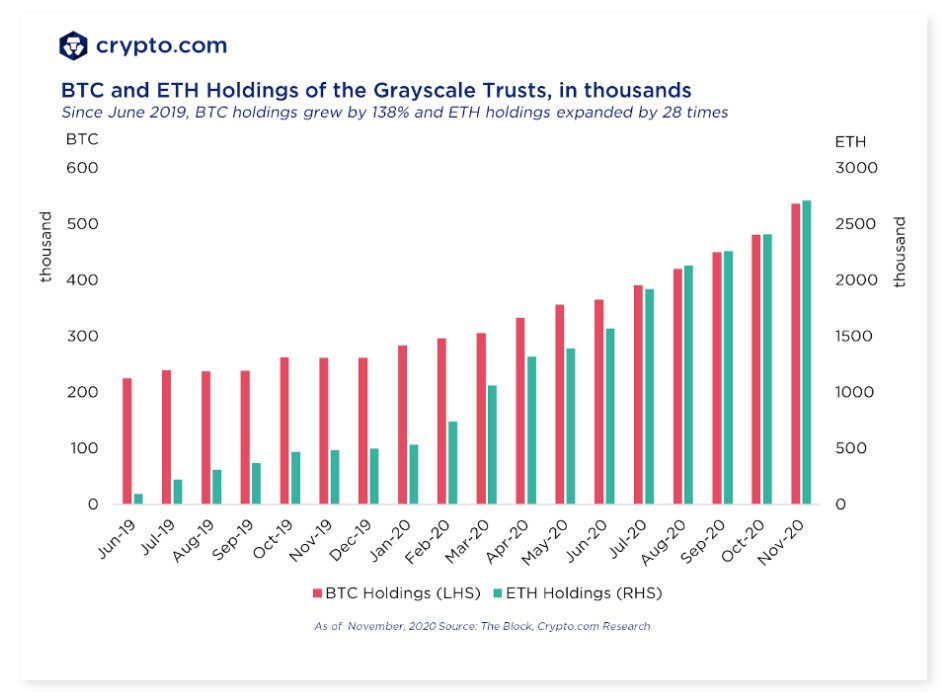

2/ Growth of Institutional Crypto Brokerages/Custodians and Asset Managers: Institutions  will turn towards institutional facilitators when entering the crypto markets, while others will choose asset managers like Grayscale.

will turn towards institutional facilitators when entering the crypto markets, while others will choose asset managers like Grayscale.

will turn towards institutional facilitators when entering the crypto markets, while others will choose asset managers like Grayscale.

will turn towards institutional facilitators when entering the crypto markets, while others will choose asset managers like Grayscale.

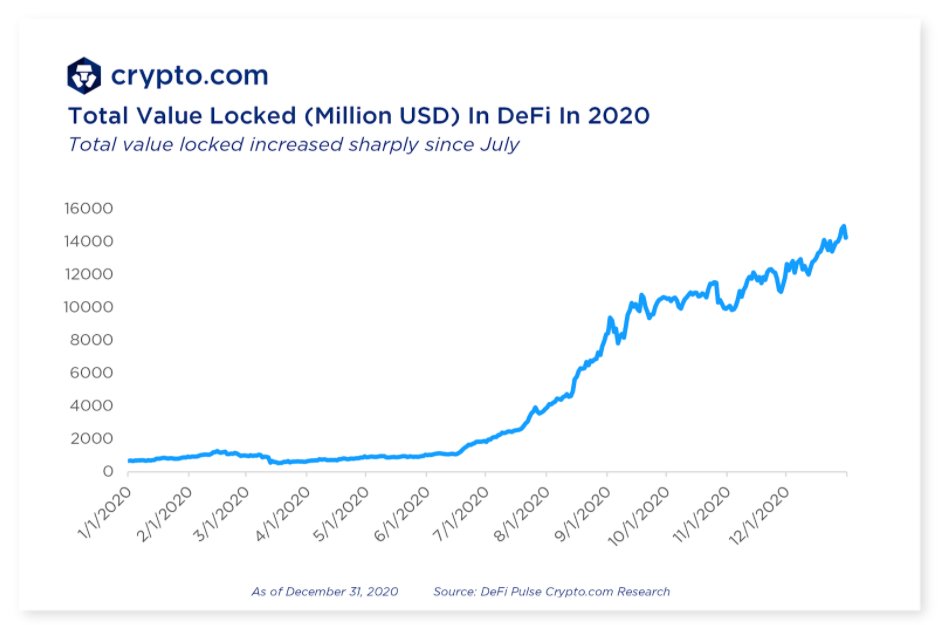

3/ Continued Growth in DeFi: DeFi will continue to grow significantly in 2021  , and the TVL will increasingly be captured by aggregators and decentralized asset managers (like #DeFi Earn), which offer the ability for investors to set-and-forget their investments.

, and the TVL will increasingly be captured by aggregators and decentralized asset managers (like #DeFi Earn), which offer the ability for investors to set-and-forget their investments.

, and the TVL will increasingly be captured by aggregators and decentralized asset managers (like #DeFi Earn), which offer the ability for investors to set-and-forget their investments.

, and the TVL will increasingly be captured by aggregators and decentralized asset managers (like #DeFi Earn), which offer the ability for investors to set-and-forget their investments.

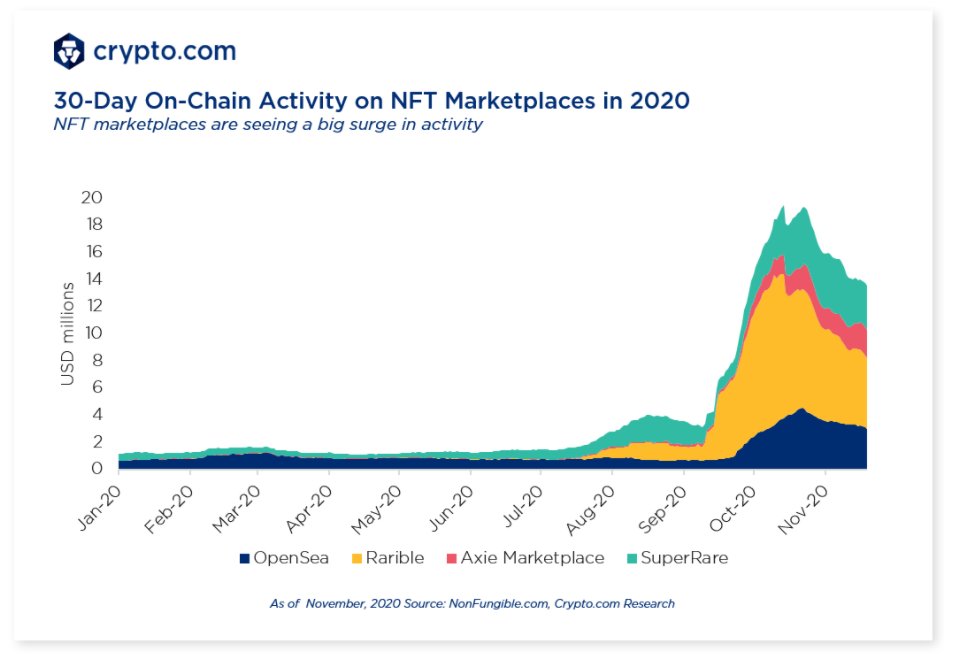

4/ NFTs - Art, Collectibles, and the Tokenization of Everything: We believe #NFTs, especially digital collectibles and art  , will continue to trend upwards as creators join in and new platforms emerge. More to share on this space soon!

, will continue to trend upwards as creators join in and new platforms emerge. More to share on this space soon!

, will continue to trend upwards as creators join in and new platforms emerge. More to share on this space soon!

, will continue to trend upwards as creators join in and new platforms emerge. More to share on this space soon!

5/ Smart Contract Chain Scalability: ETH continues to be the platform to watch, especially layer 2 solutions.

We expect some of the activity to migrate to alternative chains with strong #ecosystems, and at an accelerated pace if #scalability solutions fail to deliver on ETH.

We expect some of the activity to migrate to alternative chains with strong #ecosystems, and at an accelerated pace if #scalability solutions fail to deliver on ETH.

6/ Growth in Global Regulatory Frameworks: As crypto becomes more mainstream, we should expect further regulation for all custodial players in the crypto industry and the first attempts to regulate non-custodial players (esp. via the Travel Rule).

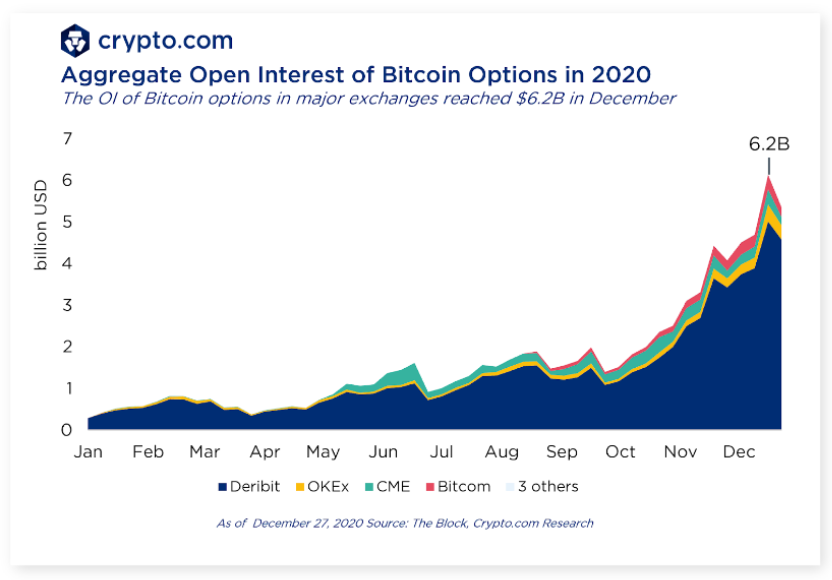

7/ Crypto Options Will Finally Hit the Big Time: An ancillary storyline for the institutional adoption of crypto is that crypto derivatives will see a tremendous growth, in particular we anticipate an explosion in crypto #options.

An exciting year ahead for the world and for crypto!

As the fastest-growing regulated player in the space, http://Crypto.com will continue to drive the industry forward and power our retail & institutional customers to achieve their full growth potential in 2021!

As the fastest-growing regulated player in the space, http://Crypto.com will continue to drive the industry forward and power our retail & institutional customers to achieve their full growth potential in 2021!

Read on Twitter

Read on Twitter