1/ Thread about Salary Sacrifice / Leasing & NHS pensions  (INCLUDING A free little tool to do the sums)

(INCLUDING A free little tool to do the sums)

One of the things I get asked about almost daily is car leasing in the NHS. Some of the quotes for electric cars (now with zero “BIK” tax) look almost too good to be true

(INCLUDING A free little tool to do the sums)

(INCLUDING A free little tool to do the sums)One of the things I get asked about almost daily is car leasing in the NHS. Some of the quotes for electric cars (now with zero “BIK” tax) look almost too good to be true

2/ Well you know the old adage about it looking to good to be true!

I'll take you through a simple way of knowing the pitfalls if you are a "high earner" (OR will be a FUTURE high earner) in the NHS pension scheme. Ive also provided a free tool if in the 1995 & 2015 NHS scheme

I'll take you through a simple way of knowing the pitfalls if you are a "high earner" (OR will be a FUTURE high earner) in the NHS pension scheme. Ive also provided a free tool if in the 1995 & 2015 NHS scheme

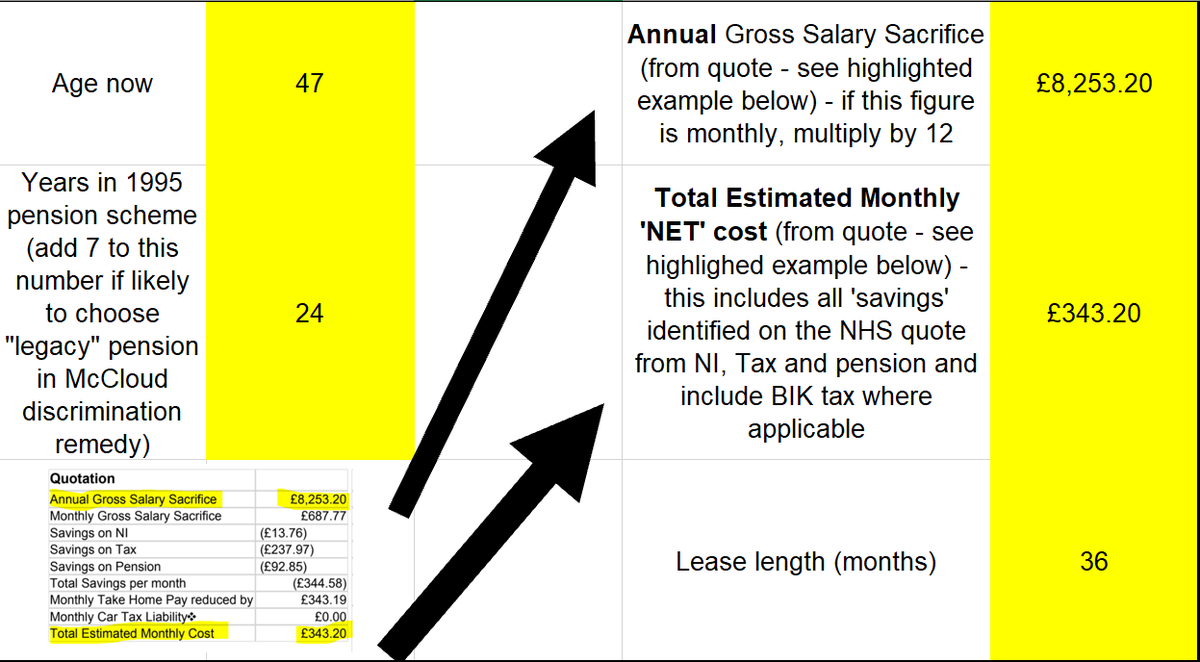

3/ OK lets start with a quote from NHS Fleet Solutions  (other companies doing SS leasing are exactly the same).

(other companies doing SS leasing are exactly the same).

The 2 figures you are going to need

Annual Gross Salary Sacrifice (this is what your PENSIONABLE salary goes down by)

Annual Gross Salary Sacrifice (this is what your PENSIONABLE salary goes down by)

Total Estimated Monthly or 'net' cost

Total Estimated Monthly or 'net' cost

(other companies doing SS leasing are exactly the same).

(other companies doing SS leasing are exactly the same).The 2 figures you are going to need

Annual Gross Salary Sacrifice (this is what your PENSIONABLE salary goes down by)

Annual Gross Salary Sacrifice (this is what your PENSIONABLE salary goes down by) Total Estimated Monthly or 'net' cost

Total Estimated Monthly or 'net' cost

4/ What a bargain I hear you scream! The fabulous electric Jag iPACE - a £65k car for £343/month with zero "BIK" tax in year 1 (and very little thereafter)

Sounds too good to be true?

So download this little tool and I'll talk through the numbers

http://bit.ly/TGSSFreeTool

Sounds too good to be true?

So download this little tool and I'll talk through the numbers

http://bit.ly/TGSSFreeTool

5/ So now you have the Excel tool (and thanks to @gdcuk & @James_Gransby for reviewing / sense checking the tool)-this is how to use it.

Start with those 2 numbers from the quote above. Then put in your age, number of years you have in 1995 scheme, and the lease length (months)

Start with those 2 numbers from the quote above. Then put in your age, number of years you have in 1995 scheme, and the lease length (months)

6/ For the "Years in 1995" - you can get this from your "TRS" or "Annual Benefit Statement".

NOTE - Becuase of the "McCloud" age discrimination case you may end up with 7 more "legacy" years in 1995 - you can add 7 to this number if you want to see the effect

NOTE - Becuase of the "McCloud" age discrimination case you may end up with 7 more "legacy" years in 1995 - you can add 7 to this number if you want to see the effect

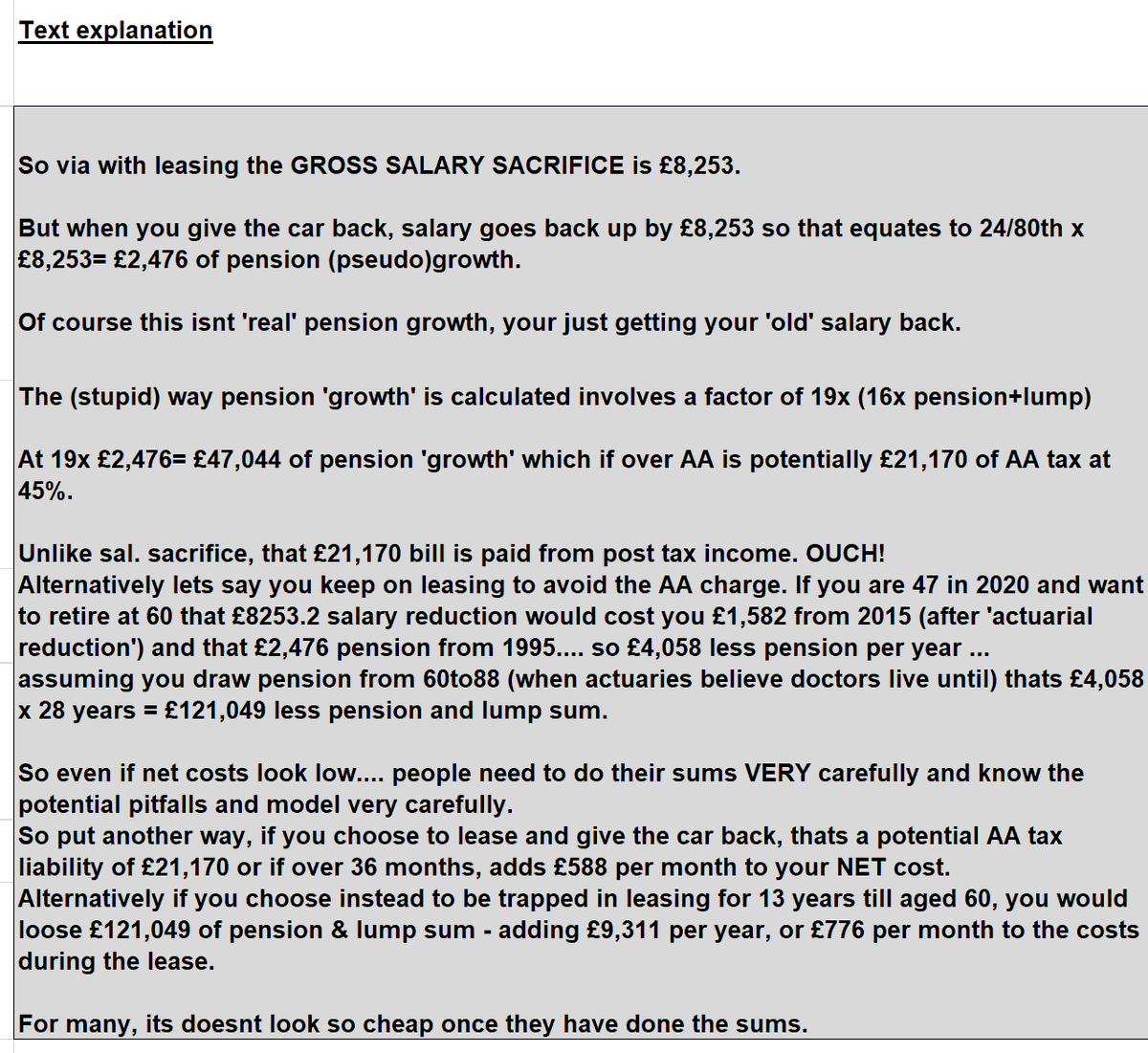

7/ So now you have completed the simple "input" stage, it will output them as a "text explanation" as to how the potential pension costs and implications have been calculated (put your own numbers in to get your own explanation).

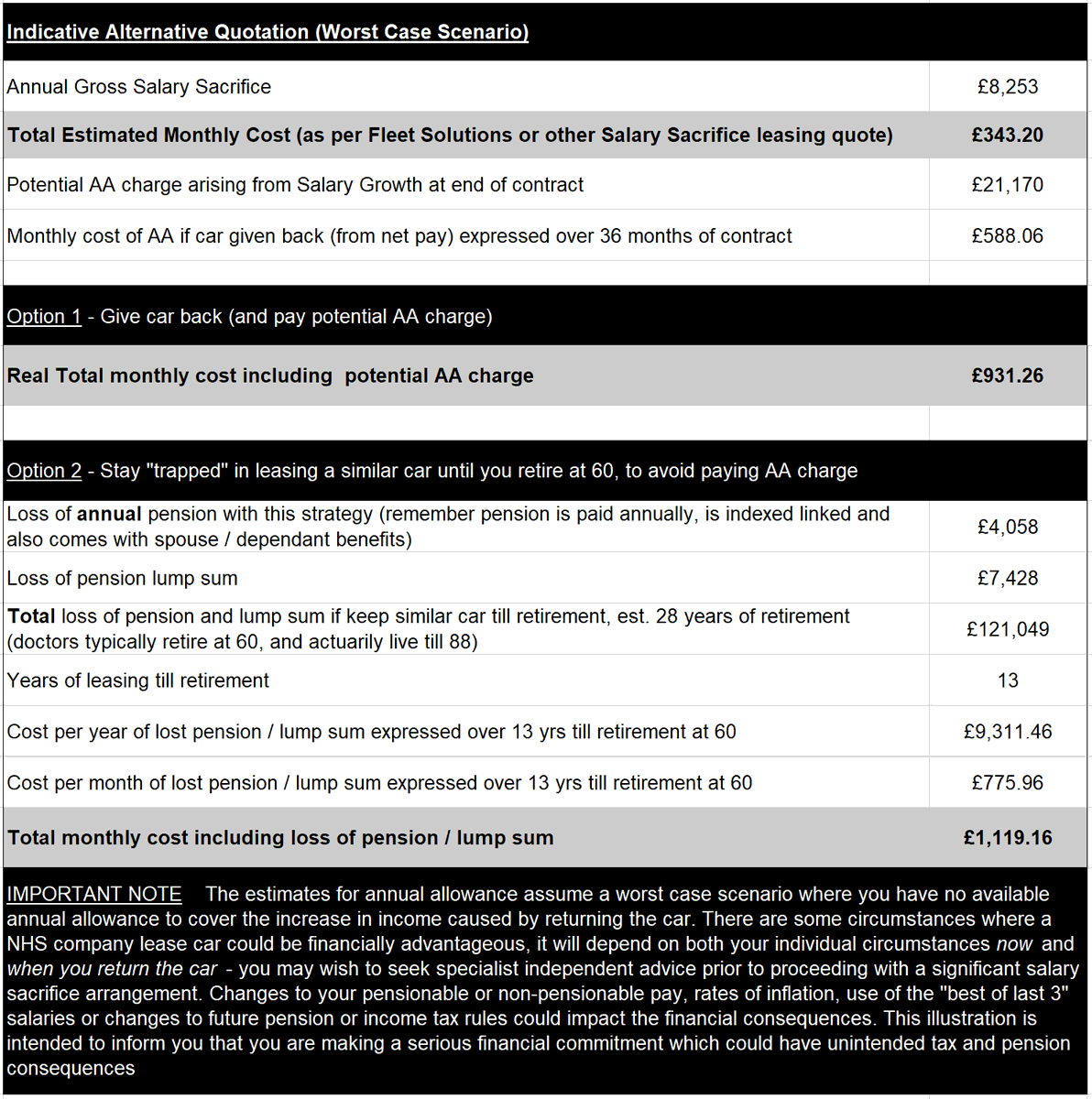

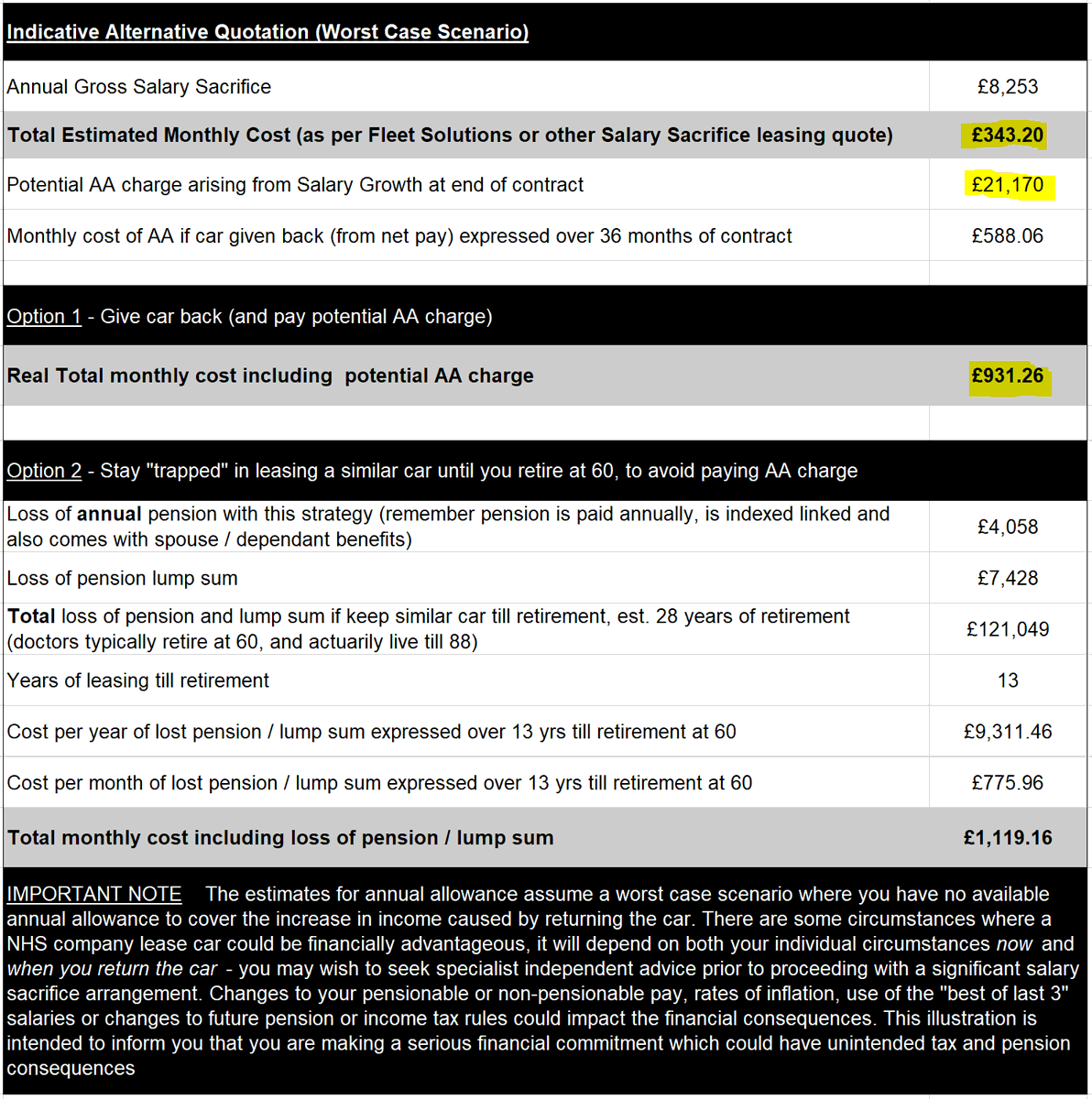

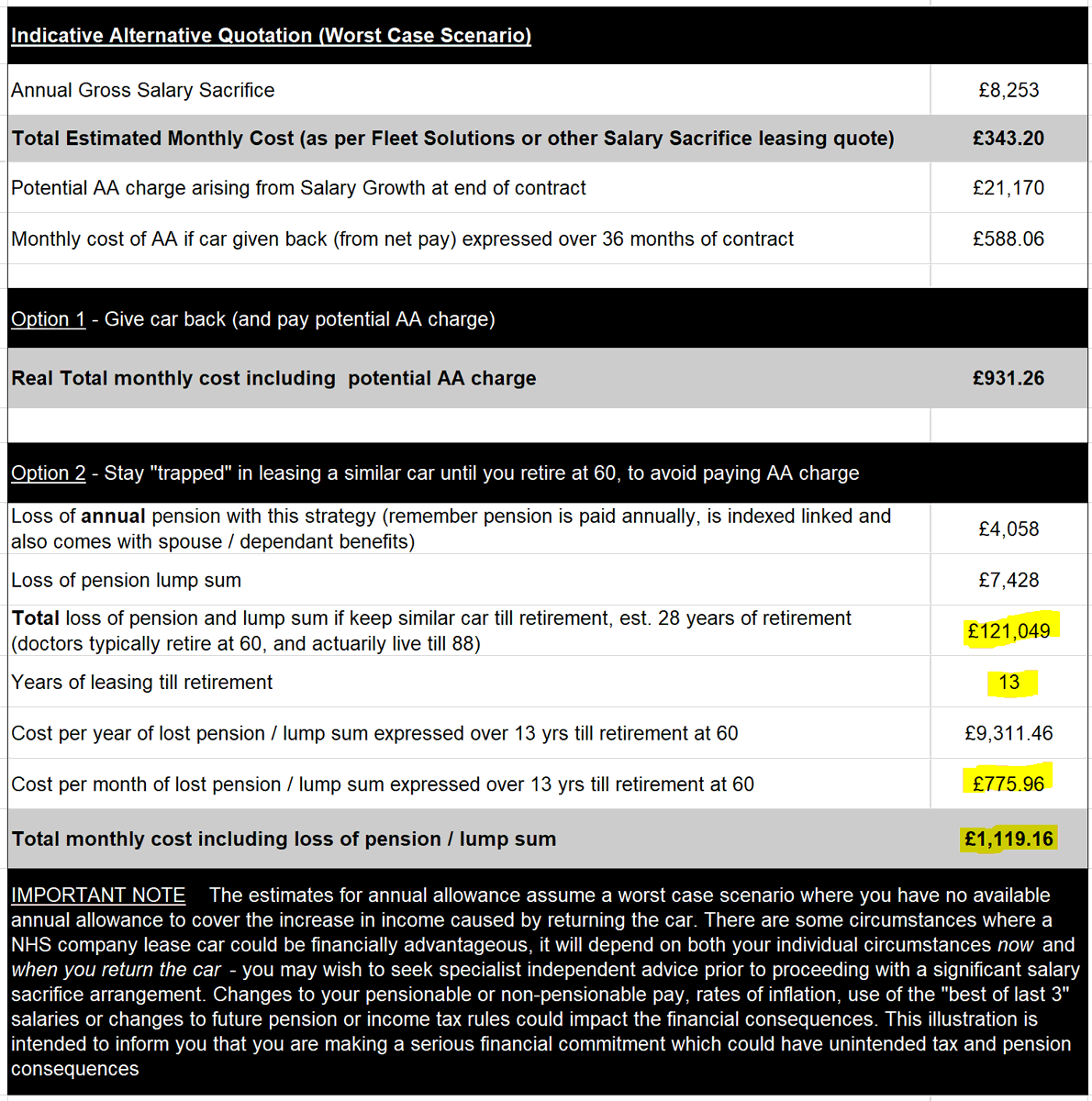

8/ And you will be presented also with what I've called an "Indicative Alternative Quotation". Its important to note this is a "worst case scenario". Be careful to read the footnote at the end  as this assumes you have no "carry forward" to mitigate any AA charges

as this assumes you have no "carry forward" to mitigate any AA charges

as this assumes you have no "carry forward" to mitigate any AA charges

as this assumes you have no "carry forward" to mitigate any AA charges

9/ This "alternate" quote is intended to show you the "net" cost on your quote isn't always what it seems. Basically it presents two ways of looking at it

Pay an AA charge (from your post tax income)

Pay an AA charge (from your post tax income)

Carry on leasing till retirement at 60 to avoid an AA charge

Carry on leasing till retirement at 60 to avoid an AA charge

Pay an AA charge (from your post tax income)

Pay an AA charge (from your post tax income)  Carry on leasing till retirement at 60 to avoid an AA charge

Carry on leasing till retirement at 60 to avoid an AA charge

10/ So with option 1 - pay the charge

Instead of the quoted "net" monthly rate of £343.20, if you roll in the potential AA charge of £21,170 (or £588.06 per month over 36 months) the actual net charge (including AA) is £931.26.

Not so cheap any more, is it?

Instead of the quoted "net" monthly rate of £343.20, if you roll in the potential AA charge of £21,170 (or £588.06 per month over 36 months) the actual net charge (including AA) is £931.26.

Not so cheap any more, is it?

11/ So what about option 2 - avoid AA by carrying on leasing?

Here the member avoids the AA charge by leasing for 13 years (till age 60) but gives up £121,049 in pension benefits (£775.96 per month). Thats the equivalent of £1,119.16 per month.

Again not an iPACE at £343.20/m!

Here the member avoids the AA charge by leasing for 13 years (till age 60) but gives up £121,049 in pension benefits (£775.96 per month). Thats the equivalent of £1,119.16 per month.

Again not an iPACE at £343.20/m!

12/ So if you are a high earner (OR will be a high earner when you stop leasing), do your sums VERY carefully, or that lease could be the worst investment you ever make. You can model it more accurately using @TheBMA Goldstone modeller including carry forward etc, but even with

13/ that or paying for expert independent advice you are basically going to have to gamble on what your future salary and inflation will be, so no-one can give you a 100% accurate estimate.

14/ Its not all doom and gloom however. Some may still benefit from leasing, but you MUST do your sums and be aware of the pitfalls. Some things to consider

The month you end the lease may be important - can you spread the "pseudo"rise in pay over 2 years, and time with

The month you end the lease may be important - can you spread the "pseudo"rise in pay over 2 years, and time with

The month you end the lease may be important - can you spread the "pseudo"rise in pay over 2 years, and time with

The month you end the lease may be important - can you spread the "pseudo"rise in pay over 2 years, and time with

15/ other pay changes / increments etc

Can you "wean" onto a less expensive car to "spread" the pay (pseudo)rise

Can you "wean" onto a less expensive car to "spread" the pay (pseudo)rise

Would another strategy entirely (i.e. LTD company) be a better option - discuss with your advisor

Would another strategy entirely (i.e. LTD company) be a better option - discuss with your advisor

Is a private lease cheaper?

Is a private lease cheaper?

Can you "wean" onto a less expensive car to "spread" the pay (pseudo)rise

Can you "wean" onto a less expensive car to "spread" the pay (pseudo)rise Would another strategy entirely (i.e. LTD company) be a better option - discuss with your advisor

Would another strategy entirely (i.e. LTD company) be a better option - discuss with your advisor Is a private lease cheaper?

Is a private lease cheaper?

16/ Of course I cannot end such a thread with pointing out just how unfair & STUPID this is. It shows perfectly why the AA just doesnt work in defined benefit schemes. You end a lease & get a £21k tax charge for NO BENEFIT in your pension. You are simply restoring your "old" pay!

17/ So I have 2 asks

@RishiSunak you MUST #ScrapAAinDB - this is just stupid

@RishiSunak you MUST #ScrapAAinDB - this is just stupid

I'm asking NHS Fleet Solutions (and others) to use this tool (or modify it) & include it in their quotes. It's just not fair to ignore this when people can get life changing bills at the end

I'm asking NHS Fleet Solutions (and others) to use this tool (or modify it) & include it in their quotes. It's just not fair to ignore this when people can get life changing bills at the end

@RishiSunak you MUST #ScrapAAinDB - this is just stupid

@RishiSunak you MUST #ScrapAAinDB - this is just stupid I'm asking NHS Fleet Solutions (and others) to use this tool (or modify it) & include it in their quotes. It's just not fair to ignore this when people can get life changing bills at the end

I'm asking NHS Fleet Solutions (and others) to use this tool (or modify it) & include it in their quotes. It's just not fair to ignore this when people can get life changing bills at the end

18/ of their lease. Drop me a line, happy to work with you to make your quotations more honest & transparent. You know who the high earners are, & who is at risk of these charges.

Please use the free tool http://bit.ly/TGSSFreeTool and share widely / RT - you could save a fortune!

Please use the free tool http://bit.ly/TGSSFreeTool and share widely / RT - you could save a fortune!

Read on Twitter

Read on Twitter