Lessons from the Tech Bubble.

Excellent thread by @corry_wang.

Two areas where similar arguments are playing out: ‘New’ Green Economy & New Currency Order with #TSLA & #BTC as the leading trades

as the leading trades

#BTC doesn’t even have implied valuations constraints! https://threadreaderapp.com/thread/1345192541545766915.html

doesn’t even have implied valuations constraints! https://threadreaderapp.com/thread/1345192541545766915.html

Excellent thread by @corry_wang.

Two areas where similar arguments are playing out: ‘New’ Green Economy & New Currency Order with #TSLA & #BTC

as the leading trades

as the leading trades#BTC

doesn’t even have implied valuations constraints! https://threadreaderapp.com/thread/1345192541545766915.html

doesn’t even have implied valuations constraints! https://threadreaderapp.com/thread/1345192541545766915.html

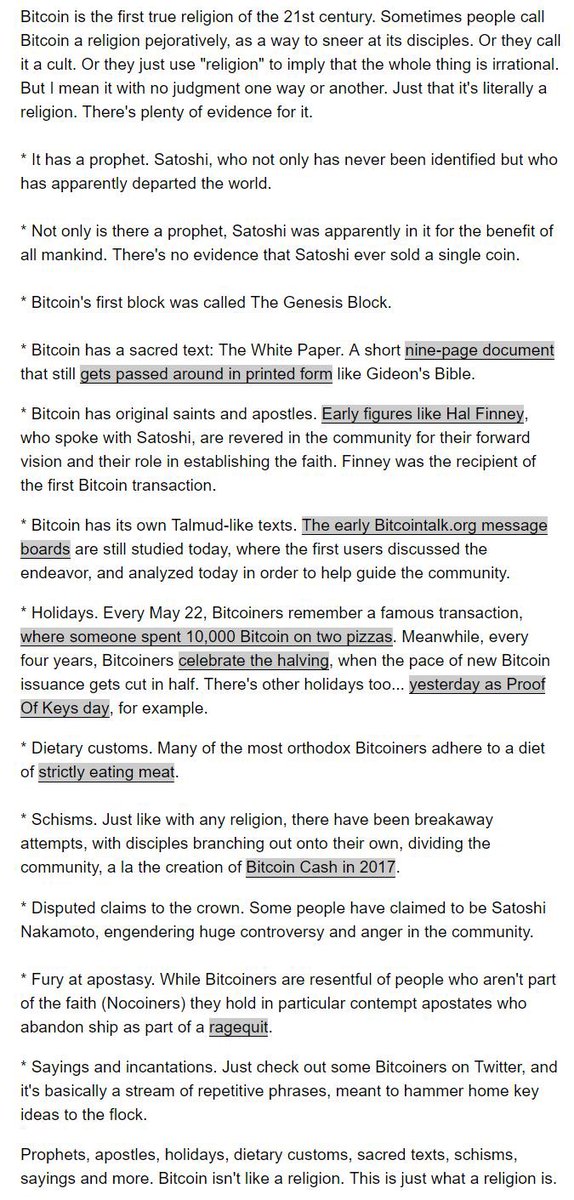

The First Religion of 21st Centrury - #BTC

@TheStalwart identifies the parallel building blocks of the Bitcoin Religion!

@TheStalwart identifies the parallel building blocks of the Bitcoin Religion!

As prices move further away from trend, at accelerating speed and with growing speculative fervor;

of course my confidence as a market historian increases that this is the late stage of a bubble

A bubble that is beginning to look like a real humdinger https://www.gmo.com/asia/research-library/waiting-for-the-last-dance/

of course my confidence as a market historian increases that this is the late stage of a bubble

A bubble that is beginning to look like a real humdinger https://www.gmo.com/asia/research-library/waiting-for-the-last-dance/

Jeremy Grantham: The one reality that you can never change is that a higher-priced asset will produce a lower return than a lower-priced asset.

You can’t have your cake and eat it.

You can’t have your cake and eat it.

You can enjoy it now, or you can enjoy it steadily in the distant future, but not both – and the price we pay for having this market go higher and higher is a lower 10-year return from the peak.

Every fault of individual human psychology will work toward sucking investors in!!

Every fault of individual human psychology will work toward sucking investors in!!

This bubble will burst in due time, no matter how hard the Fed tries to support it, with consequent damaging effects on the economy and on portfolios.

Make no mistake – for the majority of investors today, this could very well be the most important event of your investing lives.

Make no mistake – for the majority of investors today, this could very well be the most important event of your investing lives.

Don’t wait for the Goldmans/Morgans to become bearish: it can never happen.

Their best policy is clear & simple: always be extremely bullish.

It is good for business & intellectually undemanding.

It is appealing to most investors who much prefer optimism to realistic appraisal

Their best policy is clear & simple: always be extremely bullish.

It is good for business & intellectually undemanding.

It is appealing to most investors who much prefer optimism to realistic appraisal

Central Banks cannot control which bubbles inflate due to their money printing.

The money sloshes into whichever momentum trade the market chooses.

Excellent thread by @albertedwards99 on the probable social implications of rapid rise in Food Prices. https://threadreaderapp.com/thread/1339905707160850434.html

The money sloshes into whichever momentum trade the market chooses.

Excellent thread by @albertedwards99 on the probable social implications of rapid rise in Food Prices. https://threadreaderapp.com/thread/1339905707160850434.html

Read on Twitter

Read on Twitter