Lots of people talk about compound interest being one of the greatest things around.

But I want to talk about

*dollar-cost averaging*

I'll explain...

But I want to talk about

*dollar-cost averaging*

I'll explain...

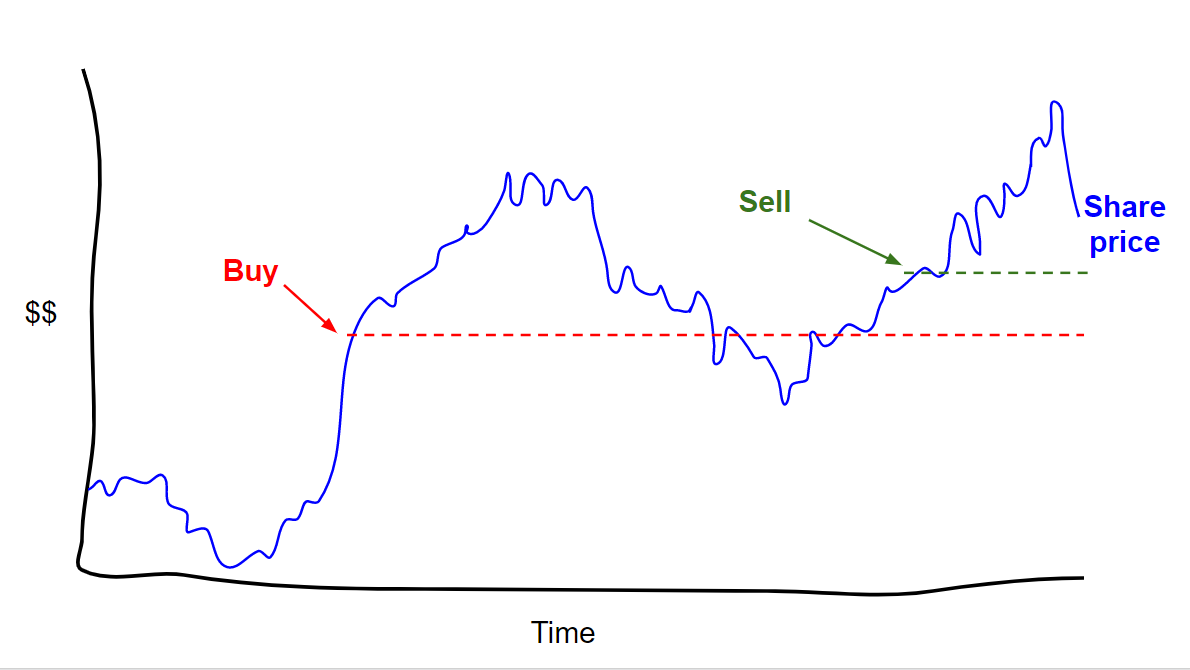

Here's a graph showing the share price of a company.

(I know what you're thinking... but I'm an accountant so drawing isn't a natural skill )

)

(I know what you're thinking... but I'm an accountant so drawing isn't a natural skill

)

)

** bUy lOw SeLL hIGh **

Everyone wants to buy low and sell high

Because that makes you the most money $$

Everyone wants to buy low and sell high

Because that makes you the most money $$

Getting the timing is hard because you never know when the share price has hit the top or bottom.

You might hit it like this

You make a gain, but it's nowhere near as much as before

You might hit it like this

You make a gain, but it's nowhere near as much as before

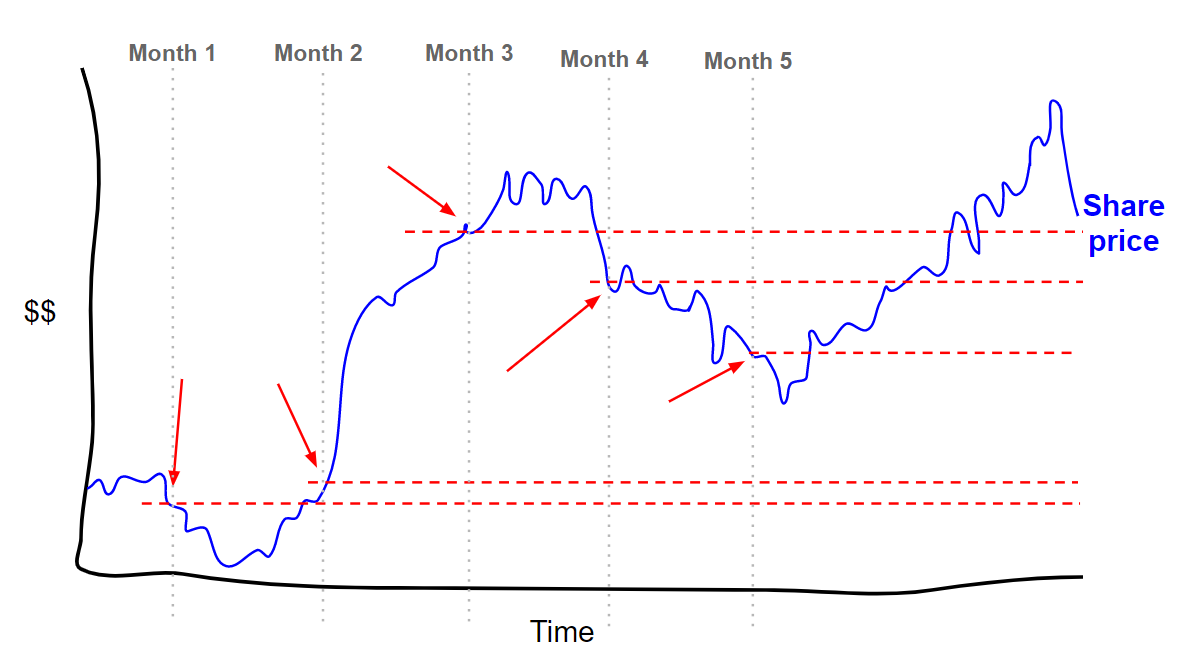

Dollar-cost averaging means buying smaller amounts at more regular intervals.

So, if you had $500 to invest then you might invest $100 every month for 5 months (example).

Here's what that would look like (red arrows = price you invested $100)

So, if you had $500 to invest then you might invest $100 every month for 5 months (example).

Here's what that would look like (red arrows = price you invested $100)

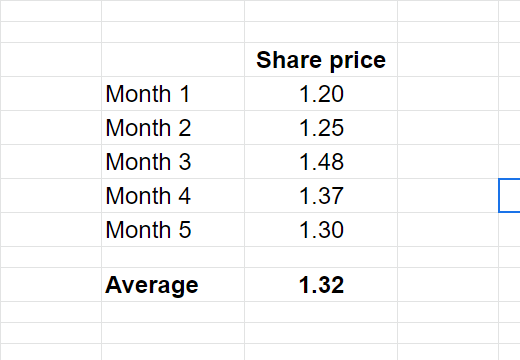

It helps to add some numbers

Now see. If you'd invested $500 in full in month 3, you'd have paid $1.48 per share

But you're smart. You dollar cost averaged.

That means the average price you paid was $1.32

Now see. If you'd invested $500 in full in month 3, you'd have paid $1.48 per share

But you're smart. You dollar cost averaged.

That means the average price you paid was $1.32

BuT BrO I cOuLd hAve BoUghT aT $1.20

Sure, but when the price was $1.20 you didn't know if that was a spike or a dip.

You could have easily gone all in at $1.48

Dollar-cost averaging reduces the risk of you going all in at a high price, not make you a fortune teller!

Sure, but when the price was $1.20 you didn't know if that was a spike or a dip.

You could have easily gone all in at $1.48

Dollar-cost averaging reduces the risk of you going all in at a high price, not make you a fortune teller!

Why now?

Free trading platforms have made it possible for the everyday investor to dollar cost average because it costs the same whether you do 1 trade or 5 trades -> £0!

*mandatory insert referral link here*

Free trading platforms have made it possible for the everyday investor to dollar cost average because it costs the same whether you do 1 trade or 5 trades -> £0!

*mandatory insert referral link here*

And yes, it's still relevant when you're investing for the long term.

You could put your life savings in $TSLA* and it could go pop next week.

Or you could dollar-cost average it and reduce the risk

*dont do this

You could put your life savings in $TSLA* and it could go pop next week.

Or you could dollar-cost average it and reduce the risk

*dont do this

It's why monthly investing is such a great idea. Smooth out the volatility.

Thank u for listening.

Thank u for listening.

For everyone* asking in my DMs, here's my referral link for trading212:

http://www.trading212.com/invite/FMOAt3oW

*no one

http://www.trading212.com/invite/FMOAt3oW

*no one

Read on Twitter

Read on Twitter