1/ Read below for my thesis behind Thunderbird ($TBRD).

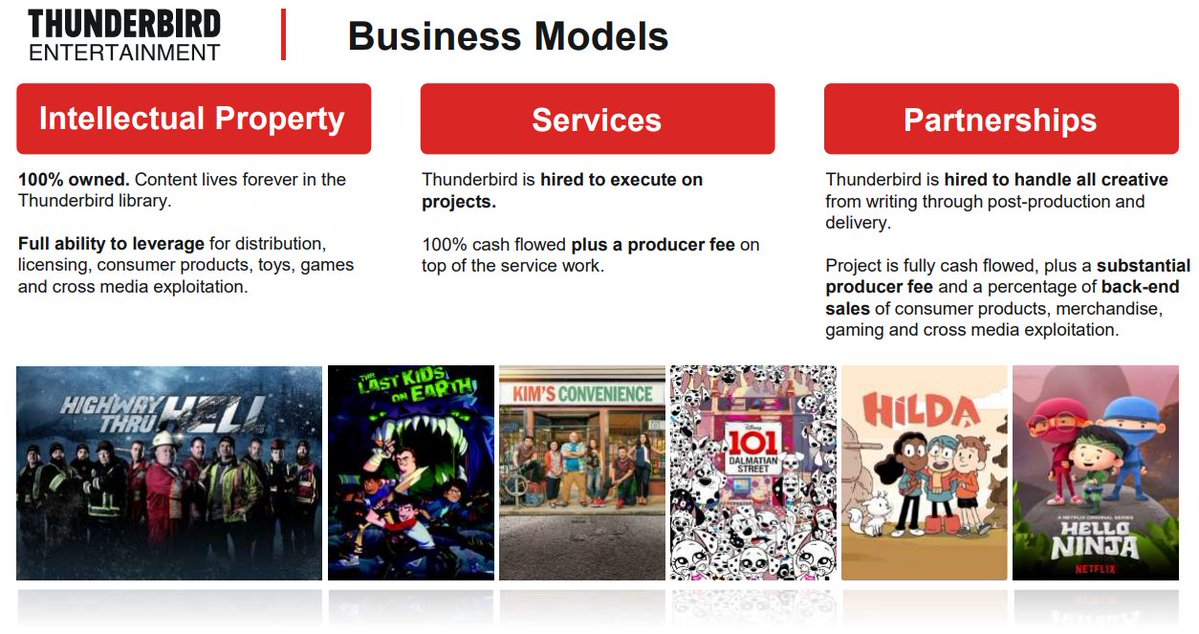

Company description: $TBRD is a provider of kids (animated) and factual + scripted content that sells to streaming platforms (i.e. $NFLX) and traditional broadcast/cable channels (i.e. $DISC.A).

Market Cap: ~C$150mm

Company description: $TBRD is a provider of kids (animated) and factual + scripted content that sells to streaming platforms (i.e. $NFLX) and traditional broadcast/cable channels (i.e. $DISC.A).

Market Cap: ~C$150mm

2/ $TBRD is expected to benefit materially from the growth in streaming, with major players entering the market incl. $NFLX, $DIS, $AMZN, Peacock, HBO Max, Hulu

Streaming, supplemented with continued spend by broadcasters, will drive significant growth in content spend

Streaming, supplemented with continued spend by broadcasters, will drive significant growth in content spend

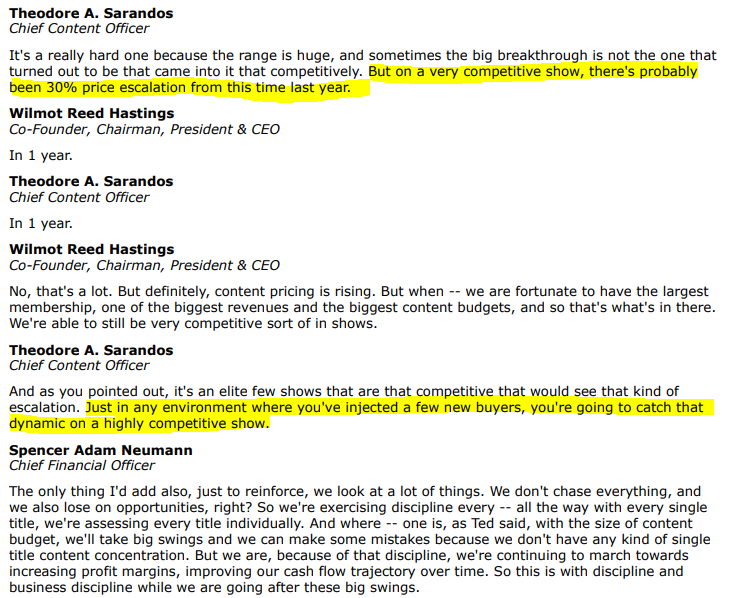

3/ Not only will streaming drive volume growth, but it will also allow $TBRD to better monetize their owned IP while seeing pricing benefits. In a Q3 2019 earnings call, $NFLX stated there had been a 30% increase in price for top content.

4/ Streamers like $NFLX are highly focused on (i) subscriber growth / retention; and (ii) pricing growth. The top reasons for churn are largely related to lack of content.

$NFLX has grown pricing at a CAGR of ~8% from '14 - '19. To continue this, new content will be required.

$NFLX has grown pricing at a CAGR of ~8% from '14 - '19. To continue this, new content will be required.

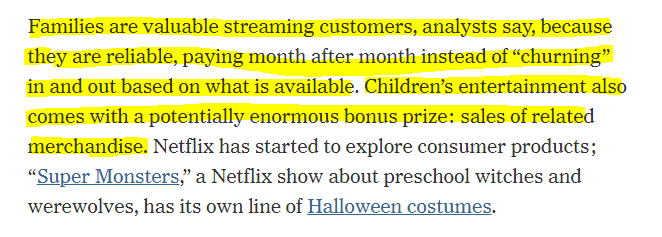

5/ Finally, $TBRD is well positioned in the markets that are getting the most attention: kids/fam content as well as factual content.

Why is this important for streamers? These make up the core "family bundle", which drives retention, as it provides content for the entire fam.

Why is this important for streamers? These make up the core "family bundle", which drives retention, as it provides content for the entire fam.

6/ $TBRD has several differentiators, including its talent (many are from top content houses, like Pixar) as well as a cost advantage relative to US peers given the strong tax credits the Canadian Government provides. TBRD does not compete on price given its strong relationships

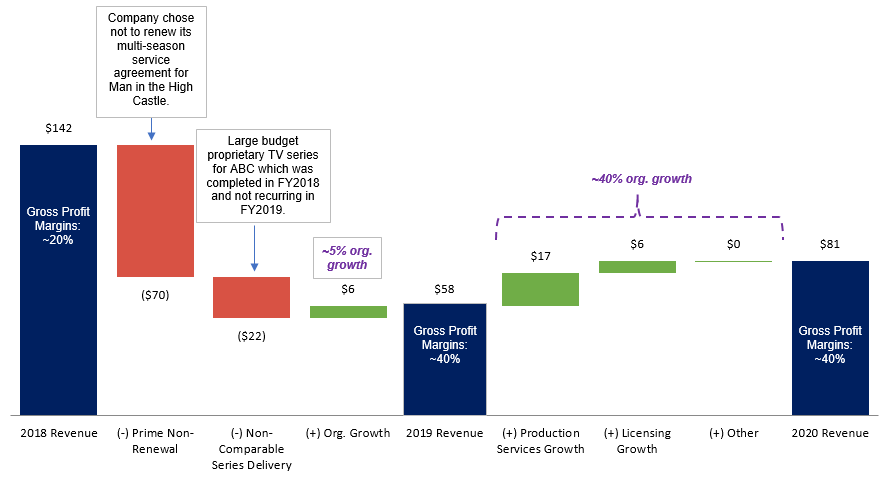

7/ $TBRD has a good track record of organic growth, accelerating significantly in FY20 after a strategic shift to higher-margin productions in FY2019 (rather than low margin projects). Org. growth was ~5% in FY19 and ~40% in FY20. Content alone should grow 10%+ excl. other opps.

8/ While TBRD should continue to grow 10%+ solely from content growth, particularly within its Atomic Cartoons segment, $TBRD also has significant growth opps from further monetizing its owned content (800+ hrs of owned content), with planned toy launches + video games in CY21.

9/ I believe the Company is attractively valued relative to its growth prospects as LT margins are likely understated as ramp-up ancillary revenue. LT potential margins of ~30% with factual content having 50%+ margins and kids content at 20-30% prior to ancillary rev.

10/ $TBRD currently trades at 10x LTM adj. EBITDA (~8.5x NTM Adj. EBITDA). I believe this is a fair value given the margin expansion opportunity (they have invested heavily in fixed costs, particularly addition of LA studio+Ottawa expansion) and double-digit topline growth.

11/ eOne, now owned by $HAS, was acquired for ~15x NTM EBITDA at the end of 2019. Its key asset is Peppa Pig.

Using this as a benchmark, it would imply a share price of $5.65, or ~85% upside relative to the current share price, assuming no discount due to size.

Using this as a benchmark, it would imply a share price of $5.65, or ~85% upside relative to the current share price, assuming no discount due to size.

12/ $TBRD has a strong balance sheet, with no corporate debt and $15mm cash (10% of market cap), driven by its cash-flowing factual business which has helped offset large investment in kids content. The Government tax credits allow the Business to invest more rapidly in content.

13/ Finally, $TBRD management is fully aligned with shareholders given its high ownership with Mgmt. + Board owning ~20% of the Company.

14/ Key catalysts include: (i) release of its consumer products and video games, (ii) rollout of new content, with a strong pipeline alongside top partners, (iii) M&A, (iv) rollout of feature films; and (iv) upgrade from the TSXV to the TSX.

15/ I have taken a starter position at $2.97 and will look to increase this as a few thesis points plays out.

Not investment advice.

Not investment advice.

Read on Twitter

Read on Twitter