1/x In this thread I set out thoughts on some of the leading US real estate  disruptors:

disruptors:

Zillow Group $ZG

Refin $RDFN

Opendoor $OPEN

Expi World Holdings $EXPI

disruptors:

disruptors: Zillow Group $ZG

Refin $RDFN

Opendoor $OPEN

Expi World Holdings $EXPI

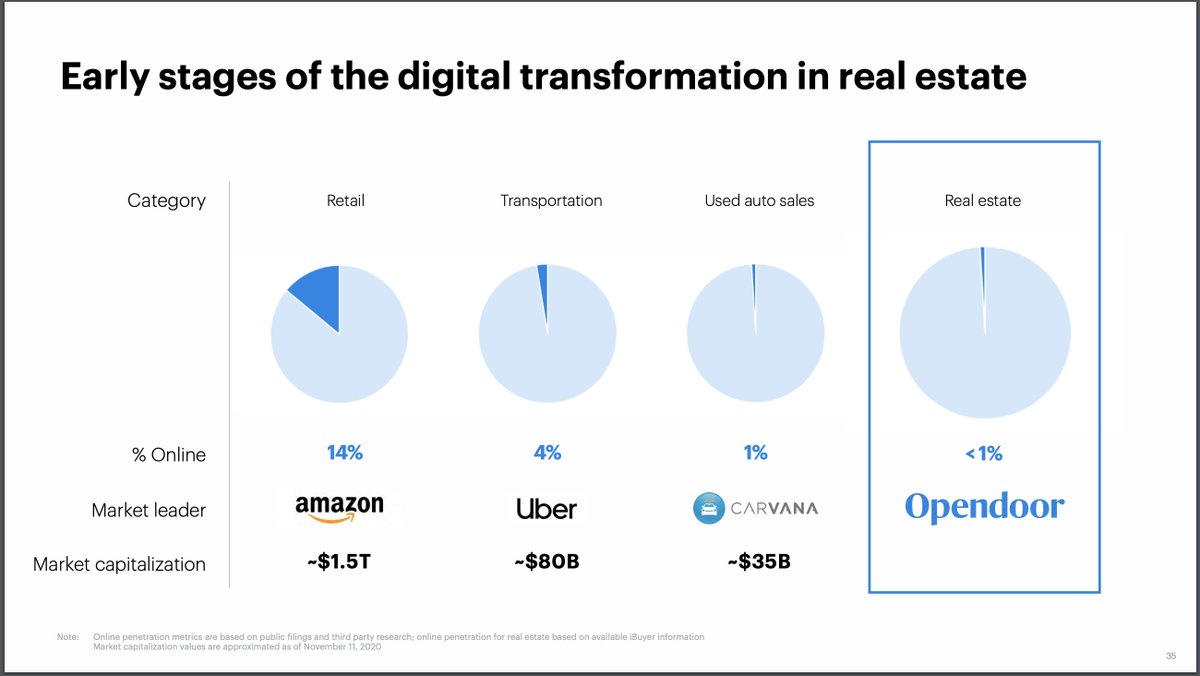

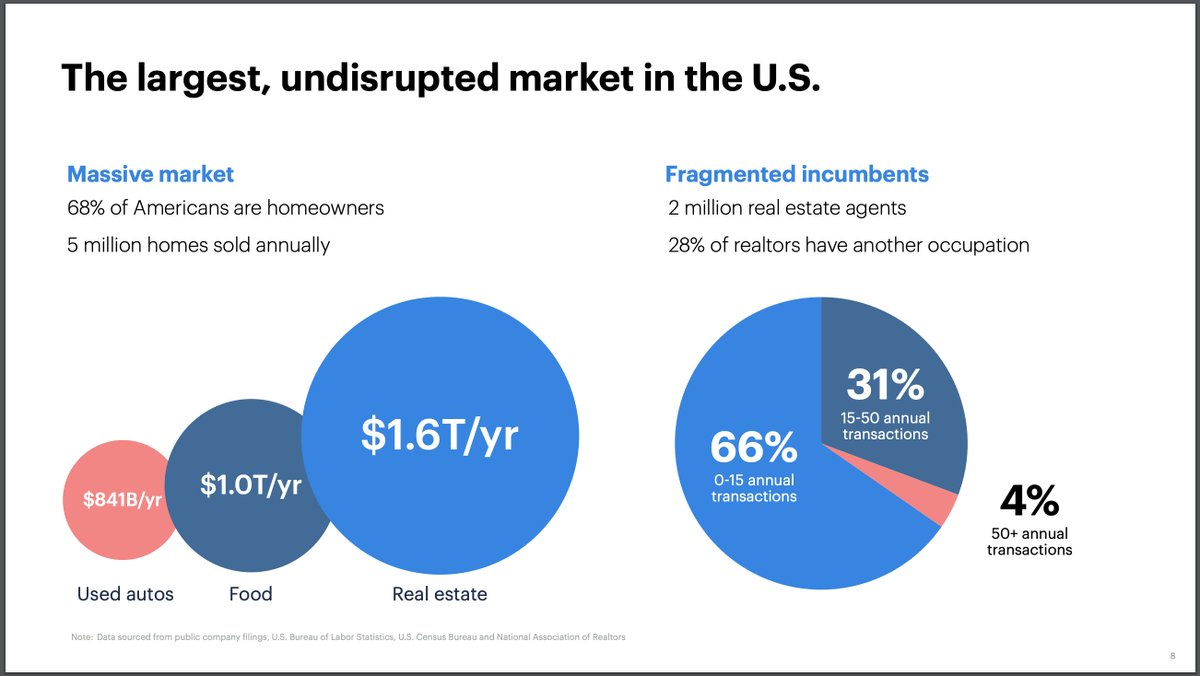

2/x. The digital transformation of US retail real estate is a huge opportunity:

- Massive fragmented market

- Low digital penetration

- Low interest rates and high propensity to move in 2021/2022, should drive record sale volumes

- Massive fragmented market

- Low digital penetration

- Low interest rates and high propensity to move in 2021/2022, should drive record sale volumes

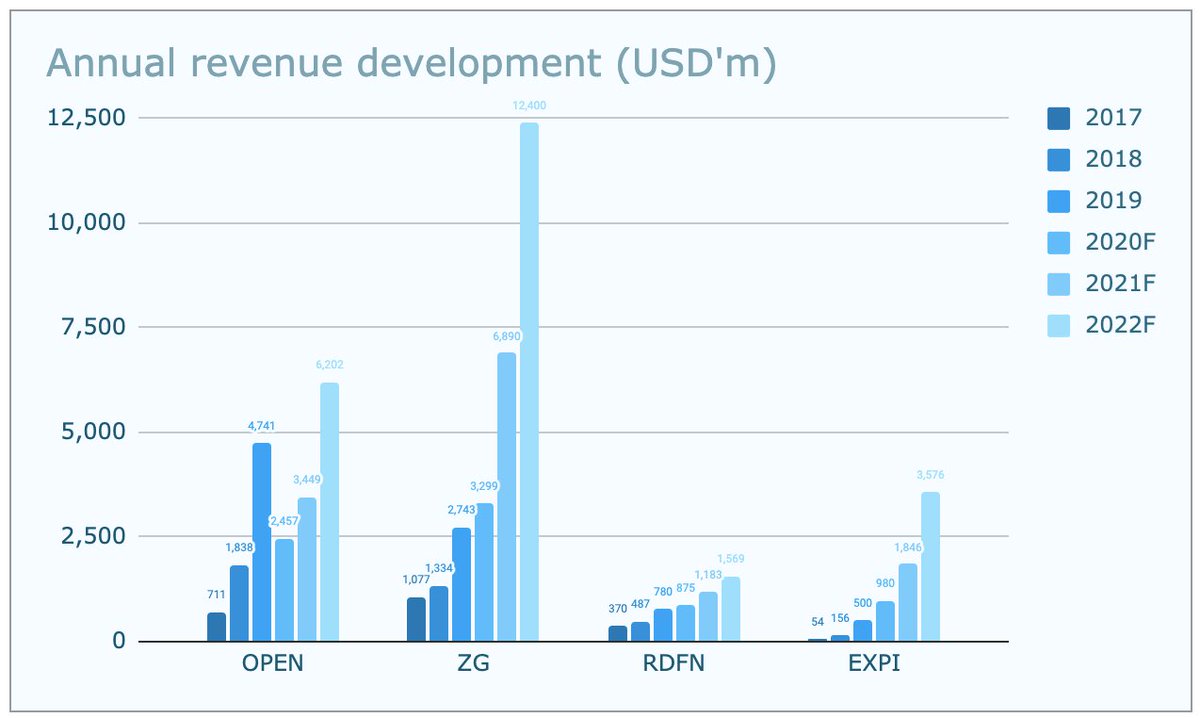

3/x. Revenue development (1/2)

$OPEN and $EXPI showed the fastest revenue growth of the four stocks in 2017 - 2019.

$OPEN specialises in directly buying and reselling homes ("iBuying") taking on balance sheet risk. iBuyers cut back acquisitions during the onset of Covid.

$OPEN and $EXPI showed the fastest revenue growth of the four stocks in 2017 - 2019.

$OPEN specialises in directly buying and reselling homes ("iBuying") taking on balance sheet risk. iBuyers cut back acquisitions during the onset of Covid.

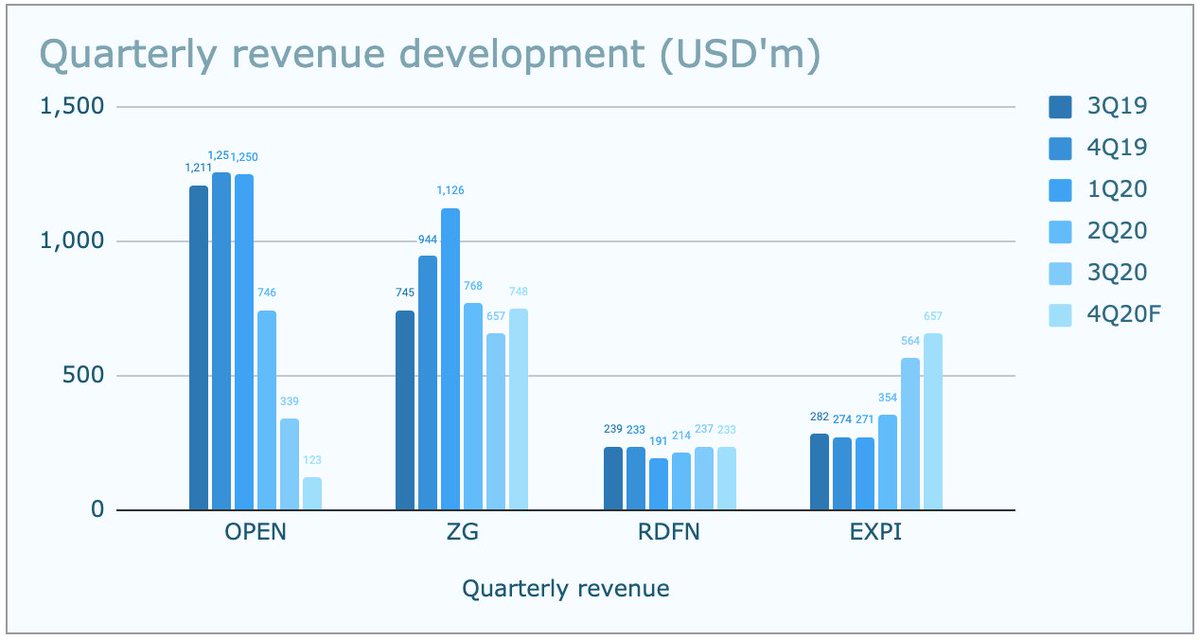

4/x. Revenue development (2/2)

The 2020 market pull-back from $OPEN is even more stark in the quarterly data.

$ZG and $RDFN had followed $OPEN into iBuying and show similar trends, but have more diversified business models, so were less impacted.

The 2020 market pull-back from $OPEN is even more stark in the quarterly data.

$ZG and $RDFN had followed $OPEN into iBuying and show similar trends, but have more diversified business models, so were less impacted.

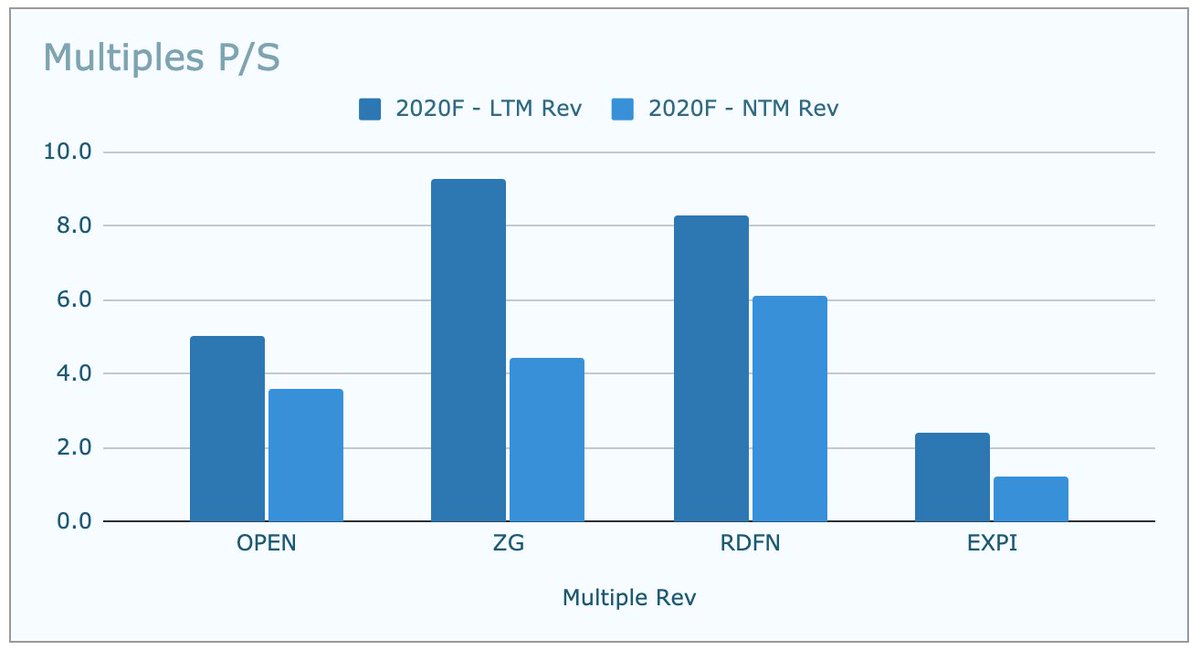

5/x. P/S Multiples

The four companies currently trade at 'fairly' similar P/S multiples.

However, I believe revenues are a poor basis for comparison as the quality of revenue (gross margins on revenue) is significantly different between them, and the mix is changing.

The four companies currently trade at 'fairly' similar P/S multiples.

However, I believe revenues are a poor basis for comparison as the quality of revenue (gross margins on revenue) is significantly different between them, and the mix is changing.

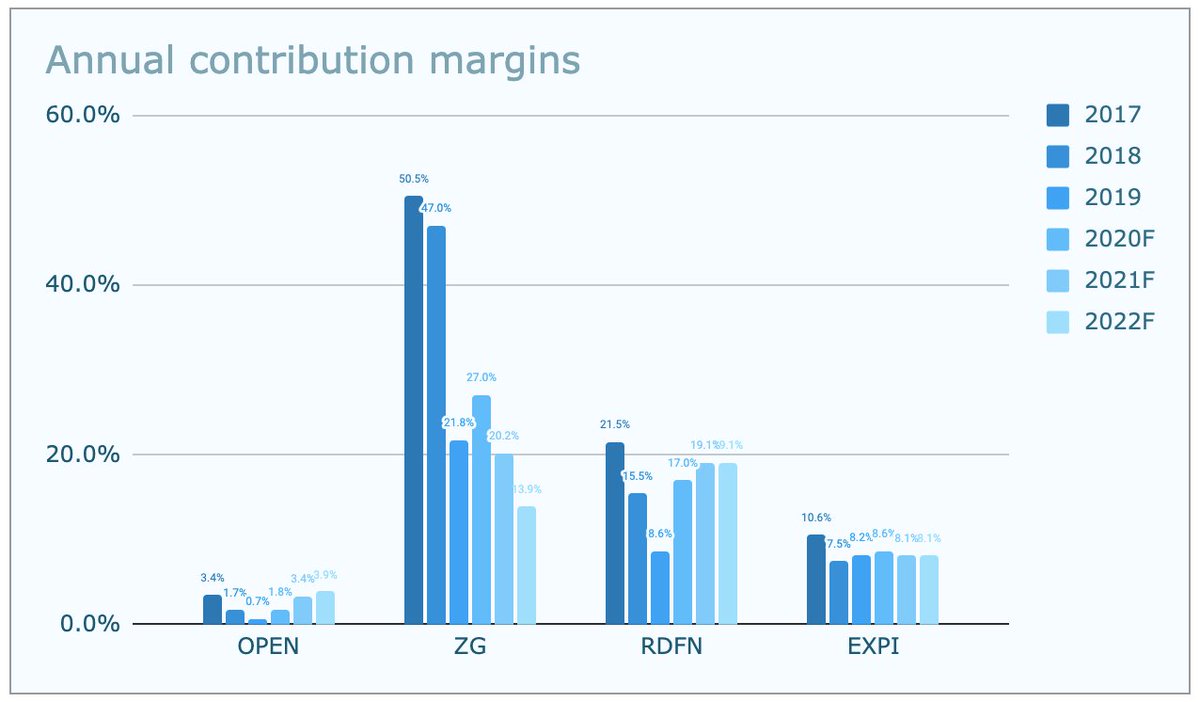

6/x. Contribution margins (CM)

$RDFN break down their gross margins between real estate brokerage (c. 28 - 33%) and iBuying (Negative 1.9 - 3.6%).

While increases in iBuying result in high revenue growth, the margins are very thin. $OPEN is almost entirely focussed on iBuying.

$RDFN break down their gross margins between real estate brokerage (c. 28 - 33%) and iBuying (Negative 1.9 - 3.6%).

While increases in iBuying result in high revenue growth, the margins are very thin. $OPEN is almost entirely focussed on iBuying.

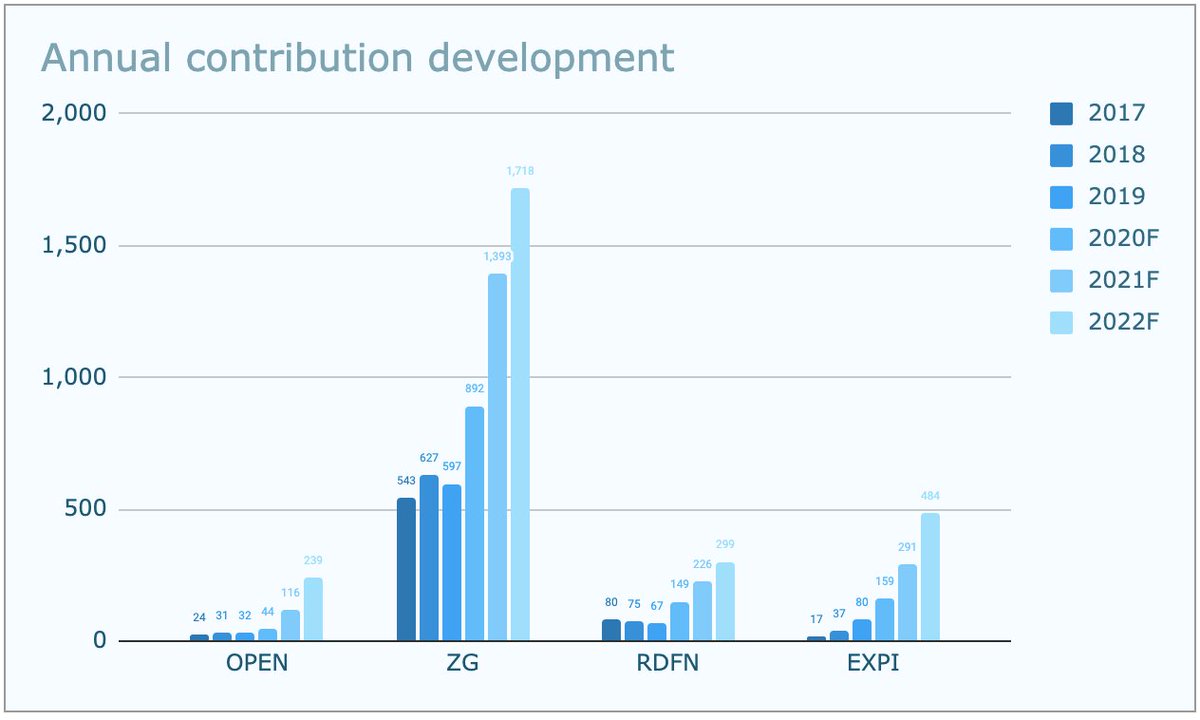

7/x. Contribution margin development

Contribution appears to be the best basis for comparison. I've calculated this a GP less sales and marketing spend for $RDFN, $EXPI and $ZG. For $OPEN I used the data provided by management.

On this basis $ZG > $EXPI > $RDFN > $OPEN

Contribution appears to be the best basis for comparison. I've calculated this a GP less sales and marketing spend for $RDFN, $EXPI and $ZG. For $OPEN I used the data provided by management.

On this basis $ZG > $EXPI > $RDFN > $OPEN

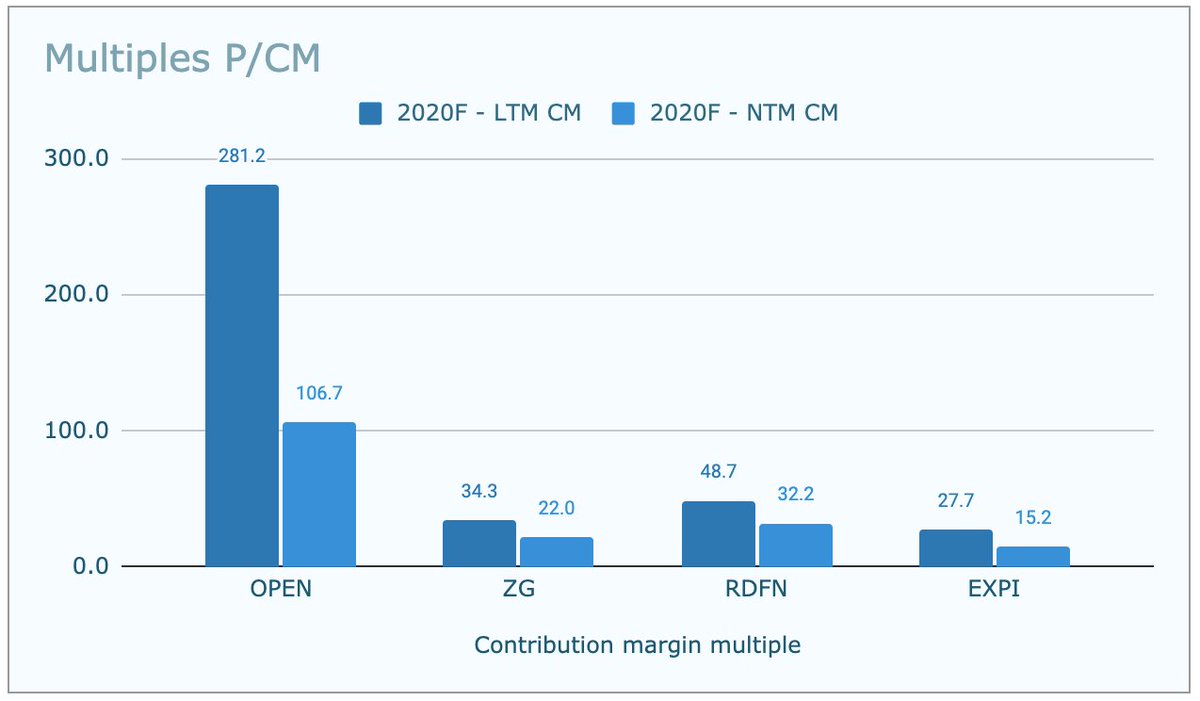

8/x. Contribution multiples

$OPEN's current contribution multiples are super high.

$EXPI and $ZG seem the most attractive on a contribution multiple basis.

I don't have a position in any of these stocks but may open one in $EXPI based on these results.

$OPEN's current contribution multiples are super high.

$EXPI and $ZG seem the most attractive on a contribution multiple basis.

I don't have a position in any of these stocks but may open one in $EXPI based on these results.

9/x Caution / notes

$OPEN projections come from their Nov 2020 presentation.

$RDFN, $EXPI and $ZG 2020 projections are the high end of management guidance. The 2021 and 2022 projections are based on sophisticated wild-ass guesses and definitely will be wrong! Do your own DD.

$OPEN projections come from their Nov 2020 presentation.

$RDFN, $EXPI and $ZG 2020 projections are the high end of management guidance. The 2021 and 2022 projections are based on sophisticated wild-ass guesses and definitely will be wrong! Do your own DD.

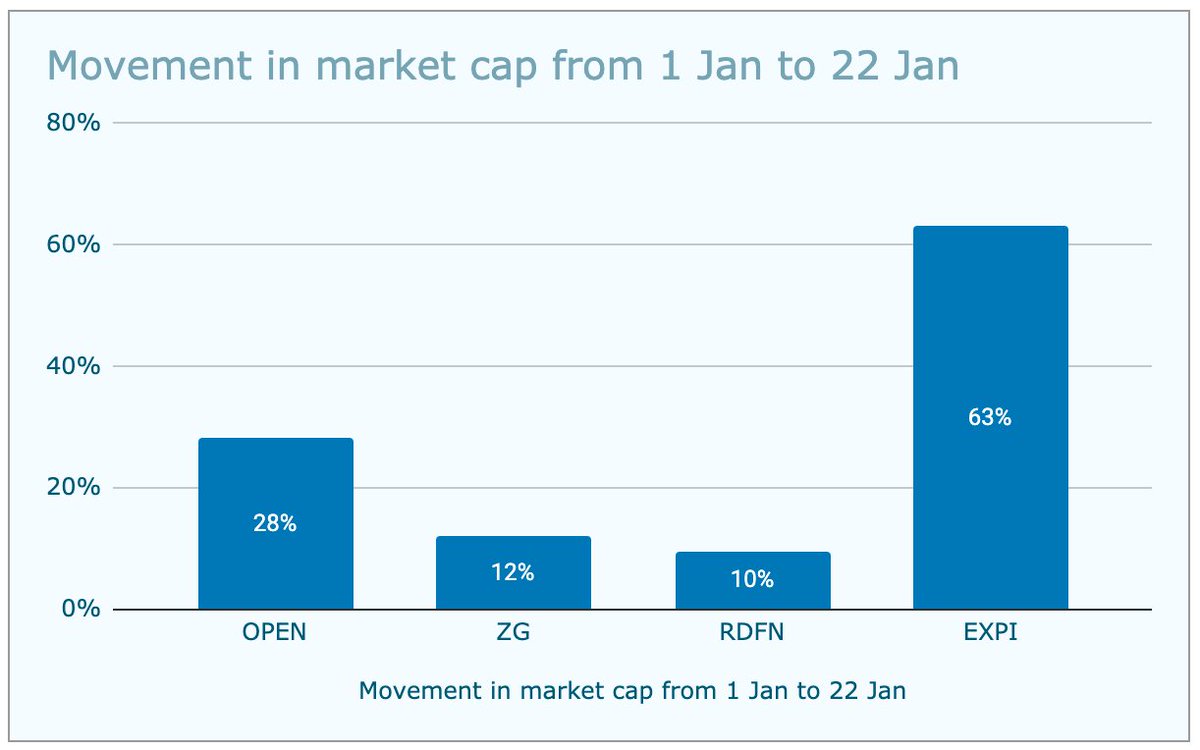

10/x 22 Jan update.

In the c. 20 days since i posted the above , there was significant appreciation in all these stocks, with $EXPI the standout.

, there was significant appreciation in all these stocks, with $EXPI the standout.

In the c. 20 days since i posted the above

, there was significant appreciation in all these stocks, with $EXPI the standout.

, there was significant appreciation in all these stocks, with $EXPI the standout.

Read on Twitter

Read on Twitter