Been in $SKLZ for a while now. Here's a long, meandering thread on my DD for anyone who is thinking about it as a possible investment or just wants to read up on the opportunity. I tried to simplify things as much as possible, while still including a few unique insights.

On the face of it, Skillz is a mobile gaming platform. Two key aspects that make Skillz unique:

(1) Gamers can win money playing on Skillz platform

(2) Skillz outsources the creation of games to independent developers

(1) Gamers can win money playing on Skillz platform

(2) Skillz outsources the creation of games to independent developers

(1a) The government has strict regulation regarding gambling. Consequently, only 4 states have legalized traditional gambling on mobile devices. Skill based betting on the other hand, is legal in 41 US states allowing for a much larger addressable market.

(1b) Skillz found a way to prove that the games on their platform are skill based. They have done so via an extensive portfolio of 58 patents focused in part on proving outcomes are not based on chance. This has enabled them to serve 80% of the world including 41 US states.

(1c) Proving this is fairly difficult from what I have read and serves as a substantial moat to new entrants. According to Andrew Paradise (CEO), $SNY and $AMZN tried to take on $SKLZ market but failed. 30 additional venture backed startups also failed.

(2a) As opposed to bearing the cost of development, Skillz has taken on a Shopify style of approach. They have built a platform for creators that includes many solutions for developers, including:

(2b) Access to the Unity development engine, game launch optimization, managed server hosting, event ops, MaaS, game analytics, anti-fraud / anti-cheat solutions, prize fulfillment, and customer support.

(2c) For most independent developers, it would be nearly impossible to build out these solutions on their own. Without these solutions and quality control, it would also be nearly impossible for developers to attract enough gamers to make the development worth their while.

(2d) Skillz has effectively democratized the ability to create games and monetize them. Very similar to what Shopify did for e-commerce, simplifying the web dev process and allowing creators to focus on what they are good at.

(2e) By doing this, $SKLZ effectively outsources their game development but doesn't pay a dime for it. Independent developers build the games and if they are monetizable, Skillz collects a royalty off the top of the sales (i.e. take-rate).

(2f) One of the overlooked benefits of this model is that if the games aren't successful, Skillz pays virtually $0. The services they provide are highly scalable and now that they have reached sufficient scale, the marginal cost is nearly nothing.

(2g) By setting their platform up in this way, Skillz has built a strong double-sided platform and is able to leverage the associated network effects to continually build a stronger platform. I do not see this flywheel being disrupted anytime soon.

(2h) CEO: "In our model, the more players enjoy their experience, the more money developers make." And the more developers make, the more developers you will get on the platform and the higher likelihood of great games. This is where the circularity starts and it is hard to stop.

(2i) Uniquely, Skillz has created another network effect. The company generates many data points (c. 1.5b / day) to enhance data-driven algorithms. This is used to enhance player match-ups, recognize cheating, and likely creates a long-tail of potential use cases down the road.

--- I believe these two elements will allow for real success in the coming years. Looking at their track record also provides serious validation. A few metrics -->

(i) Skillz users spend an average of 62 minutes per day on the platform. That's more than TikTok, Facebook, YouTube, and Snapchat!!

(ii) The number of games generating over $1m in gross market value (GMV) increased from 7 to 34 since 2016.

(ii) The number of games generating over $1m in gross market value (GMV) increased from 7 to 34 since 2016.

(iii) Skillz generates an average revenue per user (ARPU) per month of $6.30 versus $1.89 for $ZNGA and $1.50 for $GLUU.

(iv) Total GMV on the platform has soared in recent years, going from $120m in 2017 to $1,500m in 2020 (12.5x)

(iv) Total GMV on the platform has soared in recent years, going from $120m in 2017 to $1,500m in 2020 (12.5x)

(v) Between Q1 and Q2 of 2020, monthly active users (MAUs) stayed flat which is something to watch. Nonetheless, the company increased ARPU over that same period from $5.57 to $7.72 (38% increase)

(vi) Skillz put on 500m tournaments in Q2, extrapolate to 2b tournaments per year.

(vi) Skillz put on 500m tournaments in Q2, extrapolate to 2b tournaments per year.

Great right, but can they monetize this and turn it into a real business or do their financials look like $UBER's?

Short answer is yes, they can.

The company operates with 95% gross margins. This goes back to their ability to oursource the game development and effectively turn what would typically be a line item within COGS into revenue. Reminds me of $AMZN.

The company operates with 95% gross margins. This goes back to their ability to oursource the game development and effectively turn what would typically be a line item within COGS into revenue. Reminds me of $AMZN.

If the company stopped investing in new customer acquisition today and sacrificed top-line growth for bottom-line efficiency, they would already be profitable. Contribution margins for 2020 are expected to be 36% or $82m on revenues of $225m.

Over the long-term, the company expects to maintain their 95% gross margins, increase their take rate to 20% and achieve EBITDA margins of 30%. The company is aiming for EBITDA profitability by 2020.

While we are discussing financials, I thought it would be useful to point out the company has over $58m in cash and no long term debt as of their public debut.

Quickly, valuation. The company trades at a mkt cap of 3.25b (162.3m DSO x $20 share value) and an even lower EV of 3.2b because of negative net debt (cash > debt).

Implied multiples -->

14.2x EV/LTM rev, 8.7x EV/NTM rev, 5.8x EV/2022 rev.

Implied multiples -->

14.2x EV/LTM rev, 8.7x EV/NTM rev, 5.8x EV/2022 rev.

Those multiples are cheap imo given that the company is generating cash pre CACs, has a strong balance sheet, operates on 95% gross margins, and a rev CAGR of 57% over the next 2 years.

Interestingly, the companies growth projections do not include the expected growth from international expansion but DOES INCLUDE THE COSTS. Therefore, expect them to beat these projections if any revenue is generated internationally. "Under promise, over deliver."

**Next topic: a lot of people have commented on the quality of the games, indicating they are less than desirable and feel cheap.

The reality is, you're playing the wrong games. As with any platform that enables people to build something on their own, there is likely to be a tail of under-performers or low-quality providers. It is true of Uber drivers, Shopify stores, even food trucks.

The magic is that by opening up their platform to everyone, they are bound to end up with some very high quality games in addition to a tail of lesser quality games. They are effectively playing the VC game, where a handful of games generate the bulk of the returns.

Instead of going to the "Skillz Games" app directly, just google "top Skillz games" and I am confident you will quickly find the quality you are looking for.

For instance (games and ios ratings):

Dominoes Gold - 4.7 stars on 9.4k ratings

21 Blitz - 4.6 stars on 21.8k ratings

Solitaire Cube - 4.6 stars on 68.4k ratings

Notice the "Skillz Games" app only has 64 reviews but still boasts a decent average rating of 4.2 stars.

Dominoes Gold - 4.7 stars on 9.4k ratings

21 Blitz - 4.6 stars on 21.8k ratings

Solitaire Cube - 4.6 stars on 68.4k ratings

Notice the "Skillz Games" app only has 64 reviews but still boasts a decent average rating of 4.2 stars.

**Next topic: Total market opportunity.

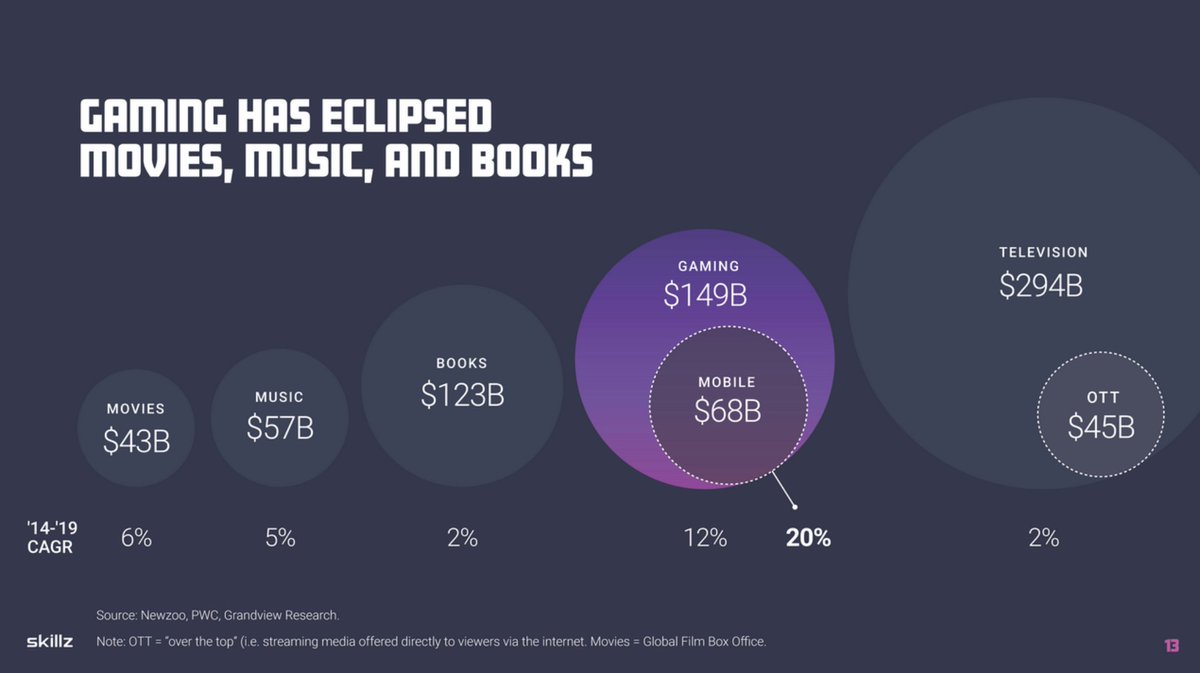

Gaming is huge and I think we all realize that. See the photo below. Not only is gaming larger than movies and music combined, and also bigger than the book market, but it's growing at at least 2x the pace of all other verticals. It won't be long before gaming exceeds TV.

The company has also indicated that they're penetration into the Android market is increasing dramatically. Should be interesting to see how it develops over time. Potentially a big boost to rev moving forward.

As if that space didn't create enough runway, the CEO has indicated they want to gamify everything. This includes exercise, learning, etc. If they can pull this off, the market opportunity is enormous.

Furthermore, esports isn't nearly as big in the US as it is in SE Asia. Wait until they start to penetrate that market and people can make money playing games?? We're just getting started here.

** Next topic: Ownership

-CEO/Co-Founder Andrew Paradise has 18% ownership post SPAC transaction (20:1 super voting rights)

-CRO/Co-Founder Casey Chafkin looks like he holds c. 5% ownership post transaction

Both intend to take their merger consideration in the form of stock (obviously good news)

-CRO/Co-Founder Casey Chafkin looks like he holds c. 5% ownership post transaction

Both intend to take their merger consideration in the form of stock (obviously good news)

Institutional investors include --

Atlas Venture 8%

Wildcat Capital Mgmt. 7%

// I may add to this as I get time and give more detail on mgmt.. All for now. Significant holding for me, double digit %. Not inv. advice, just sharing my findings.

Atlas Venture 8%

Wildcat Capital Mgmt. 7%

// I may add to this as I get time and give more detail on mgmt.. All for now. Significant holding for me, double digit %. Not inv. advice, just sharing my findings.

Read on Twitter

Read on Twitter