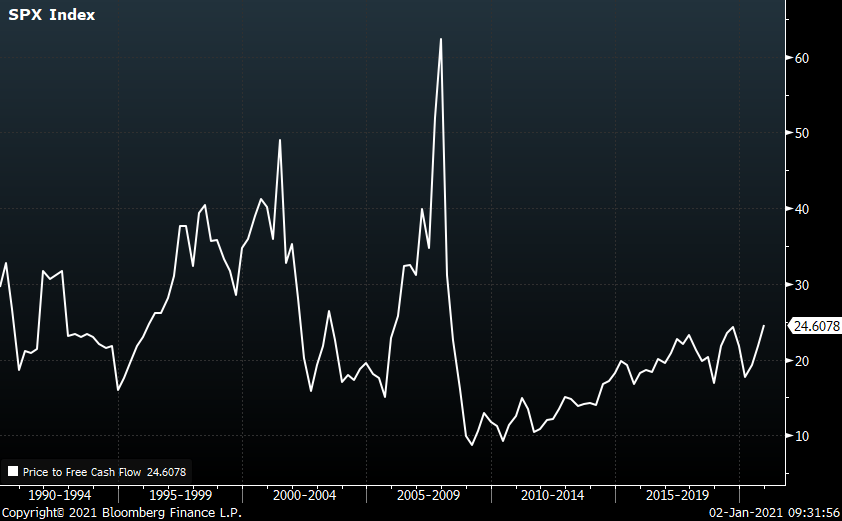

SPX $SPY P/FCF multiple today is not nearly as high as prior peaks.

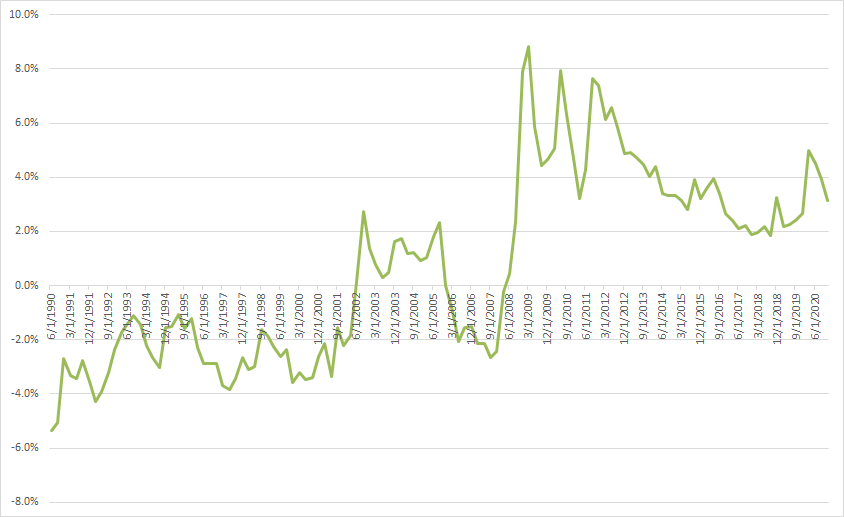

At same time, the yield investors can get on 10 year govt bonds has nearly evaporated when compared to prior peaks.

Here is the spread between SPX $SPY FCF yield and 10 year govt bond yield.

Anyone notice any interesting differences between 1999 and today?

Anyone notice any interesting differences between 1999 and today?

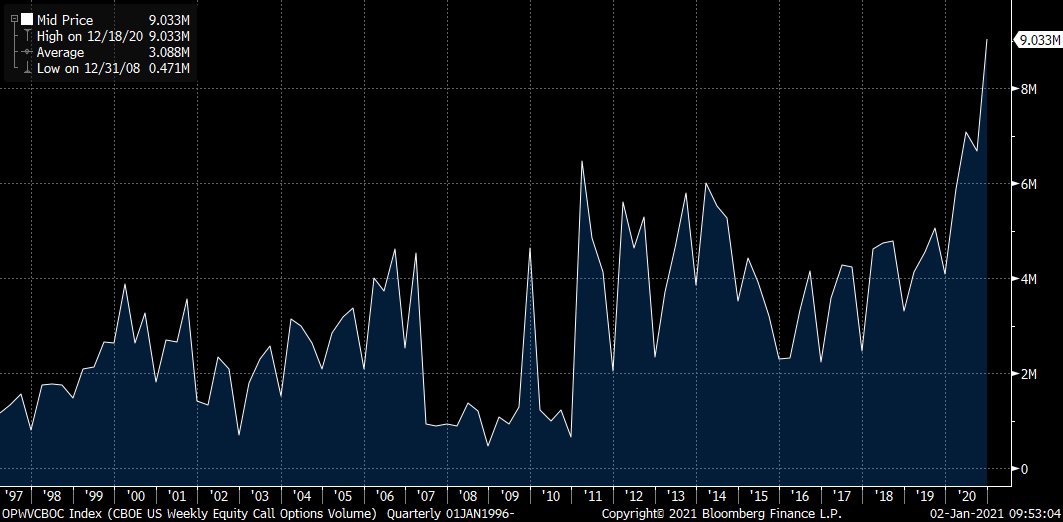

People are discovering that the purchasing power of their cash is leveraged via call options.

Still a lot of buying power out there looking for a home...

Still a lot of buying power out there looking for a home...

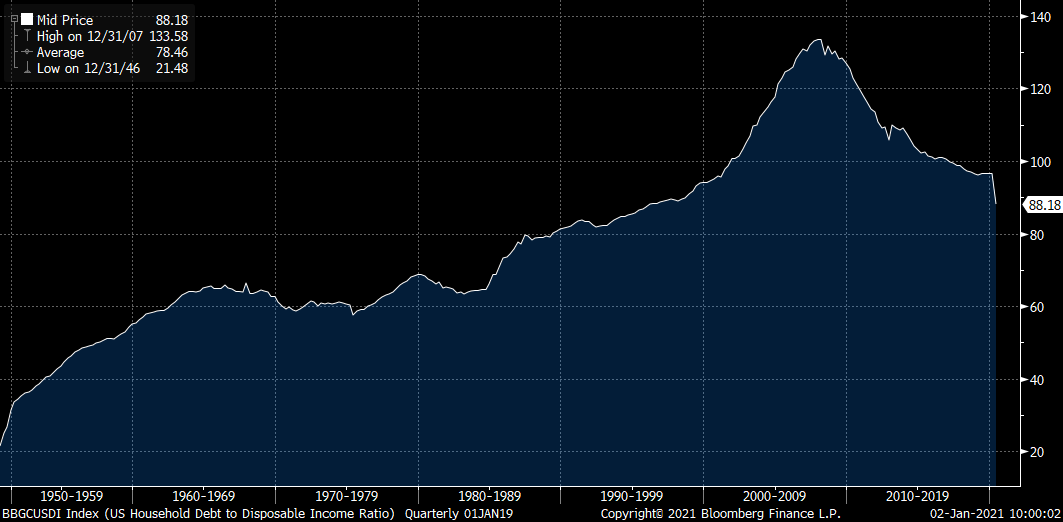

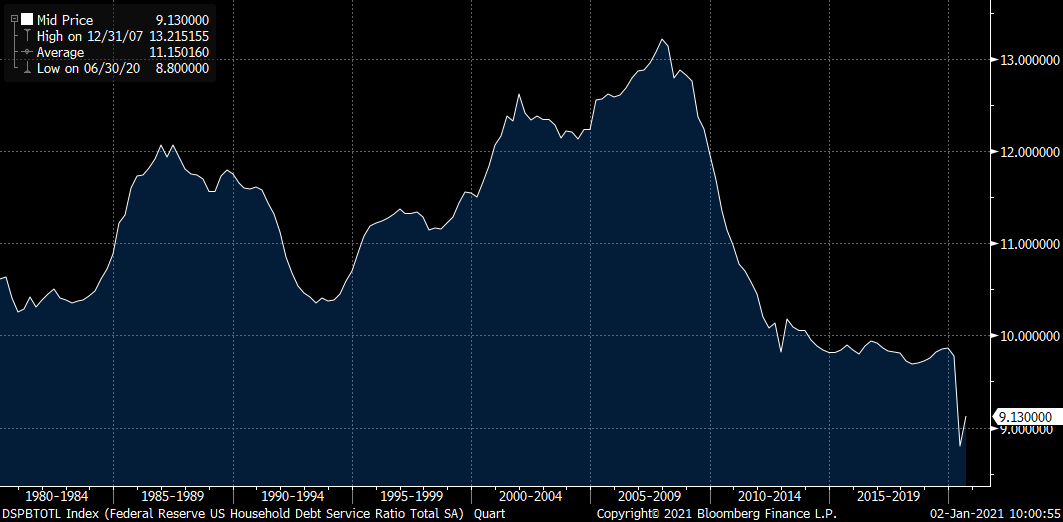

And so, US household debt service costs are now consuming less than 10% of disposable incomes.

If they direct the extra cash to market, should mkt multiple go up? If they direct it to the economy, should corp profits go up?

If they direct the extra cash to market, should mkt multiple go up? If they direct it to the economy, should corp profits go up?

Clearly there are pockets of euphoria / craziness. I'm not arguing these pockets aren't concerning.

However, that doesn't means there aren't stocks worth owning.

If people cant find individual stocks they like, the SPX ain't a bad option for them imo...

However, that doesn't means there aren't stocks worth owning.

If people cant find individual stocks they like, the SPX ain't a bad option for them imo...

And lets not forget one important thing: when it comes to investing, it pays to be an optimist... https://twitter.com/1MainCapital/status/1248613086174404612

Read on Twitter

Read on Twitter