I understand the aesthetic and emotional case (essential not luxury, only paid by one gender, etc.) for abolishing the tampon tax.

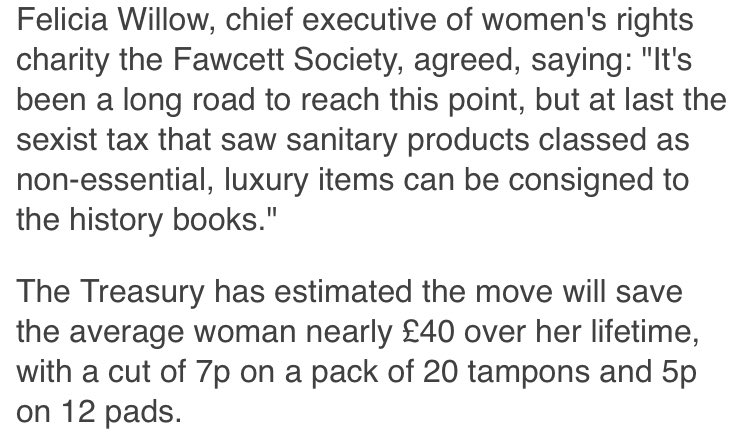

But the actual financial benefit to women is likely to be less than £40 over their lifetime.

(Thread)

But the actual financial benefit to women is likely to be less than £40 over their lifetime.

(Thread)

But the real problem isn’t that the benefits to women are small.

It is that it undermines the ability of future governments to broaden the base of VAT.

Worse still, it creates a demand for further VAT zero-ratings. Domestic fuel is essential, so why not take VAT off it?

It is that it undermines the ability of future governments to broaden the base of VAT.

Worse still, it creates a demand for further VAT zero-ratings. Domestic fuel is essential, so why not take VAT off it?

The problem is VAT exemptions and zero ratings are an inefficient way to help the less well-off.

The 0% VAT rate on children’s shoes creates larger savings for parents who buy their children pairs of £100 shoes than a single parent who buys one pair from Matalan for £10.

The 0% VAT rate on children’s shoes creates larger savings for parents who buy their children pairs of £100 shoes than a single parent who buys one pair from Matalan for £10.

A fairer option to help parents in the above case would be to pay a flat child benefit to both. Then they’d each get the same.

Fairer still, we could means test the benefit so the single parent gets more money.

Fairer still, we could means test the benefit so the single parent gets more money.

It is a mistake to assume the existing list of zero-ratings is determined by what’s essential.

Toilet paper is clearly essential, but it is taxed at 20%.

Toilet paper is clearly essential, but it is taxed at 20%.

The real winners from tampon tax abolition are anti-tax, ‘starve the beast’ small staters who want to see less spent on welfare, foreign aid and the NHS.

VAT is one of our most efficient revenue raisers, so anything that undermines it will slow the growth of public spending.

VAT is one of our most efficient revenue raisers, so anything that undermines it will slow the growth of public spending.

Every budget going forward will have a small erosion of the VAT base.

The result will be a more complicated tax system that helps industries with the most effective lobbyists. https://twitter.com/neilmurphy1978/status/1345139926850002946

The result will be a more complicated tax system that helps industries with the most effective lobbyists. https://twitter.com/neilmurphy1978/status/1345139926850002946

Read on Twitter

Read on Twitter