PSU banks-A value trap or a value buy?

Here is a thread on the affairs at PSU Banks

Management:-

Management is the number one parameter for analyzing banks

Every top wealth creating bank has had stability of the top management for many years

(1/10)

Here is a thread on the affairs at PSU Banks

Management:-

Management is the number one parameter for analyzing banks

Every top wealth creating bank has had stability of the top management for many years

(1/10)

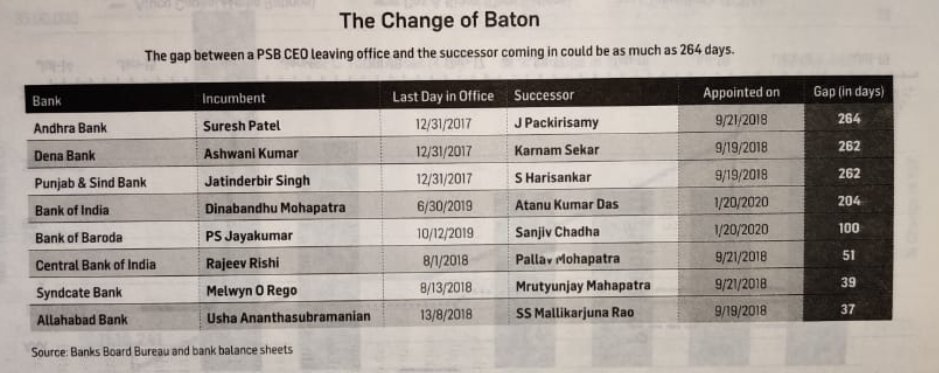

Lets talk about the change in management at top PSU banks

In the last 10 years SBI has had 4 different Chairman.

Some banks like Andhra Bank went with a top leader for 260 days.

Lack of a leader to clearly set out his vision is the biggest detriment to the PSU Banks

(2/10)

In the last 10 years SBI has had 4 different Chairman.

Some banks like Andhra Bank went with a top leader for 260 days.

Lack of a leader to clearly set out his vision is the biggest detriment to the PSU Banks

(2/10)

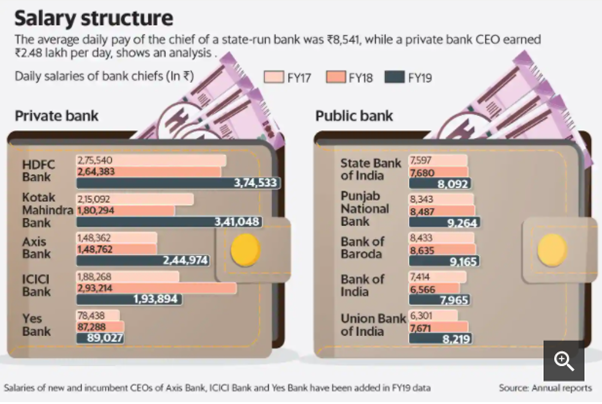

Pay structure for PSU Bank employees:-

It is no secret that PSU Bank employees are paid poorly as compared to private sector banks

As can be seen below in the poor daily pay for PSU Bank Chiefs as compared to private sector banks

(3/10)

It is no secret that PSU Bank employees are paid poorly as compared to private sector banks

As can be seen below in the poor daily pay for PSU Bank Chiefs as compared to private sector banks

(3/10)

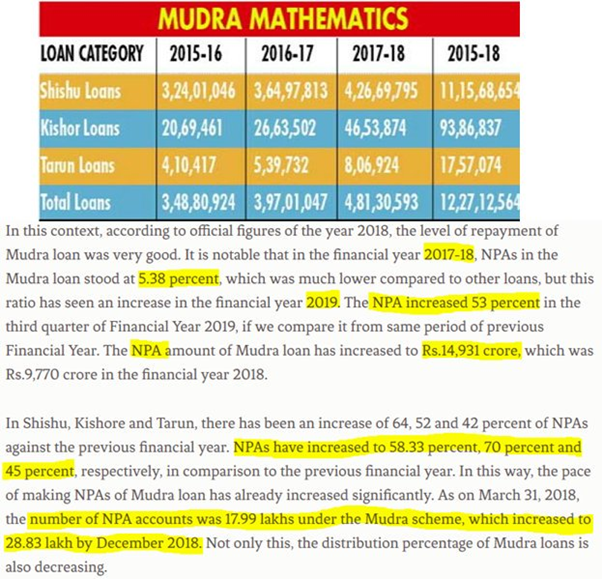

Poor lending on incremental loans:-

Mudra Loans:-

PSU banks are a major lender in the governments mudra loans

More than 60% of those loans are turning out to be NPAs as can be seen below

(4/10)

Mudra Loans:-

PSU banks are a major lender in the governments mudra loans

More than 60% of those loans are turning out to be NPAs as can be seen below

(4/10)

Agri Loans:-

As agri continues to be in stress.Banks have taken a massive hit.

SBI alone has taken a near 20,000cr.

On top of this many state governments has announce loan waivers.

PSU banks are a major lender in the agri sector.The NPAs in this sector are guaranteed.

(5/10)

As agri continues to be in stress.Banks have taken a massive hit.

SBI alone has taken a near 20,000cr.

On top of this many state governments has announce loan waivers.

PSU banks are a major lender in the agri sector.The NPAs in this sector are guaranteed.

(5/10)

Moratorium due to COVID 19:-

The poor quality of underwriting for PSU banks could be clearly seen in the morat nos.

PNB reported a loan morat of nearly 30%.

SBI reported a high morat number

RBI confirmed that the moratorium for PSU Banks was higher than Private Banks

(6/10)

The poor quality of underwriting for PSU banks could be clearly seen in the morat nos.

PNB reported a loan morat of nearly 30%.

SBI reported a high morat number

RBI confirmed that the moratorium for PSU Banks was higher than Private Banks

(6/10)

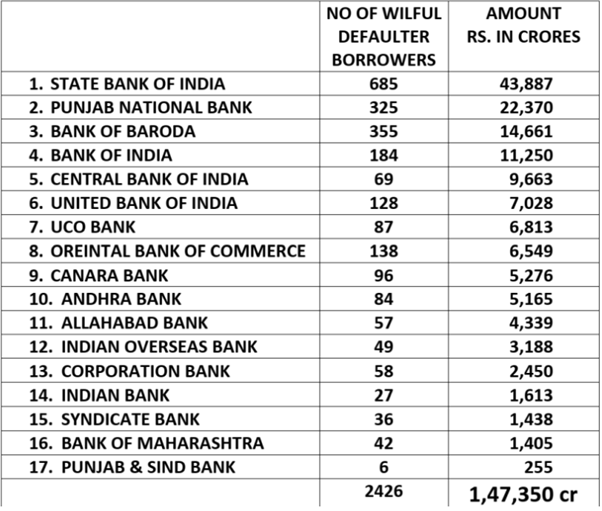

Scams:-

RBI says:-

Willful defaulters owe a massive 1.47 lakh crores to PSU Banks

No of defaults=2426....which is not a coincidence!

SBI tops the number of frauds! How will the market trust them to do normal lending?

(7/10)

RBI says:-

Willful defaulters owe a massive 1.47 lakh crores to PSU Banks

No of defaults=2426....which is not a coincidence!

SBI tops the number of frauds! How will the market trust them to do normal lending?

(7/10)

Inability to raise capital:-

Capital is the only way banks can fight the coming Tsunami of NPAs!

Private banks have raised nearly 1 lakh crores

PSU banks have failed to raise any money...in danger of breaching the minimum capital requirement under the BASEL-III norms

(8/10)

Capital is the only way banks can fight the coming Tsunami of NPAs!

Private banks have raised nearly 1 lakh crores

PSU banks have failed to raise any money...in danger of breaching the minimum capital requirement under the BASEL-III norms

(8/10)

Merger OF PSU Banks:-

Union banks merger with Andhra and Corporation bank has been a disaster.

Union bank had to absorb huge NPAs without any meaningful injection of capital.

As a time when the economy required the PSU banks the most…these banks were busy merging.

(9/10)

Union banks merger with Andhra and Corporation bank has been a disaster.

Union bank had to absorb huge NPAs without any meaningful injection of capital.

As a time when the economy required the PSU banks the most…these banks were busy merging.

(9/10)

Conclusion:-

Every Govt uses PSU banks for their own benefit.

Some concerns

-Lack of professional top management

-Poor incremental lending

-High Moratorium Numbers

-Poor capital Adequacy

Until these are solved it will be very difficult for sustainable wealth creation

(10/10)

Every Govt uses PSU banks for their own benefit.

Some concerns

-Lack of professional top management

-Poor incremental lending

-High Moratorium Numbers

-Poor capital Adequacy

Until these are solved it will be very difficult for sustainable wealth creation

(10/10)

Read on Twitter

Read on Twitter