Which brokerage should I use?

A thread to get started with #Investing and #PersonalFinance goals in 2021.

//THREAD//

#PFshare #Brokerage #RothIRA #IRA #Retirement #StockMarket

A thread to get started with #Investing and #PersonalFinance goals in 2021.

//THREAD//

#PFshare #Brokerage #RothIRA #IRA #Retirement #StockMarket

Before you keep reading, the truth is IT DOESN'T MATTER which brokerage you use as long as you do 3 things:

1) Minimize Fees

2) Have flexibility with automatic investing

3) Can buy the stocks/bonds/REITs/Funds that YOU want

Let's get started....!

1) Minimize Fees

2) Have flexibility with automatic investing

3) Can buy the stocks/bonds/REITs/Funds that YOU want

Let's get started....!

If you're in the US, lucky you!

You literally have the pick of the litter!

Popular brokerages are:

- Vanguard

- Fidelity

- Charles Schwab

- Webull

- Robinhood

- TD Ameritrade

- M1 Finance

- Wealthfront

- Merrill Edge (BOA)

- JP Morgan Chase

- Ally Invest

- Betterment

You literally have the pick of the litter!

Popular brokerages are:

- Vanguard

- Fidelity

- Charles Schwab

- Webull

- Robinhood

- TD Ameritrade

- M1 Finance

- Wealthfront

- Merrill Edge (BOA)

- JP Morgan Chase

- Ally Invest

- Betterment

...not at all an exhaustive list...

Don't spend too much time thinking about it.

We wasted 3 months before landing on Fidelity.

If you pick 'wrong', you can always transfer!

#GetStarted

Don't spend too much time thinking about it.

We wasted 3 months before landing on Fidelity.

If you pick 'wrong', you can always transfer!

#GetStarted

If you're in Canada, you're options are a bit more limited, but this is what family & friends use:

- Questrade

- Wealth Simple

- TD Bank

But will defer to @rinkydoofinance & @FIRECracker_Rev for their thoughts.

Definitely check out their blogs & "Quit Like A Millionaire"

- Questrade

- Wealth Simple

- TD Bank

But will defer to @rinkydoofinance & @FIRECracker_Rev for their thoughts.

Definitely check out their blogs & "Quit Like A Millionaire"

Okay, now that you've got a list to start at...

Lets narrow it down!

Lets narrow it down!

1) How hands on do you want to be?

If you're looking for simple passive index fund investing, practically any one of these will do

Just make sure you're looking at Expense Ratios for funds offered

Here's Vanguard, Fidelity, & Schwab https://nguyeninglifestyles.com/nick/comparing-index-funds-for-fidelity-charles-schwab-and-vanguard

https://nguyeninglifestyles.com/nick/comparing-index-funds-for-fidelity-charles-schwab-and-vanguard

If you're looking for simple passive index fund investing, practically any one of these will do

Just make sure you're looking at Expense Ratios for funds offered

Here's Vanguard, Fidelity, & Schwab

https://nguyeninglifestyles.com/nick/comparing-index-funds-for-fidelity-charles-schwab-and-vanguard

https://nguyeninglifestyles.com/nick/comparing-index-funds-for-fidelity-charles-schwab-and-vanguard

(1 continued) or you can get around the fees by just picking a brokerage with 0 fees for buying ETFs.

ETFs = Exchange Traded Funds

They're basically funds in stock form

We wrote up a quick summary about pros & cons here: https://nguyeninglifestyles.com/nick/index-funds-or-etfs

ETFs = Exchange Traded Funds

They're basically funds in stock form

We wrote up a quick summary about pros & cons here: https://nguyeninglifestyles.com/nick/index-funds-or-etfs

(1 continued) if you're looking for something EXTRA passive, like you don't even want to think about what stocks/bonds/funds to buy...

the "DIFM" (Do-It-For-Me) approach may be up your alley!

You can use robo-advisors:

Betterment & Wealthfront

OR...

the "DIFM" (Do-It-For-Me) approach may be up your alley!

You can use robo-advisors:

Betterment & Wealthfront

OR...

...have an advisor/robo-advisor feature from Fidelity, Vanguard, or Ally manage things.

You put in your retirement goals, i.e.

how much you want to have each month

when you want to retire

your income

And they figure out the rest! Almost all brokerages have a 'managed' option

You put in your retirement goals, i.e.

how much you want to have each month

when you want to retire

your income

And they figure out the rest! Almost all brokerages have a 'managed' option

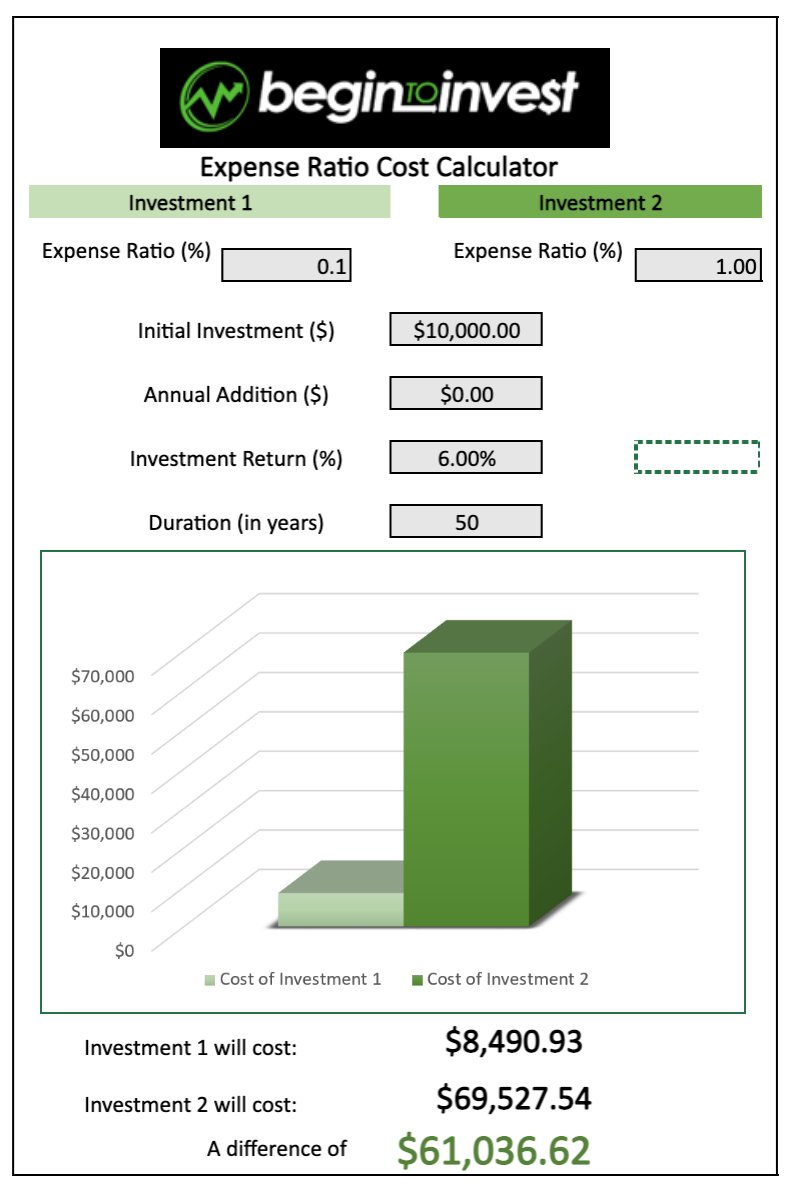

YOU want the one with the lowest fees!

Fees can literally take away 100s of 1000s of dollars from your portfolio

Look how much a 0.1% vs. a 1% fee will cost after 50 years!

And there are fund with LESS THAN 0.1% expense ratios!

Fees can literally take away 100s of 1000s of dollars from your portfolio

Look how much a 0.1% vs. a 1% fee will cost after 50 years!

And there are fund with LESS THAN 0.1% expense ratios!

2) Find one with excellent customer service that you can actually get a hold of.

Vanguard, Fidelity, & Schwab are great

They actually answer the phone, and Fidelity + Schwab have a chat function!

Call around & see if they answer YOUR Questions!

Vanguard, Fidelity, & Schwab are great

They actually answer the phone, and Fidelity + Schwab have a chat function!

Call around & see if they answer YOUR Questions!

(2 continued) this comes in handy when you accidentally transfer your entire portfolio out to another account because you misread the transfer button at midnight

True story.

Happened to us.

Flipped out for 5 minutes.

Fidelity took care of it in 3.

True story.

Happened to us.

Flipped out for 5 minutes.

Fidelity took care of it in 3.

3) If you're SUPER hands on and want to do options trading, pick a large brokerage!

One of the problems with Robinhood is that it can take forever for trades to fill at high volumes.

You're literally risking your money!

One of the problems with Robinhood is that it can take forever for trades to fill at high volumes.

You're literally risking your money!

(3 continued)

Our recommendations for options/day traders:

Fidelity, Schwab, TD Ameritrade, JP Morgan, Merill Edge, Ally Invest, Tasty Works

They all have great tools, analysis, and research options.

Our recommendations for options/day traders:

Fidelity, Schwab, TD Ameritrade, JP Morgan, Merill Edge, Ally Invest, Tasty Works

They all have great tools, analysis, and research options.

4) Your IRAs *should* have a different goal than your taxable accounts

IRAs are long-term. You can afford to put in assets that may not do well right now, but will rock it long-term!

Taxable accounts may be a bit more speculative. I have one for Dividends & Growth

IRAs are long-term. You can afford to put in assets that may not do well right now, but will rock it long-term!

Taxable accounts may be a bit more speculative. I have one for Dividends & Growth

5) Make sure you check if there are any minimums.

Vanguard has a $1k-3k minimum for their funds/ETFs

Fidelity & Schwab have $0 minimums AND you can buy Vanguard ETFs for free

Another reason why we did Fidelity for Roth IRA & Schwab for taxable accounts

Vanguard has a $1k-3k minimum for their funds/ETFs

Fidelity & Schwab have $0 minimums AND you can buy Vanguard ETFs for free

Another reason why we did Fidelity for Roth IRA & Schwab for taxable accounts

6) Additional things that you might like:

- Fractional Shares

- Research & Analysis Tools

- Price Triggers/Notifications

- Mobile App Experience

- Dedicated bank account

This is where Fidelity, Schwab, M1 Finance, Robinhood & Webull shine.

- Fractional Shares

- Research & Analysis Tools

- Price Triggers/Notifications

- Mobile App Experience

- Dedicated bank account

This is where Fidelity, Schwab, M1 Finance, Robinhood & Webull shine.

At the end of the day, we have tested and used essentially all the brokerages.

The most important thing we learned.

Pick one and get started.

You can't go wrong if you start...unless you're spending way too much on fees.

The most important thing we learned.

Pick one and get started.

You can't go wrong if you start...unless you're spending way too much on fees.

Here's a letter to new investors if you're afraid to get started.

Hopefully, you find the courage and motivation to start. https://nguyeninglifestyles.com/nick/dear-new-investors

Hopefully, you find the courage and motivation to start. https://nguyeninglifestyles.com/nick/dear-new-investors

And here's our detailed Pros & Cons about why we chose Fidelity for our Roth IRA https://nguyeninglifestyles.com/nick/which-brokerage-should-i-use-for-my-ira

Now that you've gotten the hard part done, it's time to think about your investing and navigating that interface.

Here's a cheat sheet for COMPLETE beginners https://nguyeninglifestyles.com/nick/your-cheat-sheet-to-stock-market-investing-for-complete-beginners

https://nguyeninglifestyles.com/nick/your-cheat-sheet-to-stock-market-investing-for-complete-beginners

Here's a cheat sheet for COMPLETE beginners

https://nguyeninglifestyles.com/nick/your-cheat-sheet-to-stock-market-investing-for-complete-beginners

https://nguyeninglifestyles.com/nick/your-cheat-sheet-to-stock-market-investing-for-complete-beginners

If you've made it to the end, thank you!

Leave a comment with the brokerage you ended up choosing!

#PFshare #PersonalFinance #Investing #stocks #beginner

Leave a comment with the brokerage you ended up choosing!

#PFshare #PersonalFinance #Investing #stocks #beginner

Read on Twitter

Read on Twitter