THREAD

THREAD : How do you find the next $AMZN $APPL $GOOGL?

: How do you find the next $AMZN $APPL $GOOGL?

Every investor wants to find the next Amazon. Books are written about it. Videos are made about it. FinTwit debates it, dreaming about finding and investing in companies that will be the next “100 bagger.”

Key considerations to finding the next $AMZN, etc.:

Key considerations to finding the next $AMZN, etc.: 1. Can you buy early enough, at the right price?

1. Can you buy early enough, at the right price? 2. Can you hold through gut-wrenching 80% drawdowns?

2. Can you hold through gut-wrenching 80% drawdowns? 3. Can you foresee future businesses these companies will need to enter?

3. Can you foresee future businesses these companies will need to enter? 4. Is CEO a visionary that can execute?

4. Is CEO a visionary that can execute?

Expanding on consideration 3 above, who could’ve anticipated all the incredible businesses Jeff Bezos led $AMZN into over the years, when they were just an online bookseller? Such as:

Expanding on consideration 3 above, who could’ve anticipated all the incredible businesses Jeff Bezos led $AMZN into over the years, when they were just an online bookseller? Such as:http://Amazon.com (e-commerce)

AWS

Cloudfront

Alexa/Echo

Amazon Prime

Ring

AmazonFresh

Amazon businesses (cont.)

Amazon businesses (cont.)CreateSpace

IMDBPro

KindleDirect Publishing

Twitch

Amazon Robotics

Whole Foods

Amazon Studios (movie production)

Audible

Amazon Fire

Amazon Music

...and many more

IMO, almost impossible for an individual investor to anticipate EARLY ON the world-conquering progress Bezos accomplished.

IMO, almost impossible for an individual investor to anticipate EARLY ON the world-conquering progress Bezos accomplished.And very possible what Bezos accomplished is not repeatable.

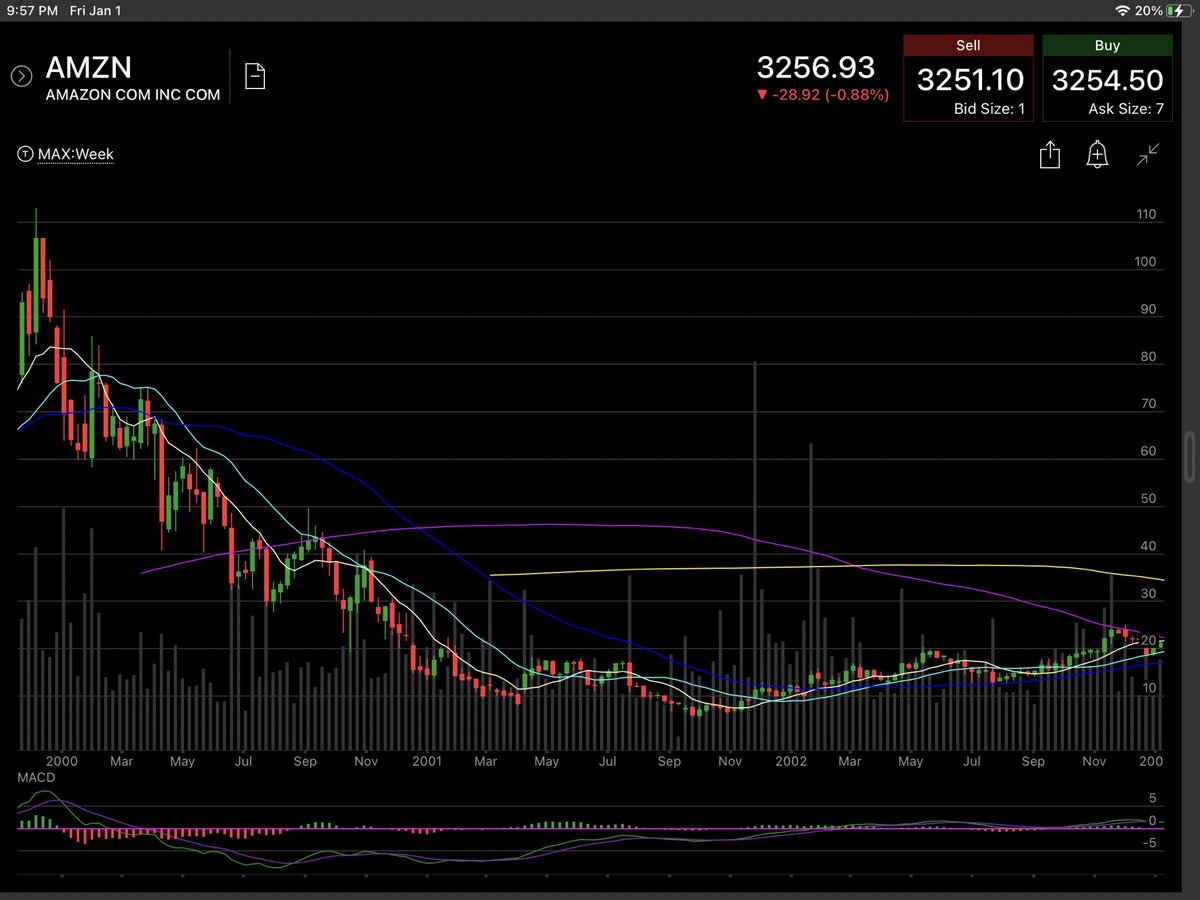

Also, most wouldn’t be able to hold through the 2001-03 dot com bust and $AMZN 90% crash

Here are the keys, IMO, to early identification of companies that “ could” become the next $AMZN:

Here are the keys, IMO, to early identification of companies that “ could” become the next $AMZN:1. A truly visionary founder CEO that will take necessary risks, execute, and adapt.

Examples: Jeff Bezos, Steve Jobs, Reed Hastings, Mark Zuckerberg, Elon Musk.

(Cont.)

2. A transformative, innovative, disruptive PLATFORM with the ability to MONETIZE each and every person using their platform.

2. A transformative, innovative, disruptive PLATFORM with the ability to MONETIZE each and every person using their platform.Ask yourself - does Amazon, Netflix, Apple, Facebook have the ability to monetize in some way each person on their platform?

Answer is yes

Examples of Monetization:

Examples of Monetization: Amazon - thru Prime subscription, e-commerce, etc.

Amazon - thru Prime subscription, e-commerce, etc. Netflix - thru monthly subscription

Netflix - thru monthly subscription Apple - thru iPhone/Mac upgrade cycles, AppStore developers, Apple One subscription

Apple - thru iPhone/Mac upgrade cycles, AppStore developers, Apple One subscription Facebook/Google - thru advertisers (eyeballs); Instagram / YouTube

Facebook/Google - thru advertisers (eyeballs); Instagram / YouTube

3. Must be able to serve each and every person on the planet, or at least the jurisdictions in which they operate.

3. Must be able to serve each and every person on the planet, or at least the jurisdictions in which they operate.Businesses that cannot MONETIZE customers, or have a limited market (such as B2B only), cannot be the next Amazon.

The TAM must be massive and constantly growing

Based on these criteria, what current companies do I foresee COULD eventually develop into the next $AMZN $APPL $FB $NFLX $GOOGL?

Based on these criteria, what current companies do I foresee COULD eventually develop into the next $AMZN $APPL $FB $NFLX $GOOGL?First, eliminate some great companies I hold (or previously held) that currently don’t fit the criteria:

$CRWD $FSLY $MDB $AYX $DDOG $VEEV $SNOW

Here is a list of companies that with the right visionary CEO, disruptive/innovative products, execution and expansion of platform, and monetization of each person, COULD become the next Amazon:

Here is a list of companies that with the right visionary CEO, disruptive/innovative products, execution and expansion of platform, and monetization of each person, COULD become the next Amazon:$ZM $SE $SHOP $ROKU $PINS $TDOC $SPOT $JMIA $U

My thoughts on each

$ZM

$ZMZoom has the platform and ability to serve every person on the planet. But, will they be able to monetize all users?

With CEO Eric Yuan, who knows what type of additional businesses will be entered in the future?

Buy price was earlier in 2020, ~$85 and a $24B market cap

$SE

$SESea Limited has multiple platforms with Shopee/Garena/Shopee Pay.

Forrest Li is a visionary CEO, and I believe will continue to execute and expand into new businesses.

At $100B market cap currently. The right time to buy was ~$20/share early 2019.

$SHOP

$SHOPShopify clearly has a killer platform and a visionary CEO in Tobi Lutke. What new businesses that we haven’t even considered will Tobi expand into?

With a massive $138B market cap, best buying opportunity is gone. Buying right was ~$45/share in early 2017.

$ROKU

$ROKU Roku has a great platform, and is able to monetize its users through advertisers. Establishing the platform, how will founder CEO Anthony Wood expand?

Does Wood have the vision and desire to grow like Amazon?

IPO in 2017, best buying was in May 2019 ~$60/share.

$PINS

$PINSLike Roku, Pinterest has a market cap of $41B. A visionary CEO, lots of data, a killer platform and partners, and the ability to monetize users.

Who knows whether Pinterest can enter into new businesses, but the foundation is there.

Best buy was in 2020 ~$25/share.

$TDOC

$TDOCIt may be hard to envision Teladoc as an Amazon-type juggernaut, but they are building out a platform in healthcare and have the advantage of being the first mover.

What expansion opportunities will present over next 5-10 years?

$29B market cap, buy was in 2018 ~$40.

$SPOT

$SPOTSpotify has a killer platform with mobile/desktop app. They monetize all users with either subscription or ad revenue.

Will the CEO execute and expand into multiple Amazon-type businesses? Time will tell.

$SPOT with $60B market cap; buy was in 2020 ~$150 & then $200.

$JMIA

$JMIAClearly Jumia is still in its infancy, but is one of those “could be” platforms in African continent that must expand and leverage its current platform into yet unknown businesses.

$3.6B market cap, so potential for massive gains. Buy was ~$20 and again ~$45.

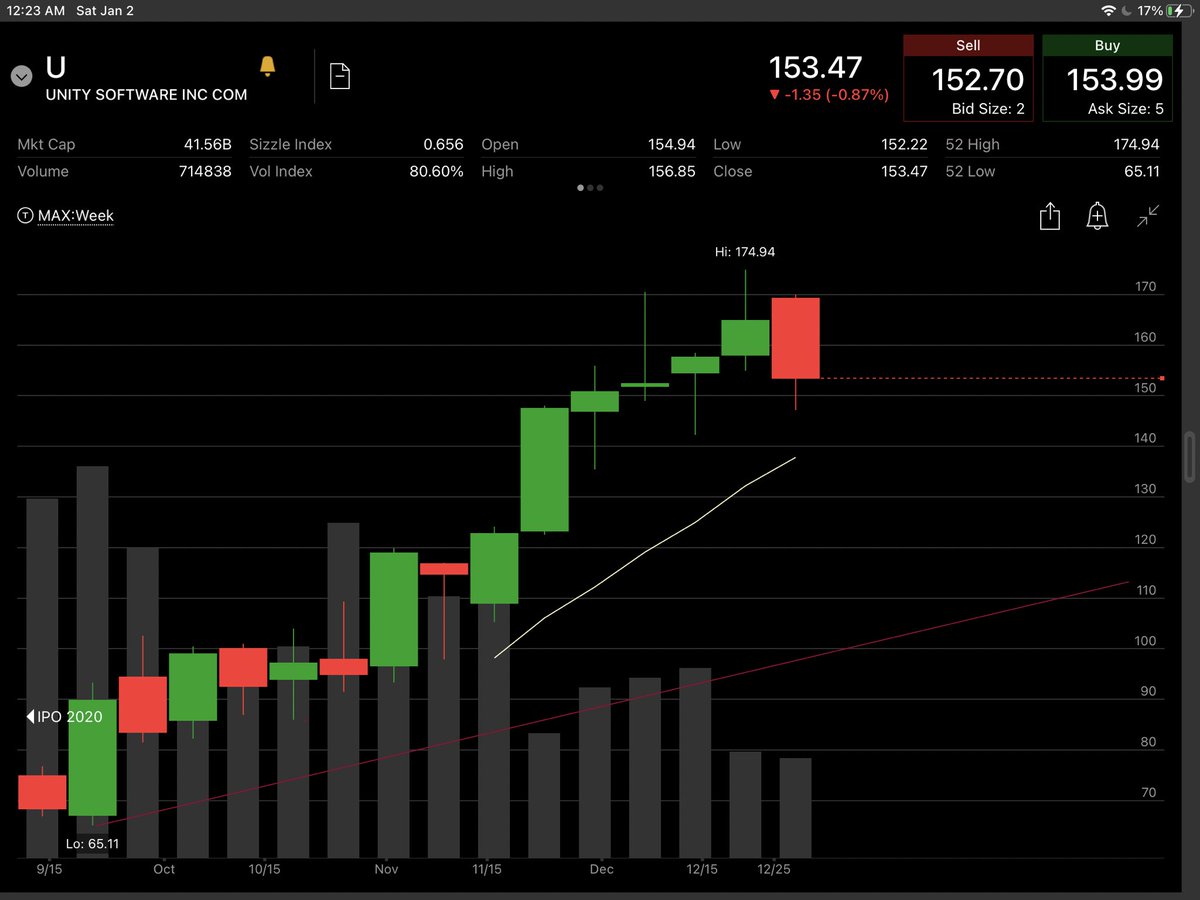

$U

$UUnity Software has big ambitions to became the developer tool in multiple industries, not just gaming. Also, to build out “The Metaverse,” and future AR/VR applications.

With their killer platform, the key will be to monetize freemium users and expand into new businesses.

Other companies with a chance to become the next Amazon? They must have or develop a killer platform upon which to expand and monetize customers:

Other companies with a chance to become the next Amazon? They must have or develop a killer platform upon which to expand and monetize customers:$MELI $TWLO $DOCU $LMND

Others? Looking forward to your feedback!

Read on Twitter

Read on Twitter