Open Thoughts On OPENDOOR

Open Thoughts On OPENDOOR

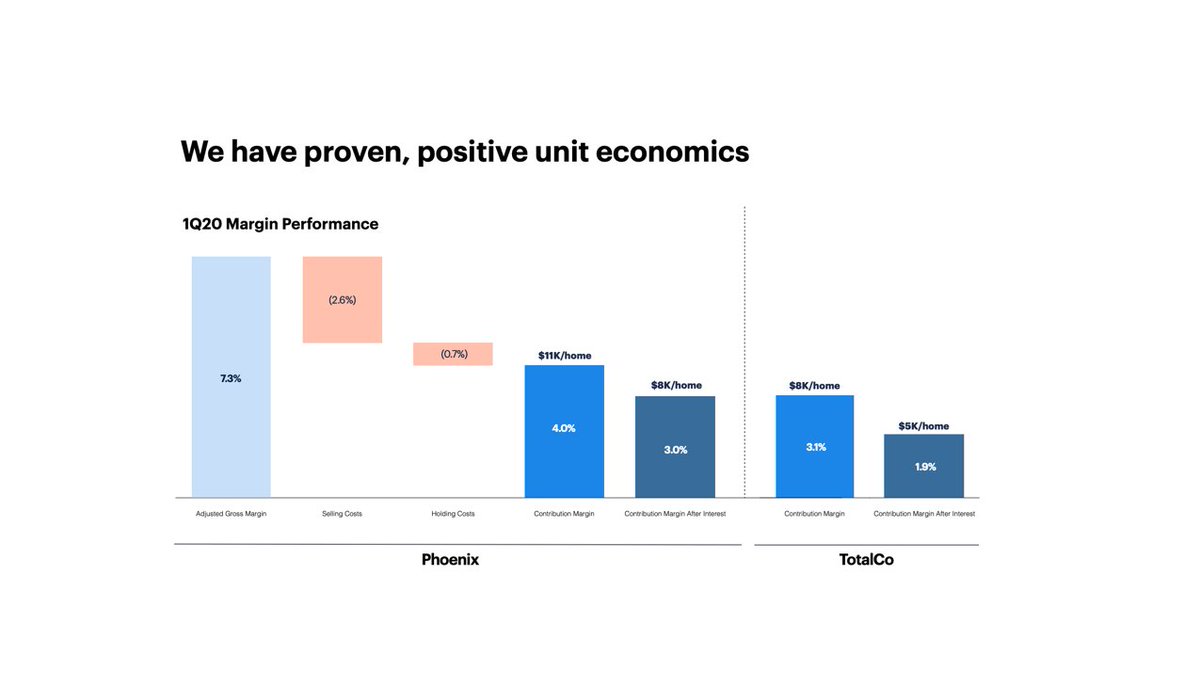

$OPEN has Gross Margins of 7% and makes around 2 to 3% per home sold

$OPEN has Gross Margins of 7% and makes around 2 to 3% per home sold Can be compared to $VRM and $CVNA business model of low margins (10%) but high volumes

Can be compared to $VRM and $CVNA business model of low margins (10%) but high volumes But does VALUATION makes senses

But does VALUATION makes senses

The Good Side

The Good Side

$OPEN and $CVNA are providing a better UX, a platform consumers can trust and convenience

$OPEN and $CVNA are providing a better UX, a platform consumers can trust and convenience Data on the auto and housing market is relatively easier to find, enabling these to compete

Data on the auto and housing market is relatively easier to find, enabling these to compete They both address HUGE markets that have not been digitised yet

They both address HUGE markets that have not been digitised yet

The Bad Side

The Bad Side

The housing & auto market face large difficulties during downturns

The housing & auto market face large difficulties during downturns Auto dealers have to limit their inventory during the downturn BUT need sufficient stocks for the recovery

Auto dealers have to limit their inventory during the downturn BUT need sufficient stocks for the recovery iBuyers (as $OPEN) have to pause buying and sell current inventory at loss

iBuyers (as $OPEN) have to pause buying and sell current inventory at loss

The Bottom Line

The Bottom Line

Both $OPEN and $CVNA are active in a large market that needs digitisation

Both $OPEN and $CVNA are active in a large market that needs digitisation Both are in hyper-growth (pre-COVID) and try to improve their unit economics

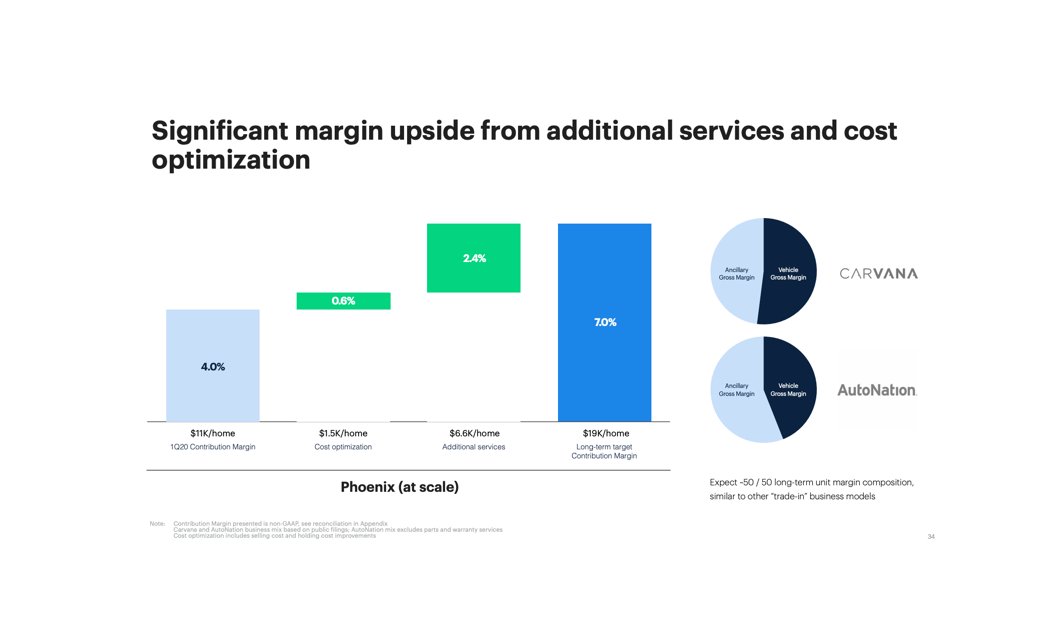

Both are in hyper-growth (pre-COVID) and try to improve their unit economics In the long run, $OPEN plans to drive its contribution margin to 7%, up from 2 - 3% today

In the long run, $OPEN plans to drive its contribution margin to 7%, up from 2 - 3% today

Tricky Valuation

Tricky Valuation

$OPEN is worth $ 12.3B on 2020 (run rate) sales of $ 5B

$OPEN is worth $ 12.3B on 2020 (run rate) sales of $ 5B Despite Opendoor’s attractive story, the long term potential and valuation don’t make perfectly sense

Despite Opendoor’s attractive story, the long term potential and valuation don’t make perfectly sense We can view $OPEN ’s sales as “Gross Sales” and its Gross Profit as “Net Revenue”

We can view $OPEN ’s sales as “Gross Sales” and its Gross Profit as “Net Revenue”

Similar to $UBER and other commission-based businesses

Similar to $UBER and other commission-based businesses $UBER generated $ 14.8B in Gross Bookings and $3.1B in Net Revenue

$UBER generated $ 14.8B in Gross Bookings and $3.1B in Net Revenue Can be approximated to $ 12B in Full Year Net Revenue

Can be approximated to $ 12B in Full Year Net Revenue With a market cap of $ 90B, it currently has a Price To Net Revenue of around 7.5

With a market cap of $ 90B, it currently has a Price To Net Revenue of around 7.5

$OPEN could generate $ 5B in sales this year and has Gross Margins (i.e. +/- commission) of around 7% so it could get $ 350m in Net Revenue

$OPEN could generate $ 5B in sales this year and has Gross Margins (i.e. +/- commission) of around 7% so it could get $ 350m in Net Revenue At today’s market cap of $ 12.3B, this mean that its Price To Net Revenue is at around 35

At today’s market cap of $ 12.3B, this mean that its Price To Net Revenue is at around 35

If sales double to $ 10B and GM increase to 10% this would translate into $ 1B in Net Revenue

If sales double to $ 10B and GM increase to 10% this would translate into $ 1B in Net Revenue At a multiple of 12, this would give a market cap of $12B, almost today's valuation

At a multiple of 12, this would give a market cap of $12B, almost today's valuation We sold our small speculative stake in $OPEN

We sold our small speculative stake in $OPENWant to dive deeper? https://www.bloomberg.com/opinion/articles/2020-10-14/opendoor-is-a-13-5-billion-spac-sensation-that-will-buy-your-house

Read on Twitter

Read on Twitter