1/8 A quick thread on  ecommerce, particularly as it relates to BASE (4477) & more so recent IPO, itsumo (7694, @itsumofan)

ecommerce, particularly as it relates to BASE (4477) & more so recent IPO, itsumo (7694, @itsumofan)

While generally bullish on BASE, I have hesitations around the ultimate depth / size, overall applicability & speed of penetration of their model in

ecommerce, particularly as it relates to BASE (4477) & more so recent IPO, itsumo (7694, @itsumofan)

ecommerce, particularly as it relates to BASE (4477) & more so recent IPO, itsumo (7694, @itsumofan) While generally bullish on BASE, I have hesitations around the ultimate depth / size, overall applicability & speed of penetration of their model in

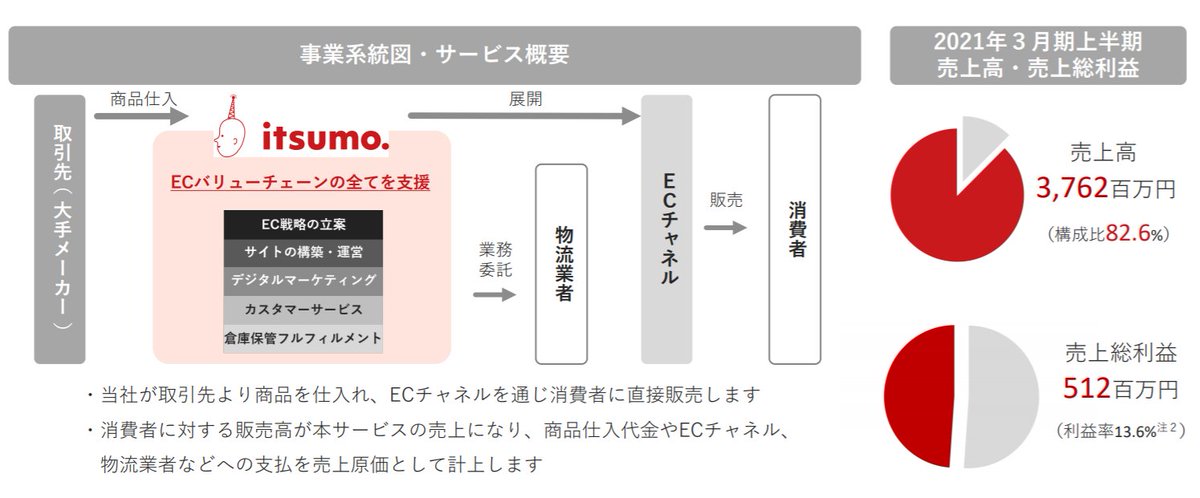

2/8 itsumo, on the other hand, is executing a "seller support" ecomm model that I'd argue is more (vs. BASE):

- Culturally, demographically & economically relevant in

- Focused on actual SMBs (vs. "micro-businesses")

- Durable, entrenched & value additive

- Culturally, demographically & economically relevant in

- Focused on actual SMBs (vs. "micro-businesses")

- Durable, entrenched & value additive

3/8 itsumo partners w/ SMBs across sectors - retail, pet, baby, cosmetics, food, etc - & supports these bizes across the entire D2C ecomm value-chain:

SMBs across sectors - retail, pet, baby, cosmetics, food, etc - & supports these bizes across the entire D2C ecomm value-chain:

- Planning + strategy

- build + manage EC presence (on $AMZN, Rakuten, etc)

- Digital mkting

- Customer service

- Fulfillment

SMBs across sectors - retail, pet, baby, cosmetics, food, etc - & supports these bizes across the entire D2C ecomm value-chain:

SMBs across sectors - retail, pet, baby, cosmetics, food, etc - & supports these bizes across the entire D2C ecomm value-chain:- Planning + strategy

- build + manage EC presence (on $AMZN, Rakuten, etc)

- Digital mkting

- Customer service

- Fulfillment

4/8 In the course of executing, itsumo builds very close personal & economic relationships w/their customers, buttressed by detailed know-how of their respective bizes. While they offer simple ecomm mkting support, their comprehensive "ecomm management" offering is the focus

5/8 Importantly, itsumo buys product from its customers & subsequently sells to consumers themselves

Some may scoff at this approach, tho I'd argue the LT implications & the potential "second order" strategies emanating from it (e.x. in-house logistics) are extremely powerful..

Some may scoff at this approach, tho I'd argue the LT implications & the potential "second order" strategies emanating from it (e.x. in-house logistics) are extremely powerful..

6/8 itsumo's existing & future biz model optionality shows hints of the compelling $3.9B valued @gopuff:

"...the startup’s “vertically integrated model,” where it buys products directly from manufacturers" & makes $ off the products they themselves sell https://techcrunch.com/2020/10/08/gopuff-funding/

"...the startup’s “vertically integrated model,” where it buys products directly from manufacturers" & makes $ off the products they themselves sell https://techcrunch.com/2020/10/08/gopuff-funding/

7/8 Some may say a big threat is that customers will go "in-house" w/time. While possible, do realize the extent of the SMB succession crisis & overall labor shortage in  . Won't be easy to recruit a quality internal replacement as a small SMB in Okayama https://twitter.com/willschoebs/status/1334137979653197824

. Won't be easy to recruit a quality internal replacement as a small SMB in Okayama https://twitter.com/willschoebs/status/1334137979653197824

. Won't be easy to recruit a quality internal replacement as a small SMB in Okayama https://twitter.com/willschoebs/status/1334137979653197824

. Won't be easy to recruit a quality internal replacement as a small SMB in Okayama https://twitter.com/willschoebs/status/1334137979653197824

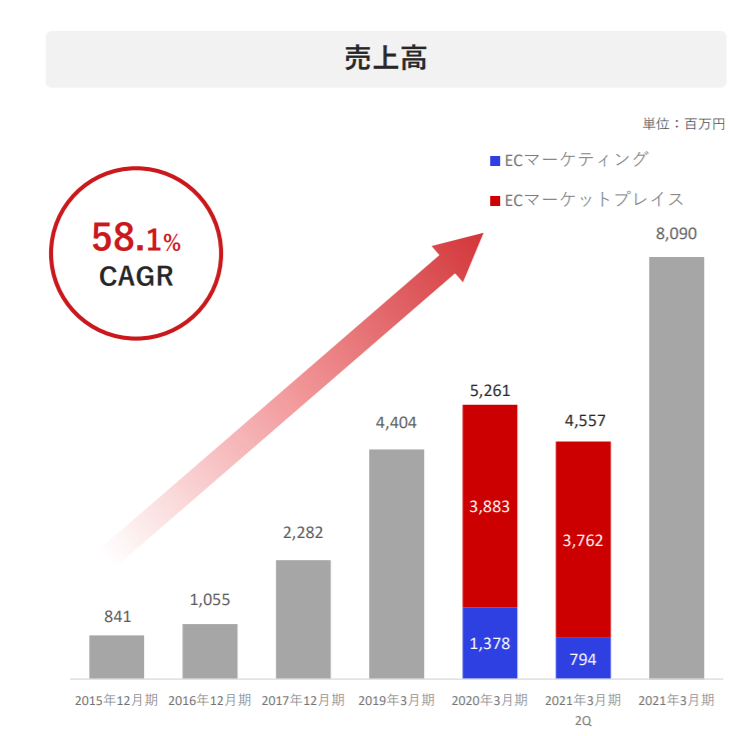

8/8 Their mkt oppty is enormous w/significant "embedded optionality" + compounding advtgs via an improving rep, further scale & accumulating execution know-how + a valuable data asset. Still so early in their journey, w/sales of just ~$77M & $265M MC

A JBI post likely needed!

A JBI post likely needed!

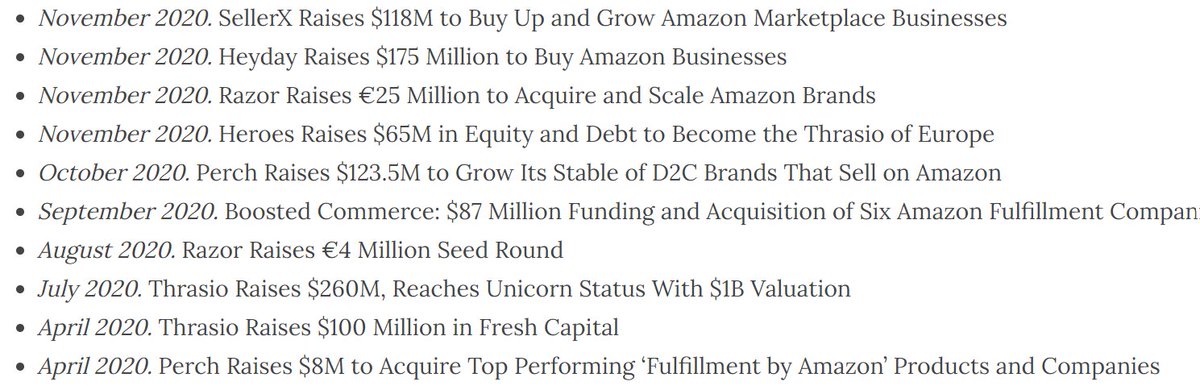

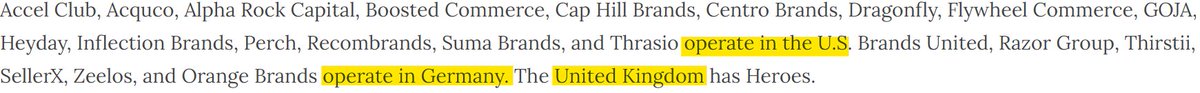

While a slightly different business model, its still interesting to compare @itsumofan against the nearly $1B of capital deployed in '20 into the growing # of serial acquirers of Amazon sellers & brands:

15 in

6 in

1 in

15 in

6 in

1 in

A recent post by @AliBHamed dives into this compelling opportunity at greater length https://crossstack.substack.com/p/the-amazon-third-party-seller-ecosystem

Been spending time exploring & comparing the career sites of the more innovative  tech companies...exciting bump in quality + clear dedication of time, resources & focus

tech companies...exciting bump in quality + clear dedication of time, resources & focus

Talent is tough to grab in , w/gov't jobs most sought after

, w/gov't jobs most sought after

A shallow comparison, but itsumo vs. NTT

itsumo vs. NTT

tech companies...exciting bump in quality + clear dedication of time, resources & focus

tech companies...exciting bump in quality + clear dedication of time, resources & focusTalent is tough to grab in

, w/gov't jobs most sought after

, w/gov't jobs most sought afterA shallow comparison, but

itsumo vs. NTT

itsumo vs. NTT

May seem like table stakes elsewhere, but bizes like @itsumofan are leading the charge in  in providing far more dynamic work & learning environments. Be it the benefits, emphasis on personal growth, engagement by senior execs or the monthly "drinking parties"

in providing far more dynamic work & learning environments. Be it the benefits, emphasis on personal growth, engagement by senior execs or the monthly "drinking parties"

in providing far more dynamic work & learning environments. Be it the benefits, emphasis on personal growth, engagement by senior execs or the monthly "drinking parties"

in providing far more dynamic work & learning environments. Be it the benefits, emphasis on personal growth, engagement by senior execs or the monthly "drinking parties"

Read on Twitter

Read on Twitter