Lessons: filter out shitty businesses as quickly as possible, don’t waste time on things you don’t want to own a long time (cont’d)

less emphasis on valuation, more on long term dynamics of the business and market company competes in.

More fintwit, less sell side research

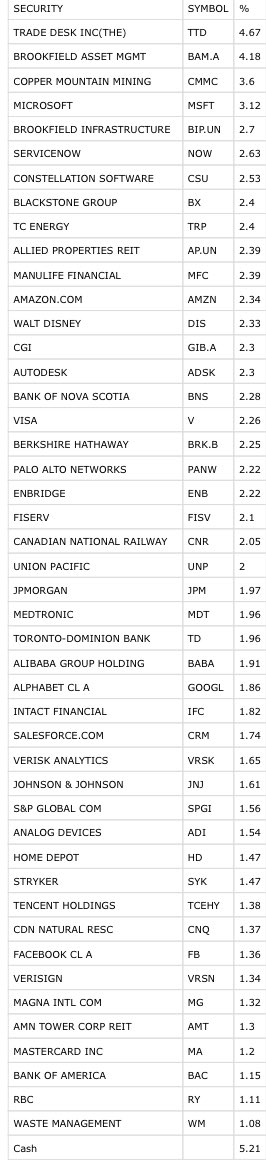

Position sizing — add to winners, reduce holdings as conviction decreases. “Don’t water the weeds and cut the roses”

Opportunity costs... weighing new position vs existing holdings, often best thing to add is something I already own.

gaps in market expectations vs actual results...eg. periods of poor sentiment for certain names brought on by factors unrelated to cash flow is an opportunity— for instance pipelines $ENB $TRP and Renewables

gaps in market expectations vs actual results...this also comes from businesses that grow faster and maintain growth far longer than market expects.

Keep thesis as simple as possible... eg. what are the 1-3 judgements I’m making that will lead to a good long term outcome. If I’m wrong on any of 1-3, how badly will it hurt?

Think in probabilities. If I never see another DCF in my lifetime, it won’t make much difference in my process.

Read on Twitter

Read on Twitter