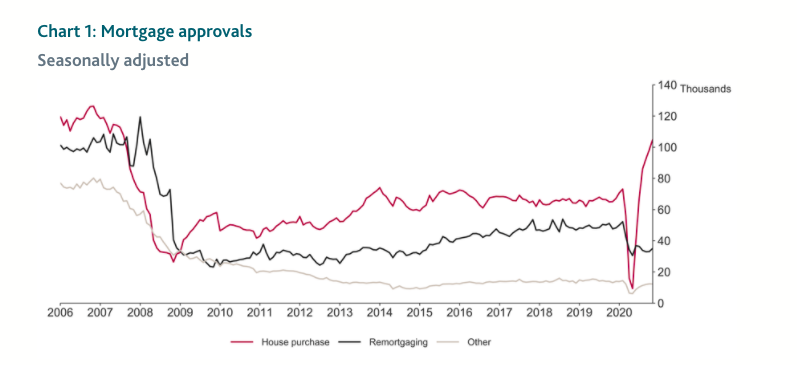

As mortgage approvals hit a 13-year high in November, the lockdown month, the boom triggered by the temporary stamp duty holiday (buy now while you can still get it!) should be a cause for concern for the @bankofengland's Financial Policy Committee and for @hmtreasury 1/2

Approvals are normally a reasonable lead indicator for where prices are going. In spite of lockdown they increased to 105,000 from 98,300 in October, the highest number of approvals since August 2007. /2

There's only one sensible interpretation of why this boom is happening. It's been created by the government's temporary stamp duty holiday, which means you pay thousands - or sometimes tens of thousands - less.

This tax break, designed to bring relief from the effects of the first lockdown, now looks very much like it's overcompensating - distorting a housing market which would otherwise be appropriately subdued given what's happening in the wider economy. Just look at this BoE chart:

The big risk for buyers is that they rush to buy now, then when the stamp duty holiday ends, demand drops suddenly and so do prices - leaving them in negative equity, with the price of their newly-purchased house dropping below the amount of the mortgage.

Negative equity doesn't matter so much if you can easily keep up repayments. But it's nasty if you lose your job, get divorced or get a long-term illness. In this country, even if you sell, the bank can still pursue the rest of the debt. And unemployment is now expected to rise.

@hmtreasury civil servants old enough to remember the Lawson boom of 1988 are probably thin on the ground now. But the bust that followed his tax-break-led boom - widely acknowledged as a serious mistake - was followed by a recession, negative equity + repossessions (= misery).

Read on Twitter

Read on Twitter