1/25

Scoop:

Some sources suggesting that $TRX may be under investigation by US regulators & have US exposure (related to Bittorrent and Poloniex) stemming from recent court filings in New York

http://securities.stanford.edu/filings-documents/1073/TF0300_01/202043_f01c_20CV02804.pdf

Scoop:

Some sources suggesting that $TRX may be under investigation by US regulators & have US exposure (related to Bittorrent and Poloniex) stemming from recent court filings in New York

http://securities.stanford.edu/filings-documents/1073/TF0300_01/202043_f01c_20CV02804.pdf

2/25

In Spring of last year, a group in New York filed claims against the Tron Foundation alleging securities fraud.

In December of 2020, the Tron Foundation filed a motion to dismiss the case on the grounds that this wasn't jurisdictionally relevant nor a direct sale.

In Spring of last year, a group in New York filed claims against the Tron Foundation alleging securities fraud.

In December of 2020, the Tron Foundation filed a motion to dismiss the case on the grounds that this wasn't jurisdictionally relevant nor a direct sale.

3/25

Those claims would be true, so long as Tron doesn't have material US operations and did not make efforts to make their token available to US customers, which is what this alleged investigation and legal exposure is about.

Those claims would be true, so long as Tron doesn't have material US operations and did not make efforts to make their token available to US customers, which is what this alleged investigation and legal exposure is about.

4/25

While I have been unable to substantiate some claims, there are a number of points that do seem to have merit in the Tron Foundation being exposed to US action that make this plausible.

While I have been unable to substantiate some claims, there are a number of points that do seem to have merit in the Tron Foundation being exposed to US action that make this plausible.

5/25

First, Tron claims that US securities law doesn't apply to the secondary transaction that took place on Binance, at the time Binance was accepting US users and neither Tron nor Binance made efforts to block those users while at the same time promoting Tron to them.

First, Tron claims that US securities law doesn't apply to the secondary transaction that took place on Binance, at the time Binance was accepting US users and neither Tron nor Binance made efforts to block those users while at the same time promoting Tron to them.

6/25

But the meat of this issue seems to stem around Poloniex and BitTorrent, two US entities that are part of the patchwork of companies affiliated with/owned by Justin Sun.

But the meat of this issue seems to stem around Poloniex and BitTorrent, two US entities that are part of the patchwork of companies affiliated with/owned by Justin Sun.

7/25

In Decemeber of 2019, after purchasing Poloniex and listing $TRX, Poloniex created a new "Level 1 Account" that had no KYC/AML requirements and could deposit/withdraw up to $10,000 USD per day without verification. https://medium.com/poloniex/a-new-account-tier-is-here-bebb4a8919e0

In Decemeber of 2019, after purchasing Poloniex and listing $TRX, Poloniex created a new "Level 1 Account" that had no KYC/AML requirements and could deposit/withdraw up to $10,000 USD per day without verification. https://medium.com/poloniex/a-new-account-tier-is-here-bebb4a8919e0

8/25

Even worse, Poloniex lets users trade crypto futures up to 50x leverage without any verification.

These are the same issues that the CFTC, SEC and Southern District of NY charged BitMex with earlier this year:

https://www.cftc.gov/PressRoom/PressReleases/8270-20

Even worse, Poloniex lets users trade crypto futures up to 50x leverage without any verification.

These are the same issues that the CFTC, SEC and Southern District of NY charged BitMex with earlier this year:

https://www.cftc.gov/PressRoom/PressReleases/8270-20

9/25

Poloniex is an entity in Seychelles, the same country that BitMex was registered in thinking they were outside of US regulatory reach in ignoring KYC/AML

However, worse than BitMex, Poloniex's operations are based in the US including key members of their executive team

Poloniex is an entity in Seychelles, the same country that BitMex was registered in thinking they were outside of US regulatory reach in ignoring KYC/AML

However, worse than BitMex, Poloniex's operations are based in the US including key members of their executive team

10/25

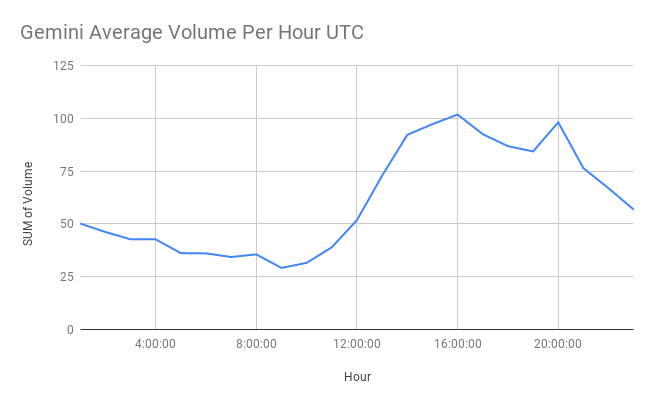

So the question becomes if Poloniex knowingly has US customers (who would simply use a VPN to connect).

An easy way to detect this is average trade volume per hour. Here is what third party data shows for a US exchange like Gemini:

So the question becomes if Poloniex knowingly has US customers (who would simply use a VPN to connect).

An easy way to detect this is average trade volume per hour. Here is what third party data shows for a US exchange like Gemini:

11/25

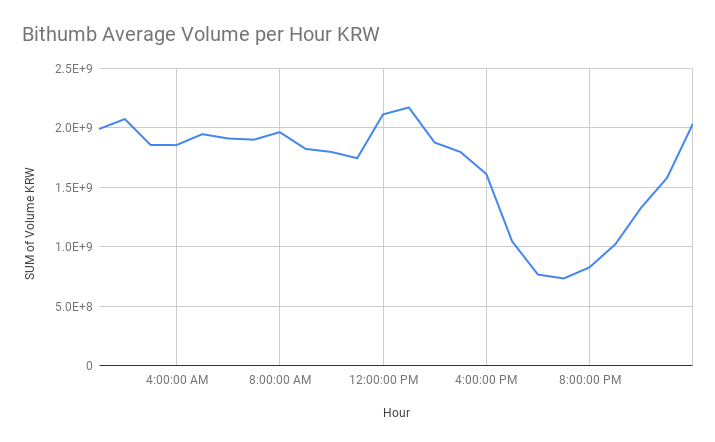

Here is the same chart but for an Asian based exchange like Bithumb, you'll notice that it follows basically the opposite trend of Gemini, at 20:00 (8PM UTC) American exchanges are active, Asian ones aren't.

At 8AM UTC, it's the opposite.

Here is the same chart but for an Asian based exchange like Bithumb, you'll notice that it follows basically the opposite trend of Gemini, at 20:00 (8PM UTC) American exchanges are active, Asian ones aren't.

At 8AM UTC, it's the opposite.

12/25

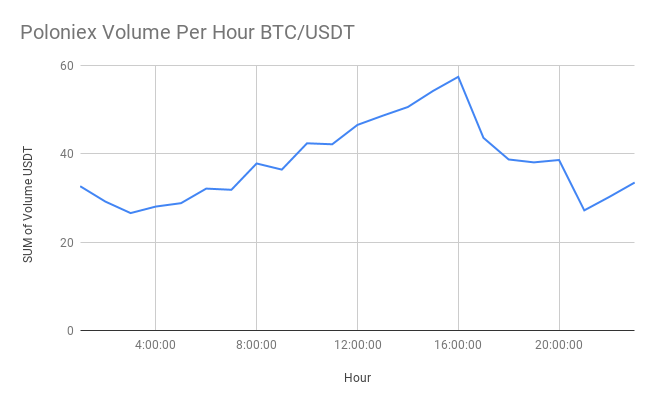

That same chart for Poloniex?

It's a much smoother chart showing strong activity during US hours.

While not a clear cut statistical case, it certainly raises eyebrows.

That same chart for Poloniex?

It's a much smoother chart showing strong activity during US hours.

While not a clear cut statistical case, it certainly raises eyebrows.

13/25

On the topic of BitTorrent, it's been made abundantly clear by the recent Verge article ( https://www.theverge.com/21459906/bittorrent-tron-acquisition-justin-sun-us-china) that the base of operations for Bittorrent and in turn $BTT is still in San Francisco.

On the topic of BitTorrent, it's been made abundantly clear by the recent Verge article ( https://www.theverge.com/21459906/bittorrent-tron-acquisition-justin-sun-us-china) that the base of operations for Bittorrent and in turn $BTT is still in San Francisco.

14/25

And that Justin Sun has significantly split his time between China and SF while working on the project.

As with Poloniex, a company can't simply not have US users and not comply with US securities law while operating in the US

And that Justin Sun has significantly split his time between China and SF while working on the project.

As with Poloniex, a company can't simply not have US users and not comply with US securities law while operating in the US

15/25

The fact they have material operations in the US would likely be weighed heavily in assessing if US securities laws apply and given that they were eligible for a significant PPP loan from the US government, that likely exhibits material operations: https://www.coindesk.com/consensys-polychain-tron-ciphertrace-blockchain-startups-got-18m-in-us-ppp-bailout-loans

The fact they have material operations in the US would likely be weighed heavily in assessing if US securities laws apply and given that they were eligible for a significant PPP loan from the US government, that likely exhibits material operations: https://www.coindesk.com/consensys-polychain-tron-ciphertrace-blockchain-startups-got-18m-in-us-ppp-bailout-loans

16/25

But the Tron Foundation attesting that $TRON, $BTT, $SUN and $JUST are not available to US users doesn't hold up.

$TRON is currently traded on Bittrex, OkCoin and eToro, while $BTT is traded on Bittrex, http://CEX.io and of course both are on Poloniex.

But the Tron Foundation attesting that $TRON, $BTT, $SUN and $JUST are not available to US users doesn't hold up.

$TRON is currently traded on Bittrex, OkCoin and eToro, while $BTT is traded on Bittrex, http://CEX.io and of course both are on Poloniex.

17/25

All of these are regulated exchanges carrying US money service business licenses (MSBs) and often require detailed applications from the team and a note from a US lawyer regarding their opinion on its security status. https://bittrex.zendesk.com/hc/en-us/articles/360000475411-How-do-I-submit-a-token-to-Bittrex-for-listing-

All of these are regulated exchanges carrying US money service business licenses (MSBs) and often require detailed applications from the team and a note from a US lawyer regarding their opinion on its security status. https://bittrex.zendesk.com/hc/en-us/articles/360000475411-How-do-I-submit-a-token-to-Bittrex-for-listing-

18/25

This seems to suggest that on these exchanges members of the Tron Foundation team would have had to have been in contact with the exchanges to make these applications, something that could be seen as going after US customers.

This seems to suggest that on these exchanges members of the Tron Foundation team would have had to have been in contact with the exchanges to make these applications, something that could be seen as going after US customers.

19/25

This also comes on allegations of Tron washtrading in frequently having a volume many times higher than its marketcap ( https://twitter.com/SashaBaksht/status/1346104318647267328) a behavior which could be found to be market manipulation (as is alleged in the $XRP case) were Tron to be found a US security.

This also comes on allegations of Tron washtrading in frequently having a volume many times higher than its marketcap ( https://twitter.com/SashaBaksht/status/1346104318647267328) a behavior which could be found to be market manipulation (as is alleged in the $XRP case) were Tron to be found a US security.

20/25

And after claims of Tron being overly centralized including singular contracts disrupting its chain: https://www.coindesk.com/tron-blockchain-stalled-for-hours-by-malicious-contract-justin-sun-says

And researchers finding that a single node can take down the entire chain: https://www.zdnet.com/article/tron-critical-security-flaw-could-break-the-entire-blockchain/

And after claims of Tron being overly centralized including singular contracts disrupting its chain: https://www.coindesk.com/tron-blockchain-stalled-for-hours-by-malicious-contract-justin-sun-says

And researchers finding that a single node can take down the entire chain: https://www.zdnet.com/article/tron-critical-security-flaw-could-break-the-entire-blockchain/

21/25

This is something that matters heavily to Tron, as they frequently promote financial lending apps and gambling apps on their blockchain.

If the blockchain was not sufficiently decentralized, those products could be found to be illegal offerings in the US.

This is something that matters heavily to Tron, as they frequently promote financial lending apps and gambling apps on their blockchain.

If the blockchain was not sufficiently decentralized, those products could be found to be illegal offerings in the US.

22/25

It is unclear exactly what the on-going investigations are, but based on some of the rumors and the info laid out here, it does seem plausible that Tron has US exposure that may expose them to US regulators more than they realize.

It is unclear exactly what the on-going investigations are, but based on some of the rumors and the info laid out here, it does seem plausible that Tron has US exposure that may expose them to US regulators more than they realize.

23/25

If there is an ongoing investigation it is worth noting that not all SEC investigations end in negative action, and even if they do they can take months or years to progress.

It is entirely possible there is no ongoing review or that such matters have already been settled

If there is an ongoing investigation it is worth noting that not all SEC investigations end in negative action, and even if they do they can take months or years to progress.

It is entirely possible there is no ongoing review or that such matters have already been settled

24/25

You should consider these pieces of info to be unsubstantiated at this stage, and I'll hope experienced journalists pick up this trial to continue investigating and reporting.

This post makes no assertations and reports insights that I believe to be plausible enough.

You should consider these pieces of info to be unsubstantiated at this stage, and I'll hope experienced journalists pick up this trial to continue investigating and reporting.

This post makes no assertations and reports insights that I believe to be plausible enough.

25/25

People should watch the Southern District US court case against Tron that was brought forward by @RCFLLP - if that case starts poking around Bittorrent or Poloniex it adds significant weight to this scoop.

People should watch the Southern District US court case against Tron that was brought forward by @RCFLLP - if that case starts poking around Bittorrent or Poloniex it adds significant weight to this scoop.

26/

None of this should be considered financial advice. It's worth treating it at as nothing more than a juicy FUD-y rumor until proven otherwise.

None of this should be considered financial advice. It's worth treating it at as nothing more than a juicy FUD-y rumor until proven otherwise.

27/

It's also worth noting that Tron did hire former SEC attorney David Labhart as a head of compliance last year, although according to his LinkedIn it seems he may no longer work there? https://www.linkedin.com/in/david-labhart-82719ba3/

It's also worth noting that Tron did hire former SEC attorney David Labhart as a head of compliance last year, although according to his LinkedIn it seems he may no longer work there? https://www.linkedin.com/in/david-labhart-82719ba3/

28/

Its also worth noting that Tron has faced regulatory scrutiny in China including a raid on their offices, back in 2019: https://qz.com/1674509/crypto-entrepreneur-justin-sun-apologizes-for-overpromoting-tron/

And according to the Verge article a few other run-ins in trying to get around Chinese censorship.

Its also worth noting that Tron has faced regulatory scrutiny in China including a raid on their offices, back in 2019: https://qz.com/1674509/crypto-entrepreneur-justin-sun-apologizes-for-overpromoting-tron/

And according to the Verge article a few other run-ins in trying to get around Chinese censorship.

29/

Note that this is *not* the same as the $XRP case where the SEC was at the point of filing.

The speculation here is surrounding possible exposure and investigations from other legal proceedings.

Much harder to say where this will go or if it exists.

Note that this is *not* the same as the $XRP case where the SEC was at the point of filing.

The speculation here is surrounding possible exposure and investigations from other legal proceedings.

Much harder to say where this will go or if it exists.

30/

People are taking this with far more weight than it deserves despite disclaimers.

This isn't the same as XRP getting directly slapped with a suit, and is much more speculative.

People are taking this with far more weight than it deserves despite disclaimers.

This isn't the same as XRP getting directly slapped with a suit, and is much more speculative.

Read on Twitter

Read on Twitter