That time everyone in Omaha forgot about Berkshire and went crazy for a bubble stock: Level 3 Communications.

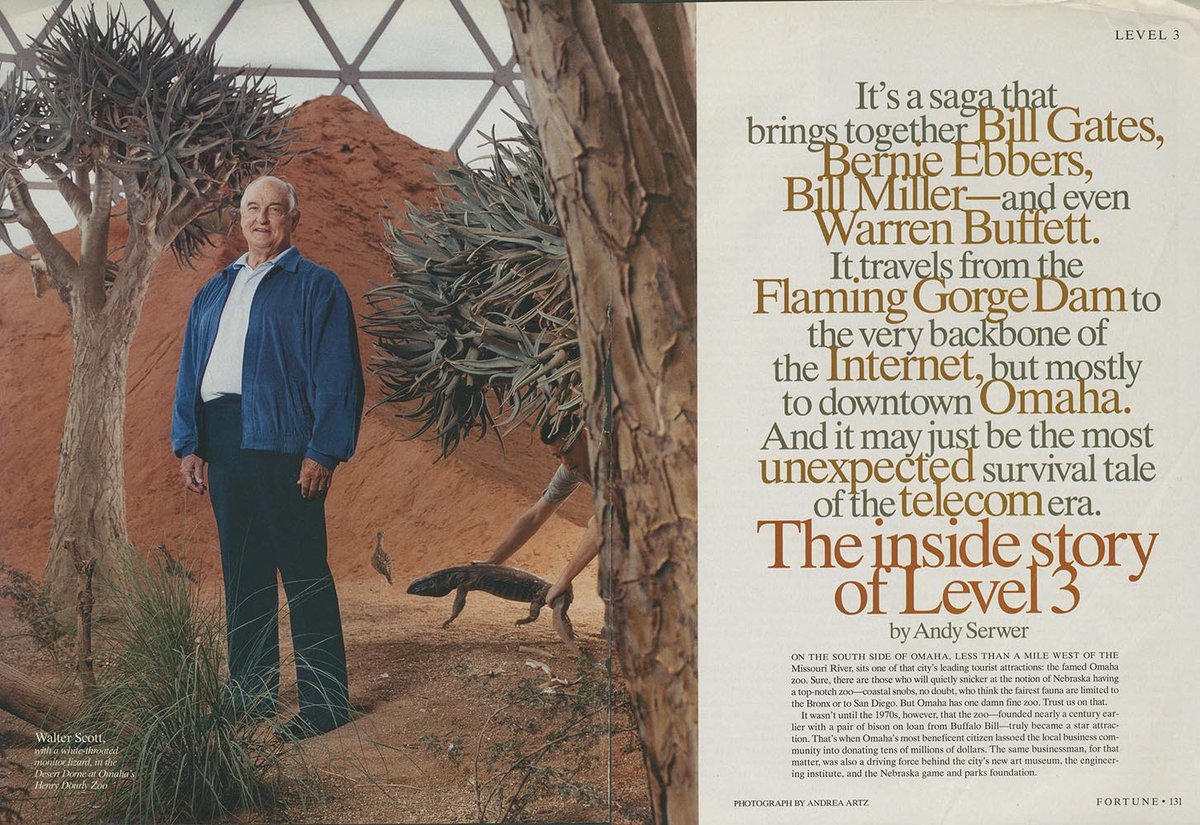

Enter Walter Scott, CEO of Kiewit, Omaha's biggest construction company (BRK's offices are at Kiewit Plaza). He and Buffett go way back: "I first got to know Walter when we were teenagers. We both had a crush on the same girl. Walter won her and they ended up getting married."

But seriously, Buffett: "A lot of people like to make simple things complex. Walter does the opposite. He has an ability to cut through what's complicated. He is a man who gives you his word. He is a person of great integrity. People here have tremendous respect for him."

Scott became CEO of Kiewit in 1979. The company had grown big building tunnels, dams, highways. It generated a ton of cash which was reinvested in its "Kiewit Diversified" segment.

A Kiewit executive named James Crowe urged Scott to buy Metropolitan Fiber System which built networks for phone companies.

Crowe renamed it MFS and started building his own networks. It became a competitive local-exchange carrier (CLEC). It spun out and went public in 1993.

Crowe renamed it MFS and started building his own networks. It became a competitive local-exchange carrier (CLEC). It spun out and went public in 1993.

In 1995, Scott attended a private meeting hosted by Buffett.

Bill Gates gave a speech about the revolutionary nature of the internet and how it could make traditional phone companies obsolete.

Scott: "Bill's talk is probably what got us thinking about the Internet."

Bill Gates gave a speech about the revolutionary nature of the internet and how it could make traditional phone companies obsolete.

Scott: "Bill's talk is probably what got us thinking about the Internet."

They went hunting for an internet company and in 1996 bought UUNet, an ISP and backbone provider, for $2 billion. A record for an internet company. This triggered Bernie Ebbers, CEO of Worldcom. In December '96, he decided to buy all of MFS.

For $14 billion.

For $14 billion.

What do you do after that kind of win? You do it all over again. But bigger and better.

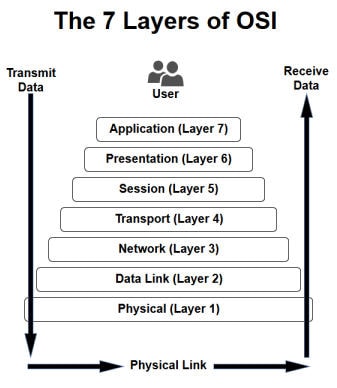

In 1997, Level 3 was formed within Kiewit Diversified with $2 billion in seed money. (Level 3 because it covered the lower three layers in the OSI model.)

In 1997, Level 3 was formed within Kiewit Diversified with $2 billion in seed money. (Level 3 because it covered the lower three layers in the OSI model.)

It was going to be a best in class fiber network to meet the surging demand.

"Our design goal is not to try to guess where design technology will take us five years from now. Our goal is to build a network that can accommodate unprecedented technological change.

"Our design goal is not to try to guess where design technology will take us five years from now. Our goal is to build a network that can accommodate unprecedented technological change.

Investors, particularly those in Omaha, were enthusiastic.

"People made a bunch of money on MFS. That set the stage for people buying Level 3. It reinforced the idea that Kiewit never misses. But people began to think about it like you could get rich overnight."

"People made a bunch of money on MFS. That set the stage for people buying Level 3. It reinforced the idea that Kiewit never misses. But people began to think about it like you could get rich overnight."

People bought pre-IPO Kiewit Diversified stock, including Buffett's nephew Tom Rogers: "I remember the lady who cuts my hair asking me about the stock. I paid my personal trainer in Level 3 shares instead of cash. I really wanted him to own this stock."

Level 3 was listed on the Nasdaq in 1998 with a market cap of $9bn (apparently the stock had been traded over the counter before).

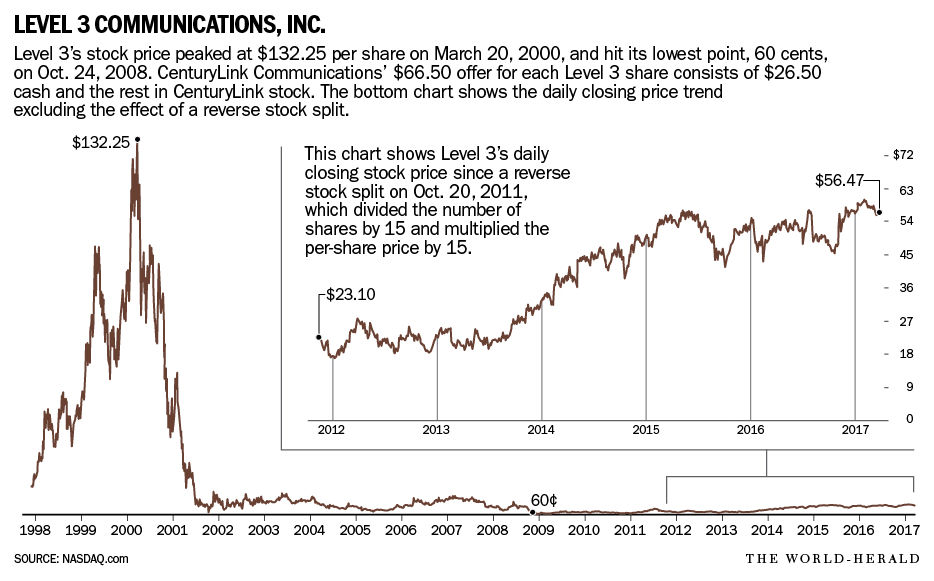

By March 2000, it reached $130 per share or a market cap of $44 billion.

https://www.latimes.com/archives/la-xpm-1998-apr-01-fi-34776-story.html

By March 2000, it reached $130 per share or a market cap of $44 billion.

https://www.latimes.com/archives/la-xpm-1998-apr-01-fi-34776-story.html

"The feeling at that time was that Level 3 was a gold mine that was never going to end," says a significant local investor. "If you didn't own the stock, you looked foolish."

Jack Grubman: "Level 3 is a great play on bandwidth...[which] will be chronically scarce. Capacity actually creates demand in this business...bandwidth-centric names are good values at any price since nobody can predict true demand caused by growth."

Then the telecom bubble unwound. A glut of capacity came online. Better technology increased the throughput for existing fiber. Wholesale prices for its fiber capacity plunged. The stock dropped from $130 to $3 by 2002.

Said one analyst: [Level 3's fiber network] "is like a great racetrack. You still need the fans. You still need the customers. And companies like AT&T and Qwest started with customers."

"There are hundreds, probably thousands of investors in Omaha who have suffered combined losses in Level 3 stock equal to tens of billions of dollars. I personally know at least five people who've lost $20mm or more." Ron Carson

In 2002, Buffett actually invested $100 million.

In 2002, Buffett actually invested $100 million.

An interesting side note is that Walter Scott didn't sell any stock.

James Crowe did. Why? "In the beginning I borrowed money to buy $55 million of Level 3 stock. I needed to pay off that debt."

James Crowe did. Why? "In the beginning I borrowed money to buy $55 million of Level 3 stock. I needed to pay off that debt."

Scott stepped down as Chairman of Level 3 in 2014.

“I wanted to stick around until I was convinced that Level 3 was solidly on a path toward its destiny”

“I wanted to stick around until I was convinced that Level 3 was solidly on a path toward its destiny”

“Who would’ve predicted that at the start of our new business, there would be a telecom meltdown, a tech wreck, terrorist attacks, a worldwide financial crisis and the Great Recession?” https://omaha.com/business/level-3-which-started-with-hopes-of-riches-but-ended-with-big-losses-for-most/article_8259659b-2ba4-5248-90ca-e00eda0a0eec.html

Excellent post on Level 3 & telecom bubble by @trengriffin

"Craig McCaw said to me during this period: “You are always at the mercy of your stupidest competitors.”

"Om Malik estimated that $750 billion vanished when the telecom bubble burst." https://25iq.com/2017/11/11/the-1990s-telecom-bubble-what-can-we-learn/

"Craig McCaw said to me during this period: “You are always at the mercy of your stupidest competitors.”

"Om Malik estimated that $750 billion vanished when the telecom bubble burst." https://25iq.com/2017/11/11/the-1990s-telecom-bubble-what-can-we-learn/

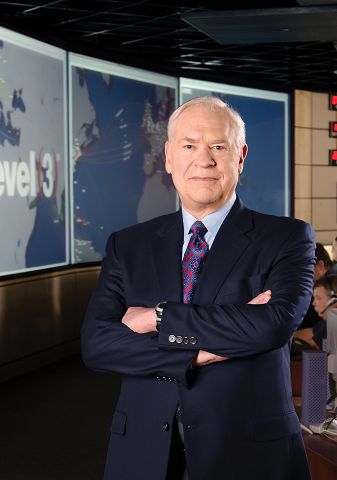

Fortune 2002 article detailing the devastation in Omaha:

https://money.cnn.com/magazines/fortune/fortune_archive/2002/07/22/326291/index.htm

& detailed company history:

http://www.fundinguniverse.com/company-histories/level-3-communications-inc-history/

https://money.cnn.com/magazines/fortune/fortune_archive/2002/07/22/326291/index.htm

& detailed company history:

http://www.fundinguniverse.com/company-histories/level-3-communications-inc-history/

Read on Twitter

Read on Twitter