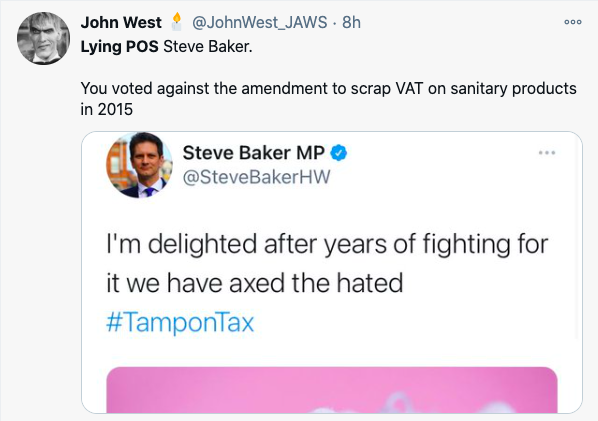

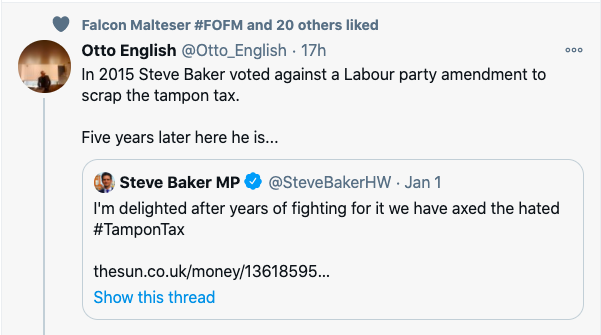

1/ I'm about to mute "tampons". Unlike @adamgarriereal I don't think there is anything obscene about sanitary products (as if  ), but the tweets about the new zero VAT rate and the implied hypocrisy of some MPs are deeply depressing. (thread)

), but the tweets about the new zero VAT rate and the implied hypocrisy of some MPs are deeply depressing. (thread)

), but the tweets about the new zero VAT rate and the implied hypocrisy of some MPs are deeply depressing. (thread)

), but the tweets about the new zero VAT rate and the implied hypocrisy of some MPs are deeply depressing. (thread)

2/ One might have supposed that after 4 years of unprecedented discussion of EU Law, national competencies, tax, etc., we would be able to have a clearer picture of the issues. Yet no. Both 'sides' have made it into a pro/anti 'Brexit' issue and missed the point.

3/ First, no one voted "to scrap" (or not to scrap) VAT on sanitary products (a.k.a. "The Tampon Tax") in October 2015 because it was not within parliament's power to do so. In the debate, the minister responsible (David Gauke) argued that a renegotiation

https://fullfact.org/economy/did-mps-vote-against-removing-tampon-tax/

https://fullfact.org/economy/did-mps-vote-against-removing-tampon-tax/

4/ with the EU would have little chance of success in the proposed timescale (7 months). Surely anyone can see why Cameron, Gauke et al. wanted to avoid coming back from Brussels empty-handed on such an emotive issue less than 2 months before an in/out referendum?

5/ At the same time, it's disingenuous of Brexiteers to suggest that zero-rating sanitary products would always be impossible within the EU. It's likely to happen by 2022. https://ec.europa.eu/commission/presscorner/detail/en/IP_18_185

6/ There also seems, on most of Twitter, to be little understanding of the history of VAT rules, which are still largely frozen in 1972 (and which explain why Ireland has a zero rate on women's sanitary products and we did not). "Period Poverty" may be a pressing issue, but so

7/ should an overcomplicated VAT system. Chocolate biscuits might have seemed like continental luxuries in comparison with a slice of cake in the 1970s, but does it now make sense to slap VAT on a chocolate hobnob but not on a cupcake groaning under a cloud of fudge frosting?

8/ VAT on WSP in the UK was already the lowest permissible rate in the EU (for Ireland: see above). In Denmark, Sweden and Finland, VAT on WSP is at the same rate as that on alcohol and tobacco. It would be a shame if applying a zero-rate to WSP is now regarded as "job done".

9/ A complex system of VAT, with different rates and numerous exemptions, is costly to administer, and even with WSP exempted, plenty of other oddities remain. Why should solar panels be taxed at the same rate as wood-burning stoves? Why shouldn't soap be exempted?

10/ It would be encouraging to think that, rather than thinking in terms of Brexit and the arguments of 4 years ago, we could now apply ourselves to the task of simplifying UK VAT, making it less costly to administer with a lower rate overall.

11/ One final question remains to which I have seen no answer today, and that is who steps in to provide support for those charities which have hitherto benefitted from the £15 million "Tampon Tax Fund"? https://www.thirdsector.co.uk/twelve-charities-share-15m-tampon-tax-funding/fundraising/article/1701331

Read on Twitter

Read on Twitter