Katapult $FSRV is probably one of the top 3 SPACs I've researched so far, and I've researched almost every recent SPAC. Credit to @rubicon59 for the idea(thread)

One thing I like most about $FSRV - The SPAC looked at over 800 companies before buying Katapult. This is the most companies reviewed I've ever seen for a SPAC

$FSRV The problem: Many people in the US live paycheck to paycheck, and many cannot afford an emergency bill of a few hundred $. They have to rely on predatory credit card companies that charge absurd interest rates to buy any large purchases

$FSRV this includes online purchases for large ticket items like furniture or other appliances. Buy now pay later is expected to make up 3% of ecom market share in the US by 2023(from Affirm) which is below 10% in EMEA

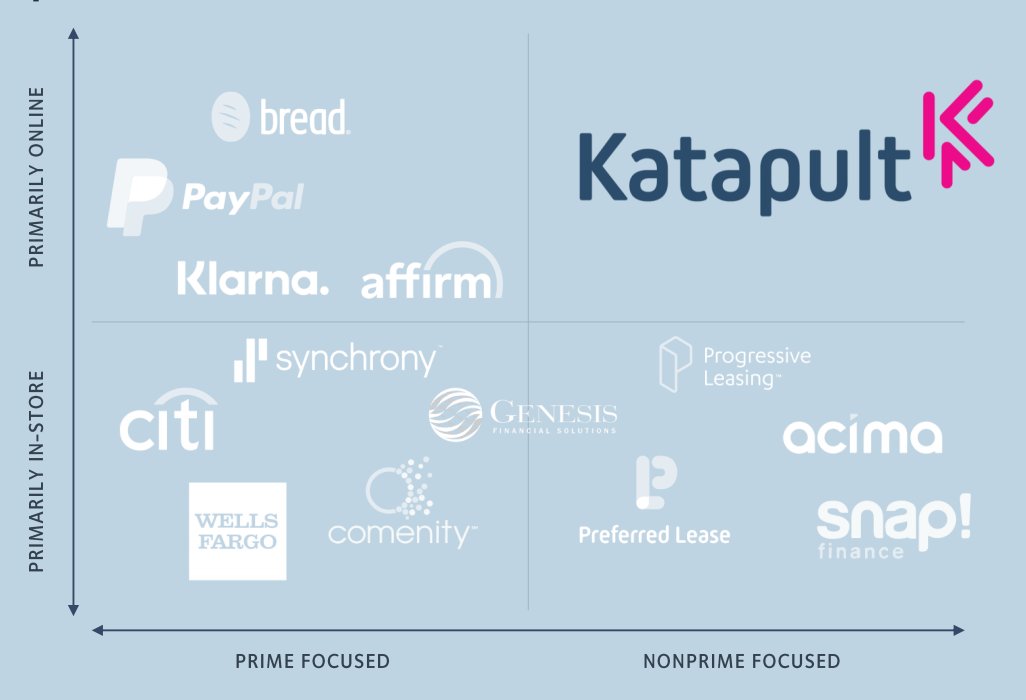

$AFRM serves many of these customers, providing a financing option far cheaper than credit cards. However, $AFRM only accepts credit worthy consumers. $FSRV Katapult fills up the void for subprime consumers

$FSRV Moat is the over 500k transactions they have recorded over 5 years as well as a proprietary platform that highly outperforms the industry. Machine learning helps to improve the platform over time

For consumers, $FSRV reduces costs by 30% vs a credit card and gives substantially more payment flexibility including an option to buyout in first 90 days

For merchants Katapult $FSRV helps to reduce abandonment rate especially for subprime consumers, who are declined 65% of the time on prime lending platforms like $AFRM

$FSRV Revenue is estimated to grow at an 87% CAGR from 2019-2023 while EBITDA is estimated to grow 75% from 2020-2023. Management is conservative with both revenue and EBITDA projections, which is a huge plus

$FSRV best of all is the fact that Katapult is 3x cheaper than $AFRM on an EV/2020 revenue basis despite higher growth. It's also substantially cheaper than publicly traded Afterpay $APT

Main risk is rev mix. $FSRV Katapult has not disclosed its rev mix from customer fees and merchant fees, each of which could trade at different multiples. For reference, Afterpay has 80%+ merchant fee mix

Overall, $FSRV seems like a great company with tons of growth potential and strong profitability

Read on Twitter

Read on Twitter