1/ THREAD

A somewhat off-the-cuff lookback megathread at #Bitcoin ’s year in 2020 and what we got right and what we got wrong (that no one asked for but here we go)

’s year in 2020 and what we got right and what we got wrong (that no one asked for but here we go)

A somewhat off-the-cuff lookback megathread at #Bitcoin

’s year in 2020 and what we got right and what we got wrong (that no one asked for but here we go)

’s year in 2020 and what we got right and what we got wrong (that no one asked for but here we go)

2/ Right -BTC Adoption

#bitcoin was still a RISK-ON asset trying to shake off the stench of a bear market prior to March 2020. Then #blackthursday.

was still a RISK-ON asset trying to shake off the stench of a bear market prior to March 2020. Then #blackthursday.

#BTC crashed in lockstep with all other assets & #FUDsters came out en masse to point out that “it wasn't a hedge/uncorrelated"

crashed in lockstep with all other assets & #FUDsters came out en masse to point out that “it wasn't a hedge/uncorrelated"

#bitcoin

was still a RISK-ON asset trying to shake off the stench of a bear market prior to March 2020. Then #blackthursday.

was still a RISK-ON asset trying to shake off the stench of a bear market prior to March 2020. Then #blackthursday.#BTC

crashed in lockstep with all other assets & #FUDsters came out en masse to point out that “it wasn't a hedge/uncorrelated"

crashed in lockstep with all other assets & #FUDsters came out en masse to point out that “it wasn't a hedge/uncorrelated"

3/ However, #bitcoin  quickly recovered and showed tremendous resilience (and upside) as #QE ramped up and the “money printer go #brrr meme proliferated. But then...

quickly recovered and showed tremendous resilience (and upside) as #QE ramped up and the “money printer go #brrr meme proliferated. But then...

quickly recovered and showed tremendous resilience (and upside) as #QE ramped up and the “money printer go #brrr meme proliferated. But then...

quickly recovered and showed tremendous resilience (and upside) as #QE ramped up and the “money printer go #brrr meme proliferated. But then...

4/ Fast-forward to summer and all of the sudden, #bitcoin  became the hottest de facto RISK-OFF asset and defensive hedge against the nation’s #QEInfinity policy. And literally, NOTHING had changed to #bitcoin

became the hottest de facto RISK-OFF asset and defensive hedge against the nation’s #QEInfinity policy. And literally, NOTHING had changed to #bitcoin  ’s properties since March. @tomshaunessy

’s properties since March. @tomshaunessy

became the hottest de facto RISK-OFF asset and defensive hedge against the nation’s #QEInfinity policy. And literally, NOTHING had changed to #bitcoin

became the hottest de facto RISK-OFF asset and defensive hedge against the nation’s #QEInfinity policy. And literally, NOTHING had changed to #bitcoin  ’s properties since March. @tomshaunessy

’s properties since March. @tomshaunessy

5/ The world AROUND bitcoin had changed. Sentiment had changed. Perception had changed. Hundred-year-old norms began deteriorating. And yet, beautifully, #bitcoin  had not. @nlw @RyanWatkins_

had not. @nlw @RyanWatkins_

had not. @nlw @RyanWatkins_

had not. @nlw @RyanWatkins_

6/ What DID happen in those several months was exactly what was supposed to happen. The already well-known and publicly anticipated #halving event dropped BTC’s #inflation rate to below 2%. @ck_SNARKs

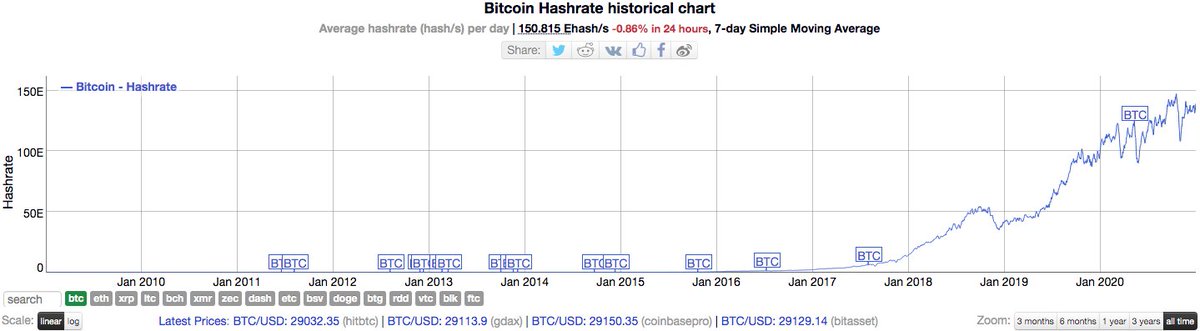

7/ Again, this was AWAYS going to happen. #BTC  simply just kept on ticking, uninterrupted, and without change. A continually-audited, predictable, time-stamping machine. Open for all, controlled by no one. @rocustus @Breedlove22

simply just kept on ticking, uninterrupted, and without change. A continually-audited, predictable, time-stamping machine. Open for all, controlled by no one. @rocustus @Breedlove22

simply just kept on ticking, uninterrupted, and without change. A continually-audited, predictable, time-stamping machine. Open for all, controlled by no one. @rocustus @Breedlove22

simply just kept on ticking, uninterrupted, and without change. A continually-audited, predictable, time-stamping machine. Open for all, controlled by no one. @rocustus @Breedlove22

8/ And this realization is precisely why #institutions began to see the value in #btc  . Infamous for its “volatility” (in USD), people have begun to see the flipside of the coin. The #fiat world and monetary system are incredibly volatile and worse, unpredictable. @giammizucco

. Infamous for its “volatility” (in USD), people have begun to see the flipside of the coin. The #fiat world and monetary system are incredibly volatile and worse, unpredictable. @giammizucco

. Infamous for its “volatility” (in USD), people have begun to see the flipside of the coin. The #fiat world and monetary system are incredibly volatile and worse, unpredictable. @giammizucco

. Infamous for its “volatility” (in USD), people have begun to see the flipside of the coin. The #fiat world and monetary system are incredibly volatile and worse, unpredictable. @giammizucco

9/ #BTC  is the most dependable, predictable, credibly neutral, independent, incorruptible, immutable, value settlement layer the world has today.

is the most dependable, predictable, credibly neutral, independent, incorruptible, immutable, value settlement layer the world has today.

#BTC price fluctuations are merely the reflection of exogenous forces acting on a fixed measuring device. @parkerlewis @APompliano

price fluctuations are merely the reflection of exogenous forces acting on a fixed measuring device. @parkerlewis @APompliano

is the most dependable, predictable, credibly neutral, independent, incorruptible, immutable, value settlement layer the world has today.

is the most dependable, predictable, credibly neutral, independent, incorruptible, immutable, value settlement layer the world has today. #BTC

price fluctuations are merely the reflection of exogenous forces acting on a fixed measuring device. @parkerlewis @APompliano

price fluctuations are merely the reflection of exogenous forces acting on a fixed measuring device. @parkerlewis @APompliano

10/ It is not #BTC  that is volatile but the rate at which the population groks bitcoin’s value which is volatile.

that is volatile but the rate at which the population groks bitcoin’s value which is volatile.

The forces that drive people to sound money (money printing, corruption, Cantillon effect) are variable as are people’s tolerance for such chicanery. @phil_geiger

that is volatile but the rate at which the population groks bitcoin’s value which is volatile.

that is volatile but the rate at which the population groks bitcoin’s value which is volatile. The forces that drive people to sound money (money printing, corruption, Cantillon effect) are variable as are people’s tolerance for such chicanery. @phil_geiger

11/ No one alive can even come close to telling you the amount of USD that will be in circulation in 1,2,5 years. How can a global economy communicate value, efficiently price markets, and engage in global commerce using a moving target?

@Melt_Dem

@Melt_Dem

12/ A parallel in history is to the time before we had global standards on units of length.

Coordination isn't so easy when there isn’t a standard, globally accepted value for your unit of measurement.

https://en.wikipedia.org/wiki/Foot_(unit)#Historical_origin

Coordination isn't so easy when there isn’t a standard, globally accepted value for your unit of measurement.

https://en.wikipedia.org/wiki/Foot_(unit)#Historical_origin

13/ OK, “preachy” session over, back to the list….

Right - BTC Development:

Another thing that #BTC got “right” in 2020 was development progress! @_JustinMoon_ @TheBlueMatt

got “right” in 2020 was development progress! @_JustinMoon_ @TheBlueMatt

Right - BTC Development:

Another thing that #BTC

got “right” in 2020 was development progress! @_JustinMoon_ @TheBlueMatt

got “right” in 2020 was development progress! @_JustinMoon_ @TheBlueMatt

14/ #Taproot (and #Schnorr sigs) implementation took major step forward w/ the code merge into #BitcoinCore Library.

This is huge bc 1) it signals that BTC’s evolution is not complete and 2) it is a boon for the #cypherpunk properties always envisaged in BTC

@AaronvanW

This is huge bc 1) it signals that BTC’s evolution is not complete and 2) it is a boon for the #cypherpunk properties always envisaged in BTC

@AaronvanW

15/ #Schnorr is bigger for #BTC  than any business or hedge fund headline by a mile.

than any business or hedge fund headline by a mile.

They’ll create plausible deniability and user protection just as the tsunami of financial regulation into #crypto has begun to form.

@pwuille @jchervinsky

than any business or hedge fund headline by a mile.

than any business or hedge fund headline by a mile. They’ll create plausible deniability and user protection just as the tsunami of financial regulation into #crypto has begun to form.

@pwuille @jchervinsky

16/ Additionally in the #btcdevelopment space was the increase in BTC dev fund opportunities like @matt_odell’s website, exchange sponsored BTC grants (thanks @petermccormack), @paradigm’s sponsorship, and initiatives like Brink (thanks @jfnewberry). https://bitcoindevlist.com/

17/ It has NEVER been easier to get paid to work on #bitcoin  . And that's pretty dang cool.

. And that's pretty dang cool.

@coinbase, @Gemini, @BitMEX (RIP), and the @HRF all stepped up in 2020.

@gladstein https://www.forbes.com/sites/rorymurray/2020/06/12/bitcoin-development-fund-for-human-rights-shows-crypto-is-for-the-people/?sh=3d8f9ab27f7c

. And that's pretty dang cool.

. And that's pretty dang cool.@coinbase, @Gemini, @BitMEX (RIP), and the @HRF all stepped up in 2020.

@gladstein https://www.forbes.com/sites/rorymurray/2020/06/12/bitcoin-development-fund-for-human-rights-shows-crypto-is-for-the-people/?sh=3d8f9ab27f7c

18/ It's also never been easier to get PAID in #bitcoin  .

.

Right - #BTC payments

payments

Thanks to @jack_mallers and @strike. The recent @russellokung news will be the “Michael Saylor” moment for athletes and celebs. Huge for normalizing #BTC as accepted money.

as accepted money.

@mdudas

.

.Right - #BTC

payments

paymentsThanks to @jack_mallers and @strike. The recent @russellokung news will be the “Michael Saylor” moment for athletes and celebs. Huge for normalizing #BTC

as accepted money.

as accepted money.@mdudas

19/ Also, #Lightning, while still extremely niche (and vulnerable), took big steps.

#Pool incentivizes usage and creates yield use case, #Wumbo channels brings in big users, & Kraken issues a statement that it will adopt Lightning in 2021. @cryptoconomy https://www.coindesk.com/kraken-exchange-integrate-bitcoin-lightning-2021

#Pool incentivizes usage and creates yield use case, #Wumbo channels brings in big users, & Kraken issues a statement that it will adopt Lightning in 2021. @cryptoconomy https://www.coindesk.com/kraken-exchange-integrate-bitcoin-lightning-2021

20/ Right - BTC Mining

China FUD has been a mainstay since #BTC origin but in 2020, big moves were made in understanding the advantages of onshoring #btcmining. Big names like @SBI and @PeterThiel turned their sights to #texas.

origin but in 2020, big moves were made in understanding the advantages of onshoring #btcmining. Big names like @SBI and @PeterThiel turned their sights to #texas.

@jpbaric

China FUD has been a mainstay since #BTC

origin but in 2020, big moves were made in understanding the advantages of onshoring #btcmining. Big names like @SBI and @PeterThiel turned their sights to #texas.

origin but in 2020, big moves were made in understanding the advantages of onshoring #btcmining. Big names like @SBI and @PeterThiel turned their sights to #texas. @jpbaric

21/ While the synergistic relationship of #oil production and bitcoin mining blossomed in the oil patches thanks to people like @martybent and thoughtful pieces on stranded #energy and bitcoin energy consumption from @nic_carter. https://www.coindesk.com/the-last-word-on-bitcoins-energy-consumption

22/ These developments, along with #StratumV2 in #mining pools will make btc mining more robust, efficient, and less centralized. Adding to #bitcoin  ’s security model and antifragility. @jp_baric @TheBIueMatt

’s security model and antifragility. @jp_baric @TheBIueMatt

’s security model and antifragility. @jp_baric @TheBIueMatt

’s security model and antifragility. @jp_baric @TheBIueMatt

24/ So, yeah, lots of good things came to BTC in 2020. It was built for times like this & the perseverance of the protocol & its community through 11 years of doubt and ridicule are paying off.

#Bitcoin will become center stage on a global scale in 2021. https://www.world-today-news.com/bitcoin-is-now-the-6th-largest-currency-in-the-world/

will become center stage on a global scale in 2021. https://www.world-today-news.com/bitcoin-is-now-the-6th-largest-currency-in-the-world/

#Bitcoin

will become center stage on a global scale in 2021. https://www.world-today-news.com/bitcoin-is-now-the-6th-largest-currency-in-the-world/

will become center stage on a global scale in 2021. https://www.world-today-news.com/bitcoin-is-now-the-6th-largest-currency-in-the-world/

25/ Bitcoin's rise brings in new challenges.

But first, we need to talk about the things it got #wrong in 2020. A new thread follows....

@valkenburgh

But first, we need to talk about the things it got #wrong in 2020. A new thread follows....

@valkenburgh

Read on Twitter

Read on Twitter