1/How to evaluate Tesla's market performance is a subject of much debate. You can slice and segment the market in many ways, and look at Tesla's performance from a number of different angles. What's the best way to do it? I try to understand how the consumer shops..

2/...the market. Ultimately, the consumer's top 3-5 needs/desired features are what will determine which products make it into the product consideration set. Understanding what those 3-5 things are & knowing your product is how companies...

3/...position/price/promote their products to consumers to try and get the best financial result.

In the auto world, PRICE, FORM FACTOR (ex: sedan, SUV, Truck) & PERFORMANCE, BRAND have always been among the key set of things consumers look for when shopping the category.

In the auto world, PRICE, FORM FACTOR (ex: sedan, SUV, Truck) & PERFORMANCE, BRAND have always been among the key set of things consumers look for when shopping the category.

4/ When the market is looked at through this lens, it's clear to see a VW ID.3 does not compete with a BMW 3 series; a VW ID4 does not compete with a MB C-Class, and neither an ID.3 or an ID.4 compete with a Model 3. So why look at EV share, at all? Looking at it is fine if one..

5/...understands that they're looking at apples and oranges. Instead, I would argue that its much better to look at products that a consumer would consider together at the time of purchase. Only then can you truly see and understand which products are winning and losing.

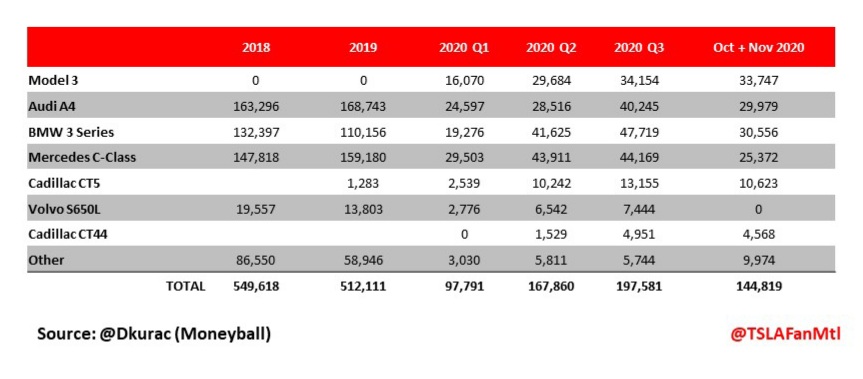

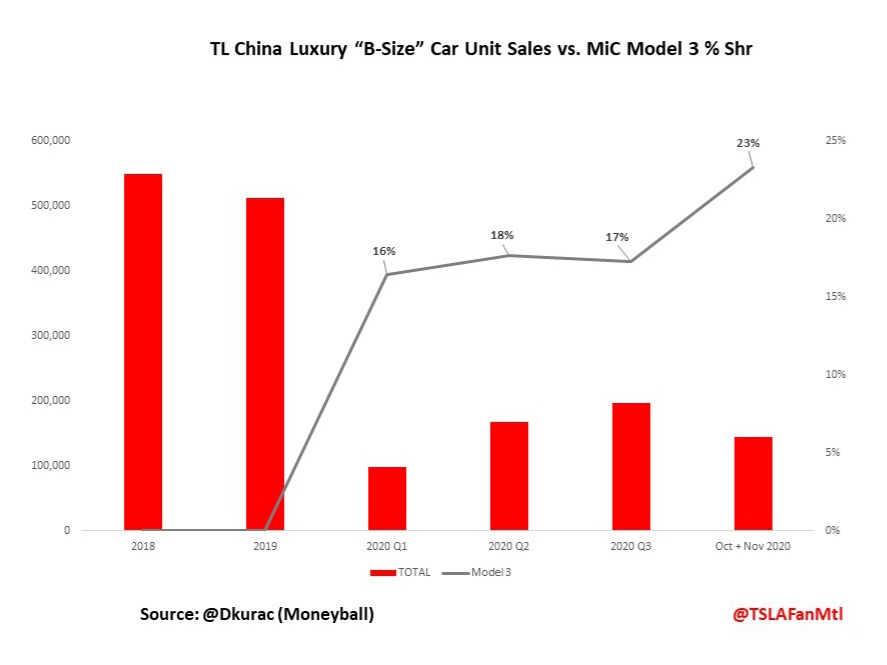

6/ I recently got my hands on some nice clean data (courtesy of @DKurac - who posted a great article that I will share at the end of this thread) that properly compares MiC Model 3 sales to Luxury OEM ICE vehicles in China. These cars all compete for the same customer.

7/ These cars, so called "B-Size" luxury vehicles, include the 3 series, the C-class, the A4...exactly the cars that the Tesla Model 3 competes with directly from a brand, price & performance perspective.

How's Tesla doing? As production expands, so too does its market share.

How's Tesla doing? As production expands, so too does its market share.

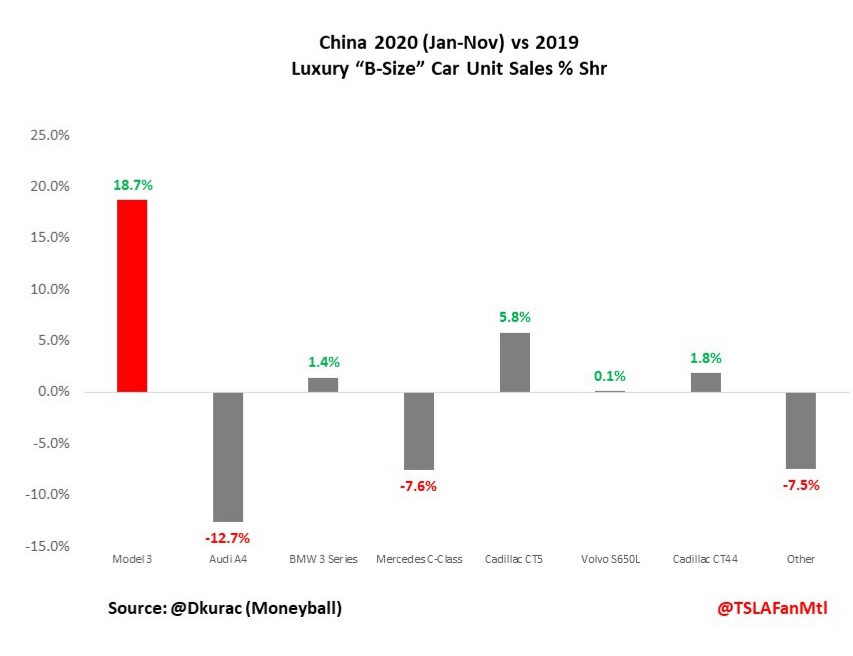

8/ In fact, Tesla MiC Model 3 is the fastest growing car in this segment - and through Oct-Nov 2020, has a 18.7% shr (23% in Oct-Nov).

There are rumors that December 2020 China deliveries are ~30k. This will surely drive $TSLA's share even higher.

There are rumors that December 2020 China deliveries are ~30k. This will surely drive $TSLA's share even higher.

9/ Who is Tesla hurting the most?

Audi A4 and MB C-Class. Although they have surely slowed the growth of other brands, too.

Audi A4 and MB C-Class. Although they have surely slowed the growth of other brands, too.

10/ Note = I did consider including 2019 Fremont-based Model 3 sales in here. Tesla sold ~30k Model 3s in China in 2019. However, those cars were much more expensive than the MiC ones sold in 2020 (due to tariffs, shipping & lack of subsidies) - it sullies the YoY comparison.

11/ Even if we included those sales in our YoY comparison, 30k Model 3s in 2019 is only a 5.8% volume share...still showing strong growth in 2020 (18.7% Jan-Nov and 23% in Oct-Nov). Growth is accelerating.

$TSLA

$TSLA

12/ Here is the Moneyball article: https://twitter.com/DKurac/status/1345677171143000064?s=19

Read on Twitter

Read on Twitter