just finished this book over christmas/nye, would recommend. Also as much as the mathematical kelly stuff is interesting, most of the effort of Thorp and co was on actually finding an edge, the position sizing was secondary.

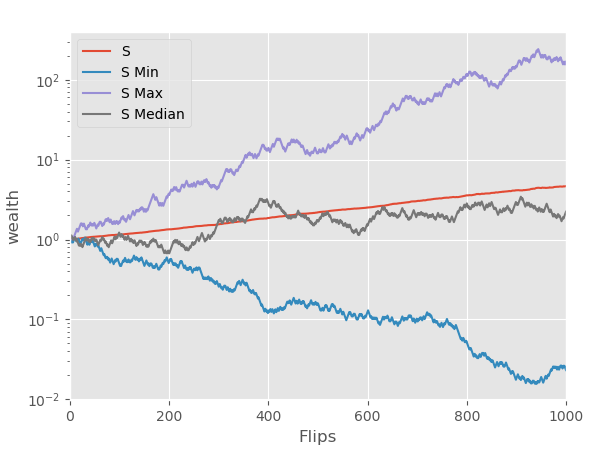

yeah Kelly maximizes log wealth and therefore returns, but the distribution of possible terminal wealth in a real world setting is kinda ugly if you're dealing with uncertainties about your edge. e.g. the standard coinflip where p = 0.52, so f = 0.04, 1000 flips x 1000 trials:

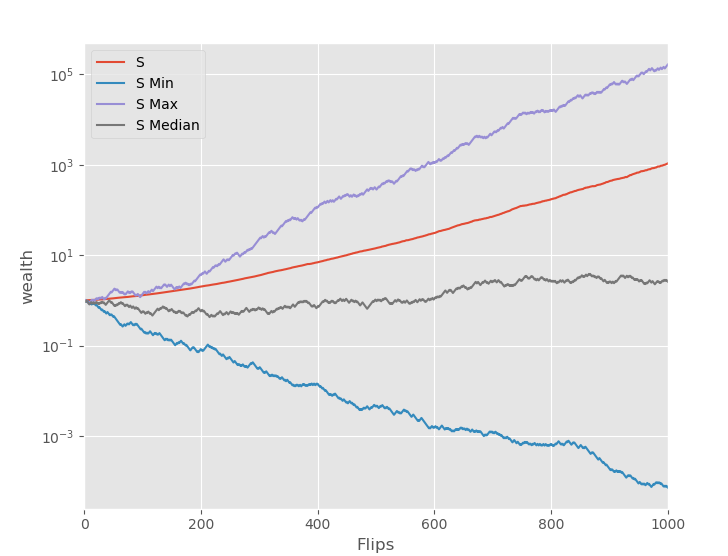

Large average return gets driven by huge upside outliers, but the median is still positive, but what if instead of a fixed p=0.52 we randomize how uneven the coin is via a uniform dist of (P-S,P+S)? this seems like a reasonable proxy for real life.

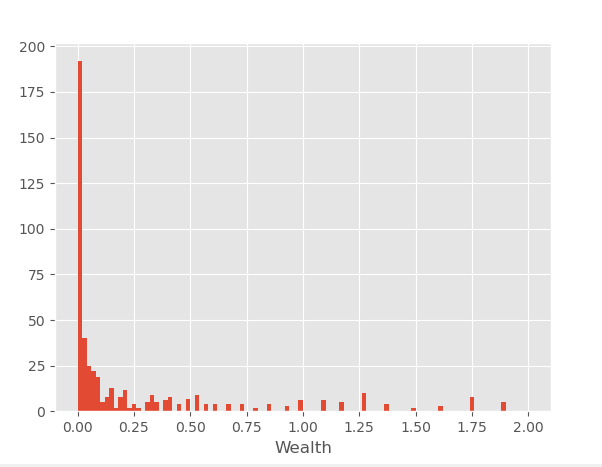

where we think we might have an edge on average but not with a lot of certainty, this is how the exact same plan works out for S=0.1, the distance between mean and median increases by a lot and the minimum return is much, much worse.

while the median is a positive return, in ~40% of cases you lose over half your bankroll, in 25% of cases you lose over 95%.

Read on Twitter

Read on Twitter