Good morning. Next time you see someone who doesn't understand simple math and car notes, please direct them to this thread. Even if you don't understand financing, I'm sure that the public school system taught math in grade school. Let's begin....

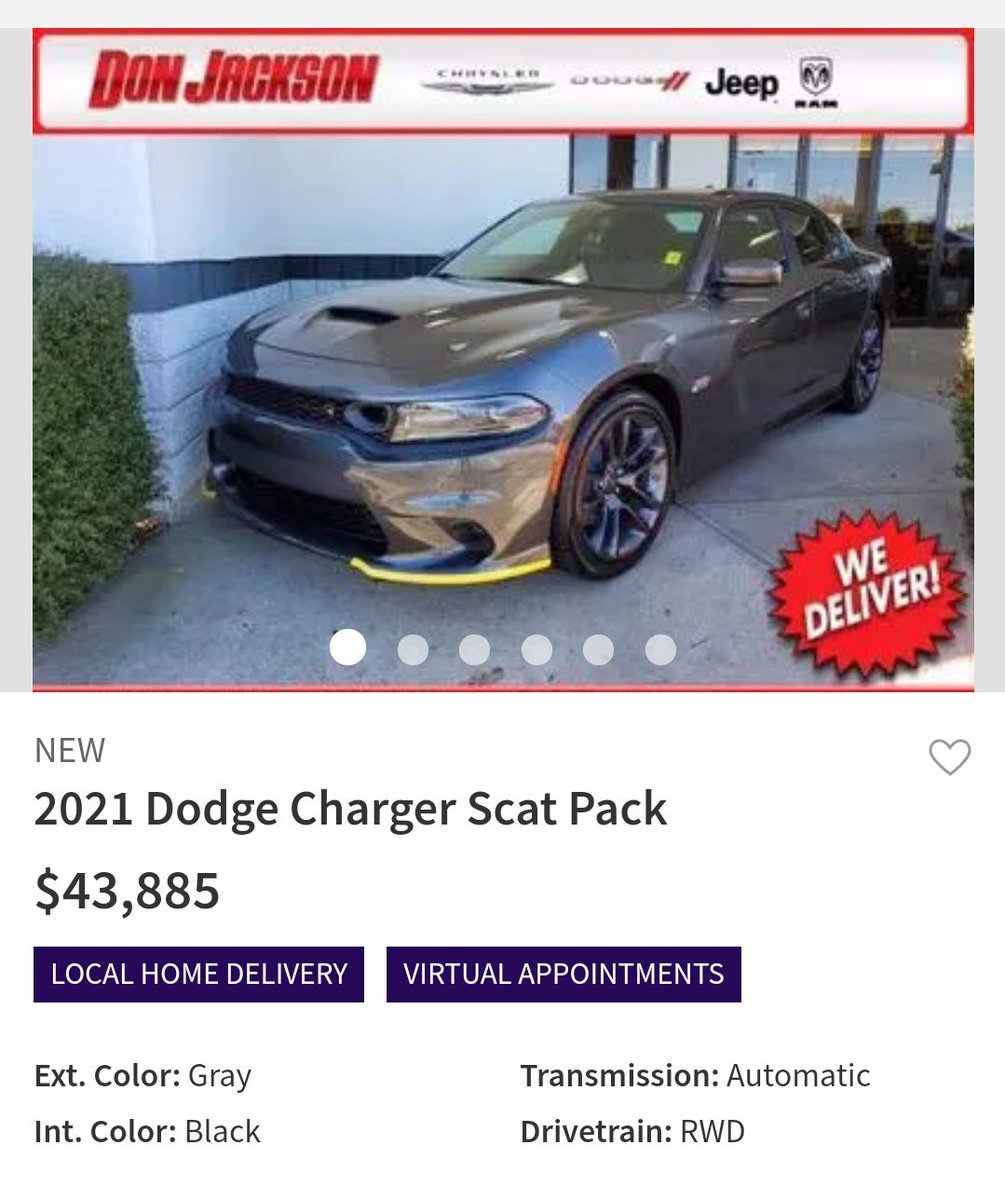

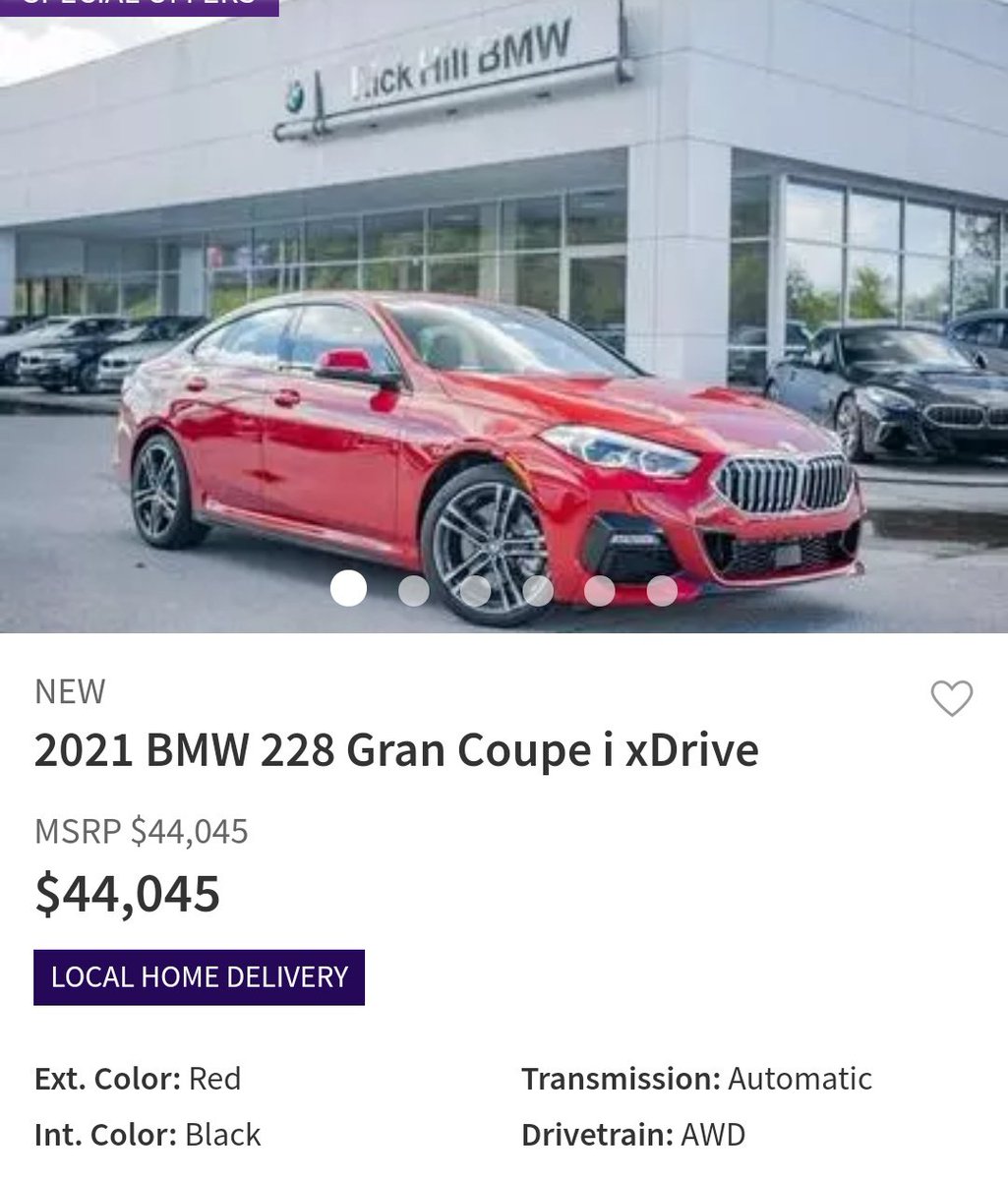

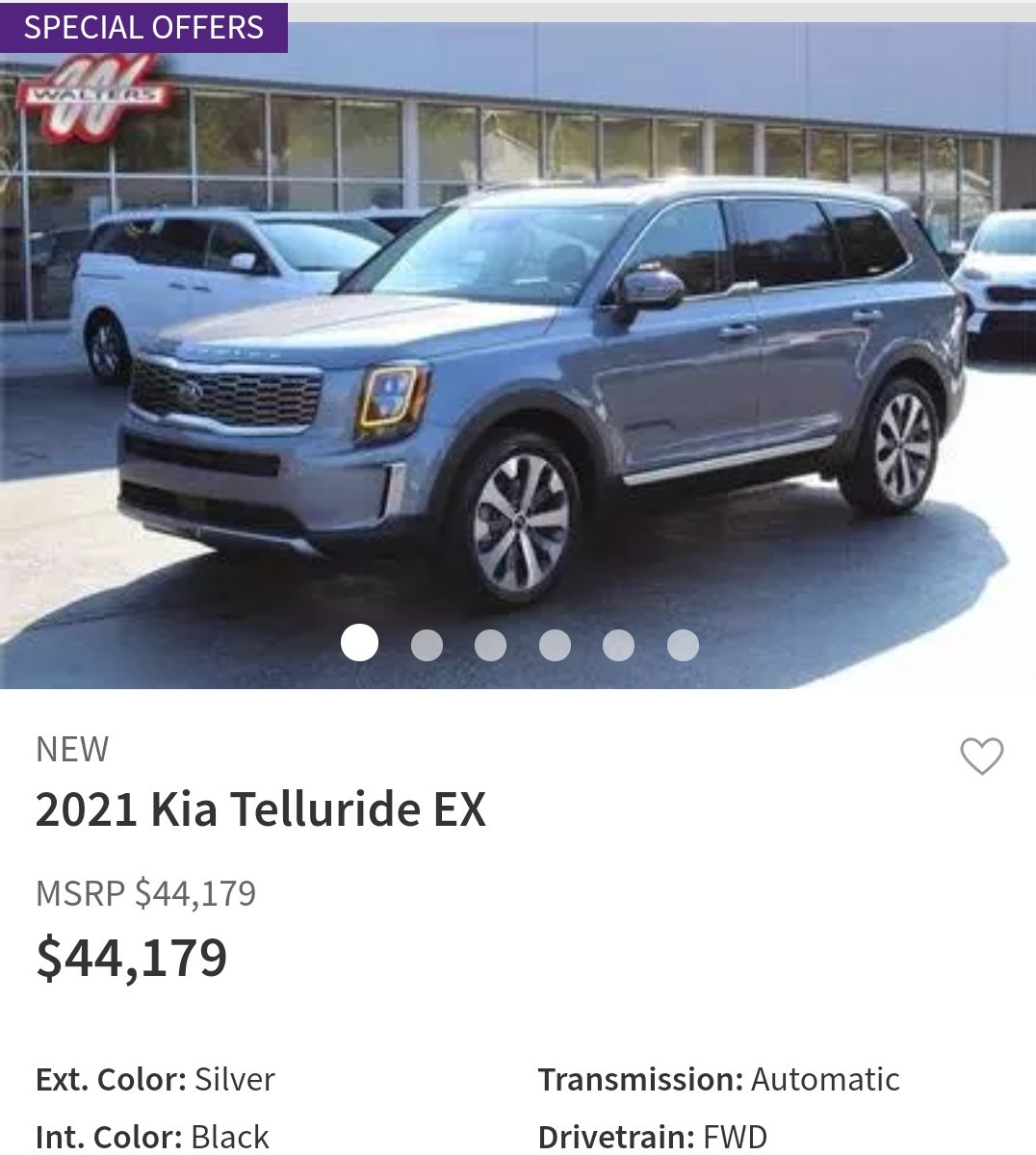

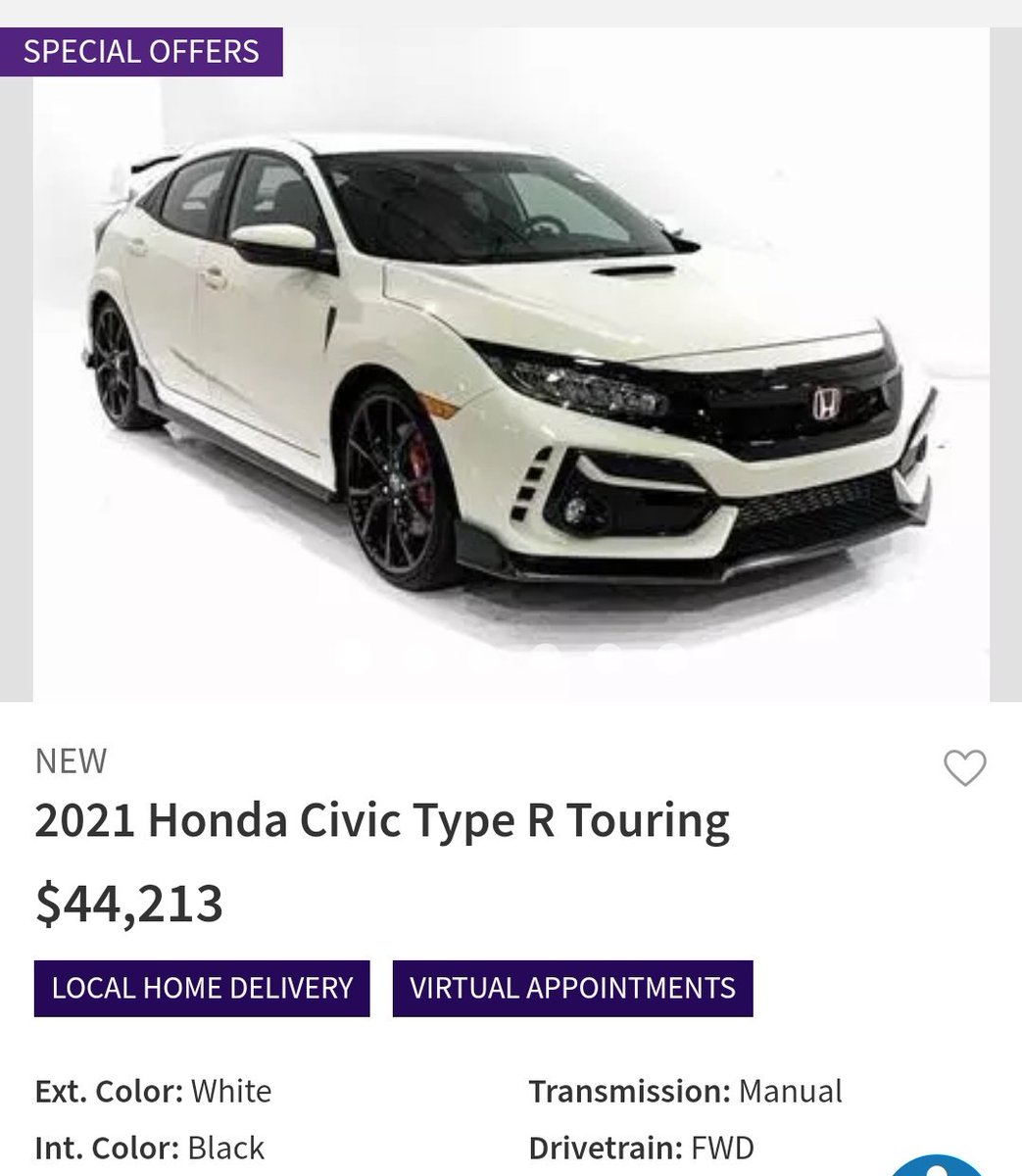

I am going to give you 4 similarly priced vehicles: an American, a German, a Korean and a Japanese vehicle. Please take time to look over each of them and the asking price.

Now based on how I've seen some of you tweet, you'd probably assume that the BMW's note would be the highest and that the Kia would be the lowest. That because you're basing your idealism of what the note should be with what YOU value the brand at.

Let me put it to you this way: What's heavier? A thousand pounds of Steel or a thousand pounds of feathers?

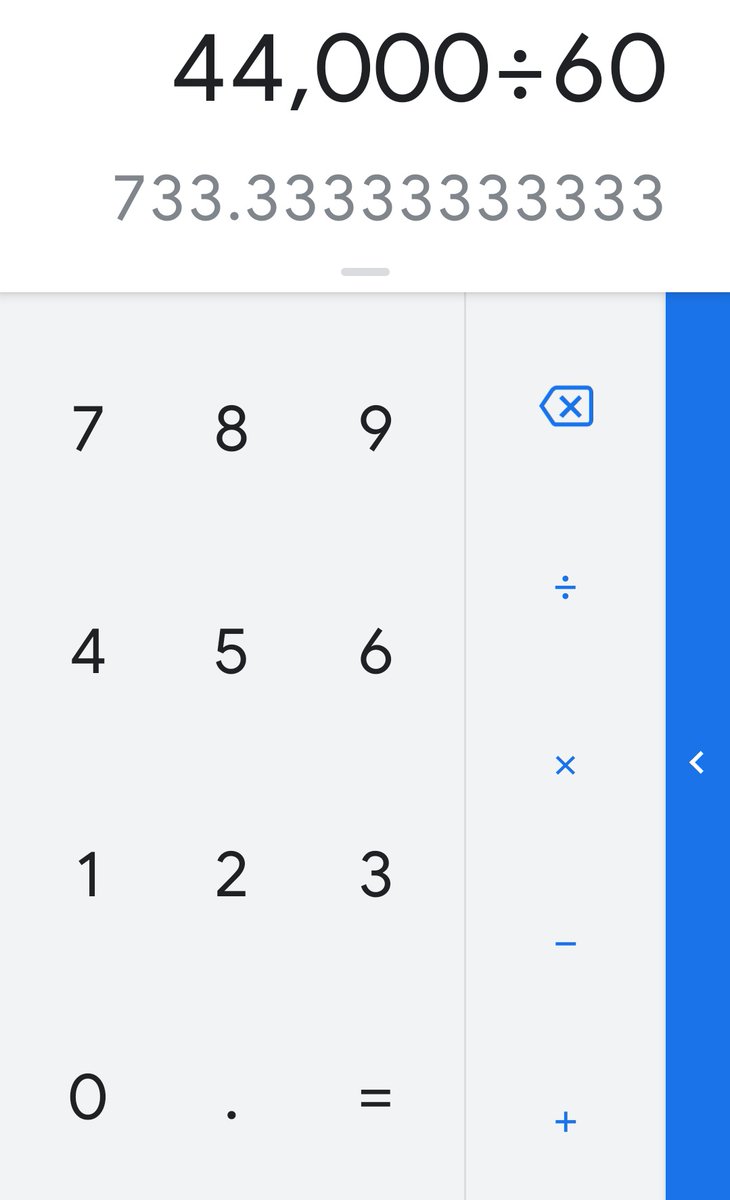

We will revisit the poll question later in this thread. Now look at the prices of the vehicles. Each of them are roughly 44k each. So lets just take forty four thousand dollars and divide it by a five year payment plan. Five years is 60 months. We shall divide 44,000 by 60.

By simply using the calculator function on your phone and implementing the same math you were taught in grade school, you will see that a five year payment plan will give you a note of $733.33 a month. The calculator does not ask which vehicle you picked, only the amount.

So to revisit the poll question: Which is heavier? The 1000 pounds of steel or the 1000 pounds of feathers? The answer is neither. They both weigh the same amount: 1000 pounds. Regardless of the brand of vehicle, if the price is the same, YOU STILL HAVE TO DIVIDE THE SAME AMOUNT.

Dividing 44k by 60 gets you $733.33. That number is BEFORE taxes, title, license and financing. So before you try to say that your note would be lower, you would be wrong. The above equation was done just using the COST of the vehicle. That note is where you START AT.

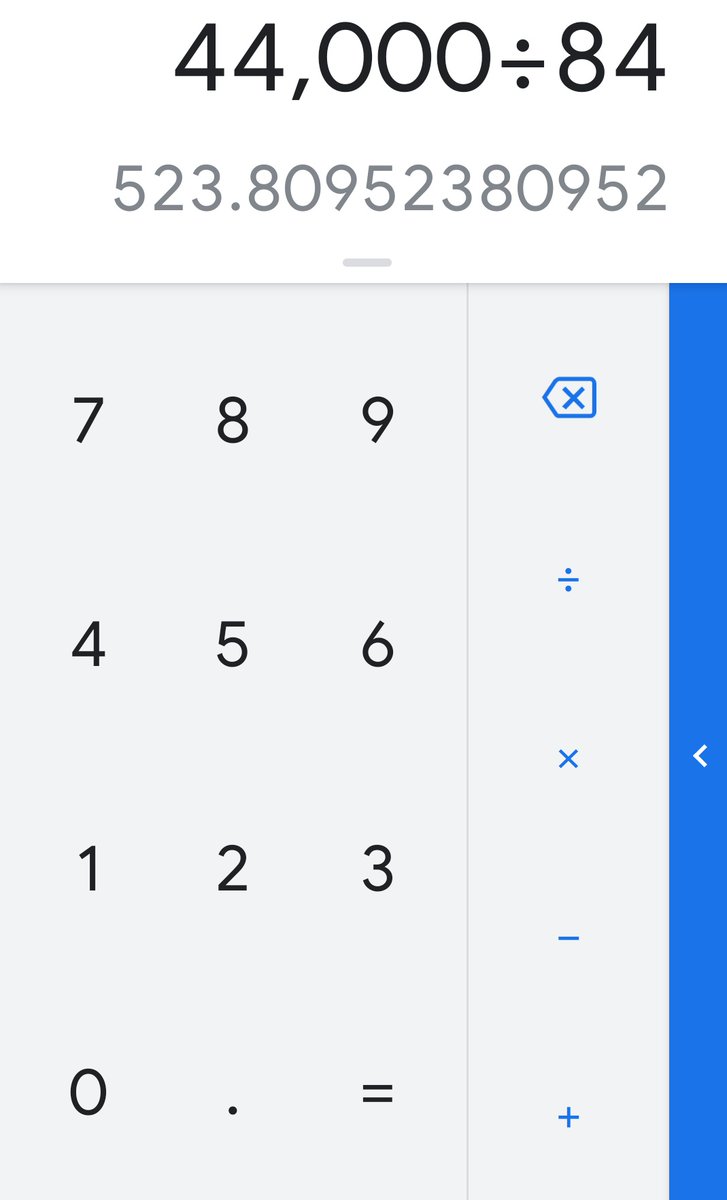

Now of course, you could stretch your payments out to 84 months, which is seven years. A lot of you don't want a high note. Doing this will make the note $523.81 a month. Remember, these figures DO NOT INCLUDE FINANCE CHARGES.

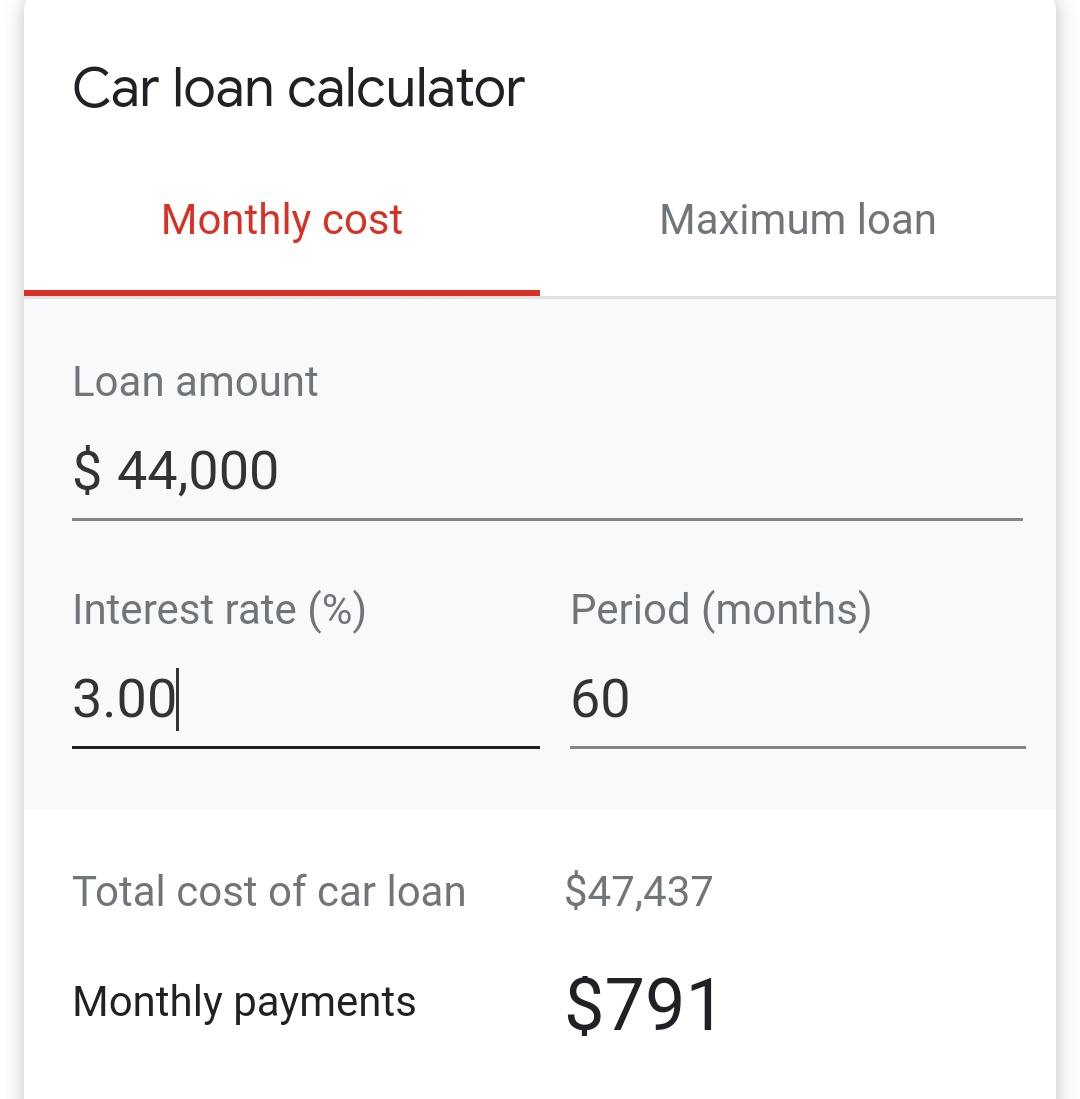

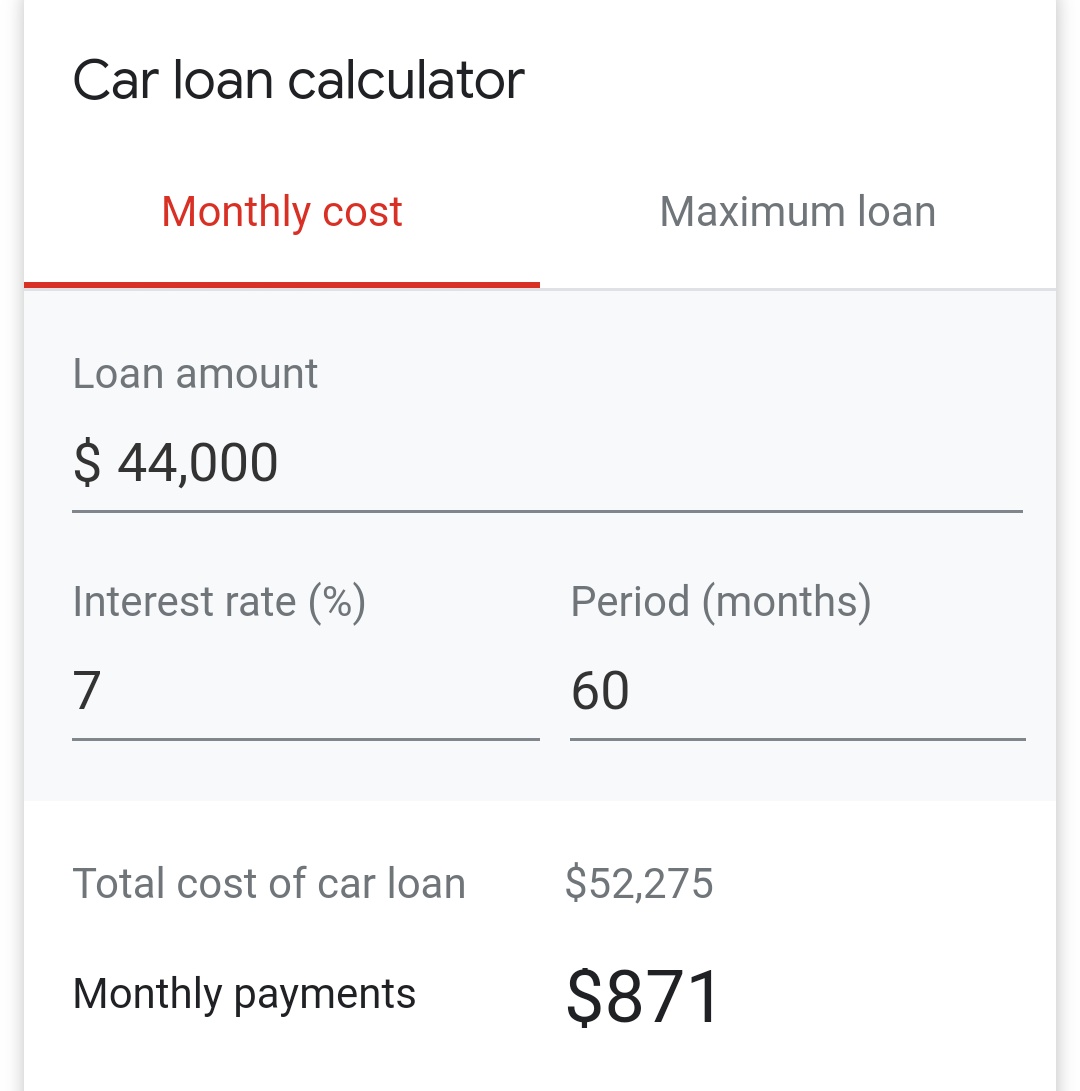

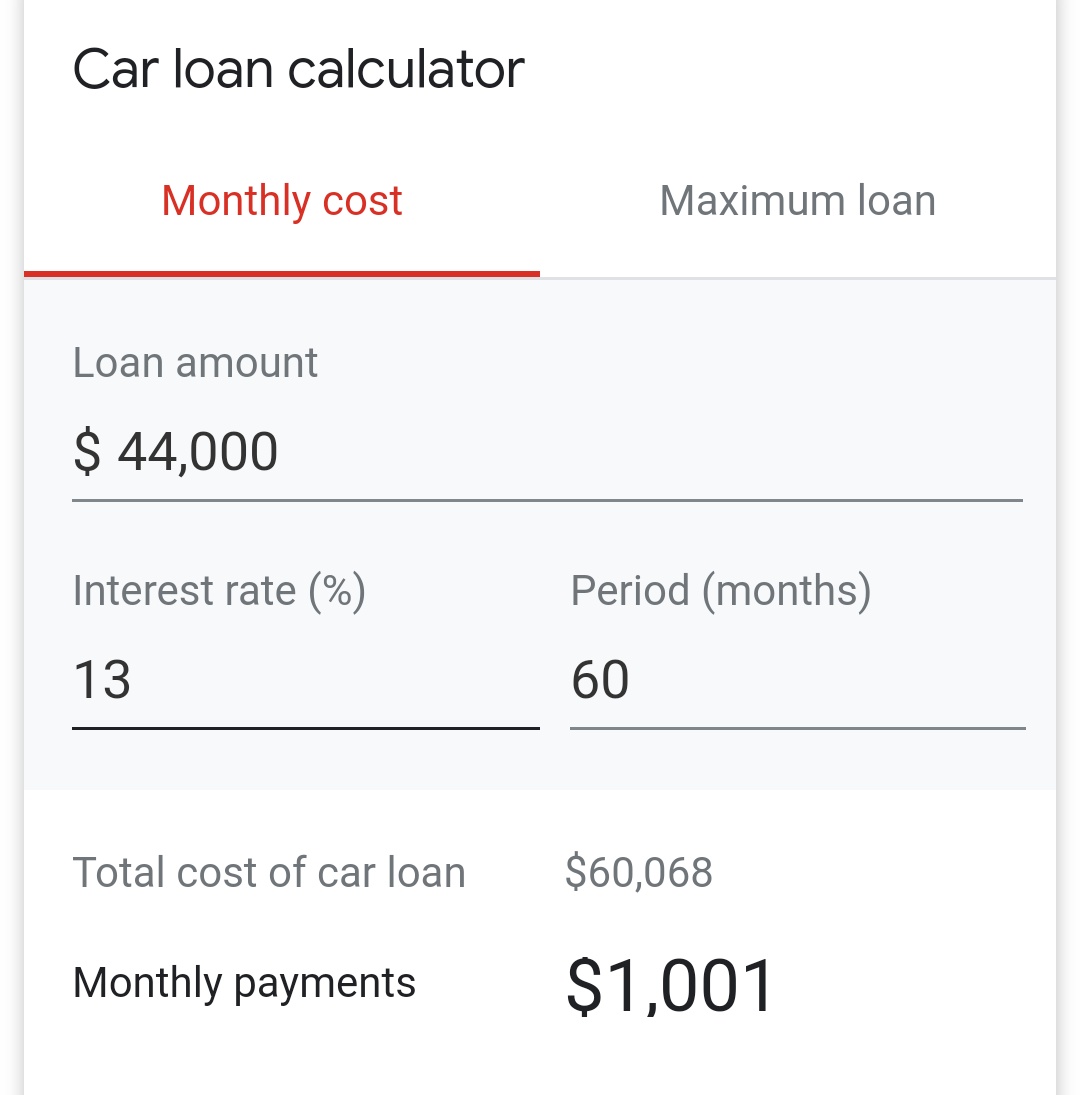

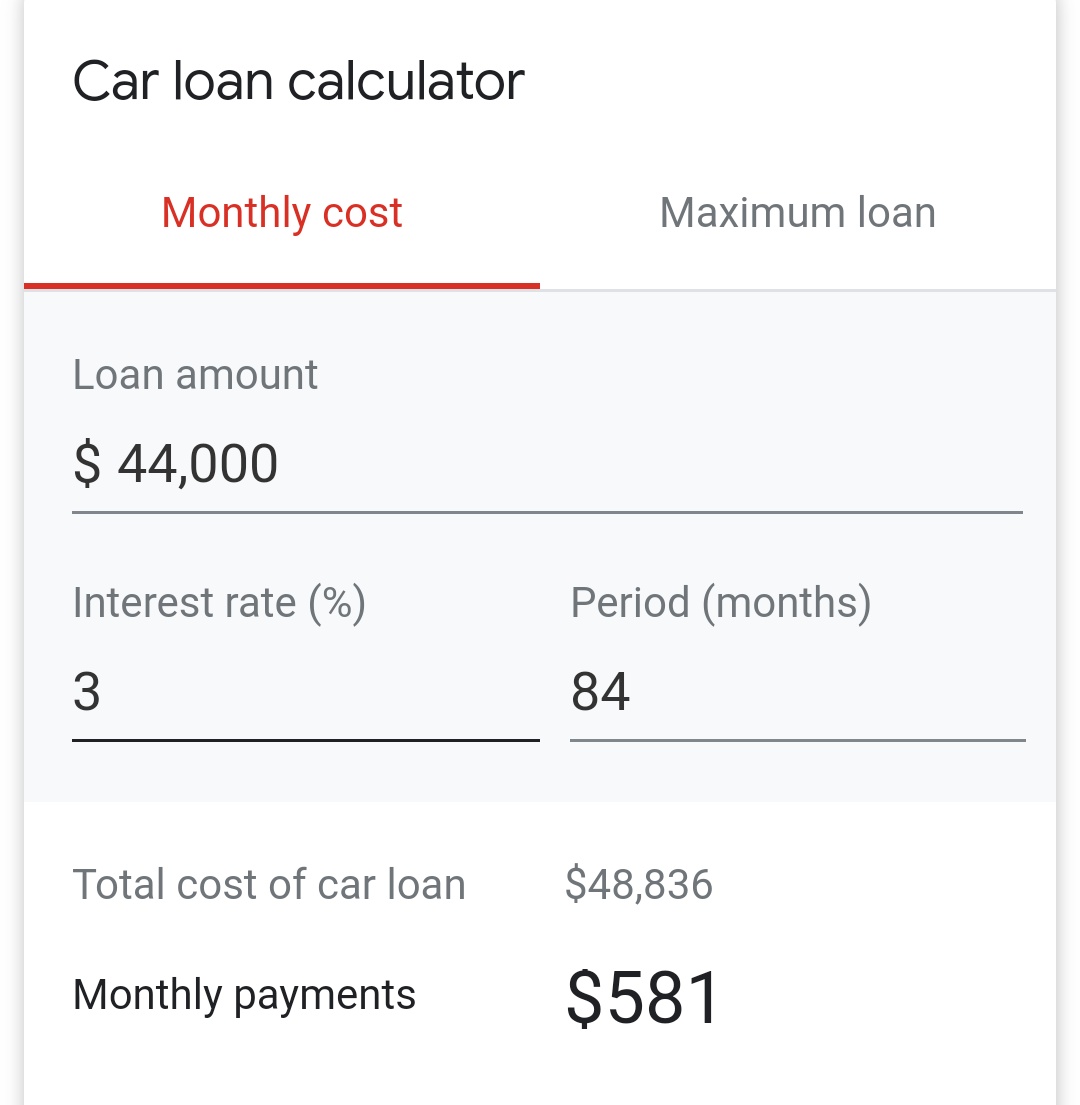

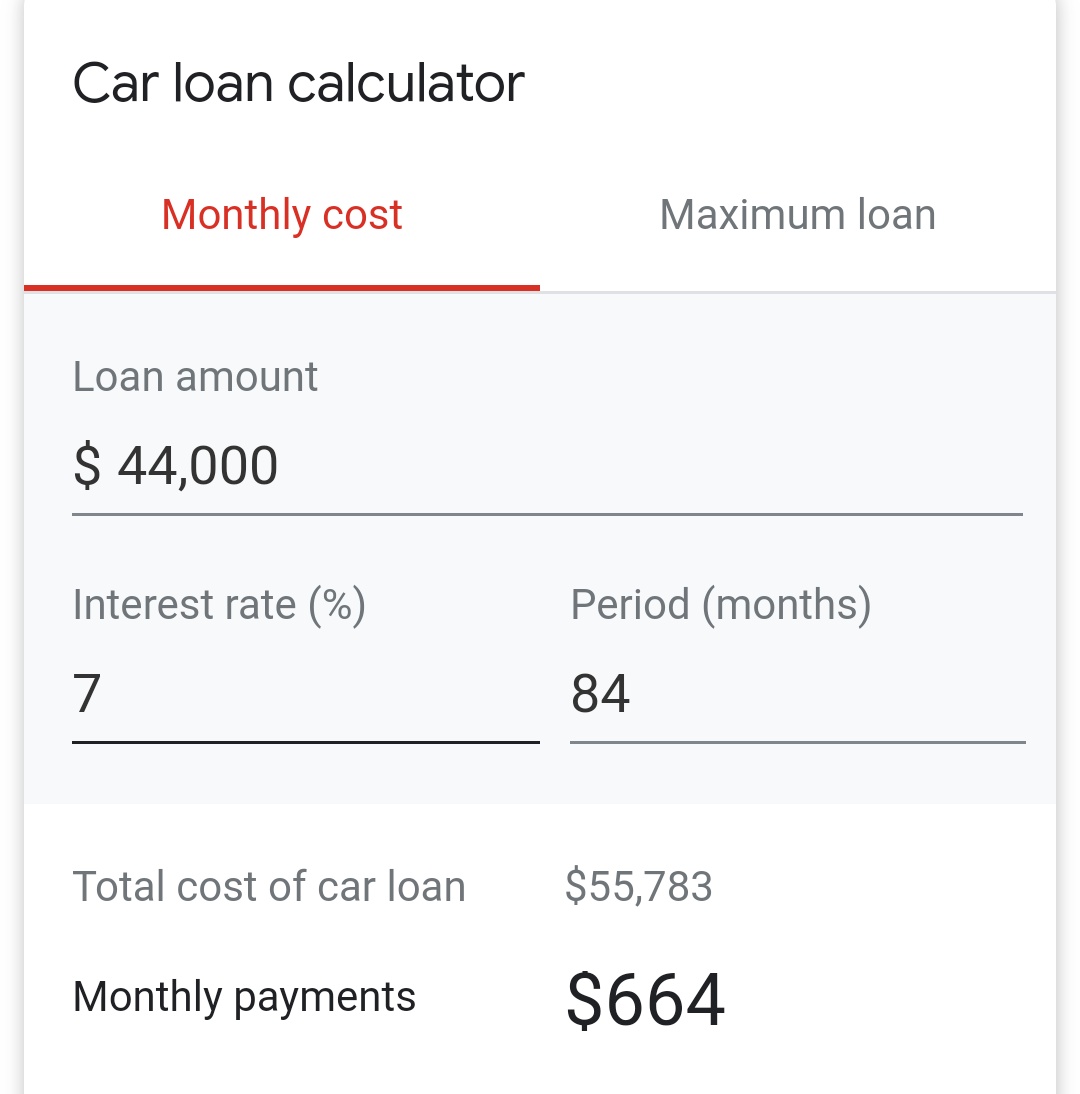

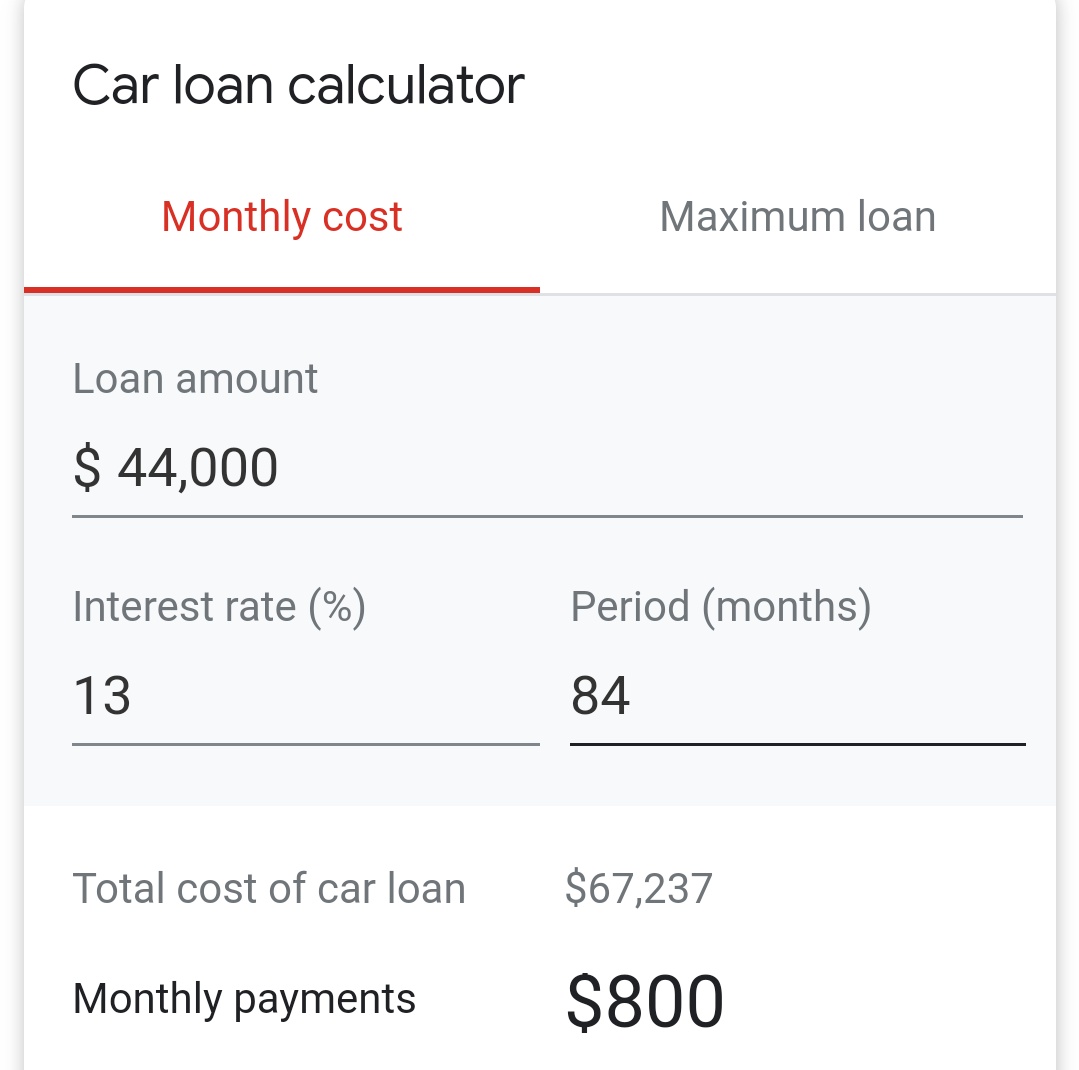

Now let me show you what you're in for. Let's say you have great credit and get a 3% interest rate, fair credit and get a 7% interest rate or poor credit and get a 13% interest rate. The below photos show what amount you're financing at each credit level over 60 months.

With great credit you will spend $3400 in finance charges at $791 a month. With good credit you will spend $8000 in finance charges at $871 a month. Bad credit? $16,000 in finance charges at $1001 a month. It does not matter which of the cars you picked, THE PRICES ARE THE SAME.

If you're thinking, "Well I can lower my payments by going 84 months", please take a look at what happens when you stretch your payments to get a lower note: the longer you finance, the more interest you pay, THE MORE YOU END UP PAYING FOR A $44,000 VEHICLE. REGARDLESS OF BRAND.

In the WORST CASE SCENARIO, you would pay $800 a month for a 44k car over 7 years and pay TWENTY THREE THOUSAND IN INTEREST. Y'all gotta start paying attention to THE MATH and not just a LOWER PAYMENT.

A nice vehicle is going to cost you. Learn the math and stop purchasing these cars and putting yourself in debt or even worse, being upside down in a vehicle when you try to trade it in. (upside down is when you owe more than its worth) I hope this thread helps you understand it.

Read on Twitter

Read on Twitter