$22B in SALES and 32% GROWTH

$22B in SALES and 32% GROWTH

An UNKNOWN company quietly pulling the strings behind

$TCEHY

$TCEHY http://Mail.RU

http://Mail.RU  OLX

OLX iFood

iFood Delivery Hero

Delivery Hero PayU

PayU Swiggy

Swiggy Remitly

Remitly Udemy

Udemy Brainly

Brainly Codecademy

CodecademyHere is an EASY thread

Prosus $PRX.AS is the international internet division of Naspers, which is most notable for acquiring 46.5% of Tencent in 2001 for $ 32m

By 2018, its stake was valued at $ 175B Naspers then cuts its stake to raise $ 10B

Naspers then cuts its stake to raise $ 10B

By 2018, its stake was valued at $ 175B

Naspers then cuts its stake to raise $ 10B

Naspers then cuts its stake to raise $ 10B

Naspers later placed its Tencent stake and other global internet investments into Prosus https://www.reuters.com/article/us-prosus-ipo-idUSKCN1VV1TG

Naspers later placed its Tencent stake and other global internet investments into Prosus https://www.reuters.com/article/us-prosus-ipo-idUSKCN1VV1TG

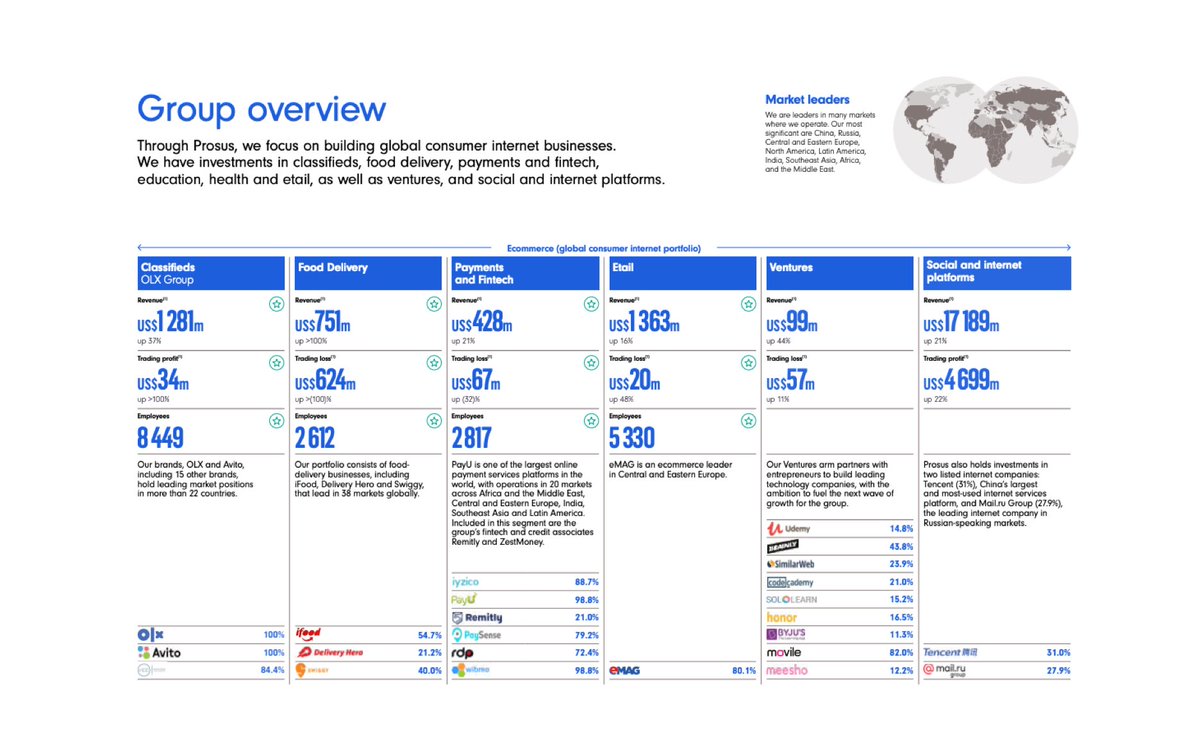

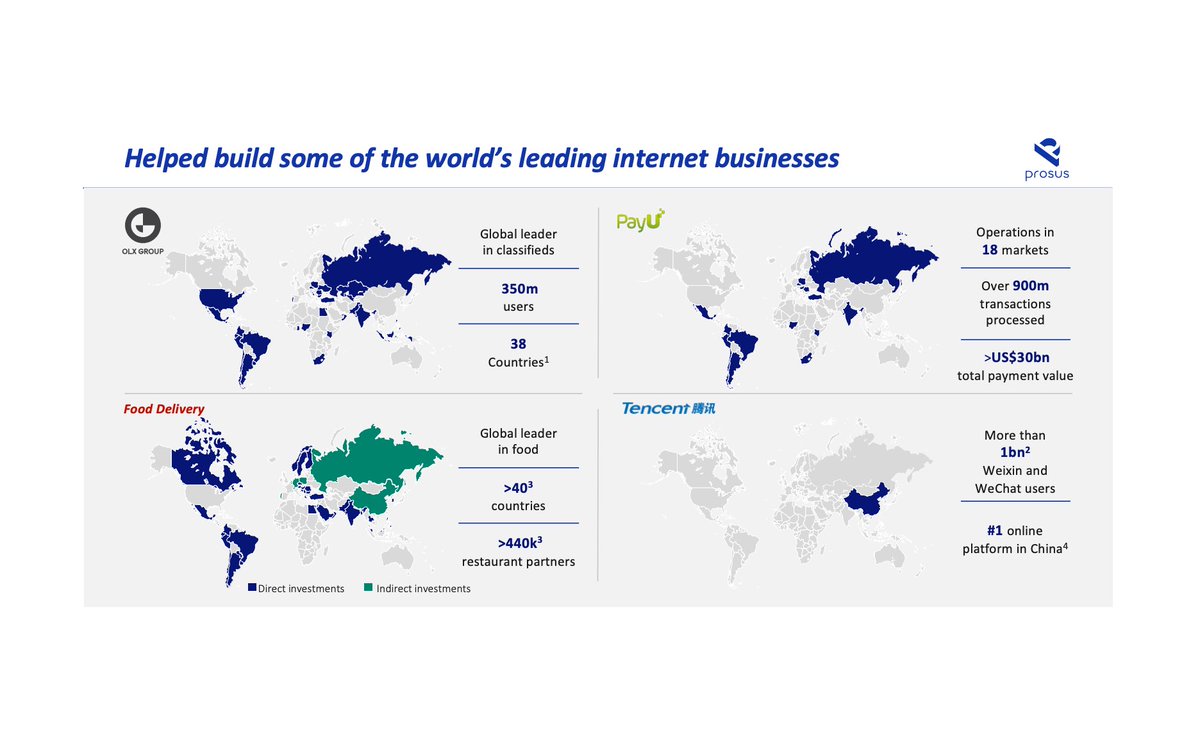

Prosus holds a stake in over 20 businesses across the WORLD, it namely owns:

· 31% of Tencent

· 28% of http://Mail.ru

· 21% of Delivery Hero

· 21% of Codecademy

· 15% of Udemy

· 31% of Tencent

· 28% of http://Mail.ru

· 21% of Delivery Hero

· 21% of Codecademy

· 15% of Udemy

This makes Prosus one of the Top 10 global consumer internet companies

And by far the largest in Europe, before Adyen, Zalando, Ocado, Delivery Hero and Just Eat

And by far the largest in Europe, before Adyen, Zalando, Ocado, Delivery Hero and Just Eat

And by far the largest in Europe, before Adyen, Zalando, Ocado, Delivery Hero and Just Eat

And by far the largest in Europe, before Adyen, Zalando, Ocado, Delivery Hero and Just Eat

Great! So this is basically an investment company. What is the master plan?

Naspers made an early and extremely successful bet on Tencent back in 2001

Naspers made an early and extremely successful bet on Tencent back in 2001

Tencent is growing and hold a stake in many Chinese and international gaming, e-commerce and entertainment companies

Tencent is growing and hold a stake in many Chinese and international gaming, e-commerce and entertainment companies

Naspers made an early and extremely successful bet on Tencent back in 2001

Naspers made an early and extremely successful bet on Tencent back in 2001 Tencent is growing and hold a stake in many Chinese and international gaming, e-commerce and entertainment companies

Tencent is growing and hold a stake in many Chinese and international gaming, e-commerce and entertainment companies

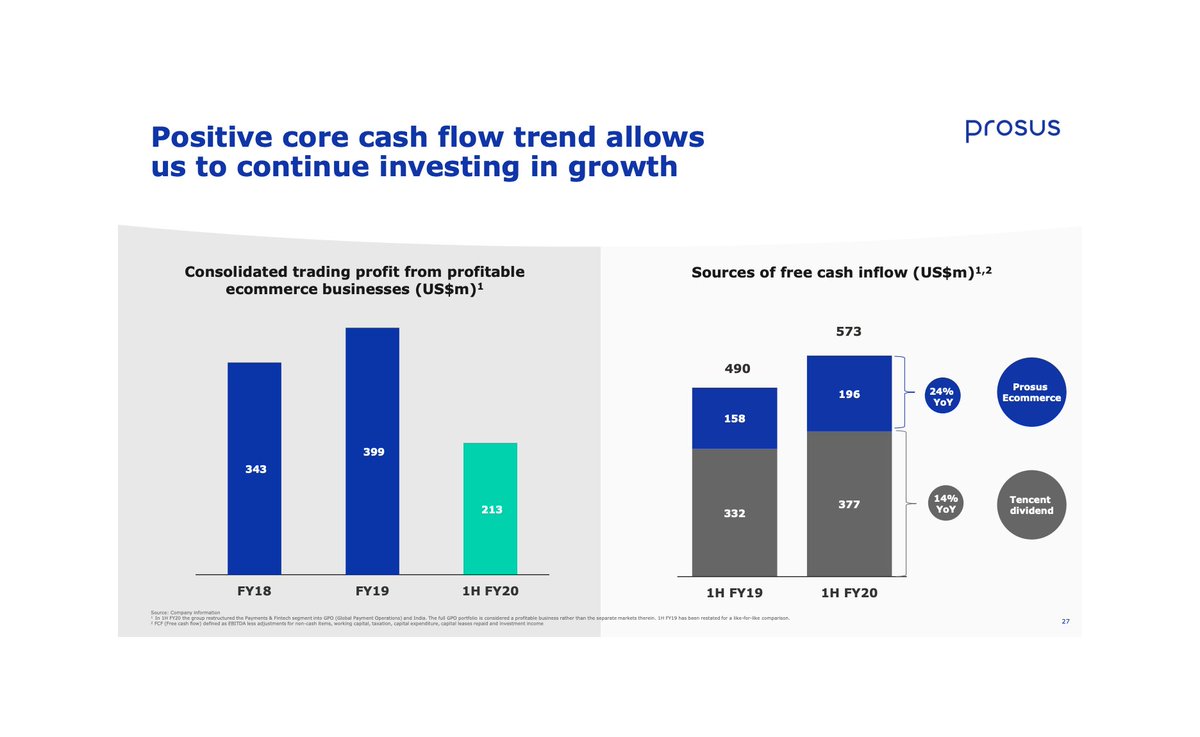

Tencent’s operations enable it to pay a dividend to its shareholders

Tencent’s operations enable it to pay a dividend to its shareholders By holding 31% of Tencent, Prosus got a $ 377m dividend during H1 ’20

By holding 31% of Tencent, Prosus got a $ 377m dividend during H1 ’20 Prosus invest this dividend back into new ventures

Prosus invest this dividend back into new ventures

“Prosus accounts for the Tencent stake as an “equity accounted investment” - a single line that added $3.41 billion euros to Prosus’ 2019 pretax profit.”

From https://www.reuters.com/article/us-prosus-ipo-factbox/factbox-prosus-tech-heavyweight-with-tencent-stake-to-list-in-amsterdam-idUKKCN1VV1TM

From https://www.reuters.com/article/us-prosus-ipo-factbox/factbox-prosus-tech-heavyweight-with-tencent-stake-to-list-in-amsterdam-idUKKCN1VV1TM

Yes! Prosus can count on solid free cash inflows from Tencent

But what is it investing into?

Classifieds

Classifieds

Food Delivery

Food Delivery

Payments and Fintech

Payments and Fintech

EdTech

EdTech

Internet platforms

Internet platforms

But what is it investing into?

Classifieds

Classifieds Food Delivery

Food Delivery Payments and Fintech

Payments and Fintech EdTech

EdTech Internet platforms

Internet platforms

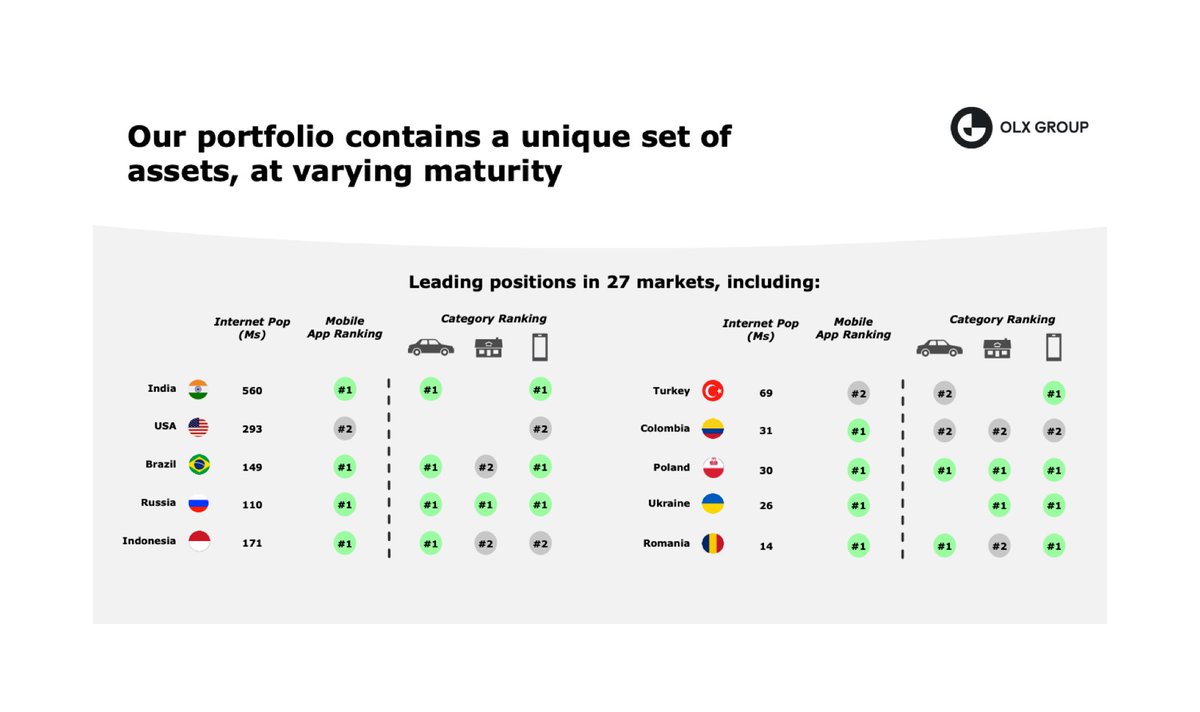

And its investments are focussed on:

China

China

India

India

Russia

Russia

Brazil

Brazil

Europe

Europe

In which it has a LEADING position

China

China India

India Russia

Russia Brazil

Brazil Europe

EuropeIn which it has a LEADING position

Why these geographies

Why these geographies Prosus is trying to replicate its Tencent investment of 2001 by investing in the new giants of today’s growing economics

Prosus is trying to replicate its Tencent investment of 2001 by investing in the new giants of today’s growing economics

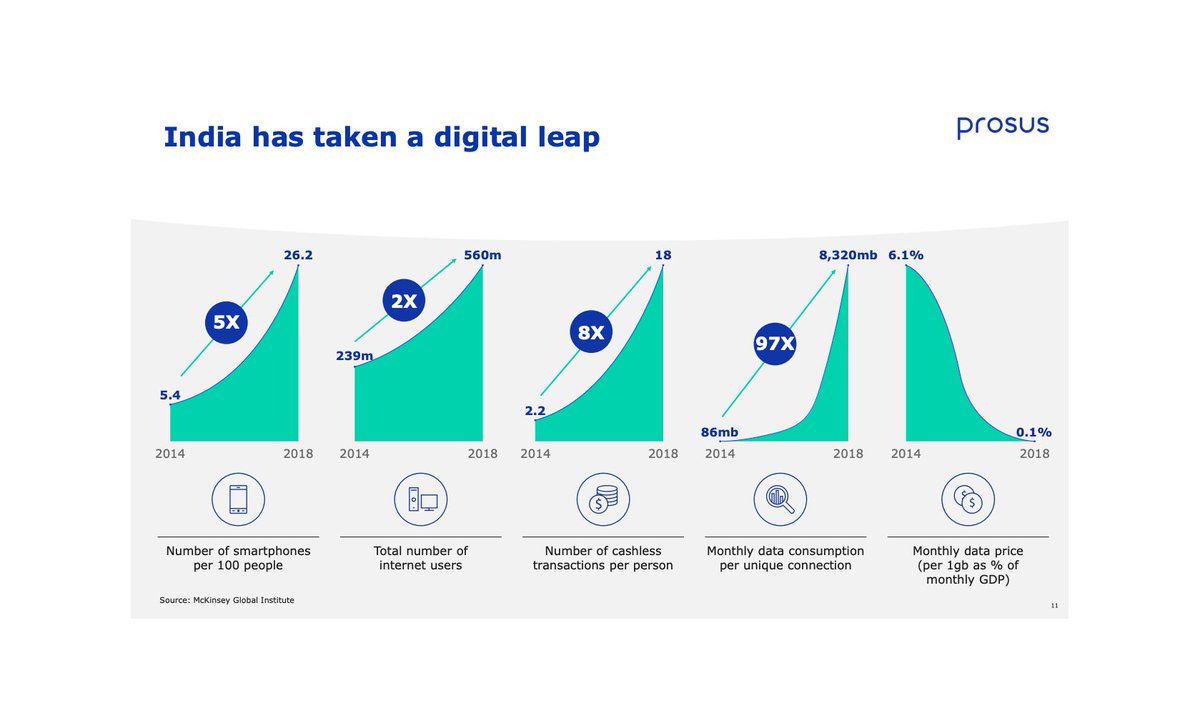

As an illustration, here is a look at the Indian market:

Number of cashless transaction were multiplied by 8 over the 2014 - 2018 period

Number of cashless transaction were multiplied by 8 over the 2014 - 2018 period

Internet users doubled over the same period

Internet users doubled over the same period

Internet costs decreased while data consumption was multiplied by 97

Internet costs decreased while data consumption was multiplied by 97

Number of cashless transaction were multiplied by 8 over the 2014 - 2018 period

Number of cashless transaction were multiplied by 8 over the 2014 - 2018 period Internet users doubled over the same period

Internet users doubled over the same period Internet costs decreased while data consumption was multiplied by 97

Internet costs decreased while data consumption was multiplied by 97

Great! So it is playing in GROWING markets

But how does it selects its champions?

But how does it selects its champions?

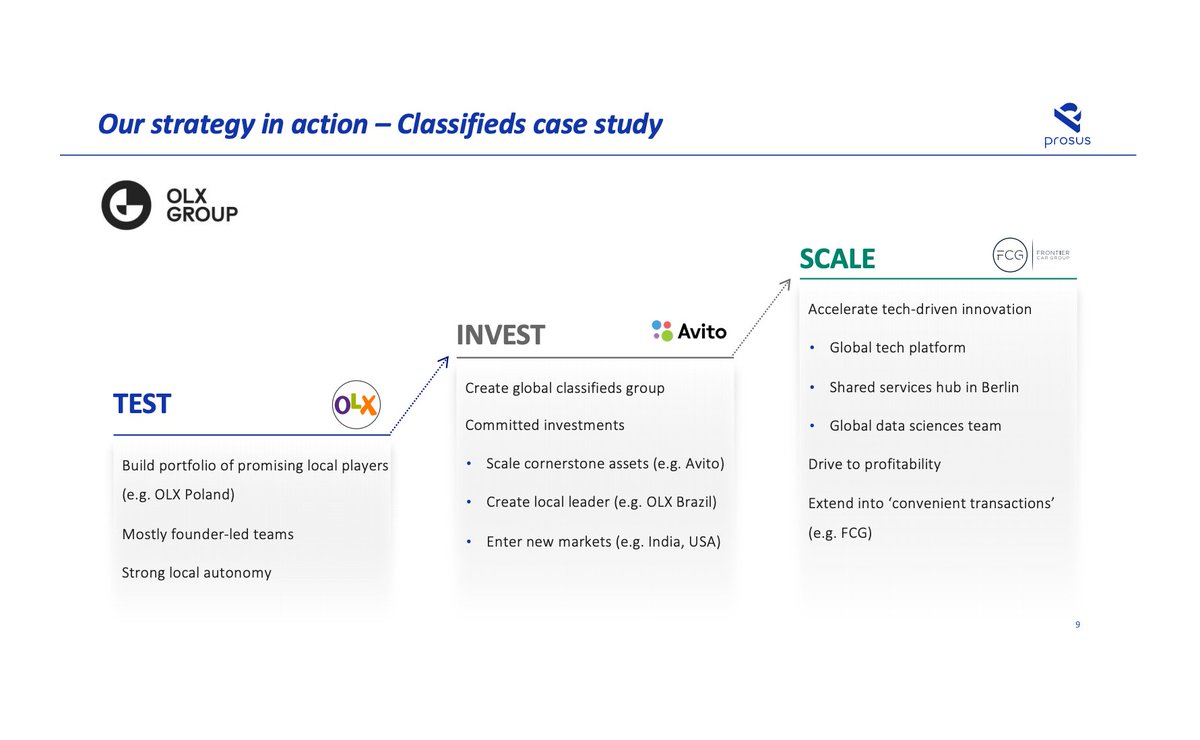

Across its different sectors, it applies a Test - Invest - Scale methodology

Across its different sectors, it applies a Test - Invest - Scale methodology

But how does it selects its champions?

But how does it selects its champions? Across its different sectors, it applies a Test - Invest - Scale methodology

Across its different sectors, it applies a Test - Invest - Scale methodology

It builds a portfolio of promising and founder-led local players

It builds a portfolio of promising and founder-led local players Enables its player to take the lead in its market by providing its cash, expertise and network

Enables its player to take the lead in its market by providing its cash, expertise and network Scales the business by providing a shared service hub and additional capital

Scales the business by providing a shared service hub and additional capital

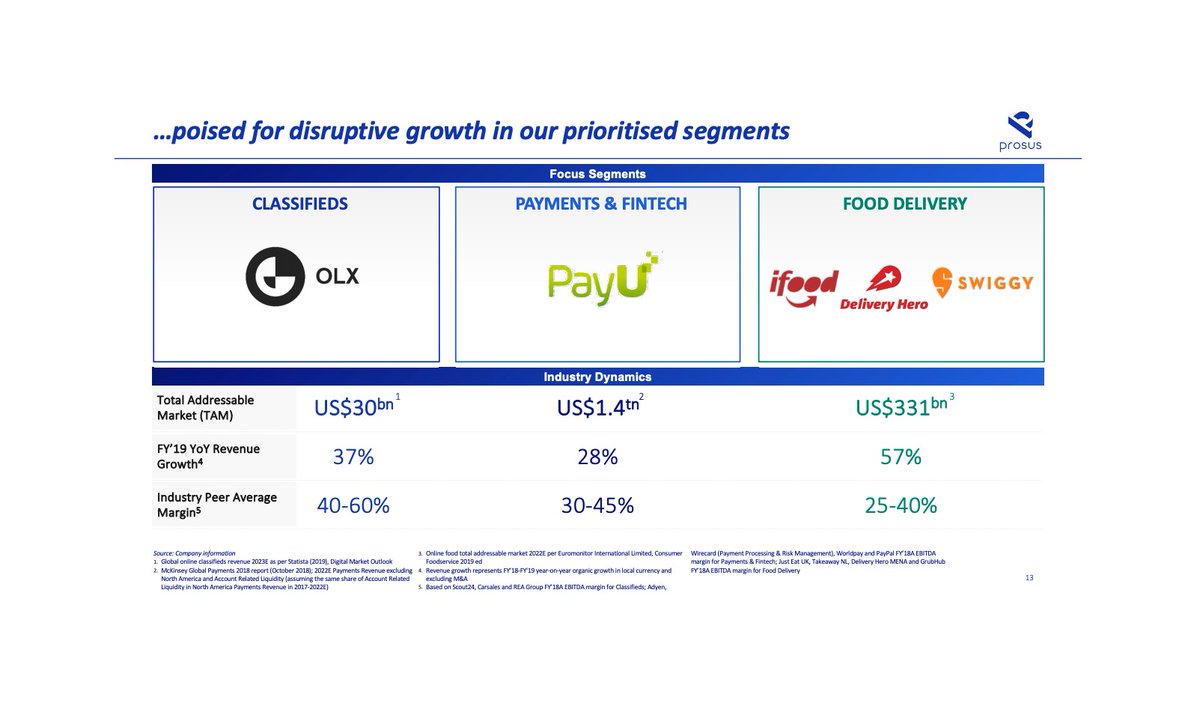

How is Prosus picking sectors?

Prosus chases LARGE and growing total addressable markets

Prosus chases LARGE and growing total addressable markets

Classifieds market is valued at $ 30B by 2023

Classifieds market is valued at $ 30B by 2023

Payments and fintech market is valued at $ 1.4T by 2022

Payments and fintech market is valued at $ 1.4T by 2022

Food delivery market is valued at $ 331B by 2022

Food delivery market is valued at $ 331B by 2022

Prosus chases LARGE and growing total addressable markets

Prosus chases LARGE and growing total addressable markets Classifieds market is valued at $ 30B by 2023

Classifieds market is valued at $ 30B by 2023 Payments and fintech market is valued at $ 1.4T by 2022

Payments and fintech market is valued at $ 1.4T by 2022 Food delivery market is valued at $ 331B by 2022

Food delivery market is valued at $ 331B by 2022

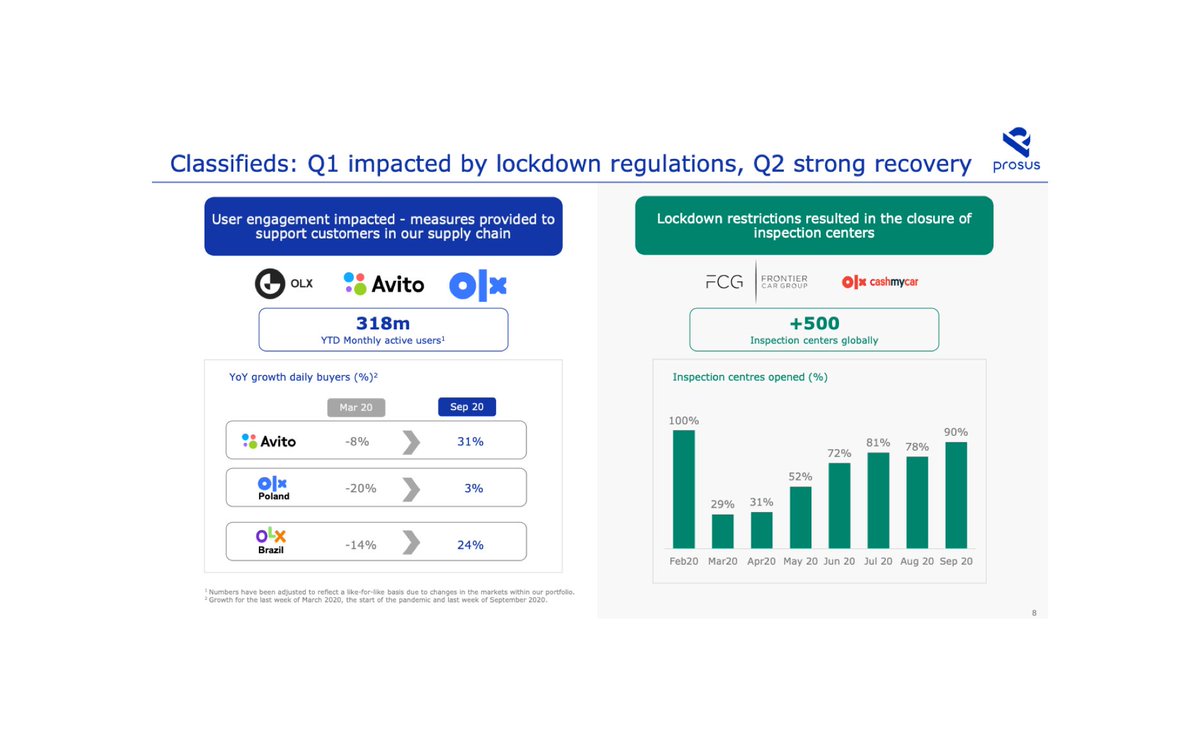

Classifieds

Classifieds Prosus owns 100% of OLX and Avito and 80% of LetGo

Prosus owns 100% of OLX and Avito and 80% of LetGo Their brands are leading the market in India, Brazil, Russia and Indonesia

Their brands are leading the market in India, Brazil, Russia and Indonesia It is making inroads into the auto market with FCG and OLX Cash My Car

It is making inroads into the auto market with FCG and OLX Cash My Car

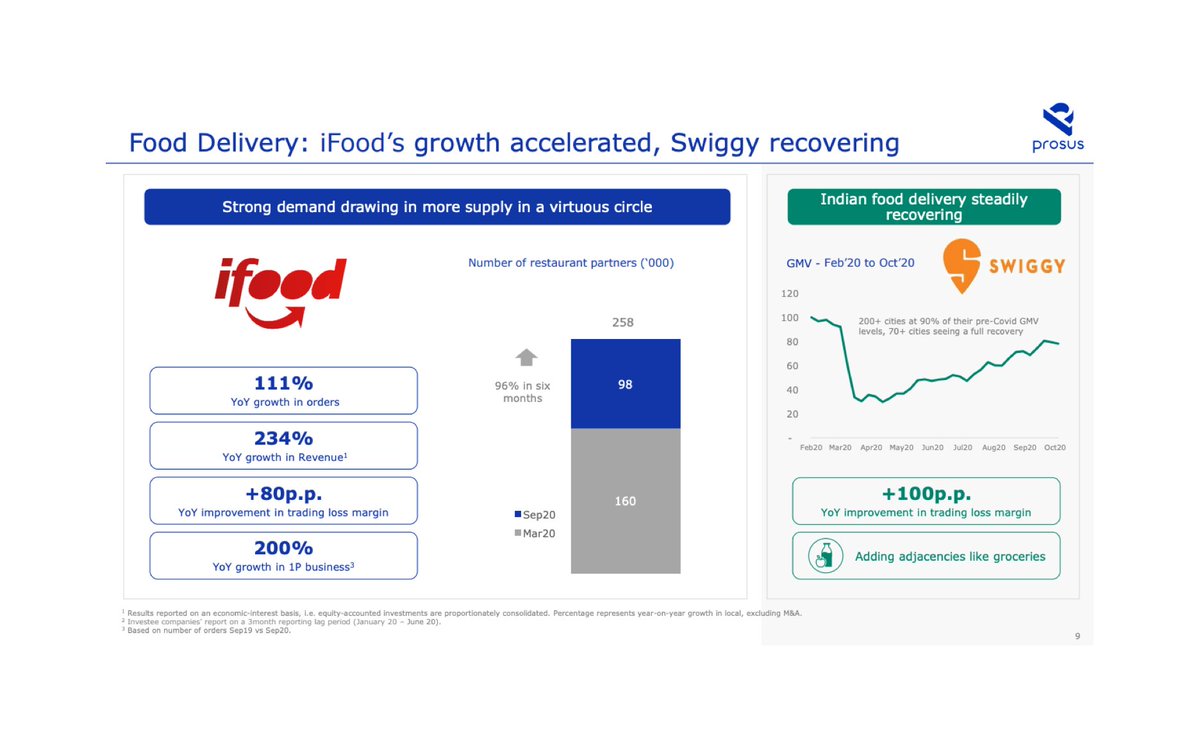

Food Delivery

Food Delivery Prosus owns 55% of iFood (Brazil), 39% of Swiggy (India) and 22% of Delivery Hero (Global)

Prosus owns 55% of iFood (Brazil), 39% of Swiggy (India) and 22% of Delivery Hero (Global) Brands are leading in Brazil and India and score above 100% YoY growth

Brands are leading in Brazil and India and score above 100% YoY growth Prosus aims to drive sales to $ 15B by 2025, up from $ 4.5B today

Prosus aims to drive sales to $ 15B by 2025, up from $ 4.5B today

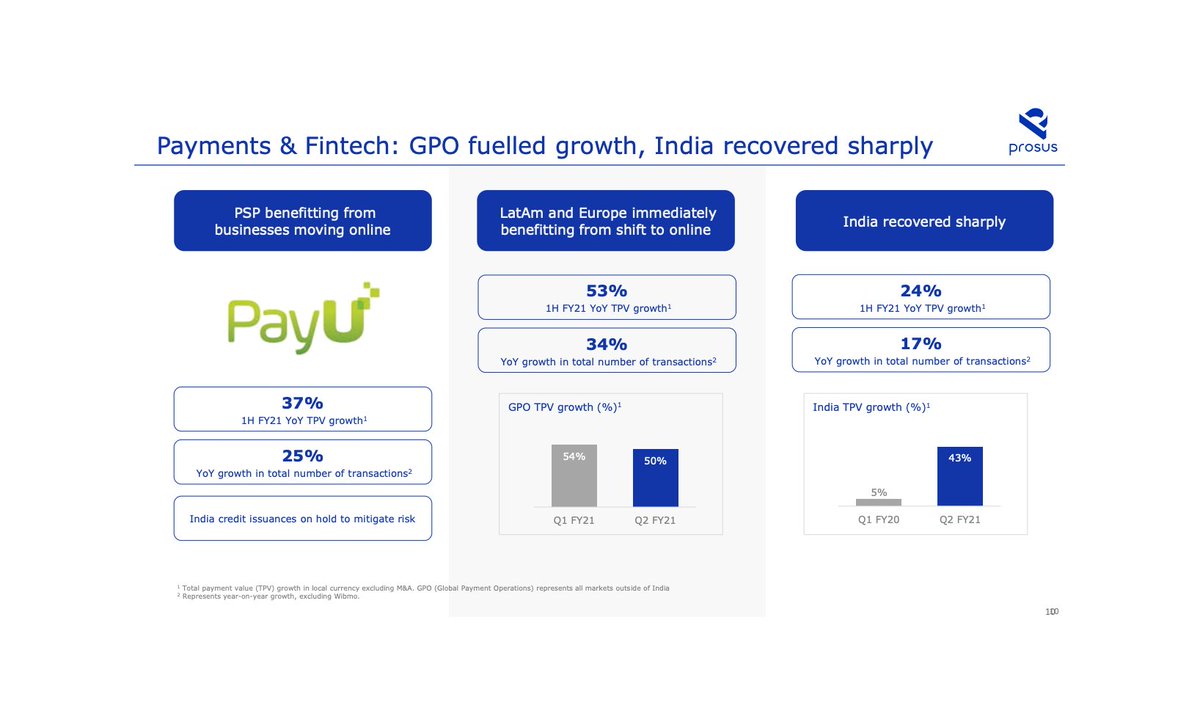

Payments and Fintech

Payments and Fintech Prosus owns 99% of PayU, a Stripe and Adyen competitor in India

Prosus owns 99% of PayU, a Stripe and Adyen competitor in India PayU generated 37% YoY growth in TPV during H1 ’20

PayU generated 37% YoY growth in TPV during H1 ’20 Prosus aims to drive sales to $ 10 - 15B by 2025, up from $ 3B today

Prosus aims to drive sales to $ 10 - 15B by 2025, up from $ 3B today

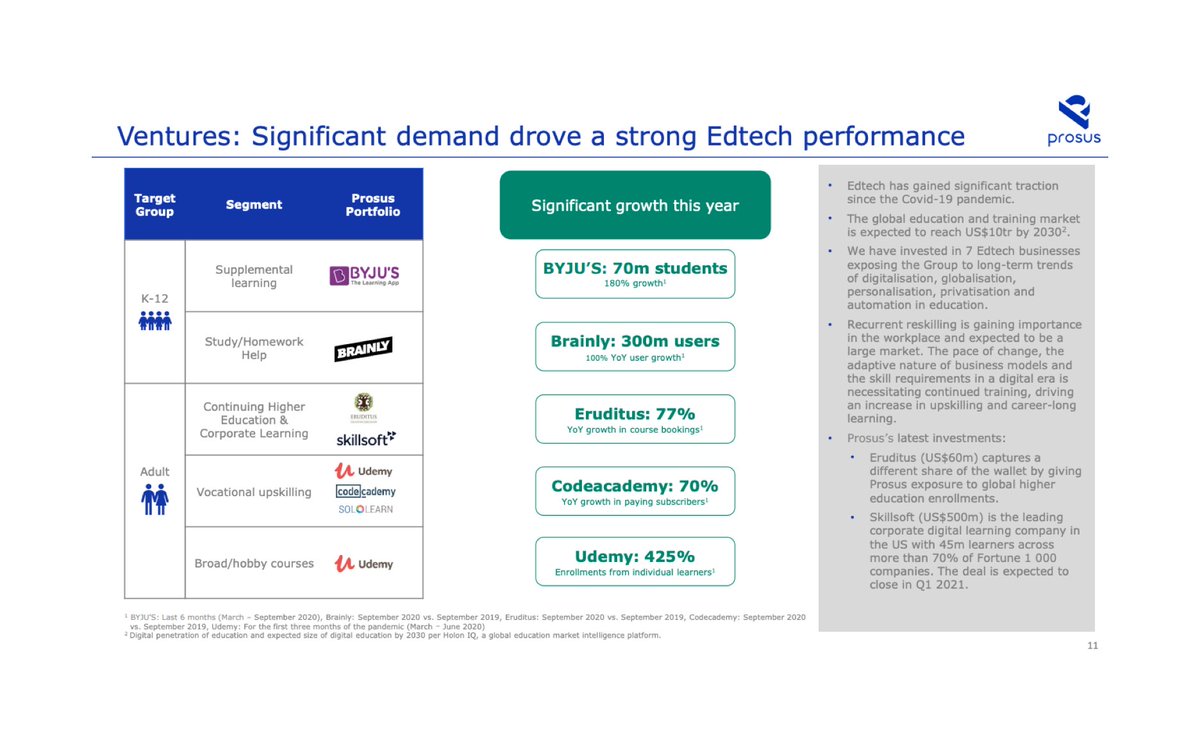

EdTech

EdTech Prosus owns 15% of Udemy, 44% of Brainly and 21% of Codecademy

Prosus owns 15% of Udemy, 44% of Brainly and 21% of Codecademy It invested $ 1B across 7 companies and these are growing their user base by +60% YoY

It invested $ 1B across 7 companies and these are growing their user base by +60% YoY Prosus recently invested $ 500m in Skillsoft which counts of 70% of Fortune 1000 companies as their clients

Prosus recently invested $ 500m in Skillsoft which counts of 70% of Fortune 1000 companies as their clients

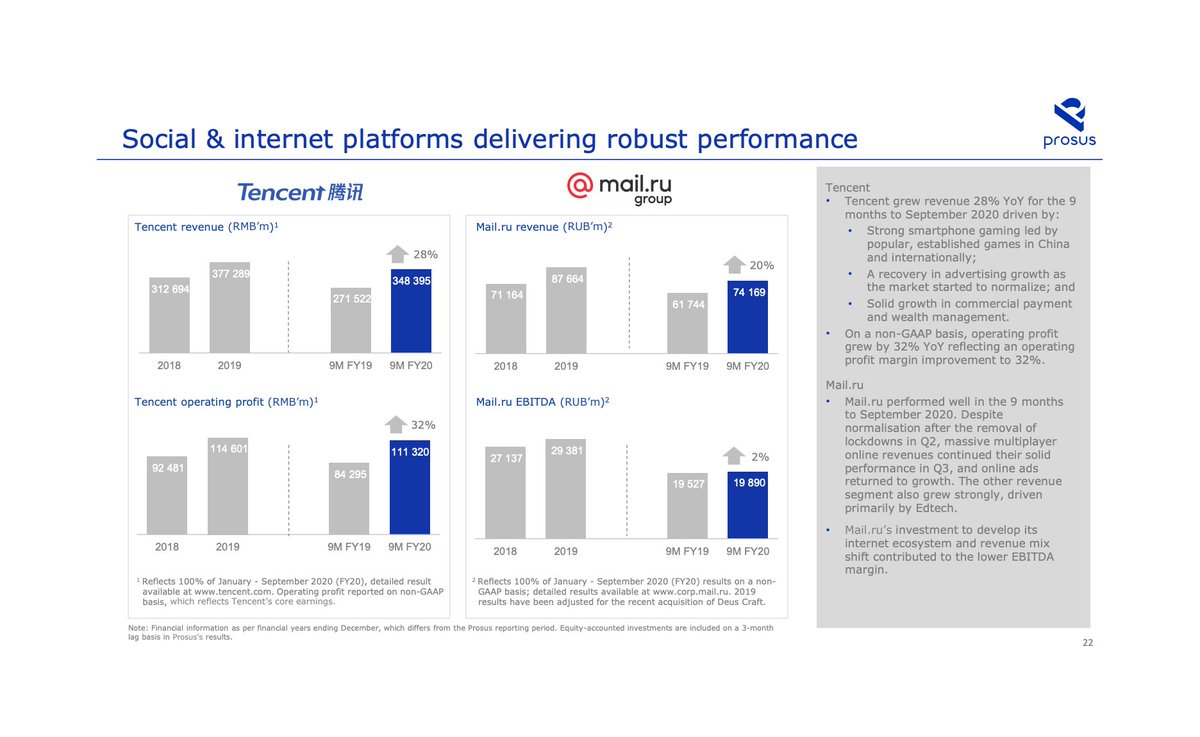

Internet platforms

Internet platforms Prosus owns 31% of Tencent and 28% of http://Mail.ru (one of Russia's largest e-commerce and social media)

Prosus owns 31% of Tencent and 28% of http://Mail.ru (one of Russia's largest e-commerce and social media) Tencent’s sales grew 28% YoY while http://Mail.ru grew by 20%

Tencent’s sales grew 28% YoY while http://Mail.ru grew by 20% Prosus invested another $ 25m in http://Mail.ru

Prosus invested another $ 25m in http://Mail.ru

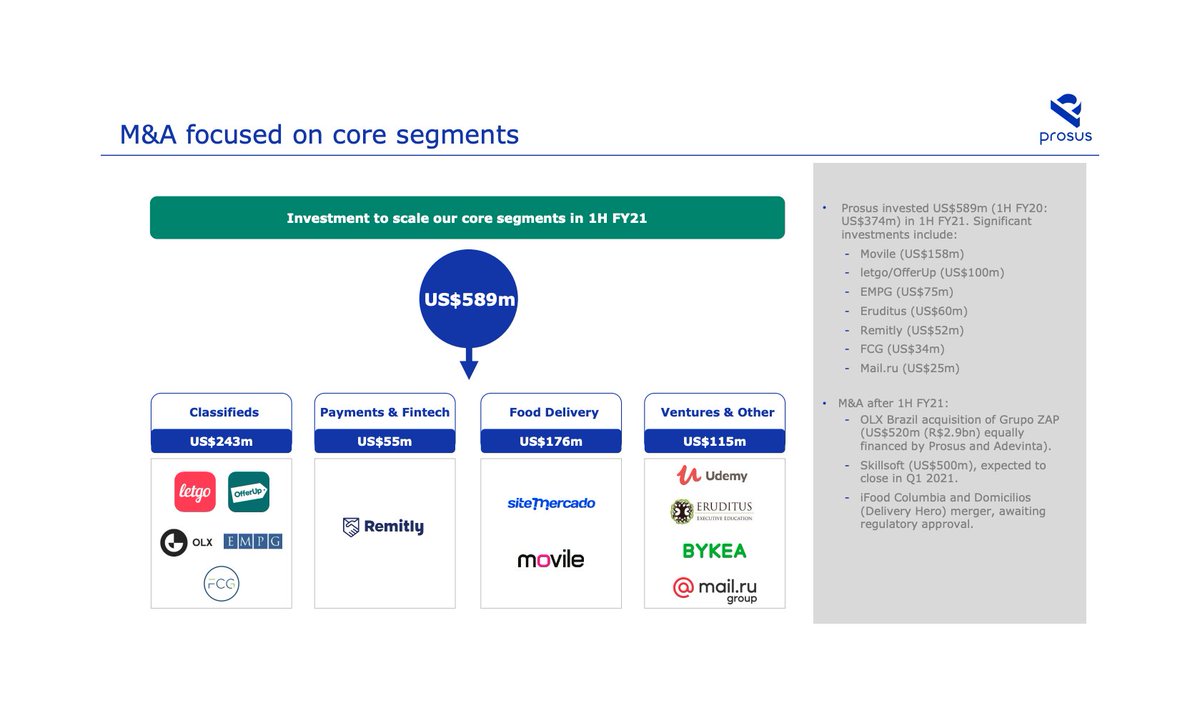

Prosus invested $ 589m in portfolio and new businesses in H1 2021

Invested $ 52m in Remitly, the fund transfer app

Invested $ 52m in Remitly, the fund transfer app

Invested $ 158m in Movile, a Brazilin investment group with a stake in iFood

Invested $ 158m in Movile, a Brazilin investment group with a stake in iFood

Invested $ 100m in LetGo / OfferUp and merged these 2 competitors

Invested $ 100m in LetGo / OfferUp and merged these 2 competitors

Invested $ 52m in Remitly, the fund transfer app

Invested $ 52m in Remitly, the fund transfer app Invested $ 158m in Movile, a Brazilin investment group with a stake in iFood

Invested $ 158m in Movile, a Brazilin investment group with a stake in iFood Invested $ 100m in LetGo / OfferUp and merged these 2 competitors

Invested $ 100m in LetGo / OfferUp and merged these 2 competitors

Financials Check

Financials Check

Revenue grew to $ 12.7B in H1 ’20 up 28% YoY from $ 9.9B the previous year

Revenue grew to $ 12.7B in H1 ’20 up 28% YoY from $ 9.9B the previous year 141% revenue growth in food delivery

141% revenue growth in food delivery 70% revenue growth in etail

70% revenue growth in etail 54% revenue growth in edtech

54% revenue growth in edtech

Trading profit reached $ 2.7B in H1 ’20 up 39% from $ 1.9B the previous year

Trading profit reached $ 2.7B in H1 ’20 up 39% from $ 1.9B the previous year Free cash flow jumped from US$14m to US$370m driven by lower food losses, strong working-cap

Free cash flow jumped from US$14m to US$370m driven by lower food losses, strong working-cap

THE BOTTOM LINE

THE BOTTOM LINE

Prosus is a holding company focussed on high growth sectors in emerging geographies

Prosus is a holding company focussed on high growth sectors in emerging geographies It scouts for leading founder-led companies and then enables it to scale in its market

It scouts for leading founder-led companies and then enables it to scale in its market

Prosus invests in markets often overlooked by global tech giants, providing a unique opportunity to invest in fast growing markets such as Brazil and India

Prosus invests in markets often overlooked by global tech giants, providing a unique opportunity to invest in fast growing markets such as Brazil and India Its activities are funded for a large part by it’s Tencent stake (31% of Tencent) and the dividends it gets from it

Its activities are funded for a large part by it’s Tencent stake (31% of Tencent) and the dividends it gets from it

Prosus invests in non-public companies in fast growing markets, providing an excellent entry point into these

Prosus invests in non-public companies in fast growing markets, providing an excellent entry point into these Prosus is a holding company and that comes at a discount versus the fair value of the sum of its holdings

Prosus is a holding company and that comes at a discount versus the fair value of the sum of its holdings We take a full stake into Prosus

We take a full stake into Prosus

Disclaimer - This is not investment advice in any form and investors are responsible for conducting their own research before investing.

Sources

✑ Investor presentation

✑ Company website

✑ Reuters

✑ Wall Street Journal

✑ TechCrunch

Sources

✑ Investor presentation

✑ Company website

✑ Reuters

✑ Wall Street Journal

✑ TechCrunch

Hope you liked this thread!

For more content, follow us on Twitter

For more content, follow us on Twitter

EASY BRIEFINGS delivered straight to your inbox

EASY BRIEFINGS delivered straight to your inbox  Don’t MISS IT

Don’t MISS IT  https://getbenchmark.substack.com

https://getbenchmark.substack.com

For more content, follow us on Twitter

For more content, follow us on Twitter

EASY BRIEFINGS delivered straight to your inbox

EASY BRIEFINGS delivered straight to your inbox  Don’t MISS IT

Don’t MISS IT  https://getbenchmark.substack.com

https://getbenchmark.substack.com

Read on Twitter

Read on Twitter