1/n

A very different kind of ..

..

Have you ever wondered why the Asset prices (Gold, Equity) are going up in a difficult year like 2020. I'll try to answer this by taking Gold as an example!

Disc: I am no expect on economics. I encourage you to read more on this

A very different kind of

..

.. Have you ever wondered why the Asset prices (Gold, Equity) are going up in a difficult year like 2020. I'll try to answer this by taking Gold as an example!

Disc: I am no expect on economics. I encourage you to read more on this

2/n

Gold has moved from $271.45 per ounce in '01 to $1971 per ounce in '20. CAGR of 10.3%.

You might say "Gold appreciated in Value". But truth is "Dollar depreciated against Gold".

B4 we dive into the rabbit hole - did you know most currencies were backed by gold till 1971?

Gold has moved from $271.45 per ounce in '01 to $1971 per ounce in '20. CAGR of 10.3%.

You might say "Gold appreciated in Value". But truth is "Dollar depreciated against Gold".

B4 we dive into the rabbit hole - did you know most currencies were backed by gold till 1971?

3/n

In 1971 US Prez Nixon abolished the Bretton Wood agreement! This gave the US Govt the ability to print money at will since there was no Gold backing the dollar.

It's no coincidence that Gold price has started to spike vs dollar from 1971.

In 1971 US Prez Nixon abolished the Bretton Wood agreement! This gave the US Govt the ability to print money at will since there was no Gold backing the dollar.

It's no coincidence that Gold price has started to spike vs dollar from 1971.

4/n

Printing money is not bad. But too much of it causes the problem!

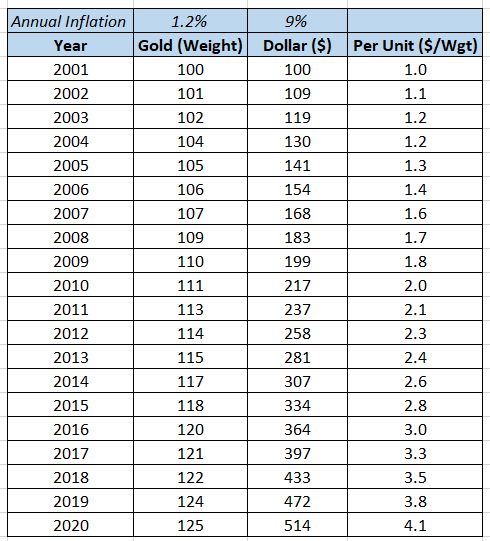

The table is a simplistic depiction of how more dollars chasing less/same gold results in Gold price vs $

Gold price vs $

Historically Gold's inflation has been 1.2%

Dollar's inflation has been ~9%

Printing money is not bad. But too much of it causes the problem!

The table is a simplistic depiction of how more dollars chasing less/same gold results in

Gold price vs $

Gold price vs $Historically Gold's inflation has been 1.2%

Dollar's inflation has been ~9%

5/n

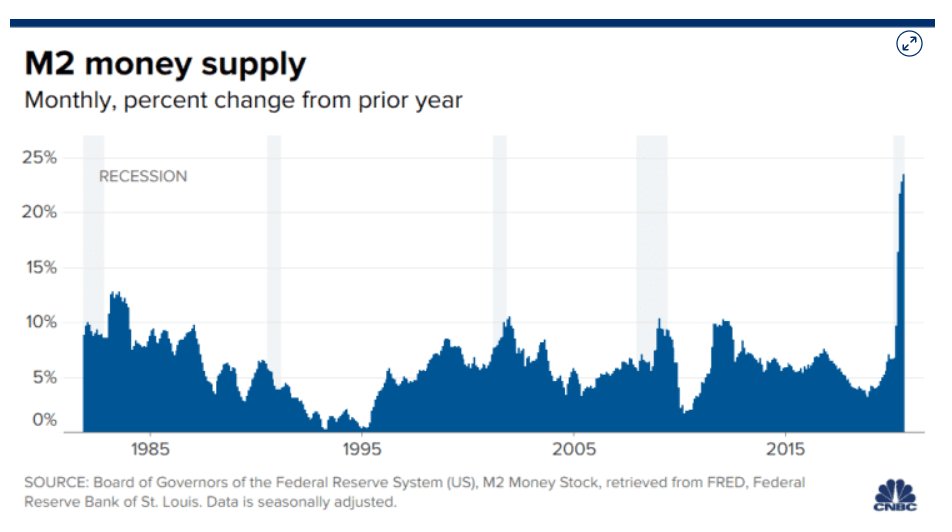

In 2020, Fed pumped over $3trillion into the economy. This is 20% of the existing money supply or inflation of Dollar. Now it's not surprising as to why assets (Gold, equity) have been going up incessantly.

In 2020, Fed pumped over $3trillion into the economy. This is 20% of the existing money supply or inflation of Dollar. Now it's not surprising as to why assets (Gold, equity) have been going up incessantly.

6/n

If this interests people - will talk about the 2nd order effects & how it's relevant to us in India.

interests people - will talk about the 2nd order effects & how it's relevant to us in India.

Sources:

Gold Price & Prod

https://cutt.ly/pjowlF3

https://cutt.ly/Sjowxxq

Money Supply

https://cutt.ly/mjowvaa

New Dollar https://cutt.ly/FjowbSb

If this

interests people - will talk about the 2nd order effects & how it's relevant to us in India.

interests people - will talk about the 2nd order effects & how it's relevant to us in India. Sources:

Gold Price & Prod

https://cutt.ly/pjowlF3

https://cutt.ly/Sjowxxq

Money Supply

https://cutt.ly/mjowvaa

New Dollar https://cutt.ly/FjowbSb

Read on Twitter

Read on Twitter