I'll deal with this crap tomorrow. https://twitter.com/FTAlphaville/status/1346321113727586307

I'll get it over with.

First of all, they spelled "Defence" wrong.

We had a war 250 years that settled this.

Second, how can you trust an article about Yellen written by someone named "J. Powell"? Come on, man!

Hopefully I've made my case.

https://archive.vn/YEbML

First of all, they spelled "Defence" wrong.

We had a war 250 years that settled this.

Second, how can you trust an article about Yellen written by someone named "J. Powell"? Come on, man!

Hopefully I've made my case.

https://archive.vn/YEbML

"Yellen, though, is far from the only prominent central banker to have accepted high-paying gigs. Indeed exactly the same charges were levelled (at the Republican-leaning) Ben Bernanke, who served as Yellen’s predecessor."

Yes, other people are corrupt, so corruption is ok.

Yes, other people are corrupt, so corruption is ok.

The implication here is that we're picking on Janet, but we didn't pick on Ben (because he's a Republican??? That's a weird one).

Mr. Powell is correct, the press as usual mostly ignored Bernanke's blatant regulatory capture. I did not. https://twitter.com/RudyHavenstein/status/590519312277905408

Mr. Powell is correct, the press as usual mostly ignored Bernanke's blatant regulatory capture. I did not. https://twitter.com/RudyHavenstein/status/590519312277905408

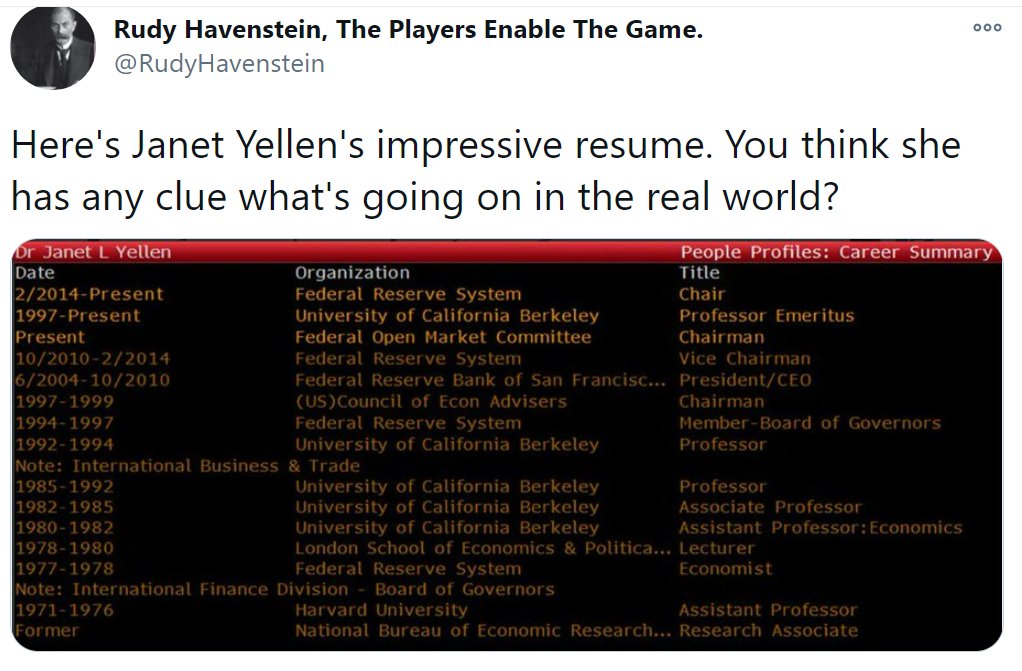

"Nor was either enriched by Wall Street prior to entering the Fed — both Yellen and Bernanke spent most of their careers in academia."

Both are worth 8-figures, having spent their lives feeding at the public trough, theorizing how people like them should micromanage our lives.

Both are worth 8-figures, having spent their lives feeding at the public trough, theorizing how people like them should micromanage our lives.

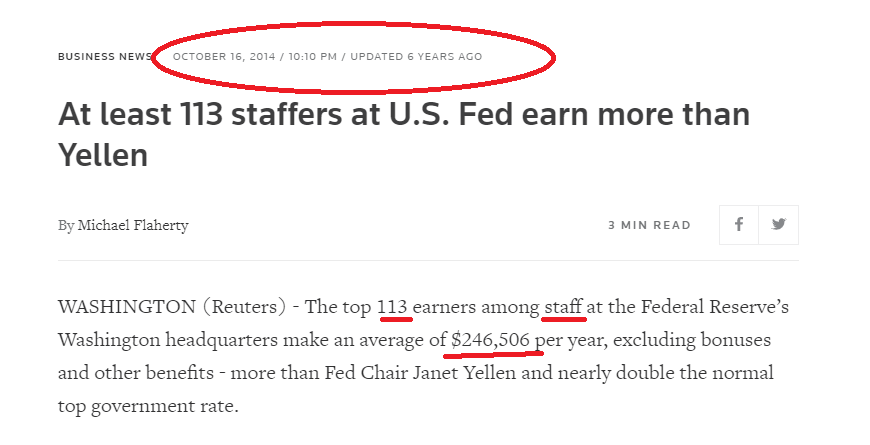

"Yellen and Bernanke were not exactly raking it in during their time at the US central bank."

Excluding their ridiculous academic pensions, both had to wait, like many regulators, until they went to work for those they regulated to pull in the big bucks.

Excluding their ridiculous academic pensions, both had to wait, like many regulators, until they went to work for those they regulated to pull in the big bucks.

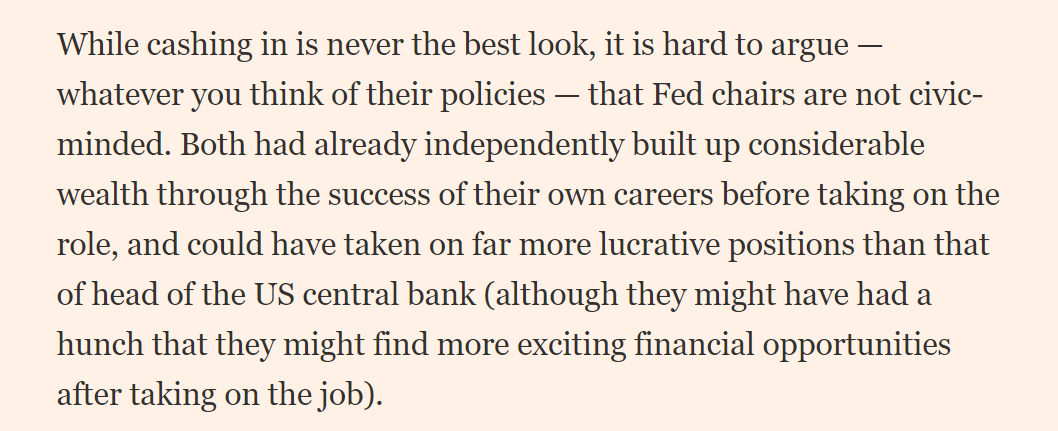

Yes, taking millions of dollars from banks you just recently were the TOP REGULATOR IN THE WORLD of is never the best look.

As for their careers, they're not Jeff Bezos. They're inbred economists who've provided intellectual cover for the kleptocracy that now rewards them.

As for their careers, they're not Jeff Bezos. They're inbred economists who've provided intellectual cover for the kleptocracy that now rewards them.

"Unlike Yellen, Helicopter Ben advised Pimco & Citadel a little a year after he left the Fed. She, meanwhile, did not take a corporate job in any form after her tenure."

This is 2-MONTHS after she left the Fed.

Maybe her "corporate job" was 'cashing in.' https://www.reuters.com/article/us-usa-fed-yellen/exclusive-yellen-gets-post-fed-payday-in-private-meetings-with-wall-st-elite-idUSKCN1HC0SI

This is 2-MONTHS after she left the Fed.

Maybe her "corporate job" was 'cashing in.' https://www.reuters.com/article/us-usa-fed-yellen/exclusive-yellen-gets-post-fed-payday-in-private-meetings-with-wall-st-elite-idUSKCN1HC0SI

Regulatory Capture #GIK, or "getting richly rewarded by the people you were just in charge of (not) regulating and might regulate in the future" is wrong, whether it's Yellen, Bernanke, Greenspan, Summers ad nauseum. I don't care what letter's after a name https://twitter.com/RudyHavenstein/status/1136300868045758466

I'm not talking about Jamie Dimon buying Yellen lunch.

I'm talking about shit like this: Citigroup, an ongoing crime-wave, paid Janet a million bucks in the last 2 years.

As Treasury Head she will no doubt remember on which side her bread is buttered. https://twitter.com/RudyHavenstein/status/1346194484900597761

I'm talking about shit like this: Citigroup, an ongoing crime-wave, paid Janet a million bucks in the last 2 years.

As Treasury Head she will no doubt remember on which side her bread is buttered. https://twitter.com/RudyHavenstein/status/1346194484900597761

If Yellen was in another field, like gender studies or evolutionary biology, I'd leave her alone, but she is the idiot savant of economics, a field that for some reason has been empowered this century as the kleptocracy's main intellectual justification. https://twitter.com/RudyHavenstein/status/1340030306095489024

Maybe it's just me, but is the suggestion here really that Yellen is going to somehow DIMINISH the role of inbred-economists like herself and make the Treasury Department our savior? What in her sordid history would give anyone that idea?

We are in for an interesting 4 years.

We are in for an interesting 4 years.

Imagine, Yellen's only regret at the Fed was not spiking your cost of living more.

Janet Yellen and her ilk are a clear and present danger to 90% of America, and I will continue to treat them as such.

https://www.cnbc.com/2017/12/13/yellens-only-regret-as-fed-chair-low-inflation.html

Janet Yellen and her ilk are a clear and present danger to 90% of America, and I will continue to treat them as such.

https://www.cnbc.com/2017/12/13/yellens-only-regret-as-fed-chair-low-inflation.html

So Janet Yellen became Fed Chair Feb. 3, 2014, & left Feb. 3, 2018.

Her legacy: Distribution of Household Wealth

Q1 2014:

Top 1% 50.3%

Next 9%: 35.6%

Next 40%: 13.3%

Bottom 50%: 0.8%

Q1 2018:

Top 1% 52.4%

Next 9%: 35.5%

Next 40%: 11.5%

Bottom 50%: 0.6%

https://www.federalreserve.gov/releases/z1/dataviz/dfa/distribute/chart/#quarter:121;series:Corporate%20equities%20and%20mutual%20fund%20shares;demographic:networth;population:1,3,5,7;units:shares;range:1989.3,2020.3

Her legacy: Distribution of Household Wealth

Q1 2014:

Top 1% 50.3%

Next 9%: 35.6%

Next 40%: 13.3%

Bottom 50%: 0.8%

Q1 2018:

Top 1% 52.4%

Next 9%: 35.5%

Next 40%: 11.5%

Bottom 50%: 0.6%

https://www.federalreserve.gov/releases/z1/dataviz/dfa/distribute/chart/#quarter:121;series:Corporate%20equities%20and%20mutual%20fund%20shares;demographic:networth;population:1,3,5,7;units:shares;range:1989.3,2020.3

Before Yellen was Fed Chair, she was on the Fed Board of Governors continuously since October 2010. Anyway...

Distribution of Household Wealth

Q3 2010:

Top 1% 47.6%

Next 9%: 38.3%

Next 40%: 13.3%

Bottom 50%: 0.8%

These are all Fed numbers.

https://www.federalreserve.gov/releases/z1/dataviz/dfa/distribute/chart/#quarter:121;series:Corporate%20equities%20and%20mutual%20fund%20shares;demographic:networth;population:1,3,5,7;units:shares;range:1991.4,2020.3

Distribution of Household Wealth

Q3 2010:

Top 1% 47.6%

Next 9%: 38.3%

Next 40%: 13.3%

Bottom 50%: 0.8%

These are all Fed numbers.

https://www.federalreserve.gov/releases/z1/dataviz/dfa/distribute/chart/#quarter:121;series:Corporate%20equities%20and%20mutual%20fund%20shares;demographic:networth;population:1,3,5,7;units:shares;range:1991.4,2020.3

Before she joined the Board of Governors, Yellen ran the San Fran Fed starting in June 2004...

Distribution of Household Wealth

Q2 2004:

Top 1% 45.8%

Next 9%: 35.6%

Next 40%: 17.6%

Bottom 50%: 1.0%

Tell me again who the Fed works for?

Distribution of Household Wealth

Q2 2004:

Top 1% 45.8%

Next 9%: 35.6%

Next 40%: 17.6%

Bottom 50%: 1.0%

Tell me again who the Fed works for?

There's a very high correlation between Janet Yellen & growing wealth inequality.

Correlation is not causation, but perhaps there's a reason she's paid hundreds of thousands per speech by some of the wealthiest people in the world.

Q3 2020: Top 10% own 88.3% of corporate equity

Correlation is not causation, but perhaps there's a reason she's paid hundreds of thousands per speech by some of the wealthiest people in the world.

Q3 2020: Top 10% own 88.3% of corporate equity

You can play the same game with "Share of Total Net Worth Held by the Top 1% (99th to 100th Wealth Percentiles)" https://fred.stlouisfed.org/series/WFRBST01134

To clarify, much of this thread refers to "Corporate equities & mutual fund shares by wealth percentile group," since the stock market, which the bottom 50% owns 0.6% of, seems to be the top priority of the Fed, one reason being so many ex-FOMC members go to Wall Street.

Read on Twitter

Read on Twitter