CRE Brokers know more about the local market, yet own little real estate.

I want to help change that.

Here is how I went from broker to owner:

I want to help change that.

Here is how I went from broker to owner:

1. I focused on one property type (industrial)

2. Built a data base of 1000 owners and tenants

3. Learned property values and lease rates

4. Found a partner who wanted to grow his RE portfolio and wanted a guy with boots on the ground knowledge.

2. Built a data base of 1000 owners and tenants

3. Learned property values and lease rates

4. Found a partner who wanted to grow his RE portfolio and wanted a guy with boots on the ground knowledge.

After focusing on one market and one property type for 3 years a deal came along.

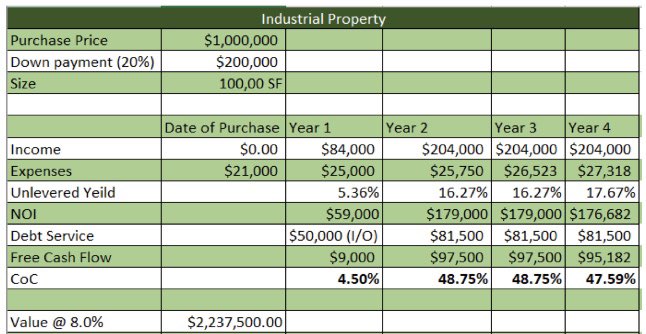

We bought a large vacant industrial facility. I knew to replacement cost was $4mm+.

We bought a large vacant industrial facility. I knew to replacement cost was $4mm+.

We offered $1mm, it was accepted.

It sat vacant for 12 mo. But we had a 12 I/o loan from the bank.

Who came along to lease a portion? Exxon mobile. 5 yr lease. Paid the note each month.

Then a 2nd publicly traded co came and leased the rest of the property.

It sat vacant for 12 mo. But we had a 12 I/o loan from the bank.

Who came along to lease a portion? Exxon mobile. 5 yr lease. Paid the note each month.

Then a 2nd publicly traded co came and leased the rest of the property.

It cash flows $179k yr after exp. not bad for $200k down payment.

Was there risk? Yes! But we can lease for less than anyone else in the market.

You make your $$ on the buy.

Here is what I learned:

1. Specialize in a property type

2. Prospect

3. Understand value

Was there risk? Yes! But we can lease for less than anyone else in the market.

You make your $$ on the buy.

Here is what I learned:

1. Specialize in a property type

2. Prospect

3. Understand value

Take the leap!

If I didn’t know the market, then who did? I was in it every day.

Bet on your self. I will take that bet all day.

If I didn’t know the market, then who did? I was in it every day.

Bet on your self. I will take that bet all day.

Read on Twitter

Read on Twitter