$MWK

I know a lot of people have shared their thoughts on this one recently. Definitely some overlap from others but here is my DD and comments on some of the risks I see.

Not inv. advice

I know a lot of people have shared their thoughts on this one recently. Definitely some overlap from others but here is my DD and comments on some of the risks I see.

Not inv. advice

$MWK (Mohawk Group) operates as a CPG company with a singular focus on leveraging marketplaces that allow for 3rd party sellers. This means they DO NOT SELL ANYTHING in traditional stores. They are trying to become the new age $PG, so to speak.

note: NOT THE CARPET COMPANY lol

note: NOT THE CARPET COMPANY lol

As a preface for the remainder of the thread: in the past, brand names provided credibility and validation. This is why people used Kleenex / Band-Aid so ubiquitously in the past. Consumers bought name brand products because they knew what they'd get.

Reviews online have eliminated the need for brand names and provided another source of validation for consumers. When I search for "resistance bands" on Amazon, I don't look for a brand name. I look for the best combination of # of ratings, overall rating, and low price.//

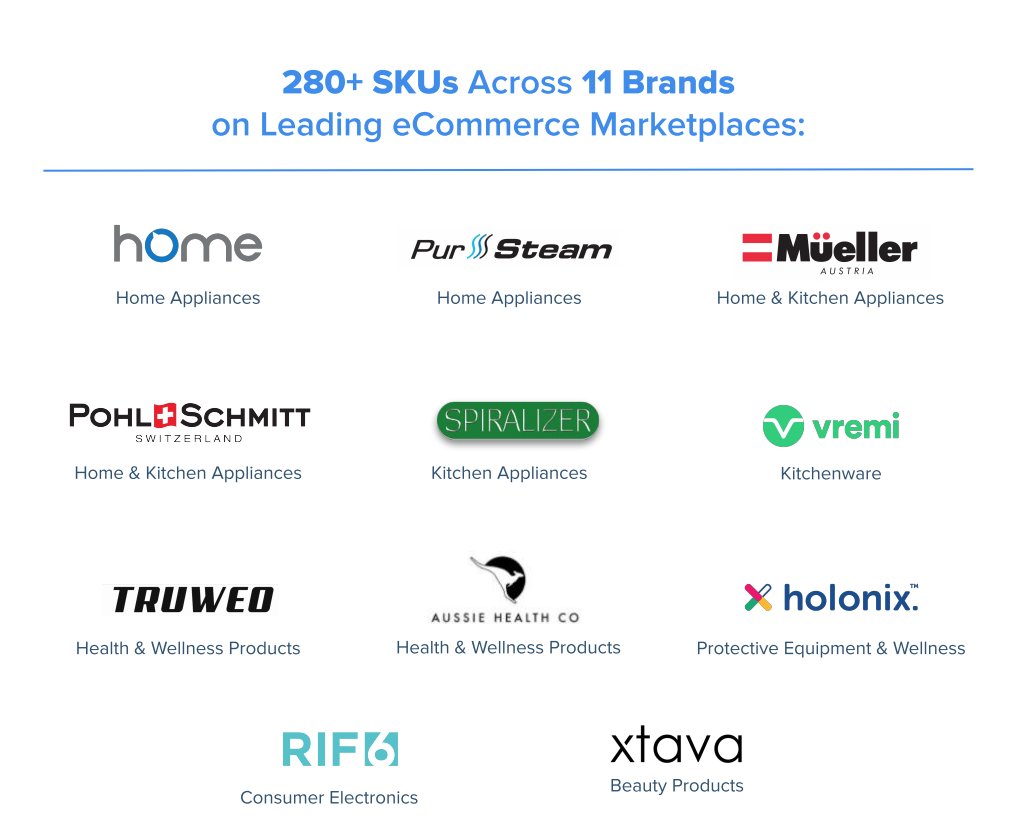

MWK is capitalizing on this transition. The company currently owns 11 brands that sell over 280 SKUs. MWK portfolio includes but is not limited to (picture is all encompassing, text is not) -->

-kitchen/home appliances (hOmelabs)

-kitchen tools (Vremi)

-personal styling/grooming (Xtava)

-electronics (RIF6)

-health detox solutions (Aussie Health Co.)

-hand sanitizer and masks (Holonix Health)

-lightweight, posture improving braces (Truweo)

-kitchen tools (Vremi)

-personal styling/grooming (Xtava)

-electronics (RIF6)

-health detox solutions (Aussie Health Co.)

-hand sanitizer and masks (Holonix Health)

-lightweight, posture improving braces (Truweo)

The company's thesis is to build brands/products where there is market whitespace with LT viability. For example, a mini fridge will likely be relevant for a long time. Fashion and fashion forward items aren't as likely to stand the test of time. MWK is focused on the former.

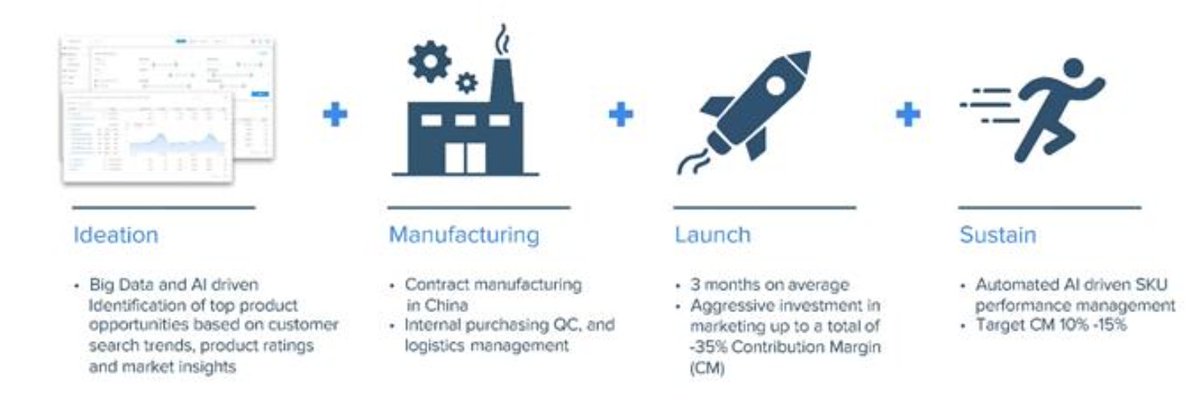

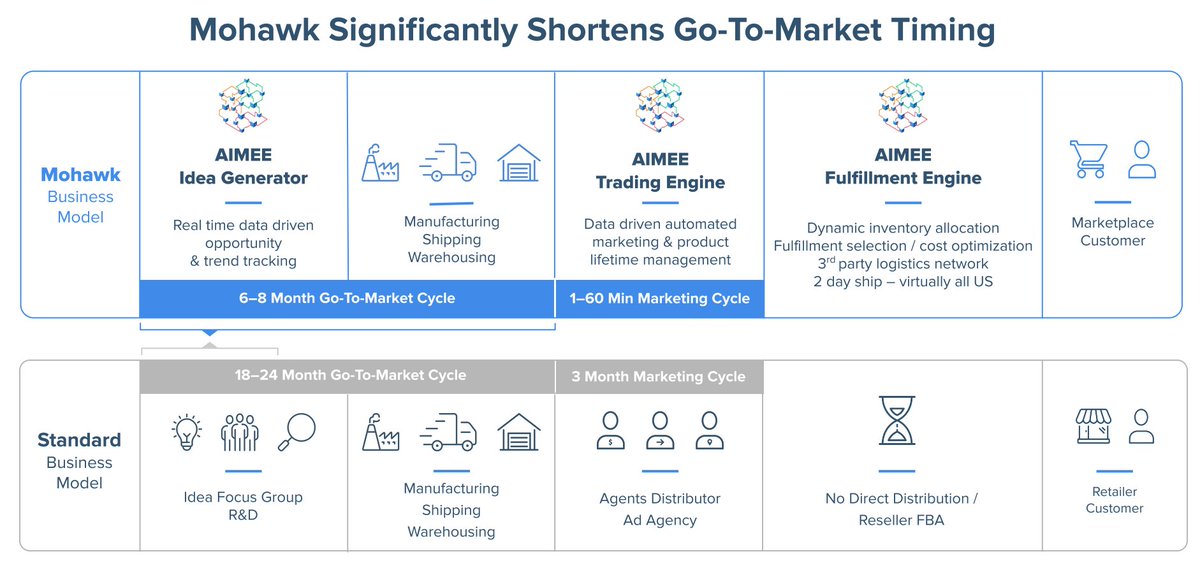

In order to identify these opportunities, the company has built their own proprietary data interpretation engine. It is called AIMEE ("AI Mohawk E-Commerce Engine").

AIMEE scrapes data from e-commerce platforms and uses natural language processing ("NLP") to gather insights. From the most recent 10k: -->

"AIMEE sources data from various e-commerce platforms, the internet and publicly available data, allowing it to estimate and determine trends, performance and consumer sentiment on products and searches within e-commerce platforms."

The company is looking for instances in which customers are unsatisfied by an existing product, or where there is an opportunity to launch a new product to fill a void that other sellers do not have a solution for. Without their AI engine, this would be hard to do at scale.

MWK also leverages their engine to automate the purchasing of marketing, automate changes in prices to optimize sales, and manage the product life-cycle. This allows the company to R&D and go-to-mkt in c. 1/3 the time of competitors.

10k: "Substantially all of our sales are made through the Amazon U.S. marketplace (95% in 2019)." AIMEE also connects via APIs to other e-com platforms. This opens the door to future product listings on other sites despite the fact that AMZN makes up bulk of existing presence.

Once Mohawk figures out which products to make, they work with contract-manufacturers in China to develop the products. The company has boots on the ground to perform QC and manage relationships for manufacturing operations.

After production, MWK takes ownership and workers with 3pl to ship the products back to the States. Next the company uses a combination of AMZN warehouses and logistics providers to fulfill D2C orders. I heard something about $mwk managing last mile but have to look further.

As MWK continues to iterate and produce more products,

it is likely they will become better and better at doing this. I predict the reps will add up quickly and the tool will become much better.

it is likely they will become better and better at doing this. I predict the reps will add up quickly and the tool will become much better.

If this is all the business was, for the current valuation (more on val later), I really like it. In addition, you get a free call option on the chance they figure out how to properly license the AIMEE platform to other retailers.

The plan was to start licensing in 4Q2019 but it didn't happen. I am moving forward with the thought that it won't happen. If it does, it is great upside. It might work seamlessly but I am somewhat unsure how they can share the tech and still maintain a competitive advantage.

CEO re: licensing: "Conversation with approximately 46 companies - larger brands and digital native brands. Already signed a couple contracts in the first two months of 2020. Will continue to invest & expect to see the base pick up. This is a priority" (paraphrased)

The final merit imo is the ability to perform M&A and integrate so quickly. The last acquisitions were integrated within 48 hours according to CEO on a podcast. I work in private equity where a transaction I closed in January of 2019 is still in the process of fully integrating.

The beauty is that they aren't paying outrageous prices due to the nature of the business they are acquiring. Most recent acquisition of Aussie Health was done for 3.25x LTM EBITDA… That is CHEAP! and incredibly sustainable.

Picture perfect PE roll-up strategy. Naturally accretive as Mohawk trades at 18x NTM EBITDA. Would be interested to hear how much EBITDA they think they can add via acqu vs. organic over NTM and what the LT trajectory looks like.

* Ok, now financials:

Company trades @ $17.21 per share with 21.844m FDSO as of 9/30/2020. Implied mkt cap of $375.95m. Net debt of -$11m so EV = c. $365m

EV/LTM rev: 2.0x

EV/NTM rev: 1.2x

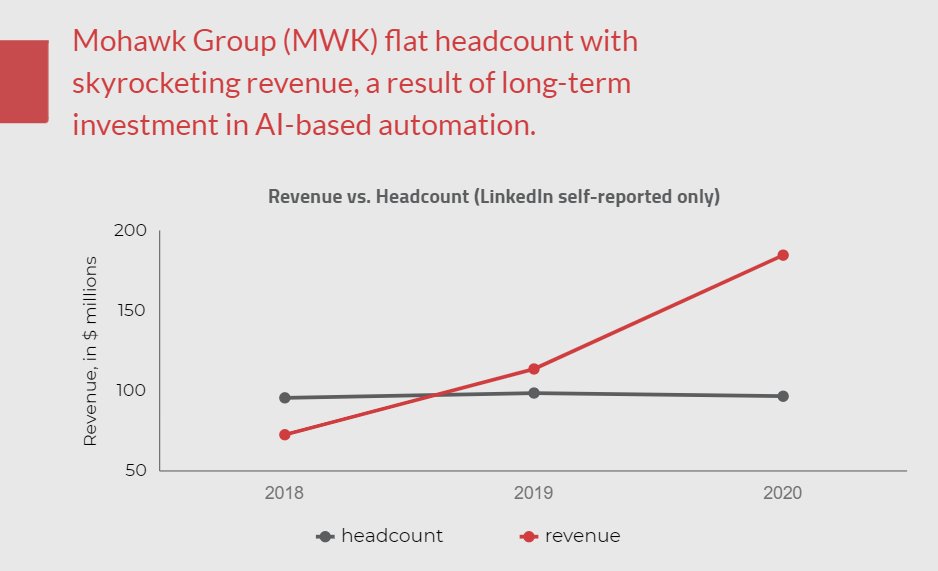

Assuming FY20 (LTM) rev $183m, FY21 (NTM) rev $298m. The company projects between 290-320m for FY21.

EV/LTM rev: 2.0x

EV/NTM rev: 1.2x

Assuming FY20 (LTM) rev $183m, FY21 (NTM) rev $298m. The company projects between 290-320m for FY21.

In impressive fashion, the company has been able to generate increased revenue despite static headcount. I can't confirm this data as I did not gather it myself, but if it is true it is a VERY GOOD sign. LinkedIn confirms only 98 employees currently.

@AsherDelug (co-founder) has indicated that $400m in rev is very much in play for 2021. If you assume he's correct, the company is trading at < 1x NTM sales.

For context,

Kraft-Heinz trades at 2.7x NTM

$PG trades at 4.9x NTM

Campbell Soup trades at 2.4x NTM

For context,

Kraft-Heinz trades at 2.7x NTM

$PG trades at 4.9x NTM

Campbell Soup trades at 2.4x NTM

2018 revs grew 101% YoY, and 2019 revs grew 56% YoY. $400m FY21 seems somewhat audacious but maybe they cracked the code or the pandemic sped things up. Next earnings (March 4) will be huge. The company beat on EPS in quarters 2 & 3 this year. In Q3 EPS was -.05 vs. est of -.32.

From the company: "The Company continues to expect to generate positive Adjusted EBITDA in the fourth quarter of 2020, excluding one-time items for transaction-related costs of the acquisition, and for the full year basis 2020"

Risks:

(1) Amazon decides to kick MWK from the platform or limit availability to necessary info

(2) Chinese manufacturing, trade war with the US, reliance on Uighur population in China?

(3) Inability to pivot to other platforms.

(4) Liquidity.

(1) Amazon decides to kick MWK from the platform or limit availability to necessary info

(2) Chinese manufacturing, trade war with the US, reliance on Uighur population in China?

(3) Inability to pivot to other platforms.

(4) Liquidity.

(1a) I don't see this as likely at all. From what I gathered, the engine runs predominately on customer facing data such as product listings and reviews. If AMZN eliminated these they would be severely hurting themselves. 3rd party sellers now make up 60% of sales on AMZN.

(2a) I don't see this as a major risk either, esp. w/ Trump leaving office. The margins are wide enough (gross profit margins c. 40%) to withstand any short-term import tarrifs. If MWK has to deal with it, that means everyone does. They won't get hit harder than others, imo.

(2b) I am more concerned about the potential reliance on the Uighur population in SE China. What China is doing to these people is unacceptable imo. Wouldn't want to invest my money here if they are leveraging slave labor. The current ESG craze wouldn't like this either...

(3a) This is the largest risk, not because I think they will lose out on AMZN but because it is best to be diversified and a lot of the upside relies on the ability to penetrate other markets through different platforms. Not sure how to evaluate this risk but it is real.

(3b) That said, I think that the stock is trading at such a discount that my confidence is not shaken.

(4a) As of 3Q20, the company has $37m in cash vs. $13.5 in an RCF (L+5.75%) and outstanding $12.9m (L+9.90%) Term Loan with $6.5m coming due currently. Total int. exp. of c. $4m over 9 months ending 9/30/2020.

(4b) They have the cash (& inventory, if necessary) to withstand. Hoping they can refinance the term loan at some point, given the increased share price and underlying biz success. If they can generate more than 10% on every dollar borrowed, then I don't mind the debt.

* Investors/ownership:

Includes institutional backing from: Google Ventures, RenTech (Jim Simons), Hudson Bay, and more.

Asher Delug (co-founder) owns 14%, CEO & CFO combined to buy $1.6m in shares in December.

Includes institutional backing from: Google Ventures, RenTech (Jim Simons), Hudson Bay, and more.

Asher Delug (co-founder) owns 14%, CEO & CFO combined to buy $1.6m in shares in December.

Another big position for me, relative to total portfolio; double digit %. I feel like this is either the biggest scam of all time or the biggest steal. Having bought some of their products before even knowing about the stock, I am inclined to think the latter is true.

What did I miss here? Any upside / risks?

Read on Twitter

Read on Twitter