[THREAD]

Fevertree (FEVR) has everything you’d want in a long-term, high conviction bet.

The company’s led by founders who own ~10% of the company.

They make a differentiated, premium product in an otherwise forgotten market.

Grab a tonic & read

https://macro-ops.com/fever-tree-plc-fevr-attacking-the-forgotten-3-4ths-of-your-drink/

Fevertree (FEVR) has everything you’d want in a long-term, high conviction bet.

The company’s led by founders who own ~10% of the company.

They make a differentiated, premium product in an otherwise forgotten market.

Grab a tonic & read

https://macro-ops.com/fever-tree-plc-fevr-attacking-the-forgotten-3-4ths-of-your-drink/

1/ Make Tonic Great Luxury Again

Tim Warrillow and Charles Rolls founded FEVR in 2004.

Both men come from beverage/spirits backgrounds. Rolls helped revive Plymouth Gin while Warrillow specialized in luxury food/beverage marketing.

They started FEVR in the British Library.

Tim Warrillow and Charles Rolls founded FEVR in 2004.

Both men come from beverage/spirits backgrounds. Rolls helped revive Plymouth Gin while Warrillow specialized in luxury food/beverage marketing.

They started FEVR in the British Library.

2/ Quality > Price

From the beginning, they focused on quality not price.

It wasn’t the ingredients that cemented FEVR’s success with customers. It wasn’t even their price point.

It was the psychological framing that tonic actually matters when making your favorite cocktail.

From the beginning, they focused on quality not price.

It wasn’t the ingredients that cemented FEVR’s success with customers. It wasn’t even their price point.

It was the psychological framing that tonic actually matters when making your favorite cocktail.

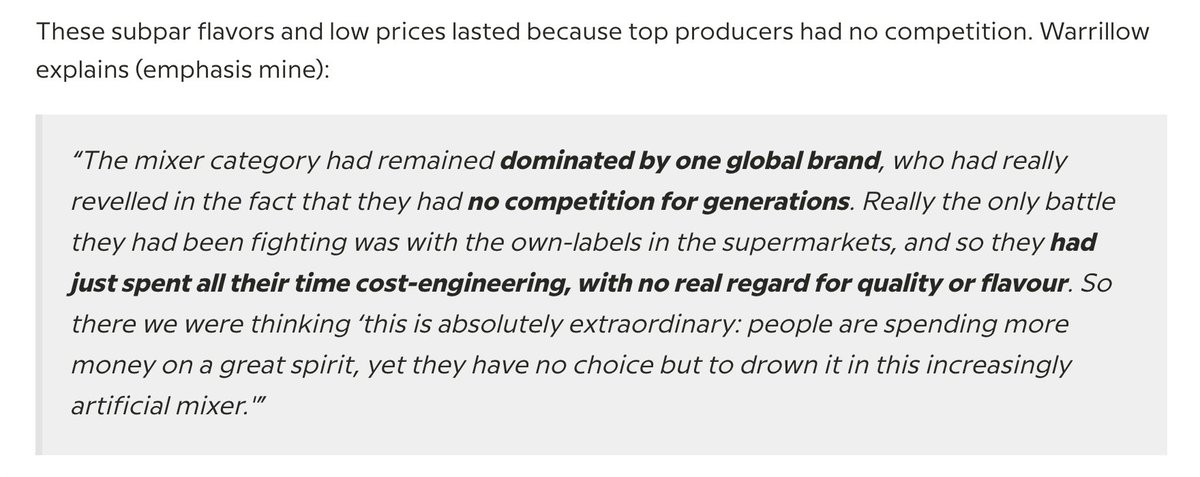

3/ Your (Bad) Flavor Is FEVR’s Opportunity

Tonic and mixed drinks got by on subpar flavor because nobody challenged the top competitors.

Everyone cared about the price of the tonic.

People were willing to pay up for spirits but weren’t given the chance to pay more for tonic.

Tonic and mixed drinks got by on subpar flavor because nobody challenged the top competitors.

Everyone cared about the price of the tonic.

People were willing to pay up for spirits but weren’t given the chance to pay more for tonic.

4/ FEVR’s pitch was “you want to pay more for a better-tasting tonic. We’ll give it to you.”

These subpar flavors and low prices lasted because top producers had no competition.

FEVR entered an industry with no competition & a differentiated mindset: focus on flavor not price.

These subpar flavors and low prices lasted because top producers had no competition.

FEVR entered an industry with no competition & a differentiated mindset: focus on flavor not price.

5/ FEVR's Secret Sauce

The company’s secret sauce is the use of the ingredient “quinine”. Quinine is the key ingredient that creates the gentle bitterness in tonic water.

The result? 13 years after its flagship product FEVR is now the go-to choice for spirit brands @ 28% share.

The company’s secret sauce is the use of the ingredient “quinine”. Quinine is the key ingredient that creates the gentle bitterness in tonic water.

The result? 13 years after its flagship product FEVR is now the go-to choice for spirit brands @ 28% share.

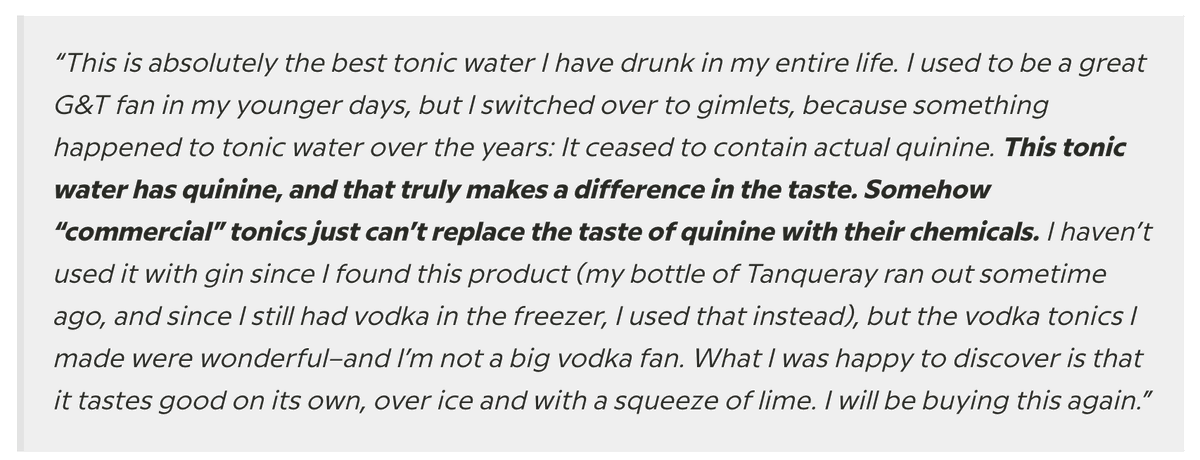

6/ Amazon Fanatics

As I write this FEVR is the #1 best-selling tonic water on Amazon despite a $2+ premium over their next-closest competitor.

The reviews are also impressive.

FEVR has 4K+ reviews with an average rating of 4.7/5 stars.

Read this user's review for yourself.

As I write this FEVR is the #1 best-selling tonic water on Amazon despite a $2+ premium over their next-closest competitor.

The reviews are also impressive.

FEVR has 4K+ reviews with an average rating of 4.7/5 stars.

Read this user's review for yourself.

7/ Taste Matters

People notice the difference between real quinine and fake chemical copycats.

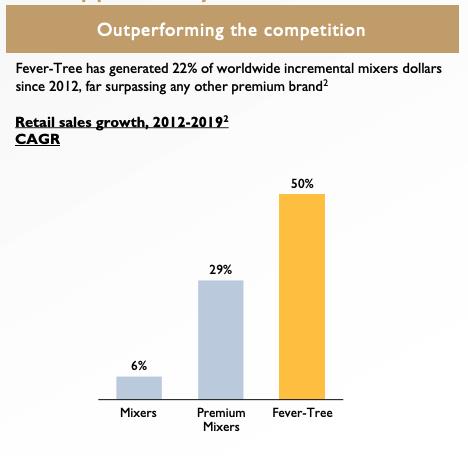

And this difference shows in the sales figures. Since 2012, FEVR has generated 22% of the worldwide incremental mixer dollars.

They hit 50% retail sales growth CAGR from 2012-2019.

People notice the difference between real quinine and fake chemical copycats.

And this difference shows in the sales figures. Since 2012, FEVR has generated 22% of the worldwide incremental mixer dollars.

They hit 50% retail sales growth CAGR from 2012-2019.

8/ Narrative To Numbers: FEVR’s Financials

The company splits its sales into four segments (% of sales as of 1H 2020):

- United Kingdom (UK): 46%

- United States (US): 26%

- Europe: 20%

- Rest of World: 8%

In 1H FEVR generated $129M in sales, $60M in Gross Profit & $27M OI

The company splits its sales into four segments (% of sales as of 1H 2020):

- United Kingdom (UK): 46%

- United States (US): 26%

- Europe: 20%

- Rest of World: 8%

In 1H FEVR generated $129M in sales, $60M in Gross Profit & $27M OI

9/ Sales Channels

FEVR sells its beverages through on-trade and off-trade channels.

Think of on-trade as restaurants, bars, etc. Off-trade comprises online and retail sales (grocery stores, liquor stores, etc.).

Due to COVID, on-trade down 61% in UK which accts. 4 45% of rev

FEVR sells its beverages through on-trade and off-trade channels.

Think of on-trade as restaurants, bars, etc. Off-trade comprises online and retail sales (grocery stores, liquor stores, etc.).

Due to COVID, on-trade down 61% in UK which accts. 4 45% of rev

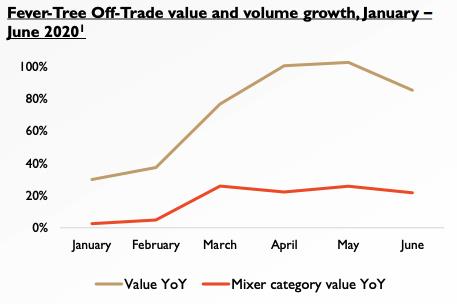

10/ Off-Trade Growth

The company grew its off-trade sales in its two largest markets (UK & US) 24% and 30%, respectively.

In fact, FEVR’s value and volume growth grew >100% during April and May in the US (see chart on left).

And in the UK, FEVR grew its value share 38%.

The company grew its off-trade sales in its two largest markets (UK & US) 24% and 30%, respectively.

In fact, FEVR’s value and volume growth grew >100% during April and May in the US (see chart on left).

And in the UK, FEVR grew its value share 38%.

11/ Taking off In Rest of World Category

The company’s now the largest tonic brand in Canada with 34% value share. And it’s the fastest-growing mixer in Australia.

Their European segment also saw massive value share gains in Germany, Belgium, Italy, and France.

People LOVE it

The company’s now the largest tonic brand in Canada with 34% value share. And it’s the fastest-growing mixer in Australia.

Their European segment also saw massive value share gains in Germany, Belgium, Italy, and France.

People LOVE it

12/ Benefits of Strong Balance Sheet

FEVR launched its first-ever national TV ad campaign in the UK and introduced new Premium Soda products.

US FEVR launched its own Amazon store-front and new Sparkling Pink Grapefruit tonic. Which led to a 73% increase in “Fever-Tree” googles

FEVR launched its first-ever national TV ad campaign in the UK and introduced new Premium Soda products.

US FEVR launched its own Amazon store-front and new Sparkling Pink Grapefruit tonic. Which led to a 73% increase in “Fever-Tree” googles

13/ Larger Markets & Greater Mindshare

FEVR made its name in the tonic water space. Yet that accounts for 6% of global premium spirits sales.

Their next target: dark spirits. According to Warrillow, dark spirits are 10x the TAM of tonic water.

FEVR made its name in the tonic water space. Yet that accounts for 6% of global premium spirits sales.

Their next target: dark spirits. According to Warrillow, dark spirits are 10x the TAM of tonic water.

14/ FEVR's Plan of Attack In Dark Spirits

Provide the best-tasting product in a market dominated by price conscious incumbents.

FEVR can leverage its distribution network to sell their dark spirits mixers.

It’s not that different from Lamborghini getting into the SUV market.

Provide the best-tasting product in a market dominated by price conscious incumbents.

FEVR can leverage its distribution network to sell their dark spirits mixers.

It’s not that different from Lamborghini getting into the SUV market.

15/ Why Taste Matters (Coke!)

There’s an element of flavor lock-in with FEVR’s products much like customers lock-in to either Coke or Pepsi.

I’m not saying FEVR has as good a business as Coke.

But once you find a tonic that tastes great and mixes well w/ drinks, why switch?

There’s an element of flavor lock-in with FEVR’s products much like customers lock-in to either Coke or Pepsi.

I’m not saying FEVR has as good a business as Coke.

But once you find a tonic that tastes great and mixes well w/ drinks, why switch?

16/ The Science of Taste Lock-in

This idea — taste lock-in — led me to an interesting podcast with Linda Bartoshuk, PhD.

During the podcast, Dr. Bartoshuk explained why our brains love certain tastes. Turns out the brain creates “templates” of flavors and tastes we enjoy.

This idea — taste lock-in — led me to an interesting podcast with Linda Bartoshuk, PhD.

During the podcast, Dr. Bartoshuk explained why our brains love certain tastes. Turns out the brain creates “templates” of flavors and tastes we enjoy.

17/ More Numbers

These advantages translate to high margins and strong free cash flow. FEVR’s generated (on average) 50% gross margins and 30% EBIT margins.

The company’s grown cash from operations at a 33% 5YR CAGR. In turn, FEVR enjoys ~100% FCF conversion w/ ample cash on BS

These advantages translate to high margins and strong free cash flow. FEVR’s generated (on average) 50% gross margins and 30% EBIT margins.

The company’s grown cash from operations at a 33% 5YR CAGR. In turn, FEVR enjoys ~100% FCF conversion w/ ample cash on BS

18/ Risks

There are four main risks:

- Lose access to quinine source

- Larger competitors flood the market (>100 as of today)

- Declining revenue in key markets (US & UK)

- Fail to penetrate new dark spirit mixer markets while losing share in the tonic water market

There are four main risks:

- Lose access to quinine source

- Larger competitors flood the market (>100 as of today)

- Declining revenue in key markets (US & UK)

- Fail to penetrate new dark spirit mixer markets while losing share in the tonic water market

19/ Valuation

Despite these risks, we see a path towards $700M in 2024 revenue and nearly $200M in pre-tax cash flow.

That would mean FEVR would have to grow revenue (on average) 16% per year while maintaining 27-28% EBIT Margins.

Off-trade biz growth potential is HUGE.

Despite these risks, we see a path towards $700M in 2024 revenue and nearly $200M in pre-tax cash flow.

That would mean FEVR would have to grow revenue (on average) 16% per year while maintaining 27-28% EBIT Margins.

Off-trade biz growth potential is HUGE.

20/ Sticky Off-Trade Biz

FEVR’s online business will benefit from COVID 3-5 years from now, and it’s on-trade (bars, restaurants) sales should return to normal levels by 2024.

That means you can buy FEVR today for 5x 2024 estimated revenues and 18x 2024 pre-tax cash flow.

FEVR’s online business will benefit from COVID 3-5 years from now, and it’s on-trade (bars, restaurants) sales should return to normal levels by 2024.

That means you can buy FEVR today for 5x 2024 estimated revenues and 18x 2024 pre-tax cash flow.

21/ Reading The Tape

FEVR is attempting to break out of an 18-month long basing pattern (see below).

While we’re hoping for lower prices, we won’t hesitate to take a starter position should the company breakout in the coming weeks.

FEVR is attempting to break out of an 18-month long basing pattern (see below).

While we’re hoping for lower prices, we won’t hesitate to take a starter position should the company breakout in the coming weeks.

22/ Concluding Thoughts

History tells us it’s a good idea to bet on founder-led companies that make a product people love in a market hemorrhaged with cost-cutting and poor quality.

Add to that a biz model that prices at a premium and generates substantial FCF w/ little cap-ex

History tells us it’s a good idea to bet on founder-led companies that make a product people love in a market hemorrhaged with cost-cutting and poor quality.

Add to that a biz model that prices at a premium and generates substantial FCF w/ little cap-ex

Read on Twitter

Read on Twitter![[THREAD]Fevertree (FEVR) has everything you’d want in a long-term, high conviction bet. The company’s led by founders who own ~10% of the company. They make a differentiated, premium product in an otherwise forgotten market.Grab a tonic & read https://macro-ops.com/fever-tree-plc-fevr-attacking-the-forgotten-3-4ths-of-your-drink/ [THREAD]Fevertree (FEVR) has everything you’d want in a long-term, high conviction bet. The company’s led by founders who own ~10% of the company. They make a differentiated, premium product in an otherwise forgotten market.Grab a tonic & read https://macro-ops.com/fever-tree-plc-fevr-attacking-the-forgotten-3-4ths-of-your-drink/](https://pbs.twimg.com/media/EqlyfgKW4AEf_3p.jpg)