Rebase tokens / elastic supply tokens are often misunderstood.

People called "rug pull" when the positive rebase of $UNIF happened, same for $SUSF yesterday.

"Dead by rebase" People dumped bc. looking at the price it was dead.

This wasn't a rug. But, how do rebases work?

People called "rug pull" when the positive rebase of $UNIF happened, same for $SUSF yesterday.

"Dead by rebase" People dumped bc. looking at the price it was dead.

This wasn't a rug. But, how do rebases work?

A price-elastic token is one where the project's total token supply is not fixed, but instead automatically adjusts on a routine basis: a 'rebase'.

They have a target price, and rebase mechanics facilitate that target by in increasing or decreasing the total supply.

They have a target price, and rebase mechanics facilitate that target by in increasing or decreasing the total supply.

“Rebases,” take place at a set time, i.e. every 24H. In such a way that users’ proportional holdings ultimately don’t change and thus aren’t diluted.

If you had 1% of the circulating supply after a rebase your token amount is changed but not your % of the total supply.

If you had 1% of the circulating supply after a rebase your token amount is changed but not your % of the total supply.

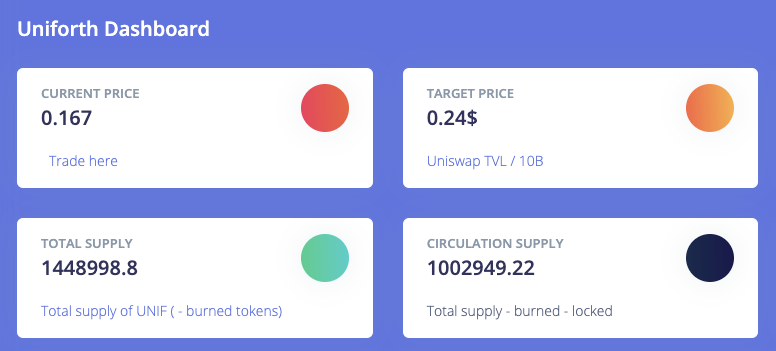

If we take $UNIF for example:

"Uniforth $UNIF is a crypto asset pegged to the total Uniswap liquidity in the Uniswap ecosystem."

UNIF rebase is pegged to total Uniswap liquidity at 1:10B ratio.

If 2.4B is locked in uniswap, target (rebase) price would be 24cents.

"Uniforth $UNIF is a crypto asset pegged to the total Uniswap liquidity in the Uniswap ecosystem."

UNIF rebase is pegged to total Uniswap liquidity at 1:10B ratio.

If 2.4B is locked in uniswap, target (rebase) price would be 24cents.

So at the moment, the $UNIF target price is $0.24 but $UNIF currently trades for $0.167. Which is 44% lower.

If this would be the rebase moment the total supply needs to decrease by ~44% to get to the target price of $0.24. This is called a 'negative rebase'.

If this would be the rebase moment the total supply needs to decrease by ~44% to get to the target price of $0.24. This is called a 'negative rebase'.

Say you have 1,000 $UNIF which has a total value of $167. After this 44% negative rebase you will have 560 tokens of $0.24, which is still $167.

Positive rebases can look like a 'rug pull'.

Here $UNIF traded at $0.591 before the rebase which had a target of $0.193. When looking at the price chart, the drop almost looks like a rug.

Only now all holders had 201% more tokens in their wallet.

Here $UNIF traded at $0.591 before the rebase which had a target of $0.193. When looking at the price chart, the drop almost looks like a rug.

Only now all holders had 201% more tokens in their wallet.

Yesterday $SUSF traded at $0.156 target was $0.10 after the +56% positive rebase people misunderstood the concept. Saying the rebase was a rug and kept dumping.

(yes the 600 ETH raised in the pre-sale was too much for a solid pump as well.)

(yes the 600 ETH raised in the pre-sale was too much for a solid pump as well.)

Rebases are designed to be tradable and could be profitable.

However, rebasing has a compounding effect.

After a positive rebase you'll have much more tokens with a potential upside. Negative rebases combined with a plunging market cap could lead to compounding losses.

However, rebasing has a compounding effect.

After a positive rebase you'll have much more tokens with a potential upside. Negative rebases combined with a plunging market cap could lead to compounding losses.

Read on Twitter

Read on Twitter