1) Intro to Sharpe Ratios:

Performance has two objectives, and they are risk and return. Comparing just one element of the portfolio to the market is not enough context.

Most people simply compare their returns to that of the market.

Performance has two objectives, and they are risk and return. Comparing just one element of the portfolio to the market is not enough context.

Most people simply compare their returns to that of the market.

2) A commonly used measure for this, is the Sharpe Ratio, which is defined as the portfolio’s risk premium, divided by its risk.

The Sharpe ratio is appealing in that it can be justified on a theoretical before-the-fact basis, and after-the-fact basis.

The Sharpe ratio is appealing in that it can be justified on a theoretical before-the-fact basis, and after-the-fact basis.

3) Values can be calculated using readily available market data. The ratio is also easy to interpret also, with it essentially being an efficiency ratio of sorts, relating rewards to risks taken.

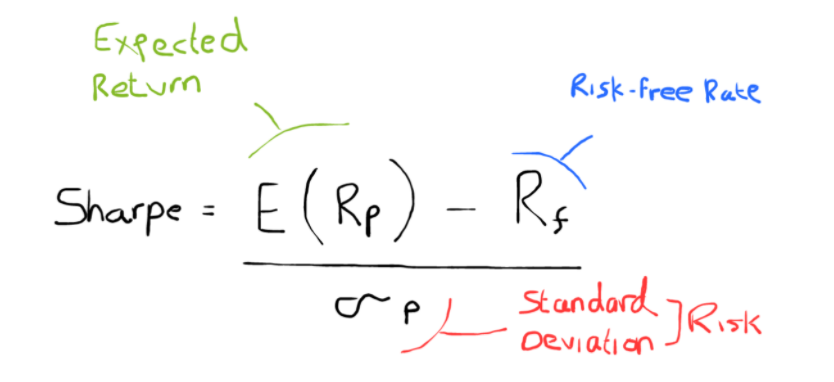

4) The Sharpe Ratio is the outcome of the Expected Return, less the risk-free rate, divided by the standard deviation of the portfolio. This would of course be on an ex-ante basis, meaning before the fact.

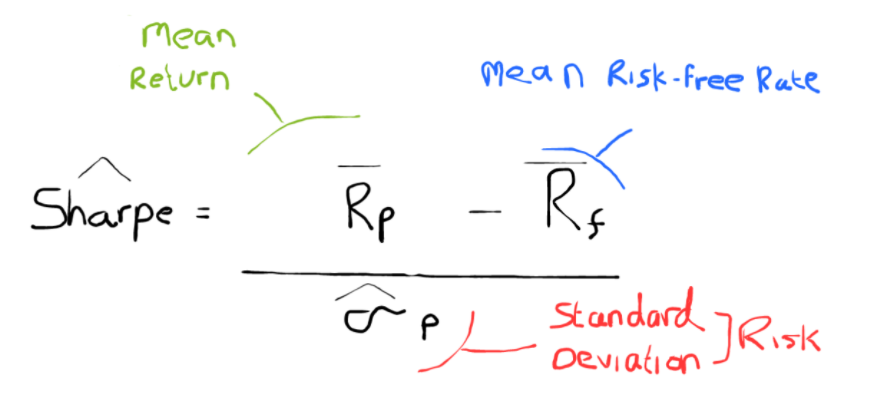

5) If we want a ex-post (after the fact) basis, we use the below equation, which is largely the same but the inputs are different. Instead, here we use the sample mean return, instead of expected return. We use the sample mean risk-free rate, and the standard deviation.

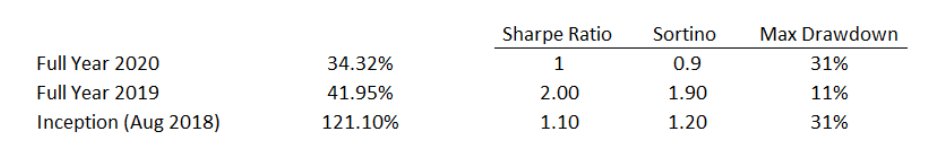

6) The greater the Sharpe Ratio, the greater the risk-adjusted return is. A Sharpe of 1 is generally considered to be okay, and anything above 1 is good. Then 2 and upwards is stellar.

For instance, my 2020 performed worse on a risk-adjusted basis than my 2019 performance.

For instance, my 2020 performed worse on a risk-adjusted basis than my 2019 performance.

7) Comparing returns only is not an effective way to ascertain how you fair against the market.

Comparing return & risk, is certainly a better way to do it.

Thanks

Comparing return & risk, is certainly a better way to do it.

Thanks

8) A lot of people asking me a few things like:

- How to calculate the SD

- How to find Risk Free Rate

For the most part, your broker should provide you a Sharpe/Sortino ratio.

But I will circle back and address this in better detail, maybe in a video, soon.

- How to calculate the SD

- How to find Risk Free Rate

For the most part, your broker should provide you a Sharpe/Sortino ratio.

But I will circle back and address this in better detail, maybe in a video, soon.

Read on Twitter

Read on Twitter