1/ Thoughts on this @Forbes $FUBO article -

The author makes some interesting points but appears to lack an understanding of the media industry, MVPD (not mVPD!) competitive landscape, pricing, and how programming costs and sports rights actually work. https://www.forbes.com/sites/bethkindig/2021/12/31/fubotv-solid-positioning-for-sports-betting/?sh=df572459cb53

The author makes some interesting points but appears to lack an understanding of the media industry, MVPD (not mVPD!) competitive landscape, pricing, and how programming costs and sports rights actually work. https://www.forbes.com/sites/bethkindig/2021/12/31/fubotv-solid-positioning-for-sports-betting/?sh=df572459cb53

2/ First on the app data... The author tries to discredit the app download data in the @kerrisdalecap report because it lacks a source. We have enterprise access to Sensor Tower and the download trends confirm the trend.

3/The author cites "category ranking" trends from the free version of Sensor Tower, but it is impossible to arrive at any meaningful conclusions from this time series.

4/ The top two providers of app download data are 1) App Annie (AA) and 2) Sensor Tower (ST). By comparison, Apptopia has limited time-series and low-quality of estimates. There is a reason why Apptopia comes free with a Bloomberg Terminal.

5/ We would note that $FUBO spent ~$18M ($72M annualized) in subscriber acquisition in Q3 (nearly 3x the amount spent in Q1 and Q2) to support growth. We don't believe this level of spend is sustainable, or scalable in a period where sports didn't return all at once.

6/ "...more interested with how Fubo has been able to compete with the largest mVPDs on price – Comcast, Charter, Hulu+ and YouTube"

First, $FUBO is the same price as Hulu w/Live TV and YouTube.

Second, continued below...

First, $FUBO is the same price as Hulu w/Live TV and YouTube.

Second, continued below...

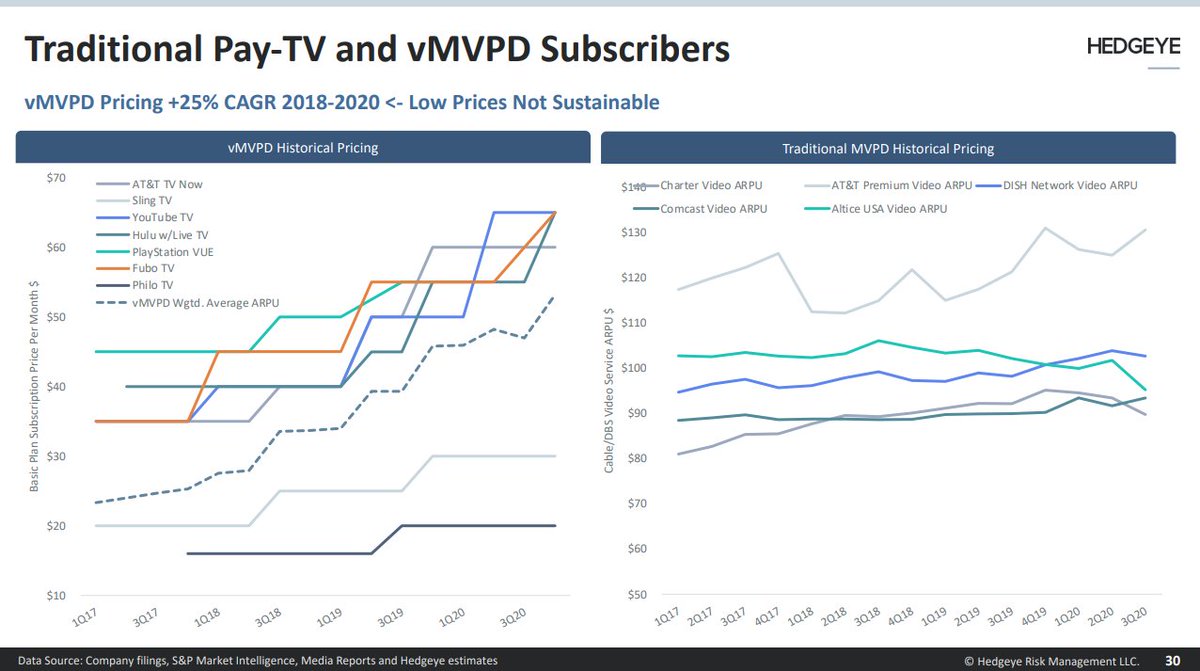

7/ $FUBO and vMVPDS don't have a structural cost advantage over MVPDS as they pay the same programming costs.

vMVPD low prices are not sustainable (lose money per sub), which is why the price will continue to go higher.

Programming costs routinely increase by 5-10% each year.

vMVPD low prices are not sustainable (lose money per sub), which is why the price will continue to go higher.

Programming costs routinely increase by 5-10% each year.

8/ MVPDs offer more sports and local programming.

$FUBO and other vMVPDS (ex-AT&T TV Now) don't have agreements to carry $SBGI RSNs. $FUBO also doesn't have complete local market coverage.

$FUBO could get this programming, but it would materially increase the price.

$FUBO and other vMVPDS (ex-AT&T TV Now) don't have agreements to carry $SBGI RSNs. $FUBO also doesn't have complete local market coverage.

$FUBO could get this programming, but it would materially increase the price.

9/ $FUBO sports focus limits their addressable market in subscribers - if the company had a significant advantage on both content and price, then why do they have the fewest number of subscribers?

10/ PhiloTV - a non-sports focused vMVPD has 50% more subscribers than $FUBO and is growing 300% YoY. https://www.cordcuttersnews.com/philo-reaches-750000-subscribers-showing-300-growth-year-over-year/

11/ The author points to $FUBO high price compared to $NFLX as evidence of the value of sports. However, $FUBO is a 0.5M subscription service with 10% monthly churn rates. $NFLX has 65M subscribers and monthly churn rates 2-3%!

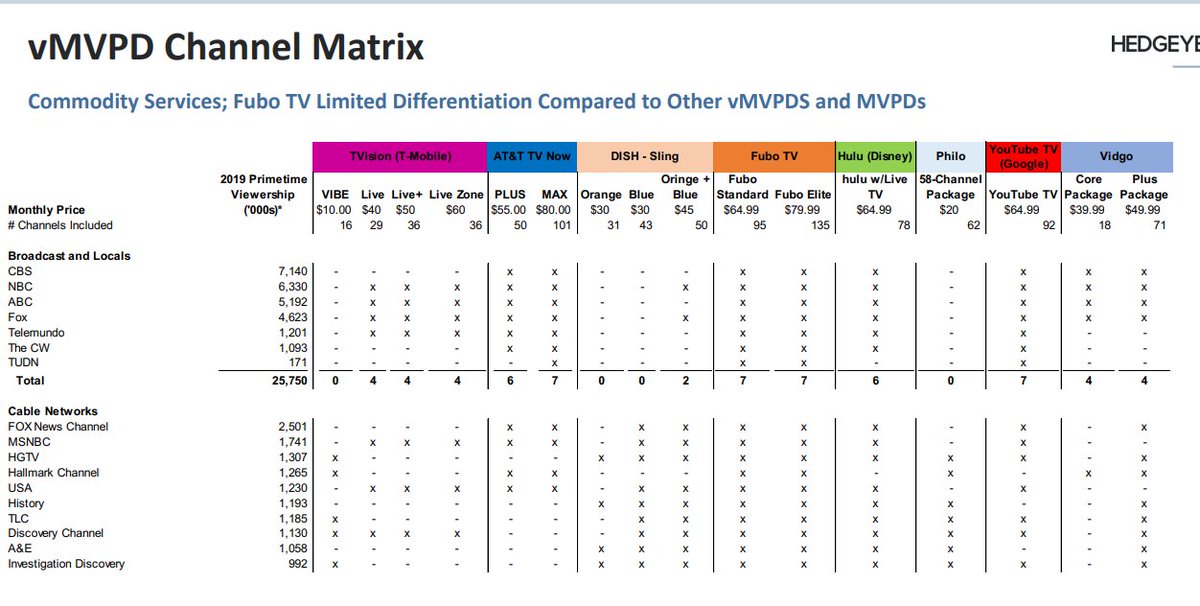

12/ What is $FUBO competitive advantage?

Programming comparison across broadcast, locals, cable & RSNs shows little differentiation among services.

$FUBO doesn't even have WarnerMedia channels, which have more viewership than the handful of "exclusive" channels Fubo does have.

Programming comparison across broadcast, locals, cable & RSNs shows little differentiation among services.

$FUBO doesn't even have WarnerMedia channels, which have more viewership than the handful of "exclusive" channels Fubo does have.

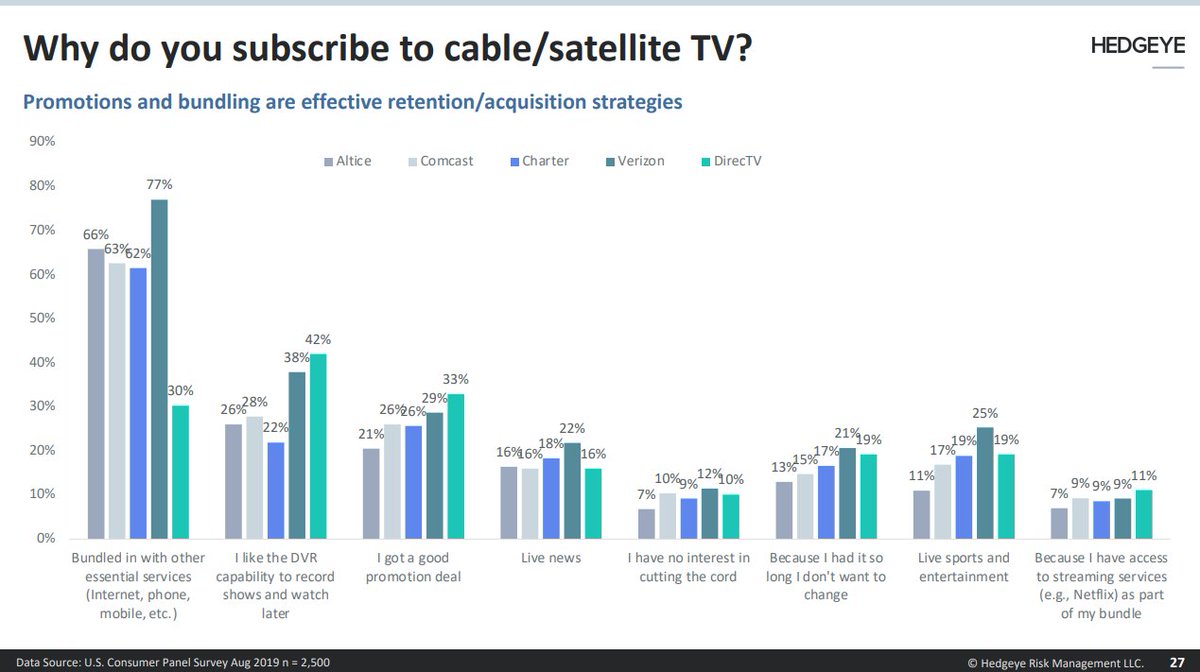

13/ Unbundling is often a more expensive proposition than keeping the bundle - especially if you want to include live sports and news programming.

Is the future of TV really linear/live TV, but streaming?

Is the future of TV really linear/live TV, but streaming?

14/ Media companies spend billions of dollars on sports rights – and overtime will use rights as an acquisition driver to support their owned streaming services (e.g., Premier League on Peacock, NFL on Amazon, etc.) - driving engagement away from $FUBO. https://variety.com/2020/tv/news/nfl-first-streaming-only-game-amazon-tv-ratings-1234875754/

15/ Author ignores the "unusual" timing of content expense that boosted the contribution margin referenced by ~600bps in Q3. Also ignores that as of 9/30 - $FUBO was NOT in compliance with their content contracts and had $85M due to related parties for affiliate fees.

16/ Sports betting is a call option and should be valued as such. The entire bull case and future value of the company are based on a product that doesn't even exist, with a company that has no clear competitive advantage or track record of execution in gaming.

17/ $FUBO acquired Balto Sports, a start-up with only 3 employees listed on LinkedIn.

While I am sure they will be able to get a free-to-play game in the market next year, it will be very expensive to scale and drive brand awareness.

While I am sure they will be able to get a free-to-play game in the market next year, it will be very expensive to scale and drive brand awareness.

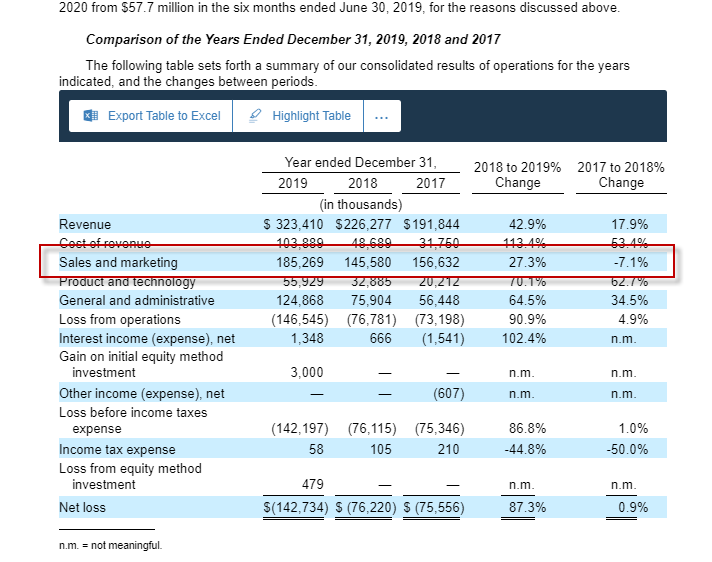

18/ $DNKG (See below) has spent $486M in S&M between 2017-2019 to build their brand and drive growth and is forecasted to spend $417M in 2020 alone.

$FUBO has spent $33M in selling and marketing YTD.

$FUBO has spent $33M in selling and marketing YTD.

19/ With no unique media content, exclusive sports rights, gaming licenses, or casino partnership (like $PENN and Barstool Sports), what is going to drive folks to $FUBO free-to-play and eventual sports wagering service? How will it be differentiated?

20 / We already know that $FUBO tried and seemed to have failed in their "exclusive" partnership with FanDuel in 2019 to integrate betting data into the platform.

https://newsroom.fanduel.com/2019/05/23/fanduel-group-and-fubotv-sign-extensive-partnership/

https://newsroom.fanduel.com/2019/05/23/fanduel-group-and-fubotv-sign-extensive-partnership/

21/ At $60/share $FUBO had an EV of $9B... compared to $DNKG of $20B and $14B for $PENN - #FinTwit bulls speculating on $100/share means that $FUBO is worth almost the same as $DNKG today.

22/ Lastly the author points to the credibility of wall street analysts to support their bull-case.

However, the author fails to disclose that each of the firms the analysts listed was also involved in taking $FUBO public and having banking interests to protect.

However, the author fails to disclose that each of the firms the analysts listed was also involved in taking $FUBO public and having banking interests to protect.

23/ The bio of the author says "technology analyst" - however, only cable and telecom analysts would have a true understanding of $FUBO business model. After all, it is most comparable to other pay-tv operators such as $CMCSA $DISH $CHTR.

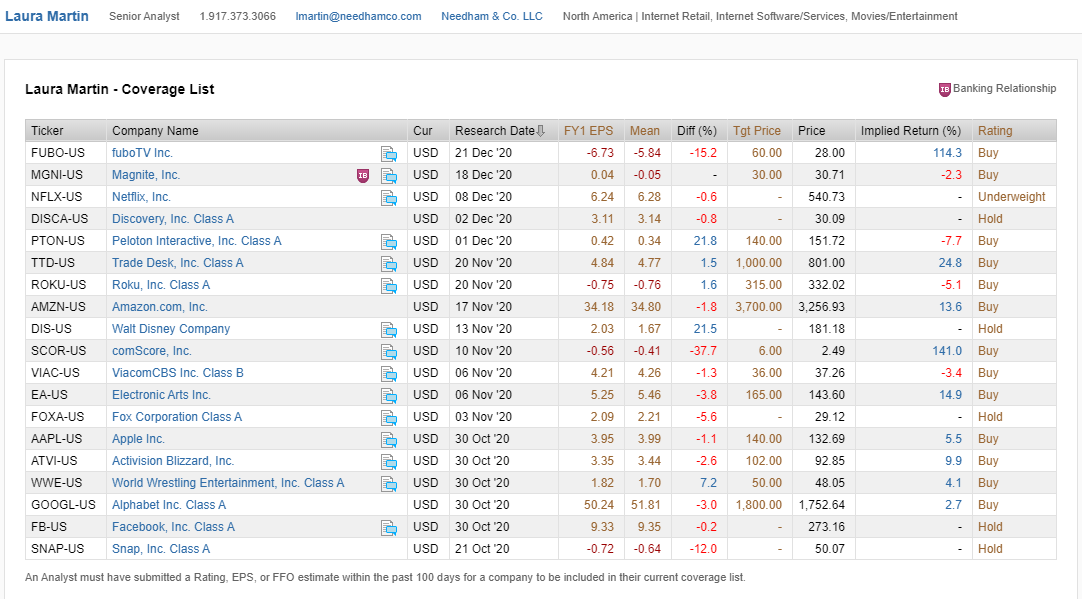

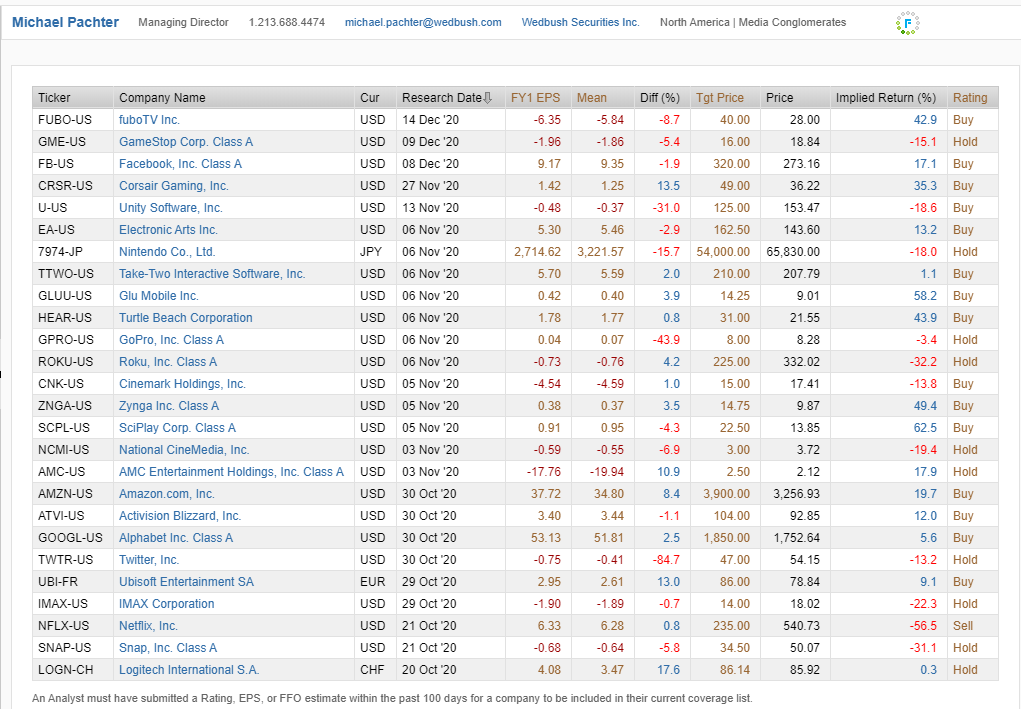

24/ We would add that all sell-side analysts covering $FUBO do not list cable or telecom as part of their coverage.

Read on Twitter

Read on Twitter