Happy new year. To help us all sober up, here's prelim data on the % of active stock and bond mutual funds that beat their M* category index in 2020. All told, 37% of active funds did so (45% before fees), down slightly from 2019 when 40% succeeded (53% before fees). (1/6)

Does the picture improve any if we look at active fund success rates on a risk-adjusted basis (i.e., Sharpe Ratio)? No. It gets worse, with 31% of active stock and bond funds topping their M* category indexes (38% before fees). (2/6)

When we focus on 2020 specifically, we find the usual range of active-fund success rates by asset class. Active foreign-stock and taxable-bond funds succeeded most often (45% beat rate after fees), active muni-bond funds least often (22% after fees). (3/6)

Here's the same thing but risk-adjusted, i.e. Sharpe Ratio. Again, we find a range of different success rates, but notice that active taxable-bond success rates are markedly lower when we account for excess volatility--just 22% beat their M* category index on this basis. (4/6)

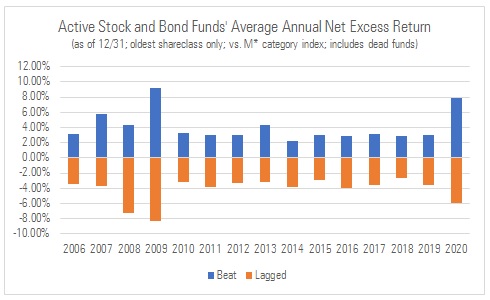

That's mostly glum. Any silver linings? Yes. Outperforming active stock/bond funds beat their M* category index by a wider avg. margin (7.8%) than underperforming funds lagged (5.9%), meaning payoff to beating > penalty for lagging. (5/6). Widest winning spread since '07. (5/6)

Read on Twitter

Read on Twitter