Central bank digital currencies (CBDCs) are something I have been putting off engaging with, but over the past week have come to take this seriously thanks to Ex Ante’s Grant Wilson, whose substack is available here: https://moneyinsideout.exantedata.com/p/chinas-digital-currency-is-a-game

CBDCs are also nicely addressed in this thread by @MaMoMVPY, but it’s Grant’s hypothesis that I want to address here. https://twitter.com/MaMoMVPY/status/1345101265399898112

Let’s start with the observation that China’s monetary policy remains “normal” in the sense that credit growth remains the mainstay of accelerating activity rather than leaning on fiscal-cum-central bank support.

The policy rate remains firmly in positive territory and the yield curve well behaved.

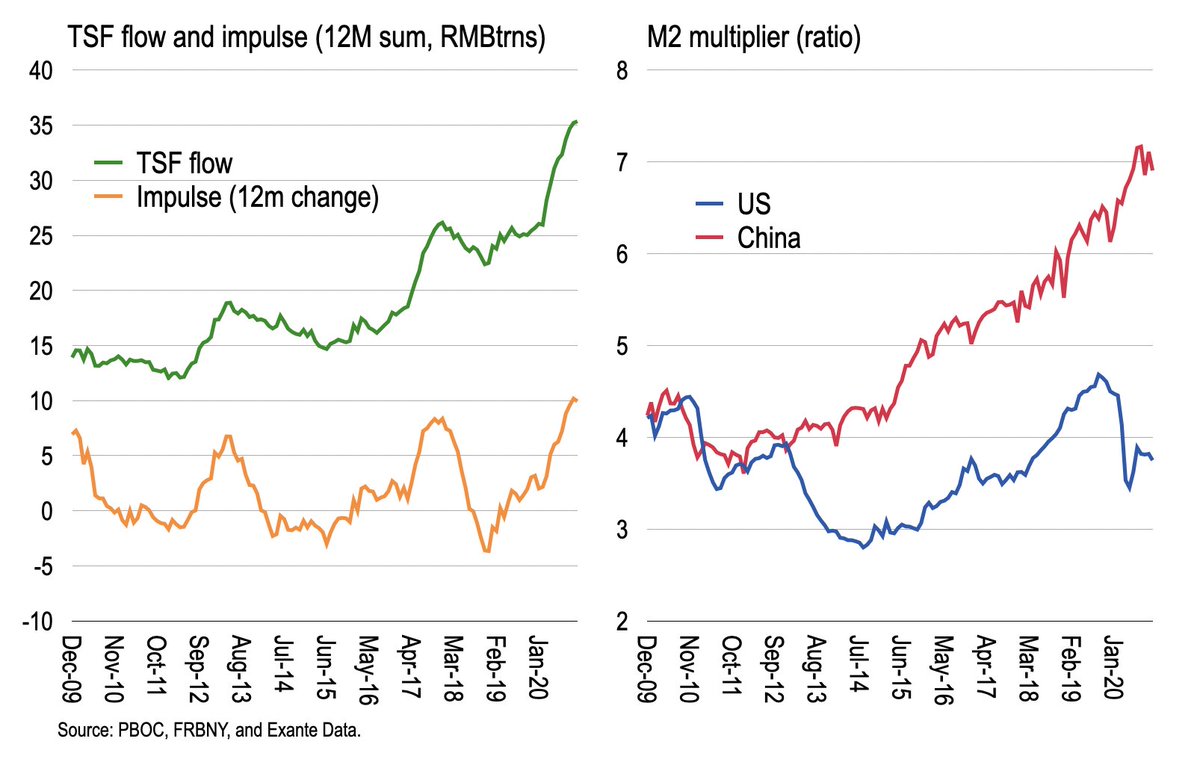

The flow of total social financing in China accelerated sharply in 2020, meaning the TSF impulse reached an all-time high (though not if scaled by GDP.)

The flow of total social financing in China accelerated sharply in 2020, meaning the TSF impulse reached an all-time high (though not if scaled by GDP.)

This is the 4th such impulse from China since GFC.

As a result, while the M2 multiplier in China and the US were comparable in 2009, China’s has crept ever higher while the US has gyrated with Fed balance sheet policies.

As a result, while the M2 multiplier in China and the US were comparable in 2009, China’s has crept ever higher while the US has gyrated with Fed balance sheet policies.

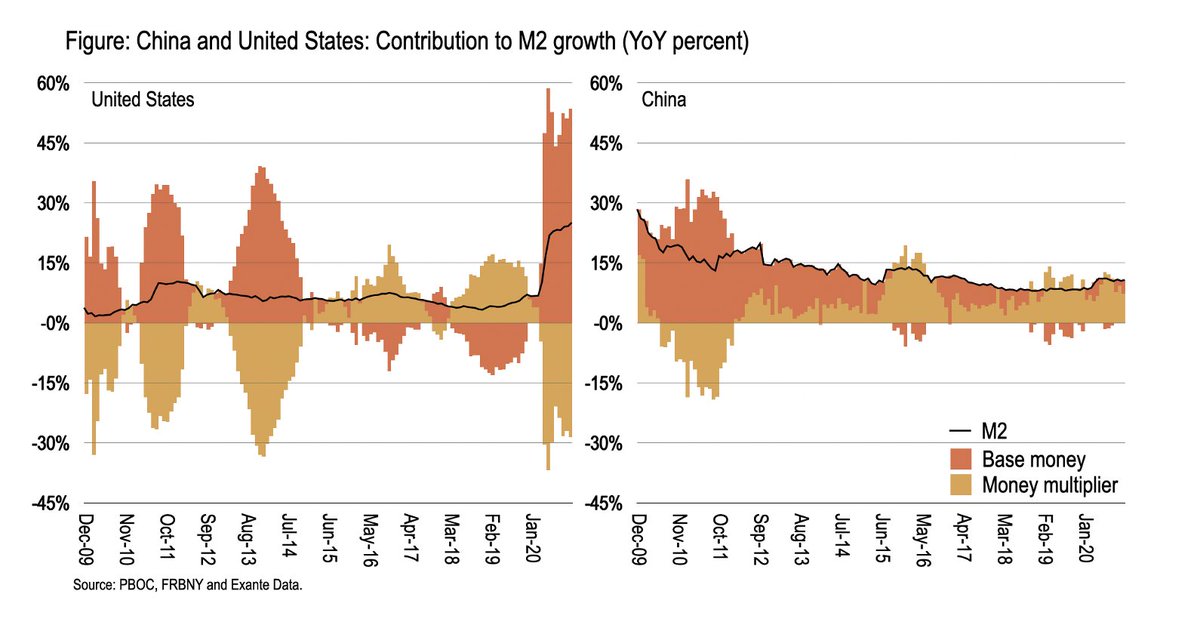

Decomposing the growth in M2, China has relied on the money multiplier instead of PBOC balance sheet expansion. So, in a sense, China’s monetary policy is much closer to “normal” than advanced economies.

Against this, given the huge expansion in credit in China over the past 10 years, should policy reach ZLB and PBOC is forced to rely on unconventional policy, then the risks from debt-deflation are substantial there. So having unconventional policy tools in place is crucial.

In this regard, PBOC has stolen a march in terms of CBDC and the possibilities implied in conducting “digital airdrops” in October and December.

As Grant notes: “The amounts were immaterial (150,000 citizens at $30 per packet = $4.5m = 0.0001% of the PBOC’s balance sheet)… so small that is not possible to understand how this fits in to the PBOC’s balance sheet, published monthly. Yet the precedent opens ‘new vistas’…”

The possibilities of each citizen having a direct account with the central bank, an electronic alternative to cash in hand as direct claim on the central bank, would indeed be potentially huge. https://www.afr.com/markets/currencies/digital-currencies-quietly-plot-their-place-in-history-20201231-p56qz6

On the negative side, contra bitcoin and the libertarian agenda of crypto currencies, tracking transactions by the State appears a dangerous imposition. But if we overcome this concern, the possibility of direct “helicopter drops” becomes real for the first time.

If PBOC is able to introduce CBDC by the time they are called upon to introduce unconventional policy, should that happen, then they can side-step QE in favour of direct transfers to residents.

Such money could then be subject to negative rates (without impairing banks) and/or expiration per Gesell if it is not “used” to encourage activity. The CB could transfer $X per week for as long as it takes to sustain activity and keep inflation running at the desired level.

What are the challenges or limits with such a policy? This seems to be something that needs to be fully worked out and remains a live issue. Here is a BIS paper on “foundational principles” of CBDC.

https://www.bis.org/publ/othp33.htm

https://www.bis.org/publ/othp33.htm

But it is already clear that part of the challenge is whether central banks will issue CBDC without backing on the asset side. QE, of course, involves purchasing assets, so the central bank’s net worth is not (immediately) impaired except through losses.

If CBs are content to “live with” negative capital, then they can potentially push quite hard on helicopter transfers. But as @birdyword pointed out over the holiday, managing negative capital is more complicated and needs to be carefully considered. https://twitter.com/Birdyword/status/1343877617771012096?s=20

For one thing, many central banks are constrained, by law, to a certain capital position. So if they were to make large enough CBDC transfers, they would trigger a recap which would typically involve being handed government debt to hold as assets.

In which case, CBDC is equivalent to QE in seeing government debt increase on the asset side, but with the benefit of getting cash into the hands of those whose spending on current goods and services is greater.

But if this chain of events unfolds, why is the decision to make quasi-fiscal transfers in the hands of the elected fiscal policymaker?

For financial stability, there is the challenge of whether there will be limits on the size of CBDC accounts.

For financial stability, there is the challenge of whether there will be limits on the size of CBDC accounts.

If retail customers can transfer their deposits to an unimpeachable balance sheet such as the central bank, this would disintermediate away from commercial banks.

And here again, the issue of whether the asset side of the CB is elastic to expanding CBDC remains important.

And here again, the issue of whether the asset side of the CB is elastic to expanding CBDC remains important.

Normal disintermediation, such as that contemplated by Tobin in the 1960s, involves non-monetary financial intermediaries absorbing a greater part of assets and expanding the range of investment vehicles available to retail investors.

http://cowles.yale.edu/sites/default/files/files/pub/d01/d0159.pdf

http://cowles.yale.edu/sites/default/files/files/pub/d01/d0159.pdf

If retail investors can transfer commercial bank deposits to the central bank, they would be withdrawing liquidity from the banking system while leaving overall non-liquid assets unchanged in size.

Given regulatory NQLA and NSFR constraints, it’s not clear that such disintermediation would be possible without the central bank engaging more liquidity provision, de facto taking on the non-liquid assets from commercial banks through QE or repos.

So Tobin’s disintermediation process would be restored, but the act of creating CBDC would force additional base money creation to boot.

Such balance sheet expansion would then bring into focus even more the sustainability of the central bank balance sheet. Of course, “lack” of sustainability means inflation risk, which is part of the purpose to begin with.

But there are times where the central bank balance sheet becomes so impaired that is creates problems that are a distant memory to many, but remains a concern for some still, such as in Argentina. Here is my model of BCRA balance sheet, for example. https://thegeneraltheorist.com/2020/12/31/mr-guzmans-impossible-plan/

Anyway, CBDC is also something under consideration as part of the ECB’s monetary strategy review, so this year will, as Grant notes, be an important once for thinking about the future of central banking.

END.

END.

Read on Twitter

Read on Twitter