1/10 Weekly #Bitcoin  Price Temperature (BPT) update

Price Temperature (BPT) update

After a week of price growth, the BPT logically heatened up as well

price growth, the BPT logically heatened up as well

Due to the volatility, the BPT Bands are also sloping up faster to higher price levels

All charts & a more detailed interpretation in this thread

Price Temperature (BPT) update

Price Temperature (BPT) update

After a week of

price growth, the BPT logically heatened up as well

price growth, the BPT logically heatened up as wellDue to the volatility, the BPT Bands are also sloping up faster to higher price levels

All charts & a more detailed interpretation in this thread

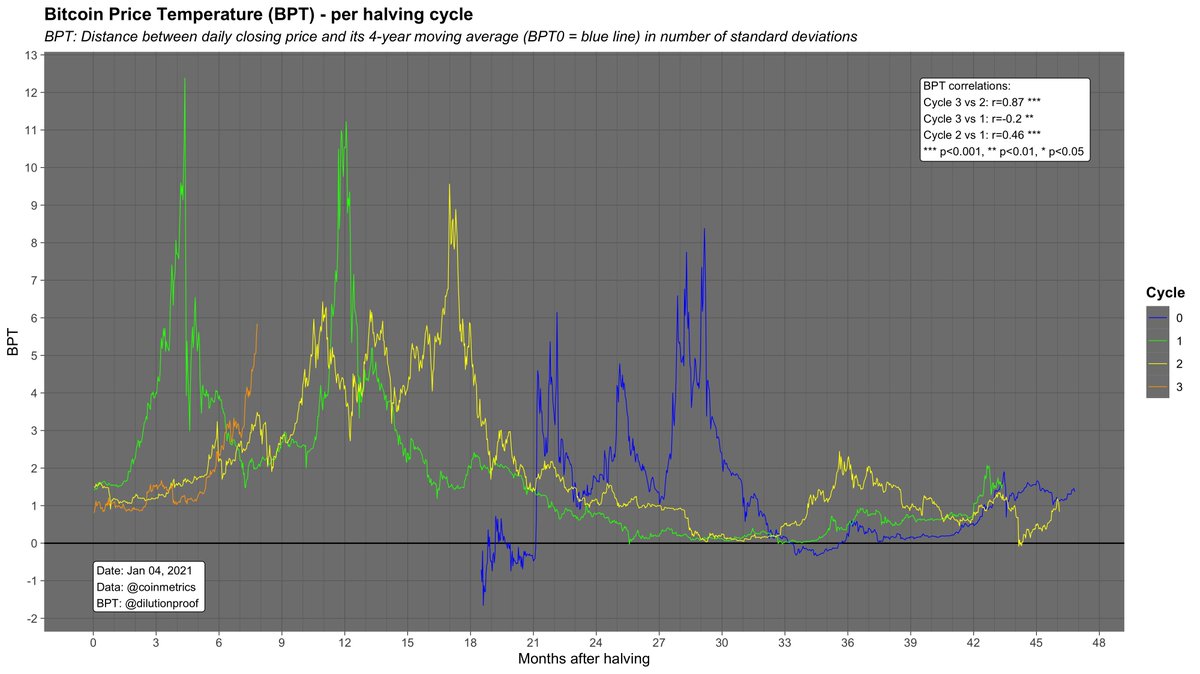

2/10 Yesterday, the #Bitcoin  Price Temperature (BPT) actually spiked through the BPT6 band for the first time (during this halving cycle) yesterday, but closed just below it at 5.84

Price Temperature (BPT) actually spiked through the BPT6 band for the first time (during this halving cycle) yesterday, but closed just below it at 5.84

During 2017, there was resistance at these relative price levels

Is #Bitcoin due for a dip?

due for a dip?

Price Temperature (BPT) actually spiked through the BPT6 band for the first time (during this halving cycle) yesterday, but closed just below it at 5.84

Price Temperature (BPT) actually spiked through the BPT6 band for the first time (during this halving cycle) yesterday, but closed just below it at 5.84During 2017, there was resistance at these relative price levels

Is #Bitcoin

due for a dip?

due for a dip?

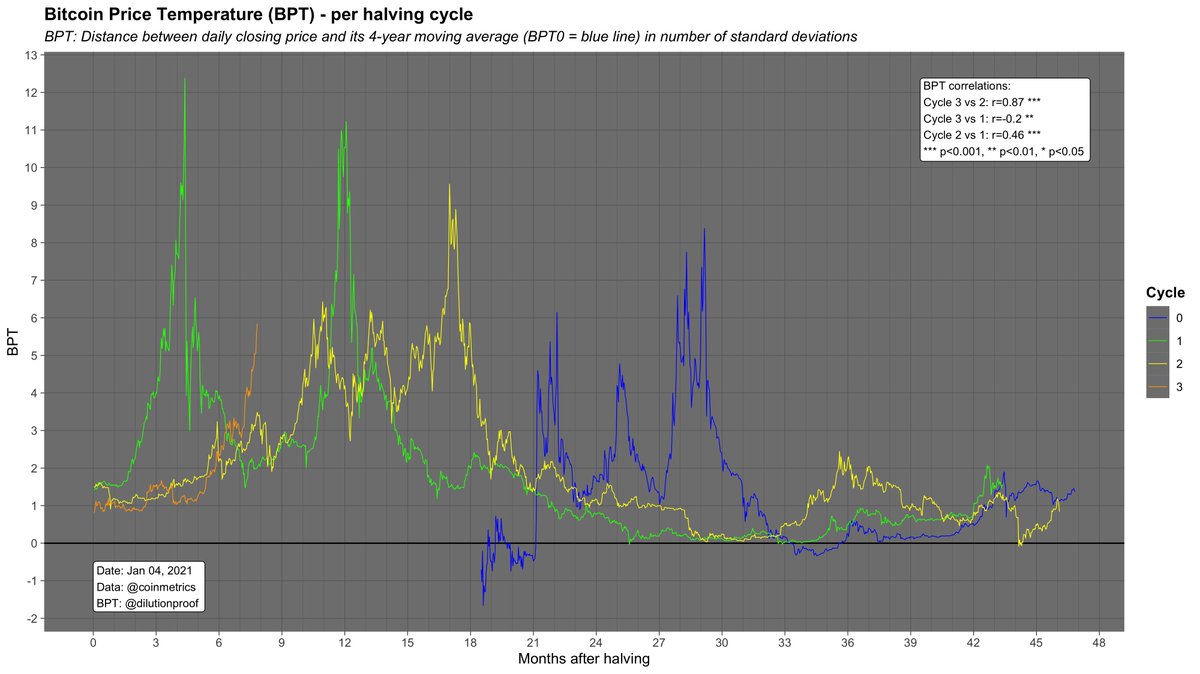

3/10 Compared to 2017, #Bitcoin  took less time to reach these levels and now has almost 2x the BPT it had at the same 2017 post-halving day

took less time to reach these levels and now has almost 2x the BPT it had at the same 2017 post-halving day

The slope of the BPT curve looks more like that of the two 2013 cycles but is overall more correlated to 2017 (r=0.87) than 2013 (r=-0.2)

took less time to reach these levels and now has almost 2x the BPT it had at the same 2017 post-halving day

took less time to reach these levels and now has almost 2x the BPT it had at the same 2017 post-halving dayThe slope of the BPT curve looks more like that of the two 2013 cycles but is overall more correlated to 2017 (r=0.87) than 2013 (r=-0.2)

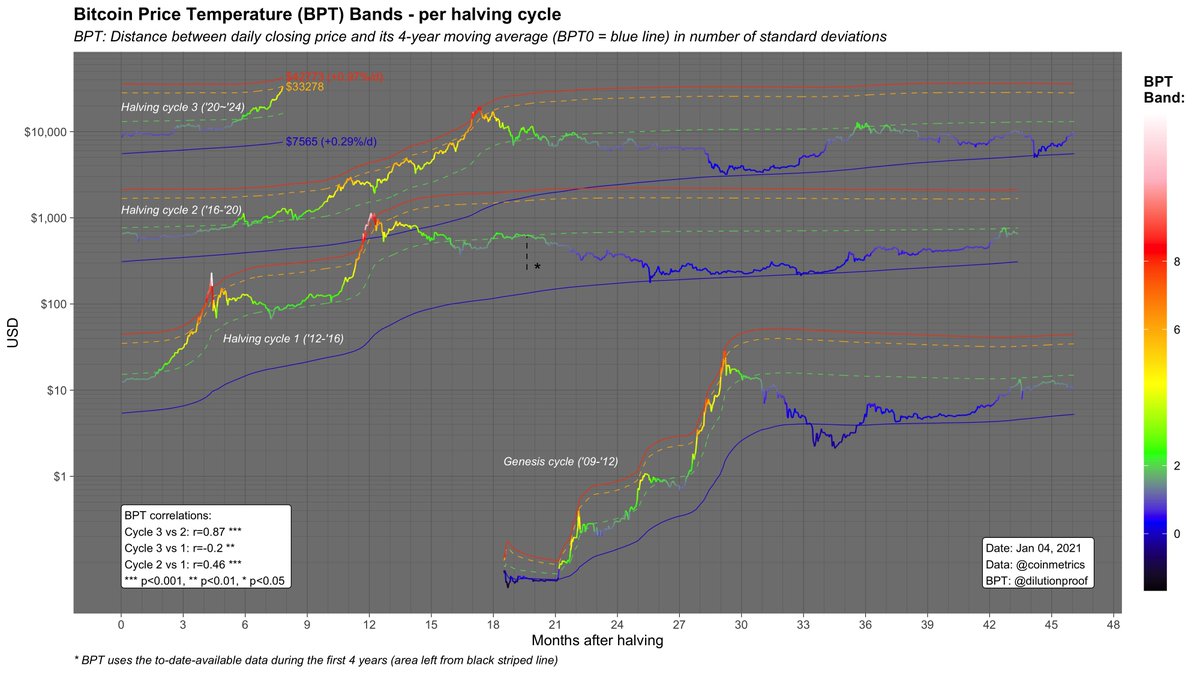

4/10 The rapid growth is visible on the BPT Bands chart as well; the #Bitcoin  price so far hasn't had a significant drawback yet since leaving the purple BPT levels early september

price so far hasn't had a significant drawback yet since leaving the purple BPT levels early september

price so far hasn't had a significant drawback yet since leaving the purple BPT levels early september

price so far hasn't had a significant drawback yet since leaving the purple BPT levels early september

5/10 Current BPT Band prices:

- BPT0: $7,565

- BPT2: $16,367

- BPT6: $33,971

- BPT8: $42,772

Notice how the BPT Bands are curling up though

The BPT8 did +0.57% last monday but +0.97% this week

More volatility -> more steeply sloping BPT Bands -> higher BPT Band price levels

- BPT0: $7,565

- BPT2: $16,367

- BPT6: $33,971

- BPT8: $42,772

Notice how the BPT Bands are curling up though

The BPT8 did +0.57% last monday but +0.97% this week

More volatility -> more steeply sloping BPT Bands -> higher BPT Band price levels

6/10 In this final per halving cycle BPT Bands chart, you can see how the current cycle is more steep than the 2017 cycle, despite being highly (r=0.87) correlated with it

The big question remains; is the steepness of the current cycle a harbinger of what to come?

The big question remains; is the steepness of the current cycle a harbinger of what to come?

7/10 At the time of writing, the #Bitcoin  price is dipping back to ~$30k levels, suggesting that the (intraday) BPT6 touch yesterday was possibly indeed an indication that price became a tad heated this weekend

price is dipping back to ~$30k levels, suggesting that the (intraday) BPT6 touch yesterday was possibly indeed an indication that price became a tad heated this weekend

However, I'm personally not convinced it'll pull back too far

price is dipping back to ~$30k levels, suggesting that the (intraday) BPT6 touch yesterday was possibly indeed an indication that price became a tad heated this weekend

price is dipping back to ~$30k levels, suggesting that the (intraday) BPT6 touch yesterday was possibly indeed an indication that price became a tad heated this weekend

However, I'm personally not convinced it'll pull back too far

8/10 It is good to realize that the #Bitcoin  Price Temperature (BPT) & Bands are just based on historic prices

Price Temperature (BPT) & Bands are just based on historic prices

Prices may appear to be (over)heated in comparison to historic prices, but IMO the actual context of those prices is currently very different https://twitter.com/woonomic/status/1345332289660600323?s=20

Price Temperature (BPT) & Bands are just based on historic prices

Price Temperature (BPT) & Bands are just based on historic pricesPrices may appear to be (over)heated in comparison to historic prices, but IMO the actual context of those prices is currently very different https://twitter.com/woonomic/status/1345332289660600323?s=20

9/10 The most important evidence for that is the absolutely unprecedented buying pressure that we've witnessed recently

Large players have created a huge supply shock in 2020 by soaking up tons of BTC from exchanges - and still appear to do so

https://twitter.com/dilutionproof/status/1345412327886172160?s=20

Large players have created a huge supply shock in 2020 by soaking up tons of BTC from exchanges - and still appear to do so

https://twitter.com/dilutionproof/status/1345412327886172160?s=20

10/10 Also, when you correct current price levels for M2 money growth, you'll see that #Bitcoin  only just hit a new all time high

only just hit a new all time high

Therefore, current #Bitcoin Price Temperature levels are higher than they would be when corrected for monetary inflation

Price Temperature levels are higher than they would be when corrected for monetary inflation  https://twitter.com/kenoshaking/status/1345492389574692869

https://twitter.com/kenoshaking/status/1345492389574692869

only just hit a new all time high

only just hit a new all time highTherefore, current #Bitcoin

Price Temperature levels are higher than they would be when corrected for monetary inflation

Price Temperature levels are higher than they would be when corrected for monetary inflation  https://twitter.com/kenoshaking/status/1345492389574692869

https://twitter.com/kenoshaking/status/1345492389574692869

Read on Twitter

Read on Twitter