$UPST +8% NEW IPO

$UPST +8% NEW IPO

A lending marketplace that uses machine learning to provide loans

A lending marketplace that uses machine learning to provide loans Sales grew 44% in first 9 months of 2020 to $ 164m and recored a profit of $ 4.6m

Sales grew 44% in first 9 months of 2020 to $ 164m and recored a profit of $ 4.6m Despite a LARGE contraction during the pandemic

Despite a LARGE contraction during the pandemic REASONABLY valued at 15 Price/Sales

REASONABLY valued at 15 Price/Sales

Upstart $UPST is an online lending marketplace that provides personal loans by using machine learning

It was founded in 2012 by Dave Grirouard, former president of Google Enterprise, Paul Gu, a Thiel Fellow and Anna Counselman, a former Google manager https://techcrunch.com/2020/11/05/inside-fintech-startup-upstarts-ipo-filing/

It was founded in 2012 by Dave Grirouard, former president of Google Enterprise, Paul Gu, a Thiel Fellow and Anna Counselman, a former Google manager https://techcrunch.com/2020/11/05/inside-fintech-startup-upstarts-ipo-filing/

It was founded in 2012 by Dave Grirouard, former president of Google Enterprise, Paul Gu, a Thiel Fellow and Anna Counselman, a former Google manager https://techcrunch.com/2020/11/05/inside-fintech-startup-upstarts-ipo-filing/

It was founded in 2012 by Dave Grirouard, former president of Google Enterprise, Paul Gu, a Thiel Fellow and Anna Counselman, a former Google manager https://techcrunch.com/2020/11/05/inside-fintech-startup-upstarts-ipo-filing/

It developed a model that is capable of determining the creditworthiness of prospective borrowers

Next to traditional variables (FICO score, income, credit report) it relies on the following features:

Next to traditional variables (FICO score, income, credit report) it relies on the following features:

Academic variables (GPA, area of study, colleges)

Academic variables (GPA, area of study, colleges)

Work history

Work history

Next to traditional variables (FICO score, income, credit report) it relies on the following features:

Next to traditional variables (FICO score, income, credit report) it relies on the following features: Academic variables (GPA, area of study, colleges)

Academic variables (GPA, area of study, colleges) Work history

Work history

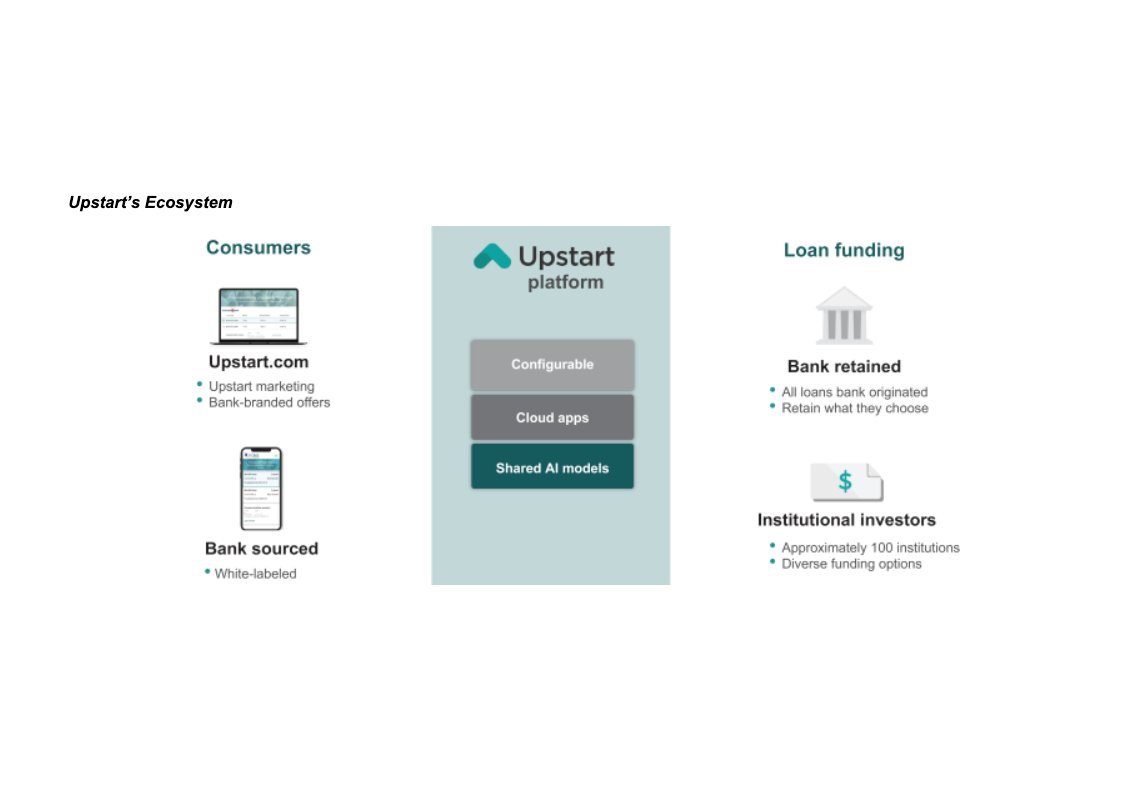

Upstart doesn’t make loans itself:

Rather it connects consumers to its network of Upstart AI-enabled bank partners

Rather it connects consumers to its network of Upstart AI-enabled bank partners

These consumers benefit from lower interest rates, higher approval rates and a highly automated and digital experience

These consumers benefit from lower interest rates, higher approval rates and a highly automated and digital experience

Rather it connects consumers to its network of Upstart AI-enabled bank partners

Rather it connects consumers to its network of Upstart AI-enabled bank partners These consumers benefit from lower interest rates, higher approval rates and a highly automated and digital experience

These consumers benefit from lower interest rates, higher approval rates and a highly automated and digital experience

In more tangible terms:

· It uses over 1,600 data points to score borrowers

· Upstart provides 27% more approvals than traditional models

· 16% lower rates than traditional models

· It uses over 1,600 data points to score borrowers

· Upstart provides 27% more approvals than traditional models

· 16% lower rates than traditional models

Upstart’s model is built on its “AI” flywheel

It uses more data and better models to undercut competition

It uses more data and better models to undercut competition

Customers get approved and get better interest rates

Customers get approved and get better interest rates

With more data, Upstart is able to generate more loans

With more data, Upstart is able to generate more loans

It uses more data and better models to undercut competition

It uses more data and better models to undercut competition Customers get approved and get better interest rates

Customers get approved and get better interest rates With more data, Upstart is able to generate more loans

With more data, Upstart is able to generate more loans

It is then able to improve its models, cut down its loss ratio and select good borrower more efficiently

It is then able to improve its models, cut down its loss ratio and select good borrower more efficiently

Upstart’s loans go from $ 1,000 to $ 50,000 and concern 3 & 5 years loan terms with an APR range of 8.27% to 35.99%

99% of these loans are funded within 1 business day after signing

99% of these loans are funded within 1 business day after signing

Borrowers can pay their loan back early at no cost

Borrowers can pay their loan back early at no cost

99% of these loans are funded within 1 business day after signing

99% of these loans are funded within 1 business day after signing Borrowers can pay their loan back early at no cost

Borrowers can pay their loan back early at no cost

What about the customer base?

Upstart is dedicated to personal loans, it thus offers helps customer with:

Moving loans

Moving loans

Home improvement loans

Home improvement loans

Medical loans

Medical loans

Credit card consolidation

Credit card consolidation

Debt consolidation

Debt consolidation

Wedding loans

Wedding loans

Upstart is dedicated to personal loans, it thus offers helps customer with:

Moving loans

Moving loans Home improvement loans

Home improvement loans Medical loans

Medical loans Credit card consolidation

Credit card consolidation Debt consolidation

Debt consolidation Wedding loans

Wedding loans

How does Upstart makes loans?

Directly through the Upstart website

Directly through the Upstart website

· A partner bank emits the loan as Upstart itself doesn’t provide any loan

· The loan can be retained by the bank, sold to Upstart’s network of institutional investors or funded by Upstart’s balance sheet

Directly through the Upstart website

Directly through the Upstart website· A partner bank emits the loan as Upstart itself doesn’t provide any loan

· The loan can be retained by the bank, sold to Upstart’s network of institutional investors or funded by Upstart’s balance sheet

· In Q3 ’20, around 22% of the loans issued directly through Upstart were retained by the originating bank

· Around 76% were purchased by institutional investors (such as PIMCO, Goldman Sachs, Morgan Stanley)

· Around 2% were funded by Upstart’s own balance sheet

· Around 76% were purchased by institutional investors (such as PIMCO, Goldman Sachs, Morgan Stanley)

· Around 2% were funded by Upstart’s own balance sheet

Through a white-label product on the bank partner’s own website

Through a white-label product on the bank partner’s own website· The bank uses Upstart’s models and algorithms to predict a prospective borrower’s creditworthiness

· It then makes the loan on its own

What is the business model?

What is the business model?Upstart generates the majority of its sales from fees paid by banks:

Referral fees for each loan referred through Upstart

Referral fees for each loan referred through Upstart Platform fees for each loan originated

Platform fees for each loan originated Loan servicing fees as customers repay their loans

Loan servicing fees as customers repay their loans

Great!

Upstart was founded by a team of ex-Silicon Valley employees that wanted to apply their experience in machine learning to loans

Upstart was founded by a team of ex-Silicon Valley employees that wanted to apply their experience in machine learning to loans

It choose the personal loans market and makes money by collecting fees from banks

It choose the personal loans market and makes money by collecting fees from banks

But how large is their market?

Upstart was founded by a team of ex-Silicon Valley employees that wanted to apply their experience in machine learning to loans

Upstart was founded by a team of ex-Silicon Valley employees that wanted to apply their experience in machine learning to loans It choose the personal loans market and makes money by collecting fees from banks

It choose the personal loans market and makes money by collecting fees from banksBut how large is their market?

According to TransUnion, there were $ 118B in unsecured loans from April 2019 to March 2020 - growing at 8% YoY

According to TransUnion, there were $ 118B in unsecured loans from April 2019 to March 2020 - growing at 8% YoY Upstart facilitated the origination of $ 3.5B in unsecured personal loans, accounting for 5% of the total market

Upstart facilitated the origination of $ 3.5B in unsecured personal loans, accounting for 5% of the total market

According to Mordor Intelligence, the digital lending market is expected to grow at a CAGR of 11.9% over the 2020 - 2025 period

According to Mordor Intelligence, the digital lending market is expected to grow at a CAGR of 11.9% over the 2020 - 2025 period Driven by the proliferation of smartphones, advanced in machine learning and cloud computing

Driven by the proliferation of smartphones, advanced in machine learning and cloud computing

“Also, technologies like Artificial Intelligence, Machine Learning, and Cloud Computing benefit the banks and fintech as they can process huge amounts of information about customers.” - Mordor Intelligence

https://www.mordorintelligence.com/industry-reports/digital-lending-market

https://www.mordorintelligence.com/industry-reports/digital-lending-market

Upstart’s ambitions do not stop at personal loans

“[…] by applying our AI models and technology to adjacent opportunities, we believe we are well-positioned to address the U.S. auto loan, credit card and mortgage markets.” - Upstart S1

“[…] by applying our AI models and technology to adjacent opportunities, we believe we are well-positioned to address the U.S. auto loan, credit card and mortgage markets.” - Upstart S1

According to the Federal Reserve Bank of St Louis, from April 2019 to March 2020, there were:

According to the Federal Reserve Bank of St Louis, from April 2019 to March 2020, there were:· $625 billion in U.S. auto loan originations

· $363 billion in U.S. credit card originations

· $2.5 trillion in U.S. mortgage originations

“In June 2020, we began offering auto loans on our platform, and in September 2020, the first auto loan was originated through the Upstart platform” - Upstart S1

Things look bright for Upstart!

The company developed a model that relies on non-traditional data to predict a borrower’s creditworthiness

The company developed a model that relies on non-traditional data to predict a borrower’s creditworthiness

It started with the personal loans segment and already serves 5% of the market

It started with the personal loans segment and already serves 5% of the market

The company developed a model that relies on non-traditional data to predict a borrower’s creditworthiness

The company developed a model that relies on non-traditional data to predict a borrower’s creditworthiness It started with the personal loans segment and already serves 5% of the market

It started with the personal loans segment and already serves 5% of the market

But it also plans to enter the auto and mortgage market, unlocking a massive TAM

But it also plans to enter the auto and mortgage market, unlocking a massive TAM As for most data-driven players, their flywheel effect is built on increasing the data they can access by increasing their customer base

As for most data-driven players, their flywheel effect is built on increasing the data they can access by increasing their customer baseBut is this profitable?

Financials Check

Financials Check

Sales grew 44% in first 9 months of 2020 to $ 164m

Sales grew 44% in first 9 months of 2020 to $ 164m Spent $ 80m on borrower acquisition, verification and servicing costs

Spent $ 80m on borrower acquisition, verification and servicing costs Recorded a contribution profit of $ 63m in first 9 months of 2020 up 151% year over year

Recorded a contribution profit of $ 63m in first 9 months of 2020 up 151% year over year

Despite a large contraction in lending during the pandemic as its partners paused lending

Despite a large contraction in lending during the pandemic as its partners paused lending Operating expenses reach $ 145m up 32% from $ 110m a year earlier

Operating expenses reach $ 145m up 32% from $ 110m a year earlier It recored a profit of $ 4.6m in the first 9 months of 2020 up from a loss of $ 10m a year earlier

It recored a profit of $ 4.6m in the first 9 months of 2020 up from a loss of $ 10m a year earlier

THE BOTTOM LINE

THE BOTTOM LINE

$UPST is a fast growing digital lending player that uses machine learning to predict borrows creditworthiness

$UPST is a fast growing digital lending player that uses machine learning to predict borrows creditworthiness It is able to provide 27% more approvals that traditional players and 70% of its operations are automated

It is able to provide 27% more approvals that traditional players and 70% of its operations are automated

It started with the personal loans market which grew 8% year over year and plans to enter the auto and mortgage market

It started with the personal loans market which grew 8% year over year and plans to enter the auto and mortgage market Upstart doesn’t hold the risks related to lending as it simply refers customers to loan providers

Upstart doesn’t hold the risks related to lending as it simply refers customers to loan providers

Given its TAM, management and financial metrics, it is reasonably valued at 15 PS

Given its TAM, management and financial metrics, it is reasonably valued at 15 PS The lending market is strongly correlated to the business cycle

The lending market is strongly correlated to the business cycle A rise in interest rates might negatively influence Upstart’s growth

A rise in interest rates might negatively influence Upstart’s growth  We take a full stake into Upstart

We take a full stake into Upstart

$DHER.DE is on our watchlist

$DHER.DE is on our watchlist  To Be Reviewed SOON

To Be Reviewed SOON

Disclaimer - This is not investment advice in any form and investors are responsible for conducting their own research before investing.

Sources

✑ Investor presentation

✑ Company website

✑ Mordor Intelligence

✑ TransUnion

✑ FED

✑ TechCrunch

✑ Crunchbase

✑ FED

✑ TechCrunch

✑ Crunchbase

Hope you liked this thread!

For more content, follow us on Twitter

For more content, follow us on Twitter

EASY BRIEFINGS delivered straight to your inbox

EASY BRIEFINGS delivered straight to your inbox  Don’t MISS IT

Don’t MISS IT  https://getbenchmark.substack.com

https://getbenchmark.substack.com

For more content, follow us on Twitter

For more content, follow us on Twitter

EASY BRIEFINGS delivered straight to your inbox

EASY BRIEFINGS delivered straight to your inbox  Don’t MISS IT

Don’t MISS IT  https://getbenchmark.substack.com

https://getbenchmark.substack.com

Read on Twitter

Read on Twitter