I keep seeing on Twitter:

“Why $ETHE has fallen by 40% when $ETH has gone up by 80%?”

Let me explain the premium in a

*Not financial advice*

1/x

“Why $ETHE has fallen by 40% when $ETH has gone up by 80%?”

Let me explain the premium in a

*Not financial advice*

1/x

For the Grayscale Ethereum trust,

1 $ETHE contains 0.01029314 $ETH.

Which can be confirmed on the grayscale website

At market close today:

1 $ETH = $1024

1 $ETHE = $ 12.00

And

0.01029314 $ETH = $10.05

The difference in this case is a premium, which was roughy 13% today

2/x

1 $ETHE contains 0.01029314 $ETH.

Which can be confirmed on the grayscale website

At market close today:

1 $ETH = $1024

1 $ETHE = $ 12.00

And

0.01029314 $ETH = $10.05

The difference in this case is a premium, which was roughy 13% today

2/x

Why premium important?

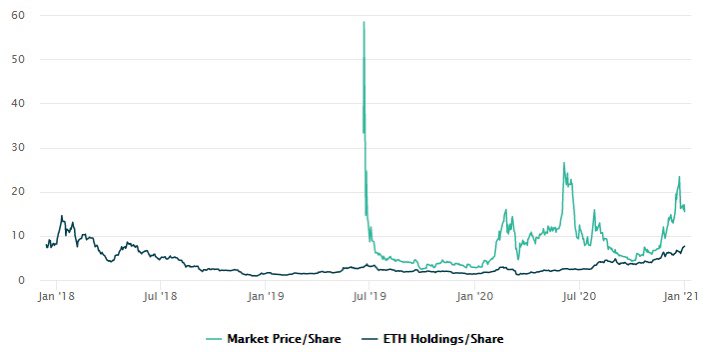

It dictates how much more you are paying over the underlying asset (ETH). Here you are paying 13% more to gain exposure to $ETH. Over the last few weeks the premium exceeded 100%. Which is double the price of $ETH for equal amount in $ETHE!

3/x

It dictates how much more you are paying over the underlying asset (ETH). Here you are paying 13% more to gain exposure to $ETH. Over the last few weeks the premium exceeded 100%. Which is double the price of $ETH for equal amount in $ETHE!

3/x

The @grayscaletrust bot which is not financial advice, shows how much you are paying at the premium price.

Today Buying 1 $ETHE costed $ 12.00, and 1 $ETH at $1024.

However you actually bought ETH at a price of $1159 which is 13% more due.

4/x https://twitter.com/grayscaletrust/status/1346199792104439809?s=21

Today Buying 1 $ETHE costed $ 12.00, and 1 $ETH at $1024.

However you actually bought ETH at a price of $1159 which is 13% more due.

4/x https://twitter.com/grayscaletrust/status/1346199792104439809?s=21

The $ETHE premium had been well over 100% for a few weeks. Meaning some investors bough Ethereum via $ETHE at a price of over $1600. Meanwhile $ETH was only $600ish.

That is the equivalent of buying Ethereum over the all time high !

5/x https://twitter.com/grayscaletrust/status/1341059479408918530?s=21

That is the equivalent of buying Ethereum over the all time high !

5/x https://twitter.com/grayscaletrust/status/1341059479408918530?s=21

Why is there a premium?

Accredited investors can contribute cash and if I’m not mistaken, “in kind” assets (Ethereum) to purchase shares at 0% premium. Also know as NAV (net asset value). After 6 months they can sell them on the market.

6/x

Accredited investors can contribute cash and if I’m not mistaken, “in kind” assets (Ethereum) to purchase shares at 0% premium. Also know as NAV (net asset value). After 6 months they can sell them on the market.

6/x

Read on Twitter

Read on Twitter