As they say, hindsight is 2020, and that phrase holds even more weight this year. With unprecedented uncertainty, and circumstances that no one saw coming, I’m surprised by how many of the predictions I tweeted about a year ago today held true: https://twitter.com/JoshStech/status/1212121533847498752

Time for another round of #realestate predictions for the new year. The headline? I’m bullish on #2021. Here’s why (thread below): https://www.linkedin.com/pulse/2021-housing-market-trends-another-year-growth-josh-stech/?published=t

Young people are diving into homeownership. In the 2nd half of 2020, 30-somethings made up a bigger share of new mortgage borrowers than at any time in the past 20 years. With FHA loan limits increasing and a possible buyer tax credit coming, I see this trend continuing.

10-year treasury notes increased ~25 bps in Q4, so there is a specter of higher mortgage rates in ‘21. But the Fed is keeping borrowing costs low at least until we return to full employment. Low interest rates will buoy housing markets. More on this here: https://sundae.com/blog/5-questions-real-estate-2021/

SPACs, IPOs, and a molten hot stock market (even #Bitcoin  ) mean a lot of newly minted rich people are walking around looking for places to put their cash. Real estate will see some of this capital infusion.

) mean a lot of newly minted rich people are walking around looking for places to put their cash. Real estate will see some of this capital infusion.

) mean a lot of newly minted rich people are walking around looking for places to put their cash. Real estate will see some of this capital infusion.

) mean a lot of newly minted rich people are walking around looking for places to put their cash. Real estate will see some of this capital infusion.

Crises create opportunities. Necessity spawns invention. Business creativity and private sector innovation are on the rise more so than the doom and gloom covid narratives might have us believe. This trend portends economic growth in coming years.

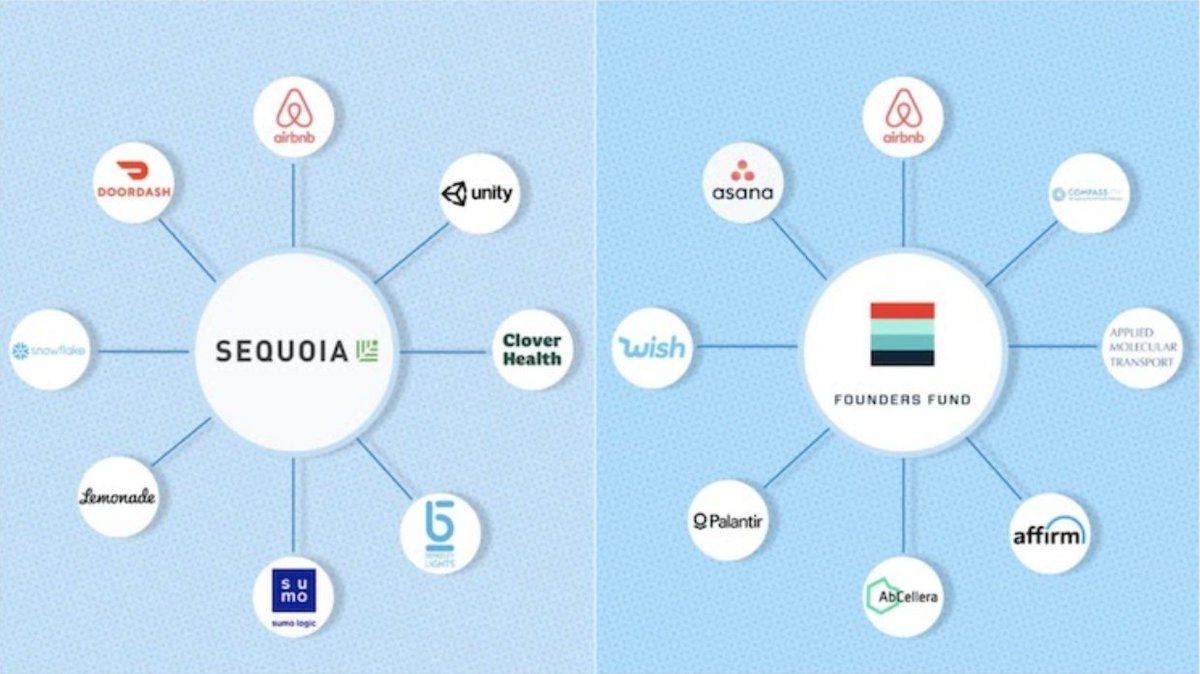

VCs made a killing in 2020 and more big venture bets look to pay off in 2021. VC success begets more investment, resulting in new business formation and job growth, plus more liquidity events that put money back into the economy. All good signs for real estate markets.

The savings rate is sky high as many consumers are still restricted or locked down by covid. This will keep pent up demand simmering and continue forcing homeowners to spend long hours at home, dreaming of more space and more house when spring comes.

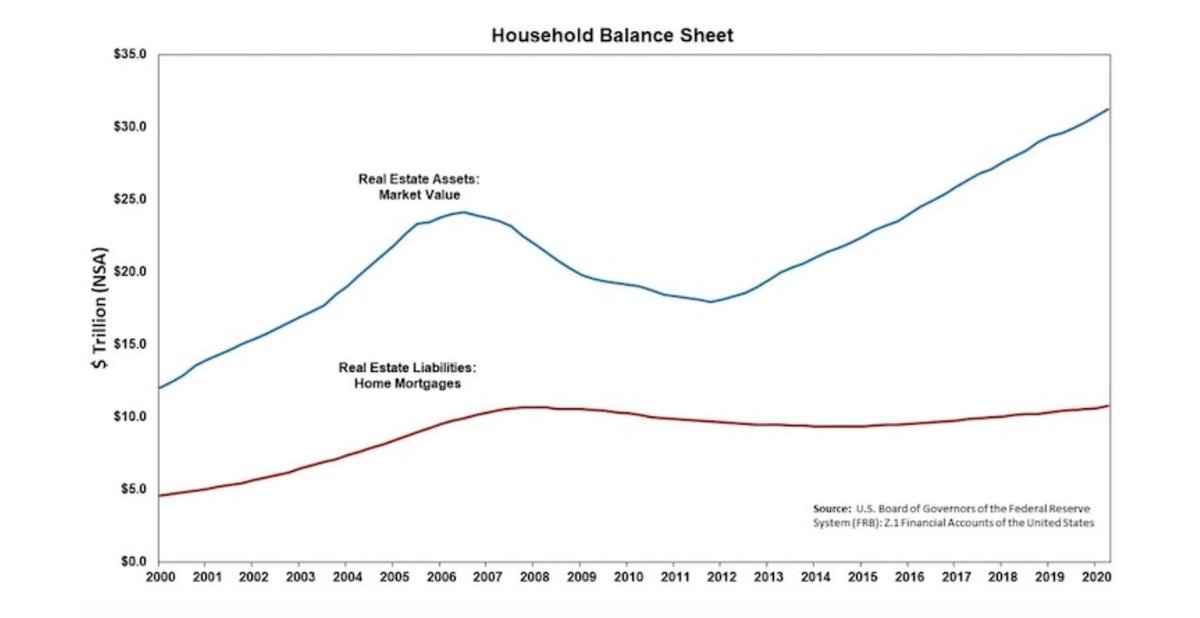

First-time homebuyers face barriers such as affordability and college debt, but move-up buyers, downsizing baby boomers benefit from a high home equity to debt ratio. Combined with low interest rates, this will propel sales in luxury homes and markets popular with retirees.

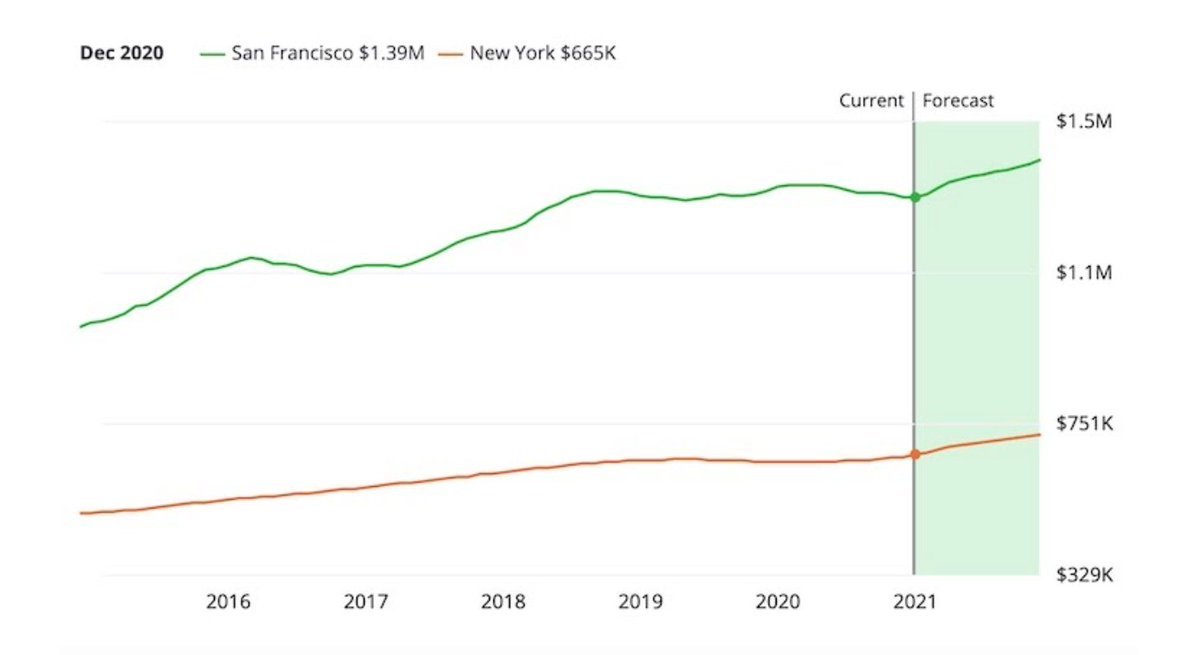

City exodus fears will prove overblown. Our research shows demand for housing in big cities (and sales prices) went up in 2020. Metro area living will only increase in 2021 & beyond. Those who do leave will head to the burbs rather than remote locations https://sundae.com/blog/more-space-higher-prices-home-sales-after-covid/

The healthcare and life sciences industries are a great case in point. Cities will benefit from growth in these sectors https://sundae.com/blog/best-cities-with-healthcare-and-life-sciences-industries/

The #remotework trend will continue to change housing dynamics for the entire country. With low interest rates and an outperforming stock market, the WFH demographic looking to upsize their housing will keep driving demand upward in 2021.

If 2020 taught us anything, it’s that we live in a volatile world where we can’t take stability or prosperity for granted. The virus, shutdowns, civil unrest, political upheaval or other exogenous shocks could render this list moot in a hurry. Humility is important. <fin>

Read on Twitter

Read on Twitter