"Bitcoin Dominance" is a questionable metric for several reasons, mainly that there's a lot of noise and false equivocation bundled up in it. Any metric that combines stablecoins, appcoins, exchange tokens, and premine coins together and compares them to bitcoin is just trolling.

Earlier this year I came across https://bitcoindominance.com/ which I think is an improvement on the Bitcoin Dominance metric, but the exclusion of Proof of Stake coins is imo somewhat arbitrary.

Setting aside the substantial differences with premine coins (governance, trust minimization, fair launch, etc), bitcoin is best compared to all other permissionless Layer 1 native coins, since they are the first-class assets used to sustain their respective origin networks.

Some might not agree that PoS coins have what it takes to be the global standard for electronic money, but many people do and in any case PoS coins are used as the first-class money of their respective chains. Therefore I think they are worth tracking alongside PoW coins.

Some market observers have also started segregating cryptocurrencies into different categories, like "payments", "app platform", "storage", etc. I think this is the wrong way to think of these assets.

All Layer 1 cryptocurrencies are competing in one category: money. The stated utility of their chain is irrelevant. At the end of the day, these tokens are used as the native, first-class medium of exchange, store of value, and unit of account i.e. "money" of a given network.

Bitcoin's ability to be used as the native, first-class asset in sidechains supports this view. For example, just as ether is used to pay for smart contract execution on Ethereum, bitcoin is used to pay for smart contract execution on @RSKsmart. Both are competing as money.

Looking at what's available, I've been dissatisfied with the tools for comparing BTC's market share to other cryptocurrencies. So I made my own spreadsheet that removes the stablecoins and other app-layer tokens and only compares permissionless Layer 1 coins.

I'm tracking two new metrics:

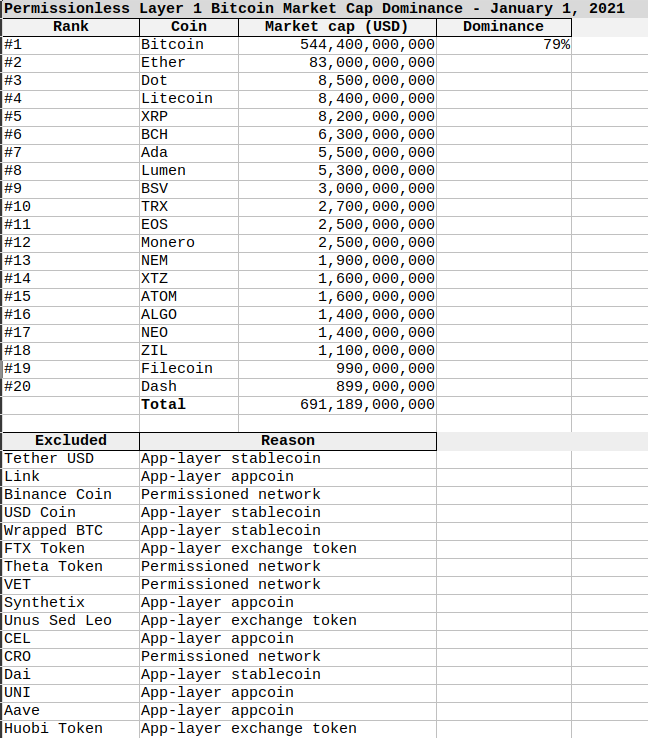

Permissionless Layer 1 Bitcoin Market Cap Dominance, sourced from http://onchainfx.com

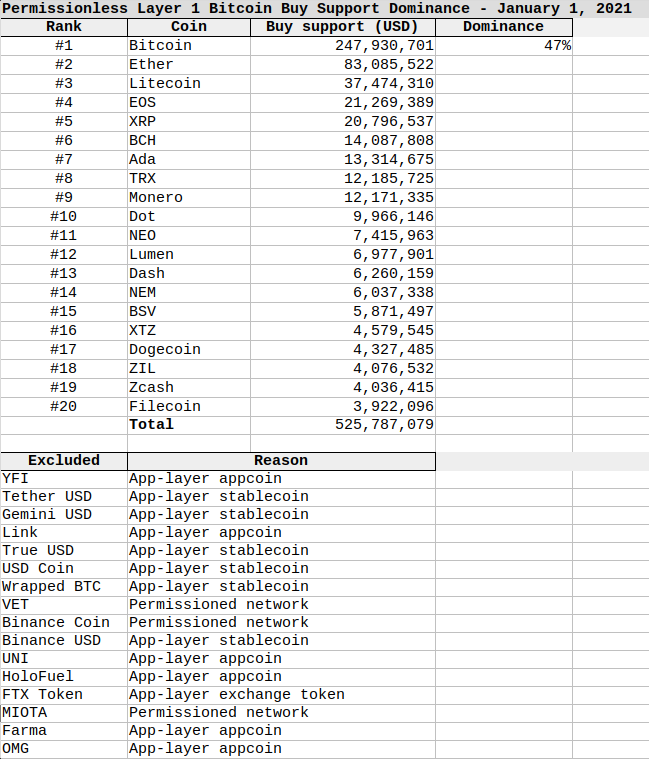

Permissionless Layer 1 Bitcoin Buy Support Dominance, sourced from http://coinmarketbook.cc

For now, I am only including the Top 20 coins in each metric.

Permissionless Layer 1 Bitcoin Market Cap Dominance, sourced from http://onchainfx.com

Permissionless Layer 1 Bitcoin Buy Support Dominance, sourced from http://coinmarketbook.cc

For now, I am only including the Top 20 coins in each metric.

Some definitions:

Market cap = circulating supply * current unit price

Buy support = USD cost of crashing the asset price by 10% across all watched order books

Bitcoin Dominance = Bitcoin stat / sum of Top 20 stats

Market cap = circulating supply * current unit price

Buy support = USD cost of crashing the asset price by 10% across all watched order books

Bitcoin Dominance = Bitcoin stat / sum of Top 20 stats

Here are the numbers for today, January 1, 2021.

Permissionless Layer 1 Bitcoin Market Cap Dominance: 79%

Permissionless Layer 1 Bitcoin Buy Support Dominance: 47%

Permissionless Layer 1 Bitcoin Market Cap Dominance: 79%

Permissionless Layer 1 Bitcoin Buy Support Dominance: 47%

If you think this is interesting,  this thread. If there's enough interest, I'll keep doing this and maybe eventually build a tool to automate it.

this thread. If there's enough interest, I'll keep doing this and maybe eventually build a tool to automate it.

And of course, feedback and constructive debate welcome!

this thread. If there's enough interest, I'll keep doing this and maybe eventually build a tool to automate it.

this thread. If there's enough interest, I'll keep doing this and maybe eventually build a tool to automate it.And of course, feedback and constructive debate welcome!

HT @onchainfx @CMBHQ and @CoinCap_io who I think was the first to track the "bitcoin dominance" metric

Read on Twitter

Read on Twitter