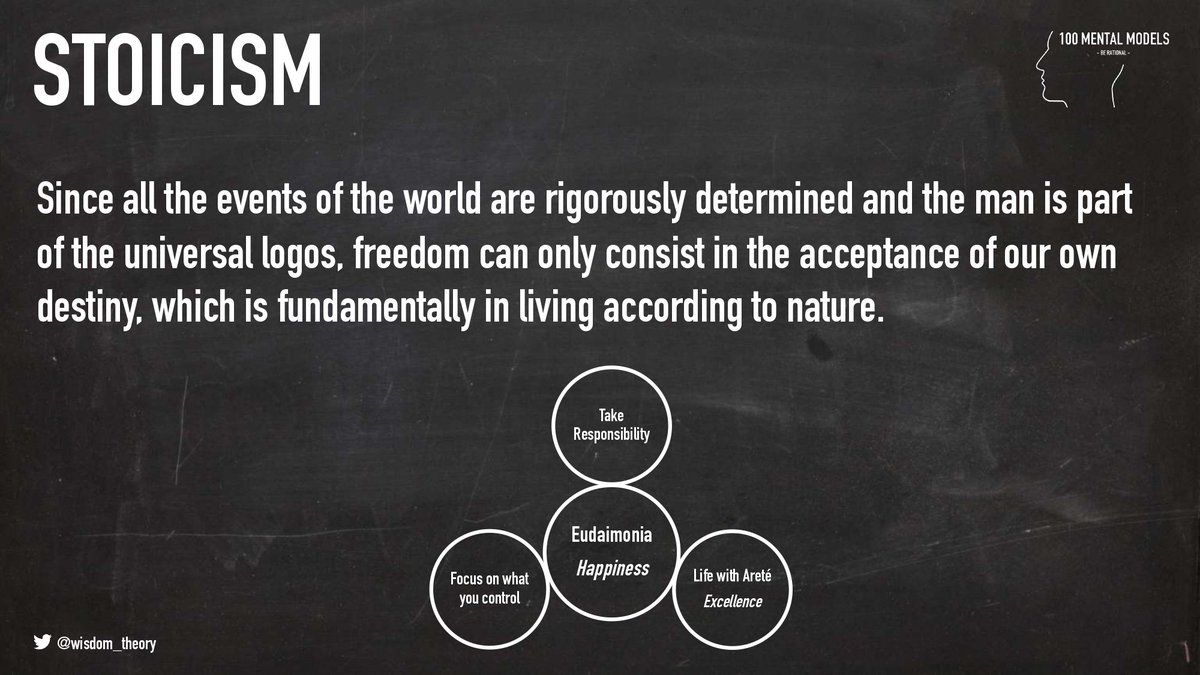

Stoicism is a 2000 years old philosophy that has given some of the best life advice to mankind.

Some of these principles can also be applied to investing which will help you become a better investor.

Some of these principles can also be applied to investing which will help you become a better investor.

Let us look at 4 such principles:

1. Fear Setting

2. Locus of Control

3. Negative Visualization

4. Being Unaffected by Other's Opinion

1. Fear Setting

2. Locus of Control

3. Negative Visualization

4. Being Unaffected by Other's Opinion

You might find may people that set goals, not only in life, but also when it comes to investing, like "I want 25% CAGR over my investment career."

It is good to set goals, but it is even better to define fears.

It is good to set goals, but it is even better to define fears.

When we make any investment, most people always look at how much returns will that stock give.

What we must instead do is ask ourselves,

"What can go wrong?"

"Is the downside protected?"

"What will I do if I am wrong?"

"What will cause me to change my mind?"

What we must instead do is ask ourselves,

"What can go wrong?"

"Is the downside protected?"

"What will I do if I am wrong?"

"What will cause me to change my mind?"

You must always invert. This will help you to think better.

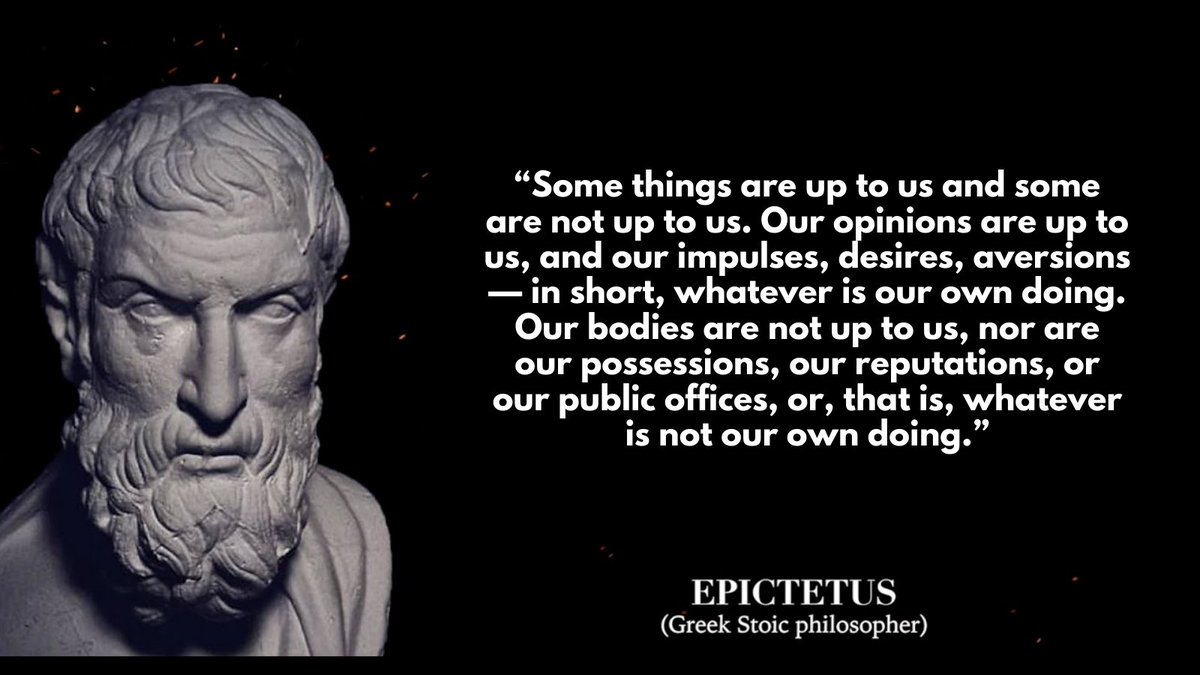

We always think about how much returns we can get from any investment, even though the investment return is NOT in our control.

As an investor, here are the things which we can control:

1. Our Emotions

2. Purchase Price

3. Downside Risk

4. Investment Horizon

5. Selecting Quality Business

1. Our Emotions

2. Purchase Price

3. Downside Risk

4. Investment Horizon

5. Selecting Quality Business

These are things where you must focus on as an investor, rather just looking at what kind of returns you might get.

3. Negative Visualization.

"It’s not what happens to you, but how you react to it that matters."

— Epictetus

"It’s not what happens to you, but how you react to it that matters."

— Epictetus

You see your portfolio cut in half during the COVID crisis. There is panic everywhere and you rush to sell your stocks.

Something like this was totally UNEXPECTED. And when such a thing materializes, you panic and take decisions emotionally.

Something like this was totally UNEXPECTED. And when such a thing materializes, you panic and take decisions emotionally.

Negative visualization is a great way to prevent this sense of irrational surprise at life’s ‘misfortunes.’

“About the worst thing that can happen is not something going wrong, but something going wrong and catching you by surprise.”

— @RyanHoliday

“About the worst thing that can happen is not something going wrong, but something going wrong and catching you by surprise.”

— @RyanHoliday

The goal of negative visualization is not to avoid shocks, but to reduce their impact on you when they materialize.

It will help you avoid taking decisions emotionally.

It will help you avoid taking decisions emotionally.

4. Being Unaffected by Other's Opinion.

There is a strong market rally. Valuations are highly stretched and there are no bargains available.

In such cases, you are holding onto cash. Your portfolio is underperforming.

There is a strong market rally. Valuations are highly stretched and there are no bargains available.

In such cases, you are holding onto cash. Your portfolio is underperforming.

Meanwhile, your friend has made three digit returns in API stocks.

In such cases, you would obviously look stupid holding cash while others are having a party.

In such cases, you would obviously look stupid holding cash while others are having a party.

Instead of "proving" to others that you are a good investor, you must realize that you underperforming your friend, or even the index shouldn't matter to you.

What should matter to you is whether or not you reach your financial goals on time.

What should matter to you is whether or not you reach your financial goals on time.

Always remember:

Investment has more to do with emotions than with intelligence.

Applying some of the Stoic principles can help you manage your emotions during your investment journey.

Managing your emotions will help you avoid stupid mistakes that would hurt your portfolio.

Investment has more to do with emotions than with intelligence.

Applying some of the Stoic principles can help you manage your emotions during your investment journey.

Managing your emotions will help you avoid stupid mistakes that would hurt your portfolio.

There are multiple disciplines whose concepts you can apply to investments.

Charlie Munger talks about being multidisciplinary and collecting mental models to make better decisions when it comes to both life and investments.

Charlie Munger talks about being multidisciplinary and collecting mental models to make better decisions when it comes to both life and investments.

You can begin your journey towards becoming multidisciplinary by taking the 100 Mental Models Program https://gumroad.com/a/569701491/AxfYH

Read on Twitter

Read on Twitter