1/ Financial Dependence

When debt payments + other living expenses > your own income

You need someone else (parent or a bank loan) to cover the difference

When debt payments + other living expenses > your own income

You need someone else (parent or a bank loan) to cover the difference

2/ Financial Solvency

Debt payments + other living expenses = your own income

You are current on all your debt payments and you can meet your financial commitments and other living expenses without any outside help.

Debt payments + other living expenses = your own income

You are current on all your debt payments and you can meet your financial commitments and other living expenses without any outside help.

3/ Financial Stability

After being financially solvent, you have saved enough to create an emergency fund

But how much and what should you use it for?

After being financially solvent, you have saved enough to create an emergency fund

But how much and what should you use it for?

It should be enough to cover basic living expenses for 3-6 months

Could be used for unexpected expenses (medical bill, car repair, moving costs) or a job loss

Could be used for unexpected expenses (medical bill, car repair, moving costs) or a job loss

4/ Debt Freedom

The level of debt freedom differs among people

Some believe it's when you no debt including mortage

The level of debt freedom differs among people

Some believe it's when you no debt including mortage

Some others believe it's when you have repaid all your high-interest debt (credit cards, car payments, student loans)

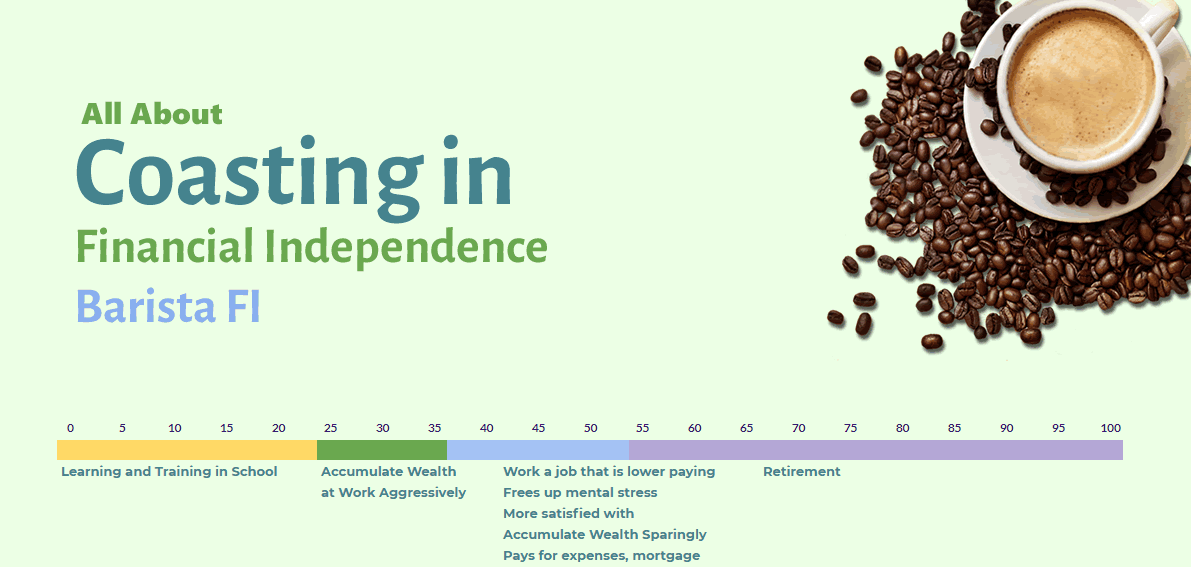

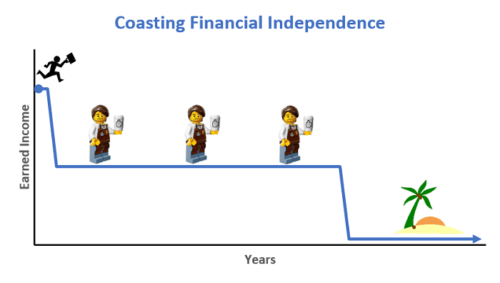

5/ Coasting FI

Also known as Barista Financial Independence

Able to, if you wanted, leave from a job into a new one, that may be lower-paying but more enjoyable or less stressful

Also known as Barista Financial Independence

Able to, if you wanted, leave from a job into a new one, that may be lower-paying but more enjoyable or less stressful

This is due to significant savings in the early years of your career or just the most recent years of it, which would be able to provide for the later years of your retirement after it has compounded if you don’t add any more money in.

All you need is to make enough money to get to your specified retirement age when you will be withdrawing the money from your investments.

This is usually achieved through hard work and frugal spending in your early career stage so that you coast your way into retirement.

This is usually achieved through hard work and frugal spending in your early career stage so that you coast your way into retirement.

6/ Financial Security

Investment Cash Flow > Basic Living Expenses

Basic Living expenses include accommodation, bills, food, transportation, insurance

Does NOT include eating out, vacations, gifts or entertainment

Investment Cash Flow > Basic Living Expenses

Basic Living expenses include accommodation, bills, food, transportation, insurance

Does NOT include eating out, vacations, gifts or entertainment

Gives security in case of job loss to retain a frugal lifestyle without having to worry about getting a new job or touching your emergency fund

7/ Financial Flexibility

Ability to live off investment cash flow, while having a flexible spending budget based on yearly market fluctuations and returns

Ability to live off investment cash flow, while having a flexible spending budget based on yearly market fluctuations and returns

8/ Financial Independence

It's based on the 4% rule, i.e. withdrawing 4% of your funds each year

Your investments and savings have accumulated to 25x your annual expenses

Historically, this will be enough to allow you to maintain your current lifestyle in retirement

It's based on the 4% rule, i.e. withdrawing 4% of your funds each year

Your investments and savings have accumulated to 25x your annual expenses

Historically, this will be enough to allow you to maintain your current lifestyle in retirement

9/ Financial Freedom

Your investment cash flow supports your current lifestyle and allows you to spend extra funds for bucket-list items (dream car, long vacations, moving overseas to live in another country)

Your investment cash flow supports your current lifestyle and allows you to spend extra funds for bucket-list items (dream car, long vacations, moving overseas to live in another country)

10/ Financial Abundance

Investment cash flow far exceeds your needs plus bucket list items, approximately 3x your financial freedom amount

You have the security of maintaining that lifestyle even during a bad year, or a bear market

/END/

Investment cash flow far exceeds your needs plus bucket list items, approximately 3x your financial freedom amount

You have the security of maintaining that lifestyle even during a bad year, or a bear market

/END/

If you liked this thread, give a like and a retweet

For more educational threads on financial independence and investing for beginners see below for a collection of threads

https://twitter.com/itsKostasWithK/status/1345790210441928708?s=20

https://twitter.com/itsKostasWithK/status/1345790210441928708?s=20

For more educational threads on financial independence and investing for beginners see below for a collection of threads

https://twitter.com/itsKostasWithK/status/1345790210441928708?s=20

https://twitter.com/itsKostasWithK/status/1345790210441928708?s=20

Read on Twitter

Read on Twitter