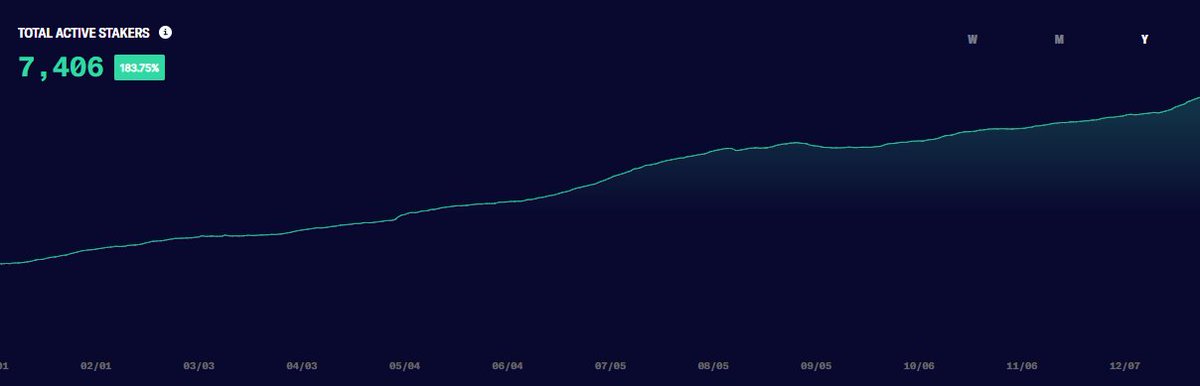

Digging into #Synthetix #Staking rewards... protocol’s inflationary monetary policy will increase SNX supply +1.25% weekly thru Sept'23, after which falls to +2.5% annual inflation into perpetuity. These SNX tokens are distributed to SNX stakers weekly... 1/n

There are two primary incentives for staking your SNX to support the Synths collateral pool... 1) Exchange Rewards (fee's captured from trades on the Synthetix exchange)... and 2) Staking Rewards (inflation pay out)... 2/n

To earn any rewards on your stake, you must maintain a collateralization ratio > 750% ..... designed to ensure Synths pool is backed by sufficient collateral to absorb large price shocks.

So what's the yield? current yield on staking $SNX to the Synth collateral pool is ... 29.54% APY! This is 6.65% yield from exchange trading fees collected and distributed to stakers + 22.89% in inflationary rewards...

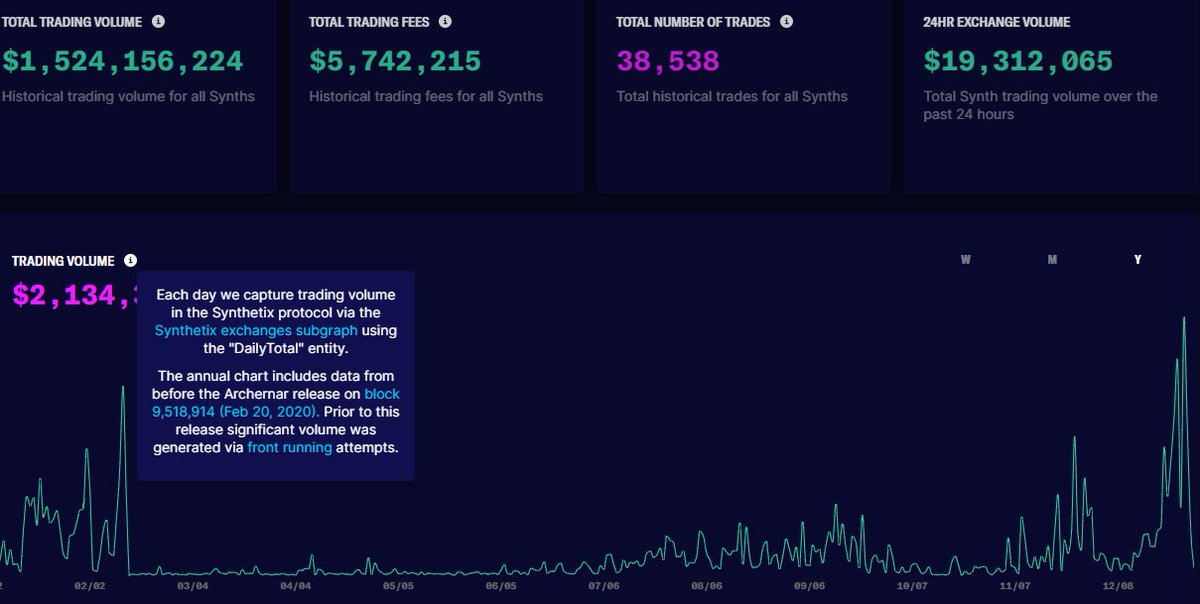

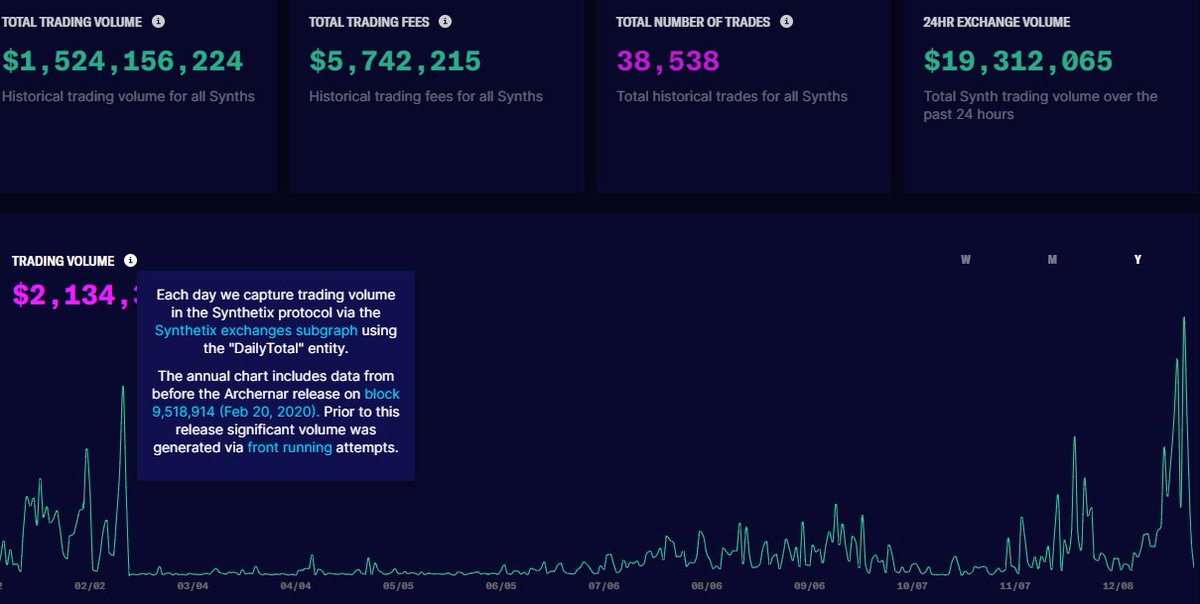

Interestingly, YTD trading volume on the exchange is $2.1bn, however pre-February there was a major front running attempt that made up nearly $600M in volume. Seems the official number they want to use is $1.5bn YTD trading volume.

6/n

6/n

$1.5bn trade vol YTD = $5.74M fees, (average 38bps). pretty incredible fee generation when you consider todays BD's earn single digit bps commission and B/O spread generally well below 5bps for large caps.. 7/n

Thing most ppl don't yet understand is #DeFi fee generation is a usurp of the fee's Broker Dealers / centralized platforms capture in the TradFi. The middle is getting automated, and their fee's are being shared. But I think the fee pool is going to be A LOT bigger... 8/n

Many are relating #Staking yield to "fixed Income" (see @staked_us website), however I think of it more as an equity / dividend system. You buy the equity (token), stake to earn the dividend (yield). I'm open to suggestions as to why FI is more relevant than equity/div.... 9/n

Read on Twitter

Read on Twitter