Enjoying this debate between @ChrisBloomstran and @garyblack00 on $TSLA. My followers will know I’m biased toward Chris’s view. But let me try to be objective here.

So, in the clearly infectious words of @SahillBloom, “Who’s up for a story?” https://twitter.com/ChrisBloomstran/status/1345491339106988032

So, in the clearly infectious words of @SahillBloom, “Who’s up for a story?” https://twitter.com/ChrisBloomstran/status/1345491339106988032

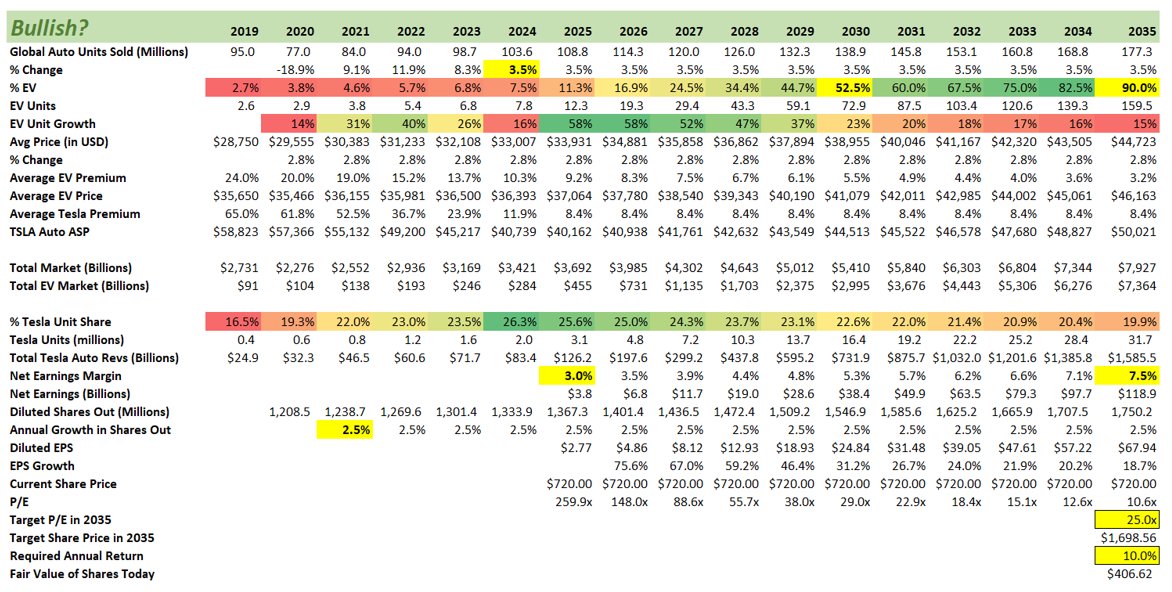

I’ll keep it very simple and decompose it into the key drivers.

Whether you are bullish, neutral or bearish, you can build something similar quite easily, and plug in however you think it will play out.

3|22

Whether you are bullish, neutral or bearish, you can build something similar quite easily, and plug in however you think it will play out.

3|22

I should also note that this only seeks to answer the “how much is Tesla worth as an automaker?” question. This doesn’t go on the @chamath trajectory, because I just can’t.

4|22 https://twitter.com/AlbertBridgeCap/status/1286629550848217088

4|22 https://twitter.com/AlbertBridgeCap/status/1286629550848217088

Different groups estimate that the world bought 65-95 million new cars and light trucks in 2019.

In my bull case, I see over 175 million sold in 2035, and 90% of them will be EV.

Those arguing for ride-sharing in our autonomous future need to revise this number down.

5|22

In my bull case, I see over 175 million sold in 2035, and 90% of them will be EV.

Those arguing for ride-sharing in our autonomous future need to revise this number down.

5|22

In a (tremendously) bullish scenario, I see Tesla with a 20% share of all EV’s produced, which would be 18% of all cars and light trucks.

Toyota, FWIW, is the largest auto manufacturer in the world, was founded in 1937 and has a 10% global market share today. VW has 7%.

6|22

Toyota, FWIW, is the largest auto manufacturer in the world, was founded in 1937 and has a 10% global market share today. VW has 7%.

6|22

In 2019, Tesla produced 365K vehicles. In that same year, Ford made over 5 million, and VW made nearly 11 million.

Incorporating this bullish perspective above, I have Tesla producing nearly 32 million vehicles in 2035.

7|22

Incorporating this bullish perspective above, I have Tesla producing nearly 32 million vehicles in 2035.

7|22

And despite $TSLA becoming a mass market producer in this scenario, I see them selling them at an ASP of $50K.

This will generate $1.6 TRILLION of sales for Tesla in 2035.

(Told you I was being bullish)

8|22

This will generate $1.6 TRILLION of sales for Tesla in 2035.

(Told you I was being bullish)

8|22

The automakers with the largest scale today are Toyota and VW. They do 4-7% net margins. By 2035 (in this scenario) Tesla would truly be a mass producer.

9|22

9|22

However, with a global production and distribution footprint & models and trims to suit all these $1.6 trillion of buyers (and product refreshes to keep them interested), I still going to model a higher, 7.5% net margin.

This means nearly ~$120 billion of net profit.

10|22

This means nearly ~$120 billion of net profit.

10|22

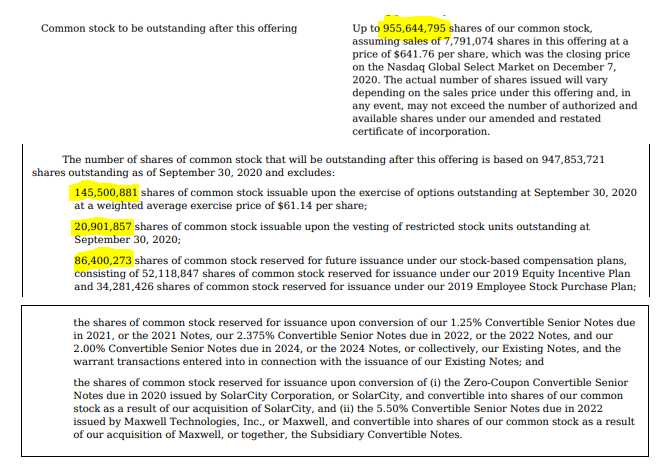

Meanwhile starting with the 1,208 million of diluted shares most recently disclosed by the company, and despite the generous stock based-compensation plans, I am modelling only 2.5% annual growth in diluted shares out at $TSLA.

11|22

11|22

So, with nearly ~$120 billion of profit and 1.75 billion shares out, this works out to Tesla generating over $65 of earnings per share in 2035.

12|22

12|22

And even though it will already be massive and generating $1.6 trillion in sales, let’s assume that Mr. Market will still be happy to pay a P/E of 25x for those earnings.

13|22

13|22

That gets us to a target share price in 2035 of nearly $1,700.

14|22

14|22

That is much higher than where it is today.

But that is in 2035.

So let’s assume that between now and then, Mr. Market only expects (and demands) to make 10% a year on his $TSLA investment.

15|22

But that is in 2035.

So let’s assume that between now and then, Mr. Market only expects (and demands) to make 10% a year on his $TSLA investment.

15|22

Meanwhile in a “bearish” scenario where EV is only 80% of all production in 2035 and Tesla has “only” a 10% market share of EV unit sales, it still does $1 trillion in revenues.

Again, Toyota today has the highest market share in the world, at a shade over 10%.

17|22

Again, Toyota today has the highest market share in the world, at a shade over 10%.

17|22

And if I estimate a 4% net margin and still make the assumption that people will love Tesla and be happy to pay a P/E of 18x, and want to earn just 12.5% a year to hold it, then what is it worth today?

18|22

18|22

About $50.

In Philadelphia, or anywhere, it's worth 50 bucks.

19|22

In Philadelphia, or anywhere, it's worth 50 bucks.

19|22

And these assumptions aren’t really that bearish at all.

So how then do you get to the current share px of ~$720?

You assume all new cars sold in 2035 will be EV and that Tesla will have a 25% global market share. This will be sales of $2.2 trillion dollars.

20|22

So how then do you get to the current share px of ~$720?

You assume all new cars sold in 2035 will be EV and that Tesla will have a 25% global market share. This will be sales of $2.2 trillion dollars.

20|22

Then you assume that Tesla will make net margins of 10% (50% higher than Toyota today) and will thus generate $220 billion in profit.

21|22

21|22

Read on Twitter

Read on Twitter