Hard to predict when an avalanche is going to happen. Best bet is to notice the signs & remain in a state of preparedness until the snow-load resolved one way or another.

2/Bank failures are not really "insurable events"; ask @darwinslair; they're not independent events susceptible to statistical analysis. FDIC "insurance" doesn't work like fire insurance or storm insurance.

Also doesn't indemnify covered parties directly…

Also doesn't indemnify covered parties directly…

3/…Instead, the pooled funds used to buy up dodgy assets until the failing bank looks good enough to be bought up by another bank.

If too many banks failing at same time, Milton Friedman's confidence game is over.

If too many banks failing at same time, Milton Friedman's confidence game is over.

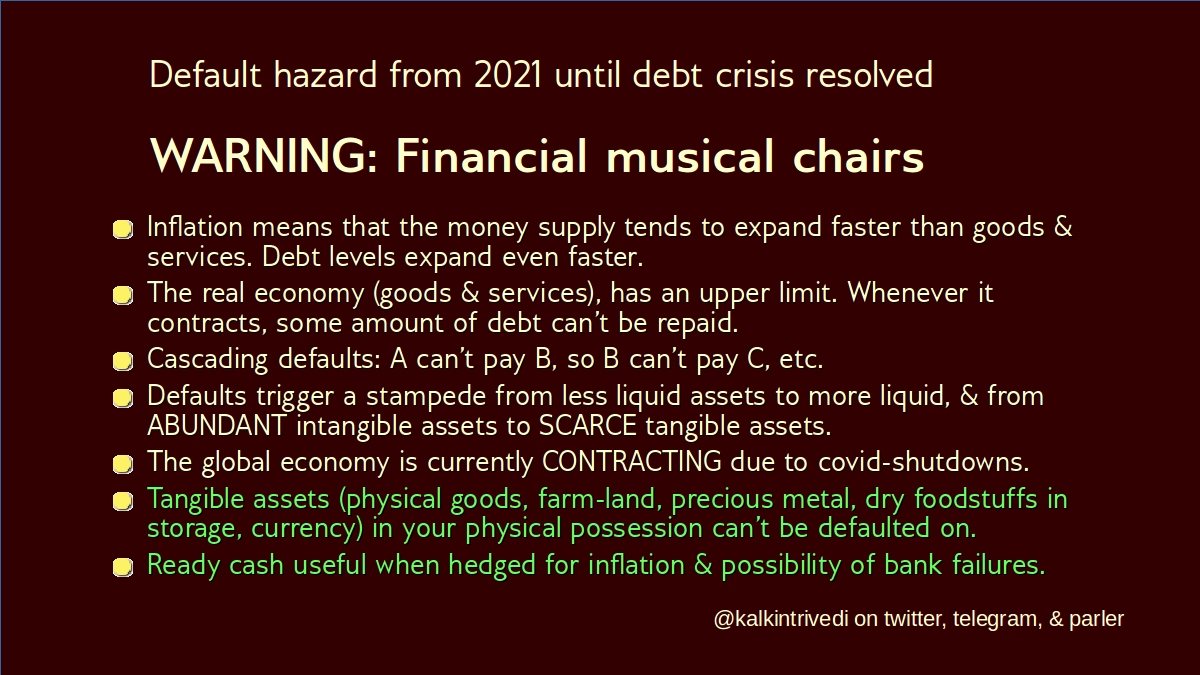

4/We're also dealing with the effects of ongoing & escalating shutdowns.

I've been turned away from my bank once already when their ATM stopped working (lobby closed since Mar 2020). No other branches for many miles.

Temporary can become permanent.

I've been turned away from my bank once already when their ATM stopped working (lobby closed since Mar 2020). No other branches for many miles.

Temporary can become permanent.

5/Bank failure is relatively worst-case scenario. It's pretty bad: the bread deliveries halt when drivers & bakeries aren't getting paid.

But personal tragedy can strike if YOU go insolvent. Avoid new debt, & be wary about extending credit.

But personal tragedy can strike if YOU go insolvent. Avoid new debt, & be wary about extending credit.

6/I've already been defaulted on. 10s of $1000s unpaid debt, on top of nominal losses from devaluation of real estate from shutdown of downtown & constant rioting (currently down $100K).

I saw it coming, & prepared with hedges & loss-mitigation. Worry about yourself.

I saw it coming, & prepared with hedges & loss-mitigation. Worry about yourself.

7/I suggest not counting on the monetary reset part of the so-called #GreatReset going smoothly. For one thing, there is a huge temptation on part of the 1% to transfer as much of the losses to the rest of us.

Good luck & great prosperity to you.

Good luck & great prosperity to you.

Read on Twitter

Read on Twitter