On Christmas a tweet from @PeterSchiff caught my eye.

In it Peter argued that #Bitcoin should be compared to high growth stocks instead of gold.

should be compared to high growth stocks instead of gold.

That’s understandable given the lacklustre performance of gold this year...

Time for a thread

In it Peter argued that #Bitcoin

should be compared to high growth stocks instead of gold.

should be compared to high growth stocks instead of gold.That’s understandable given the lacklustre performance of gold this year...

Time for a thread

1/ To be fair Peter is right in the fact that it’s hard to compare gold and #BTC  .

.

Bitcoin is on the early part of its adoption curve which means it is loaded with a large asymmetric return potential. Not the case for gold.

So let’s look at some stocks. https://twitter.com/PeterSchiff/status/1341835752909533185

.

. Bitcoin is on the early part of its adoption curve which means it is loaded with a large asymmetric return potential. Not the case for gold.

So let’s look at some stocks. https://twitter.com/PeterSchiff/status/1341835752909533185

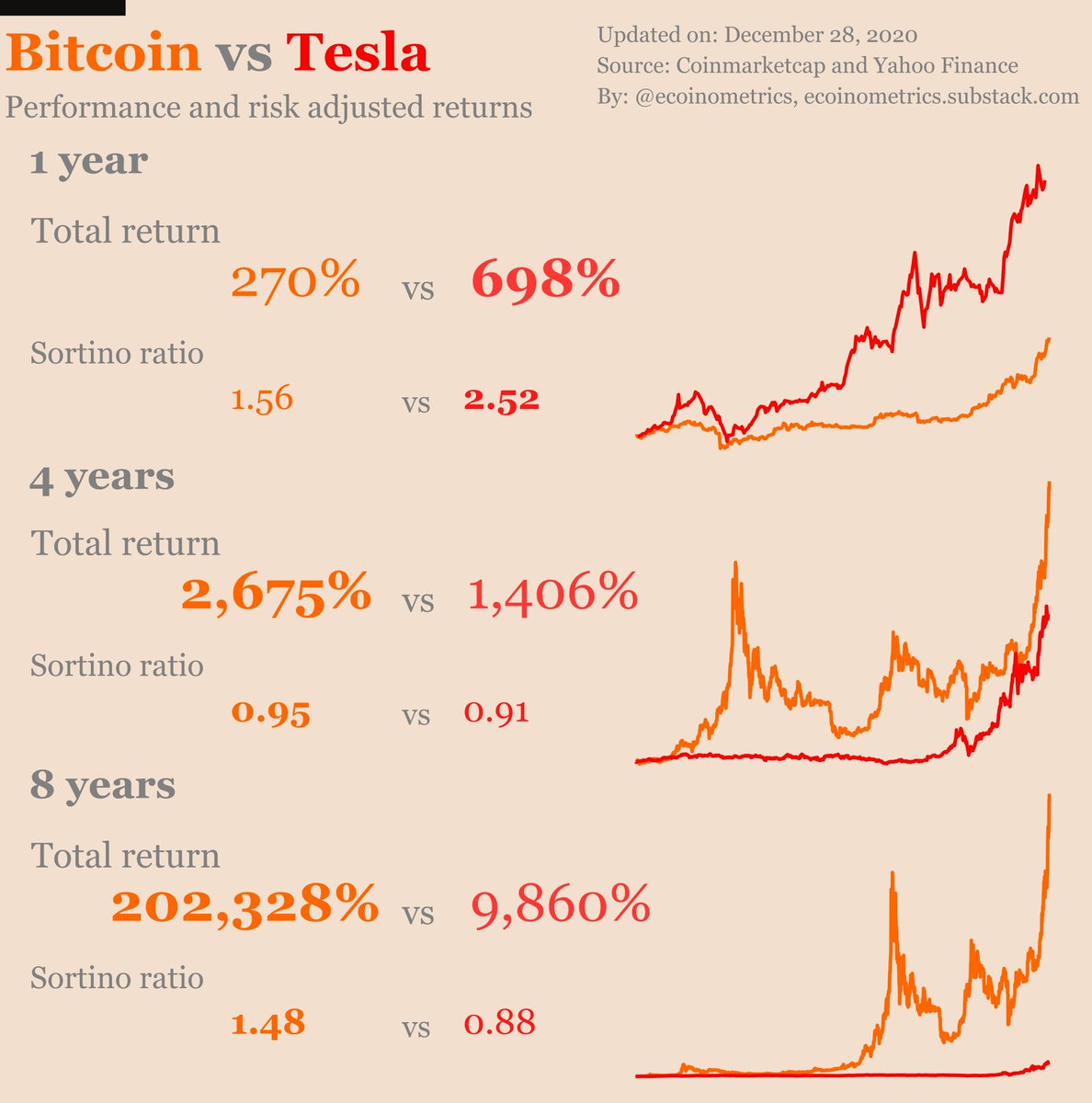

2/ Tesla outperformed Bitcoin this year both in total and risk adjusted returns.

But look back over longer time periods and #Bitcoin emerges as the clear winner.

emerges as the clear winner.

But look back over longer time periods and #Bitcoin

emerges as the clear winner.

emerges as the clear winner.

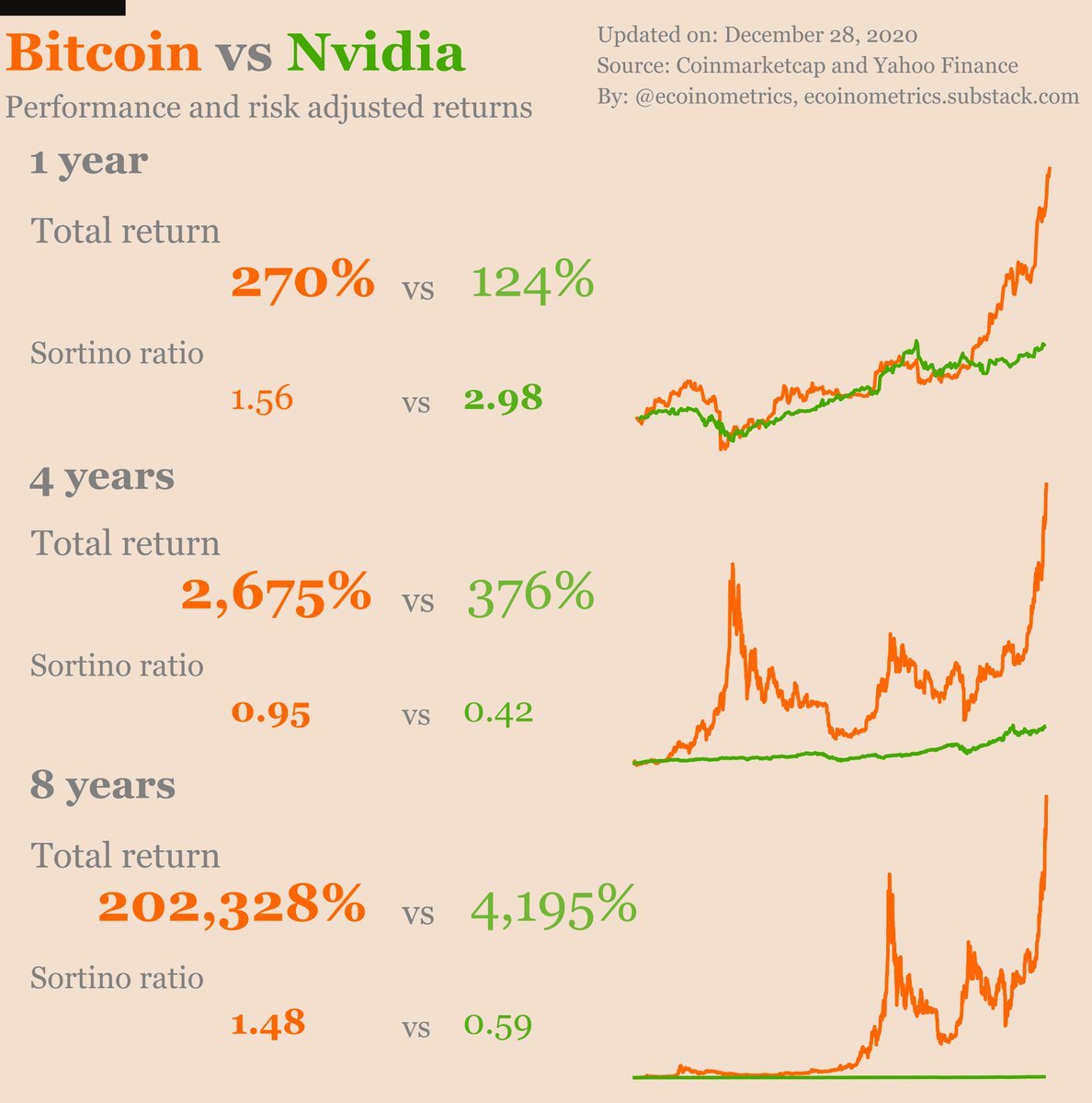

3/ Nvidia did pretty well this year too. It didn’t beat #Bitcoin  in total returns but it did so in risk adjusted returns.

in total returns but it did so in risk adjusted returns.

But still over longer periods of times #Bitcoin is the clear winner.

is the clear winner.

in total returns but it did so in risk adjusted returns.

in total returns but it did so in risk adjusted returns.But still over longer periods of times #Bitcoin

is the clear winner.

is the clear winner.

4/ There is a pattern here. It is possible for some stocks to perform better than #Bitcoin  over short periods of time.

over short periods of time.

But over a long time horizon there is always a clear winner.

I haven’t looked at the entire stock market but here is what you get with a small sample.

over short periods of time.

over short periods of time. But over a long time horizon there is always a clear winner.

I haven’t looked at the entire stock market but here is what you get with a small sample.

5/ Over 1 year, you can find stocks that perform better than #Bitcoin  either in terms of total or risk adjusted returns.

either in terms of total or risk adjusted returns.

either in terms of total or risk adjusted returns.

either in terms of total or risk adjusted returns.

6/ Over 4 years some stocks performed as well as #Bitcoin  for risk adjusted returns. But #BTC

for risk adjusted returns. But #BTC  is simply growing faster.

is simply growing faster.

for risk adjusted returns. But #BTC

for risk adjusted returns. But #BTC  is simply growing faster.

is simply growing faster.

8/ What’s driving #Bitcoin  ’s over performance?

’s over performance?

- The supply shock of each new halving cycle.

- The small market cap of #BTC relative to its nature as a store of value.

relative to its nature as a store of value.

- The fact that we are early on the adoption curve.

All things you don't get in the stock market.

’s over performance?

’s over performance?- The supply shock of each new halving cycle.

- The small market cap of #BTC

relative to its nature as a store of value.

relative to its nature as a store of value.- The fact that we are early on the adoption curve.

All things you don't get in the stock market.

9/ For the same reasons this over performance is likely to continue in the years to come.

More discussions on all that in this issue of the Ecoinometrics newsletter https://ecoinometrics.substack.com/p/ecoinometrics-december-30-2020

https://ecoinometrics.substack.com/p/ecoinometrics-december-30-2020

More discussions on all that in this issue of the Ecoinometrics newsletter

https://ecoinometrics.substack.com/p/ecoinometrics-december-30-2020

https://ecoinometrics.substack.com/p/ecoinometrics-december-30-2020

10/ The Ecoinometrics newsletter's goal is to understand the place of #Bitcoin  in the future of finance.

in the future of finance.

If you have learned something today go check it out and subscribe

https://ecoinometrics.substack.com/

https://ecoinometrics.substack.com/

in the future of finance.

in the future of finance. If you have learned something today go check it out and subscribe

https://ecoinometrics.substack.com/

https://ecoinometrics.substack.com/

Read on Twitter

Read on Twitter