Next up at @ASSAMeeting is Finance session on covid and markets with deep dives on correlations across bond markets impact of Fed programs on corporate bonds (including amplifying effects from bond funds), and avoiding defaults. Useful review of some of the market activity

Haddad et al try to explain weakness of IG bonds which underperformed their CDS and were almost as sold off as HY and equity- unsurprisingly answer is liquidity/cash seeking. These IG bonds recovered quickly when Fed programs announced - and were net beneficiaries via issuance

Falato et al map the vulnerability to markets amplified by bond funds - which creates new vulnerability channel. This contagion risk trend maps with empirical evidence and not super surprising, but useful for Fed learning/adjustment of new tools.

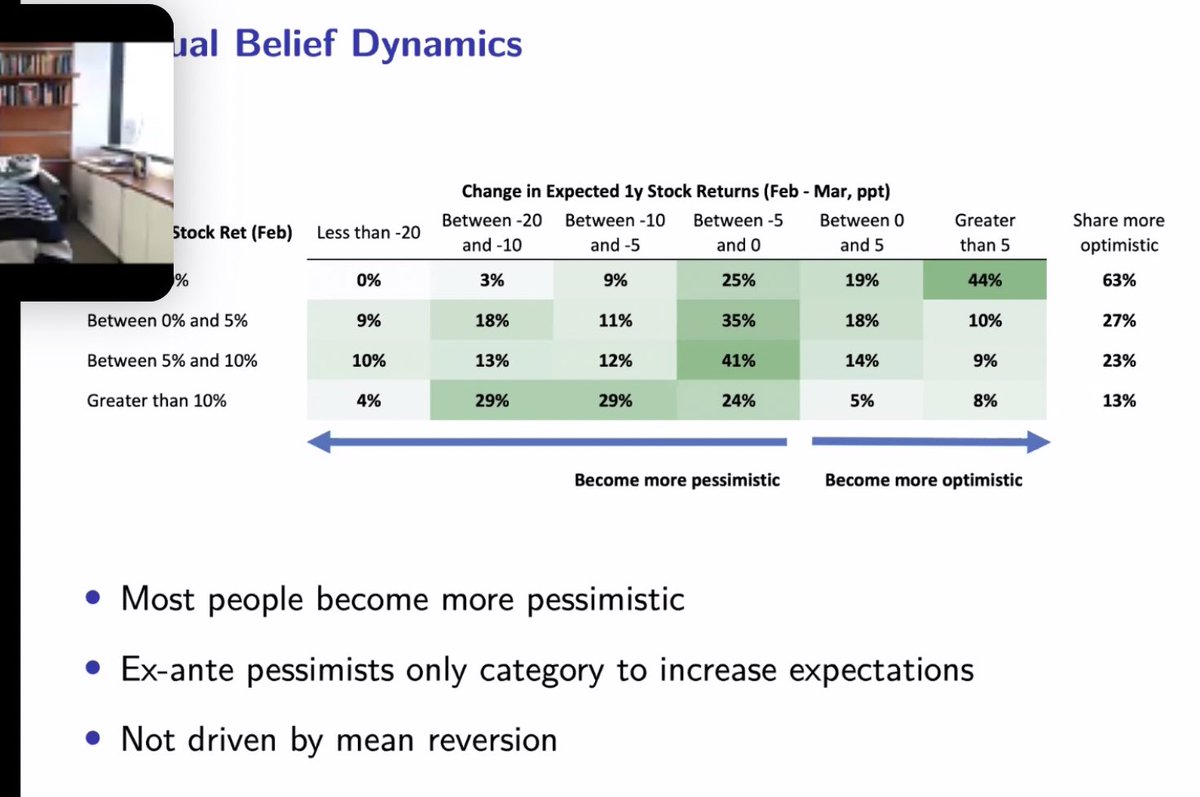

Giglio et al use ongoing Vanguard survey data to map investor sentiment during the crash. Unsurprisingly, during + shortly after crisis, investors see higher likelihood of a major correction. More interesting, the more pessimistic ex-ante, become more optimistic during correction

... but few of the Vanguard investors opportunistic. Some move to cash (realising losses), but generally little allocation shift and little opportunistic. Would be interesting to see moves later in the year. Of course this investor set likely to be less mobile than others

Read on Twitter

Read on Twitter