Remember, the big key here is that the debt quality is good when the loan was issued. When incomes come back for those that actually needed to take Forbearance, mostly like all stay in their homes. Some people didn't need to take this program. Over time the data should get better https://twitter.com/stlouisfed/status/1345067651660447749

The housing bubble boys by their own creation were going to fail always in 2020. Once people understand that these are not economic people but grifters then their 30%-50% crash calls make sense. Forbearance Numbers were smaller than what the Shadow Inventory was in 2012.

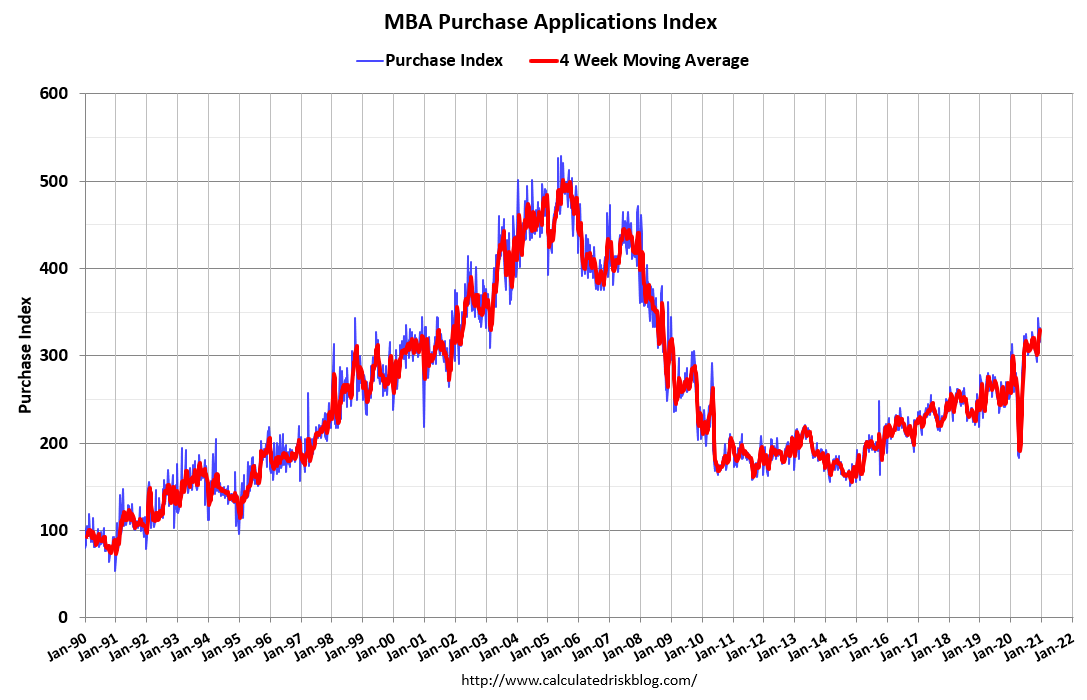

Demand is much better now than in 2012, and this group kept on pushing the home price crash story back then. If you get my drift, they don't know what they're talking about.

If any housing crash person doesn't talk about Demographics first and mortgage rates 2nd. Don't fall for the doomsday writing. Remember, these are not real economic people, most are anti central bank cranks who just like to cry every day.

A huge factor is that we just came from the weakest housing recovery cycle ever. You can't have a bubble boom if that is the case. https://loganmohtashami.com/2020/08/26/demographics-crushed-the-housing-bears-in-2020/

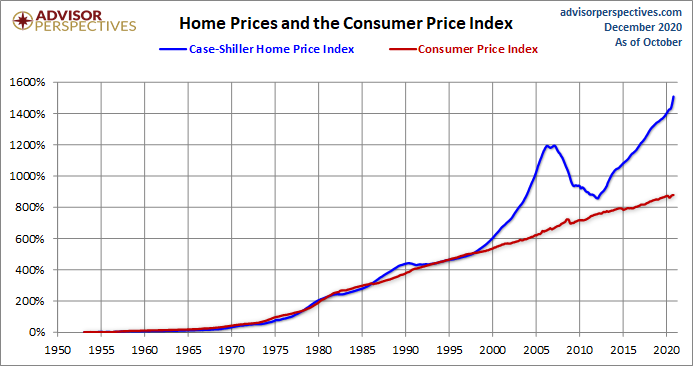

Remember, if you're saying housing bubble, this means you're calling for prices to go back to 1996 levels. No middle ground here. This has to happen with the best housing demographic patch ever recorded in history and the lowest mortgage rates recorded in history.

Create a model that can get you at least a 30%-50% crash in prices in a Calender year and then demand has to stay low for some time after. That is how you get your 1996 pricing back baby! My Forbearance Crash Bros good luck!

Read on Twitter

Read on Twitter