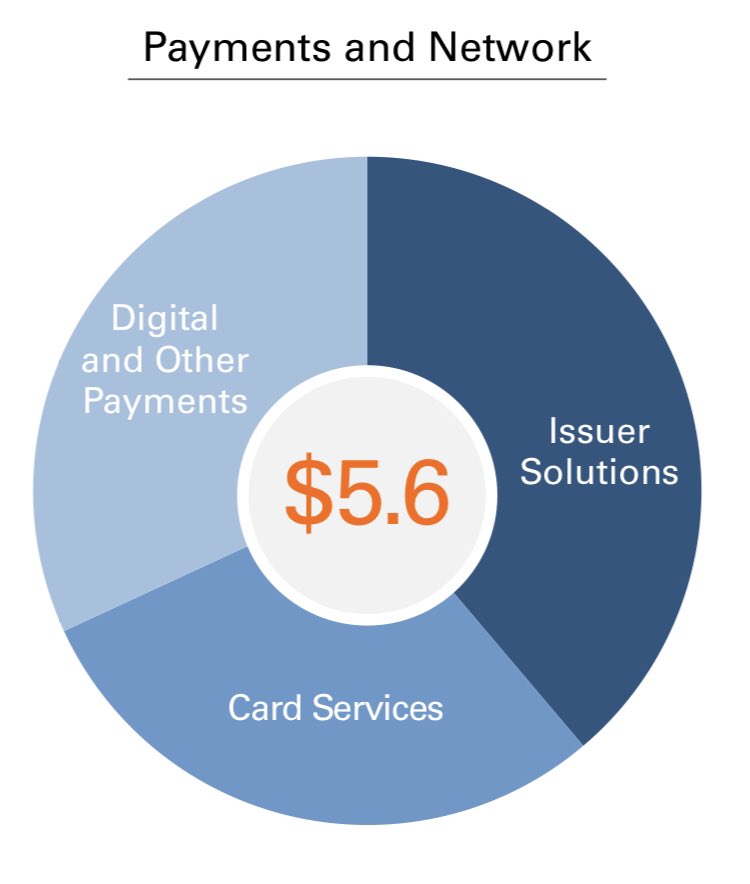

More thoughts on $FISV, digging into the Payments & Network segment (~40% of FISV revenue)

TLDR: Lots of moving parts but this is where the most synergies and growth optionality can be found, with 2 highly complementary and strategic pieces of legacy FISV/FDC now merged together

TLDR: Lots of moving parts but this is where the most synergies and growth optionality can be found, with 2 highly complementary and strategic pieces of legacy FISV/FDC now merged together

1) $FISV Payments & Network is a dynamic set of businesses, best summarized as payment solutions for banks comprising:

- card payments and related services to issuers of all sizes, worldwide (2/3 of segment revenue)

- non-card digital payments: P2P, A2A, RTP, Bill Pay (other 1/3)

- card payments and related services to issuers of all sizes, worldwide (2/3 of segment revenue)

- non-card digital payments: P2P, A2A, RTP, Bill Pay (other 1/3)

2) Focusing first on the $FISV card payments business, today this is the:

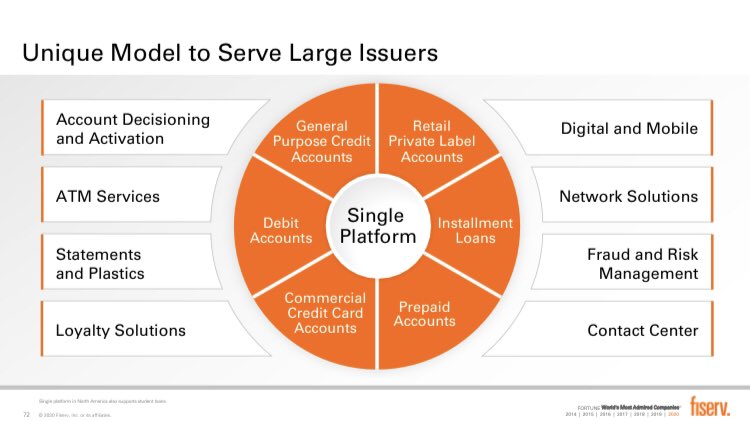

a) undisputed #1 in issuer processing with capabilities across all products (credit, debit, private label, installment loans) operating around the

b) clear #3 debit network in the behind $V and $MA

behind $V and $MA

a) undisputed #1 in issuer processing with capabilities across all products (credit, debit, private label, installment loans) operating around the

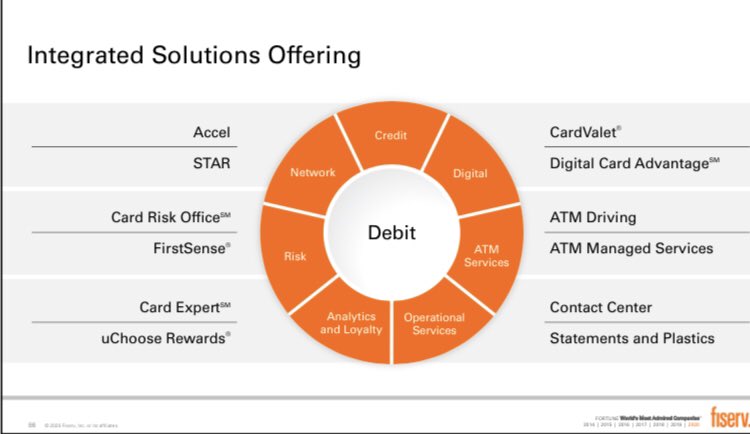

b) clear #3 debit network in the

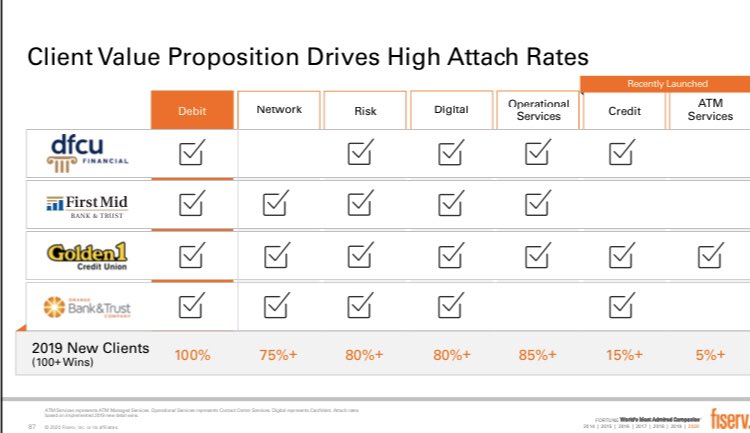

behind $V and $MA

behind $V and $MA

3) Legacy $FISV historically focused on small/mid-sized debit issuers and ATM processing in the  , while FDC served large issuers of both credit and debit around the

, while FDC served large issuers of both credit and debit around the

Through the merger, they also combined 2 of the leading PIN debit networks in : Accel (FISV) + Star (FDC)

: Accel (FISV) + Star (FDC)

, while FDC served large issuers of both credit and debit around the

, while FDC served large issuers of both credit and debit around the

Through the merger, they also combined 2 of the leading PIN debit networks in

: Accel (FISV) + Star (FDC)

: Accel (FISV) + Star (FDC)

4) These $FISV card payments businesses are 2/3 of segment revenue, roughly equally split between:

Issuer Solutions: processing for large issuers

Card Services: processing for small/mid-sized issuers + the PIN debit networks

Lots of synergies across these complementary assets

Issuer Solutions: processing for large issuers

Card Services: processing for small/mid-sized issuers + the PIN debit networks

Lots of synergies across these complementary assets

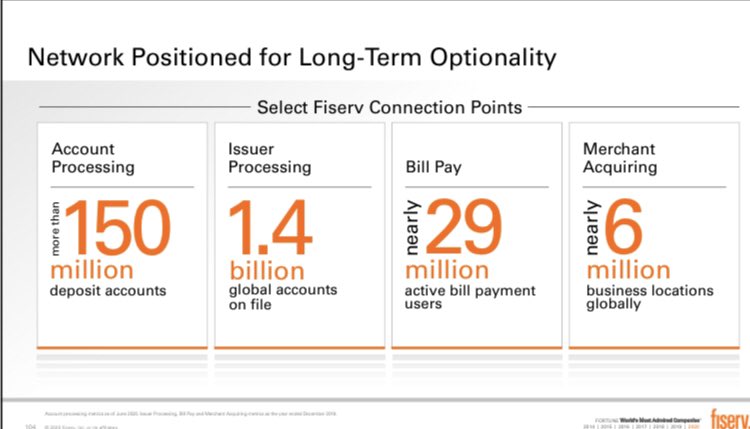

5) The combined issuer businesses of $FISV/FDC process for 1.4B card accounts globally

It’s $3B+ revenue vs. #2 TSYS which is ~$2B and focused on large credit issuers only

In largest market , $FIS, $V DPS, $JKHY also compete as 3rd party processors vs banks’ in-house systems

, $FIS, $V DPS, $JKHY also compete as 3rd party processors vs banks’ in-house systems

It’s $3B+ revenue vs. #2 TSYS which is ~$2B and focused on large credit issuers only

In largest market

, $FIS, $V DPS, $JKHY also compete as 3rd party processors vs banks’ in-house systems

, $FIS, $V DPS, $JKHY also compete as 3rd party processors vs banks’ in-house systems

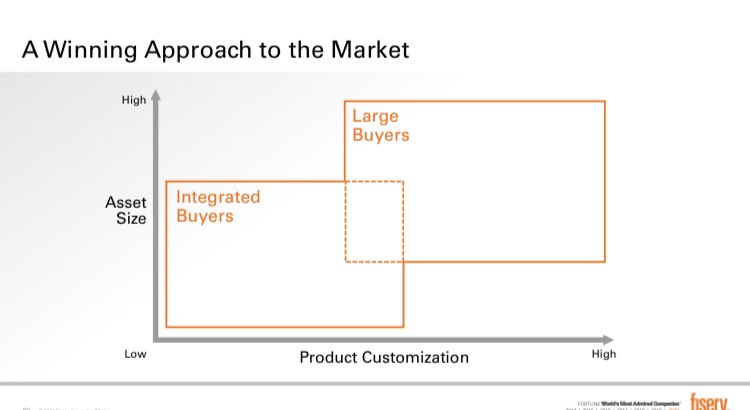

6) Since it serves such a diverse set of banks, $FISV organizes issuer processing to target 2 distinct sets of customers:

- large issuers seeking customized, a la cart solutions fit for need

- smaller banks that prefer integrated solutions, bundled around core processing

- large issuers seeking customized, a la cart solutions fit for need

- smaller banks that prefer integrated solutions, bundled around core processing

7) The $FISV large issuer business is $2B+ revenue and serves 26 of top 50 US credit issuers (12 of these combined credit and debit), 5 of top 6 US private label issuers, 5 of top 10 issuers in EMEA, 7 of top 12 credit issuers in India and a growing presence in LatAm

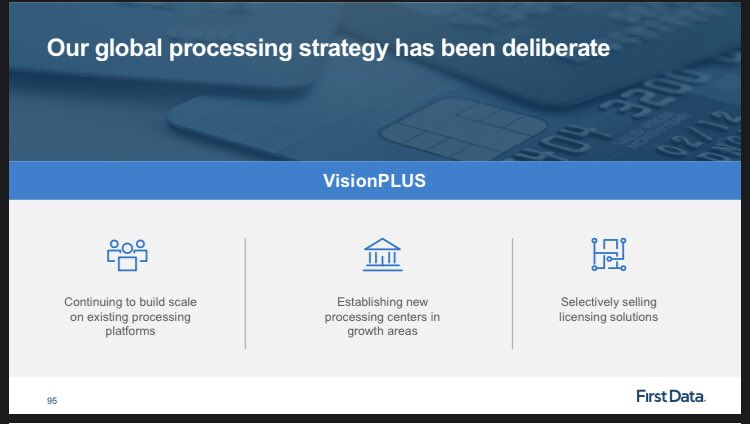

8) $FISV issuer processing operates 2 FDC platforms: Optis ( ) and VisionPlus (

) and VisionPlus ( ), the latter either fully outsourced processing or as software license for banks to run in-house

), the latter either fully outsourced processing or as software license for banks to run in-house

Coincidentally, legacy FISV was already using VisionPlus as it’s underlying issuer processing stack

) and VisionPlus (

) and VisionPlus ( ), the latter either fully outsourced processing or as software license for banks to run in-house

), the latter either fully outsourced processing or as software license for banks to run in-houseCoincidentally, legacy FISV was already using VisionPlus as it’s underlying issuer processing stack

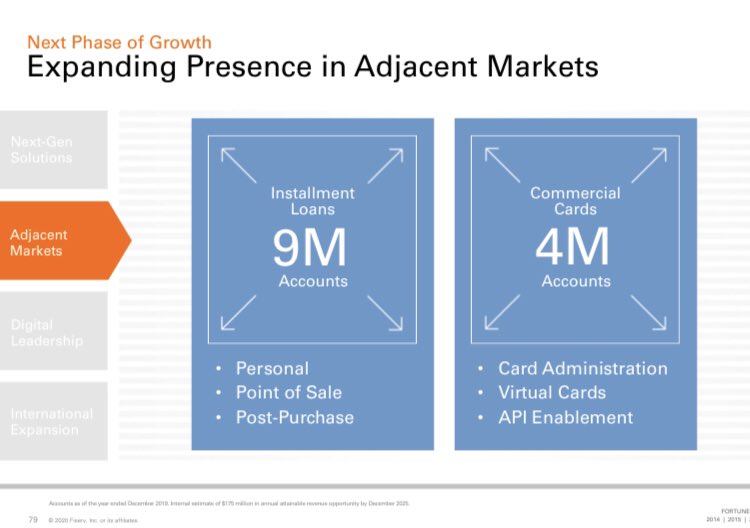

9) In the  market, $FISV issuer processing is focusing on extending reach of Optis with large issuers (recently won $ADS and 2 other top 25), while expanding in adjacent growth markets: processing installment/BNPL loans and commercial/B2B cards on the same platform

market, $FISV issuer processing is focusing on extending reach of Optis with large issuers (recently won $ADS and 2 other top 25), while expanding in adjacent growth markets: processing installment/BNPL loans and commercial/B2B cards on the same platform

market, $FISV issuer processing is focusing on extending reach of Optis with large issuers (recently won $ADS and 2 other top 25), while expanding in adjacent growth markets: processing installment/BNPL loans and commercial/B2B cards on the same platform

market, $FISV issuer processing is focusing on extending reach of Optis with large issuers (recently won $ADS and 2 other top 25), while expanding in adjacent growth markets: processing installment/BNPL loans and commercial/B2B cards on the same platform

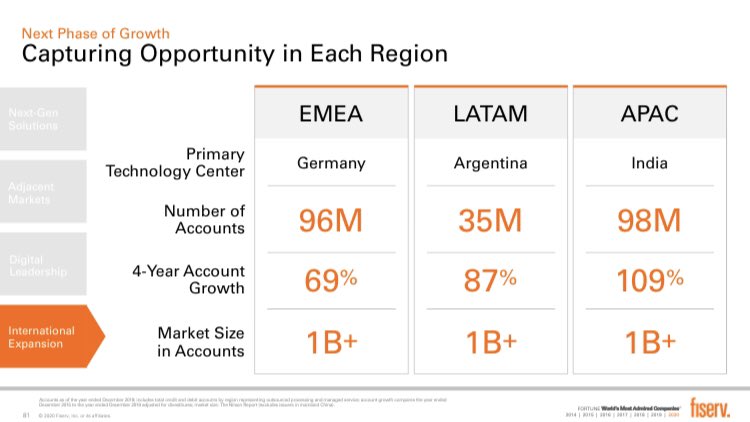

10) Already well positioned around  (doubling accounts processed ex-US since 2016), $FISV has a long runway to continue scaling VisionPlus overseas where billions of accounts are still processed in-house

(doubling accounts processed ex-US since 2016), $FISV has a long runway to continue scaling VisionPlus overseas where billions of accounts are still processed in-house

Ample green field opportunity for the leading 3rd party processor to grow

(doubling accounts processed ex-US since 2016), $FISV has a long runway to continue scaling VisionPlus overseas where billions of accounts are still processed in-house

(doubling accounts processed ex-US since 2016), $FISV has a long runway to continue scaling VisionPlus overseas where billions of accounts are still processed in-houseAmple green field opportunity for the leading 3rd party processor to grow

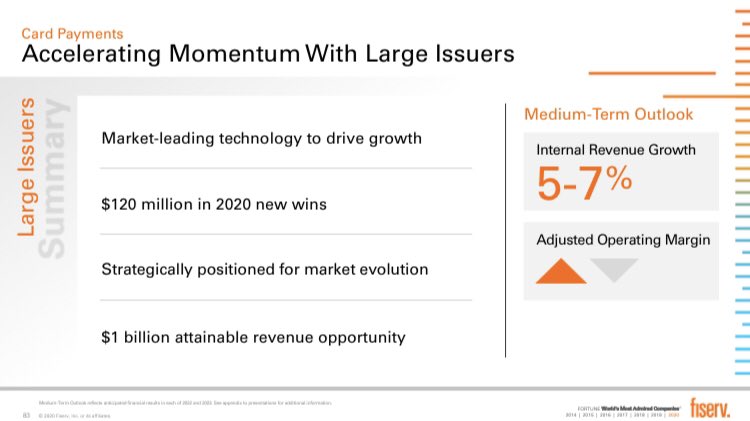

11) For this large issuer subsegment, $FISV is guiding to 5-7% organic growth, which on current $2B+ revenue base is ~$100-150M/yr — not heroic given the $1B attainable revenue opportunity identified: $600M between new solutions/adjacent markets and $400M via international growth

12) Integrated Solutions is the other $FISV issuer processing unit, which serves 3,500+ small/mid-sized banks in  that overlap with FISV’s core processing footprint

that overlap with FISV’s core processing footprint

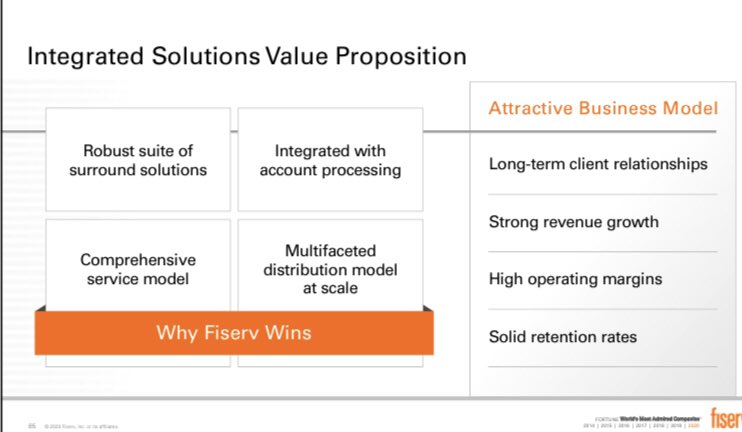

With nearly $1B revenue, its tightly bundled card processing + core account processing drives differentiation https://twitter.com/bluetoothdds/status/1339437491548516352

that overlap with FISV’s core processing footprint

that overlap with FISV’s core processing footprintWith nearly $1B revenue, its tightly bundled card processing + core account processing drives differentiation https://twitter.com/bluetoothdds/status/1339437491548516352

13) The $FISV integrated offering is quite simple — surround debit processing with ATM, credit, PIN network, loyalty, risk, etc — all services that small banks and credit unions need to compete effectively, delivered by a single provider leveraging the existing core relationship

14) Every bank today offers debit cards and $FISV is highly successful cross selling these other services, typically signing up 100+ small banks/yr to debit processing with 75%+ attach rates on other surrounds

Credit (through FDC Optis) + ATM (from 2018 Elan acq’n) are still new

Credit (through FDC Optis) + ATM (from 2018 Elan acq’n) are still new

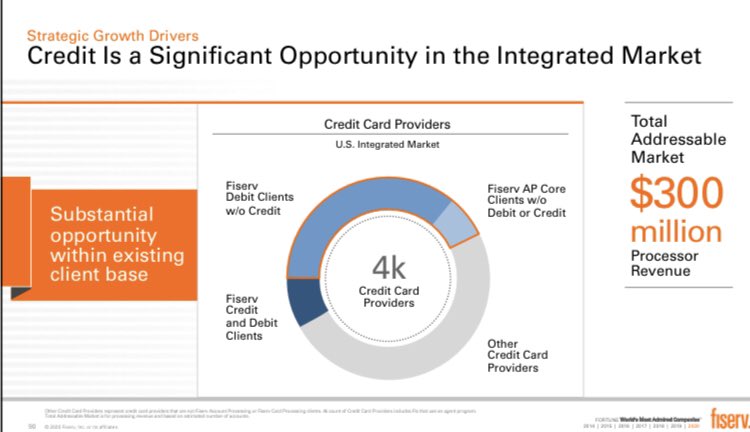

15) Ability to process credit for small bank/credit unions was a big gap that $FISV filled now with FDC’s Optis platform

The TAM is 4K banks: FISV provides credit processing today for ~400. At 75% attach rate to banks it already provides debit processing, FISV could add 1K+ more

The TAM is 4K banks: FISV provides credit processing today for ~400. At 75% attach rate to banks it already provides debit processing, FISV could add 1K+ more

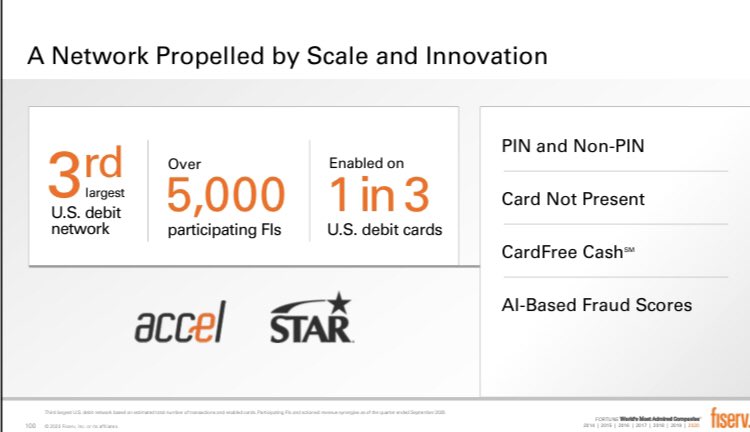

16) The other half of the $FISV Card Services segment is the network assets of combined Star/Accel, together ~$700M revenue

Enabled on the back of 1 in every 3 debit cards in with 5K participating issuers, FISV owns the clear #3 US debit network with ~25% share behind V/MA https://twitter.com/bluetoothdds/status/1245826416324661248

with 5K participating issuers, FISV owns the clear #3 US debit network with ~25% share behind V/MA https://twitter.com/bluetoothdds/status/1245826416324661248

Enabled on the back of 1 in every 3 debit cards in

with 5K participating issuers, FISV owns the clear #3 US debit network with ~25% share behind V/MA https://twitter.com/bluetoothdds/status/1245826416324661248

with 5K participating issuers, FISV owns the clear #3 US debit network with ~25% share behind V/MA https://twitter.com/bluetoothdds/status/1245826416324661248

17) $FISV has big plans for this small, but strategic asset in the merged portfolio

It’s already taken action on several initiatives that will generate $170M+ annual incremental revenue (+25% uplift vs combined Star/Accel pre merger), with room for more over time

It’s already taken action on several initiatives that will generate $170M+ annual incremental revenue (+25% uplift vs combined Star/Accel pre merger), with room for more over time

18) Initiatives include leveraging the $FISV footprint across banks/merchants to drive more issuance/usage of cards enabled and routing of transactions over Star/Accel vs V/MA rails

With connectivity into so many endpoints, there’s optionality on ways to use these network assets

With connectivity into so many endpoints, there’s optionality on ways to use these network assets

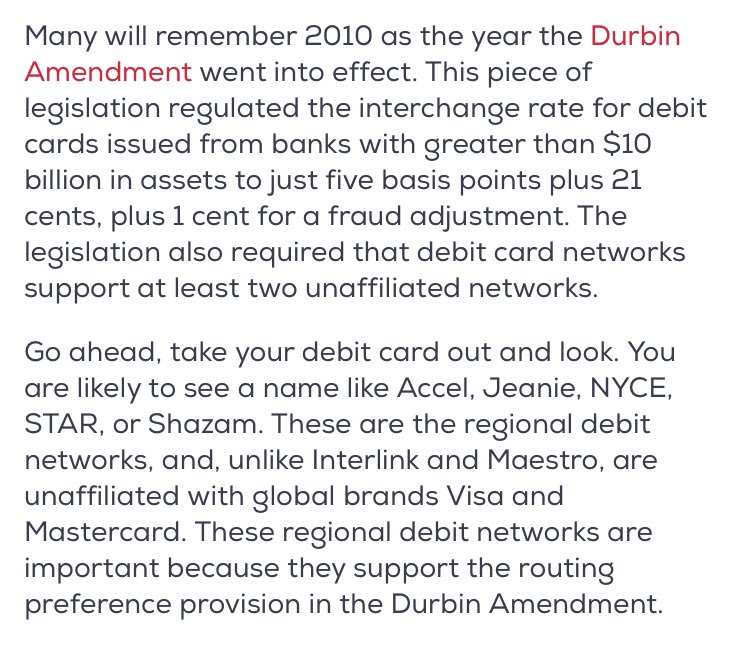

19) Why does PIN debit matter?

In a post-Durbin world:

1) Issuers of V/MA debit in must enable a 2nd unaffiliated (non-V/MA) network brand on the back of card

must enable a 2nd unaffiliated (non-V/MA) network brand on the back of card

2) Merchants accepting V/MA debit have the option to route transactions over this 2nd network, typically lower fees

In a post-Durbin world:

1) Issuers of V/MA debit in

must enable a 2nd unaffiliated (non-V/MA) network brand on the back of card

must enable a 2nd unaffiliated (non-V/MA) network brand on the back of card2) Merchants accepting V/MA debit have the option to route transactions over this 2nd network, typically lower fees

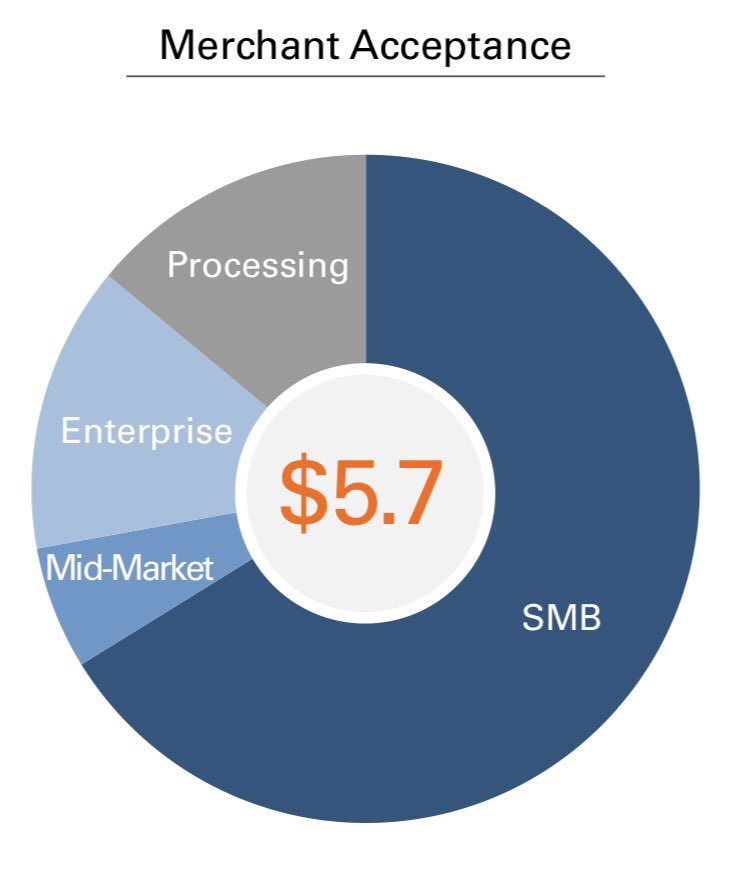

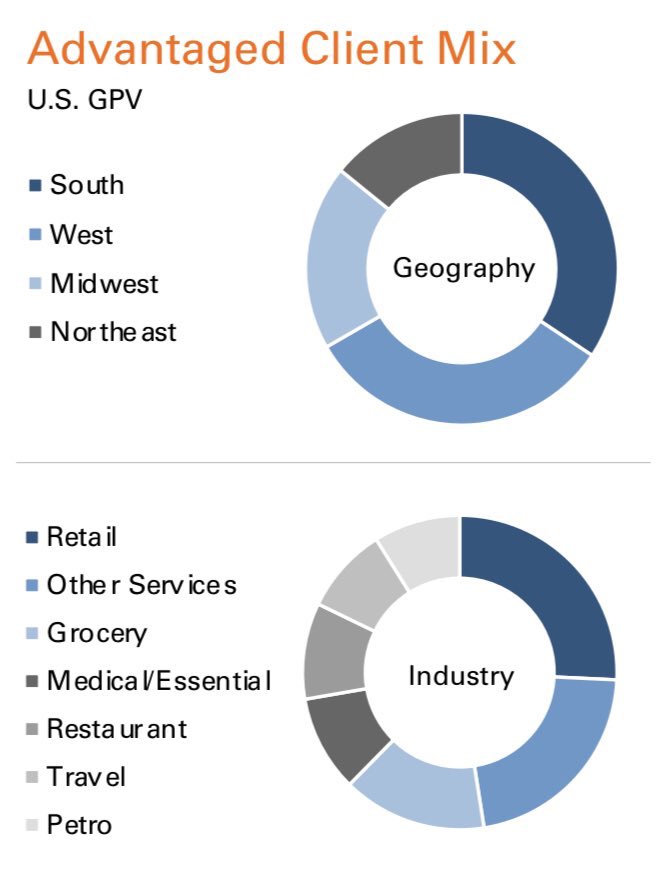

20) The merchant footprint of $FISV is ideally suited to help it grow PIN debit:

- lots of SMB merchants who typically delegate routing decisions to their acquirer (i.e. FISV), and

- a large merchants where volume is concentrated in debit heavy verticals such as grocery/petro

- lots of SMB merchants who typically delegate routing decisions to their acquirer (i.e. FISV), and

- a large merchants where volume is concentrated in debit heavy verticals such as grocery/petro

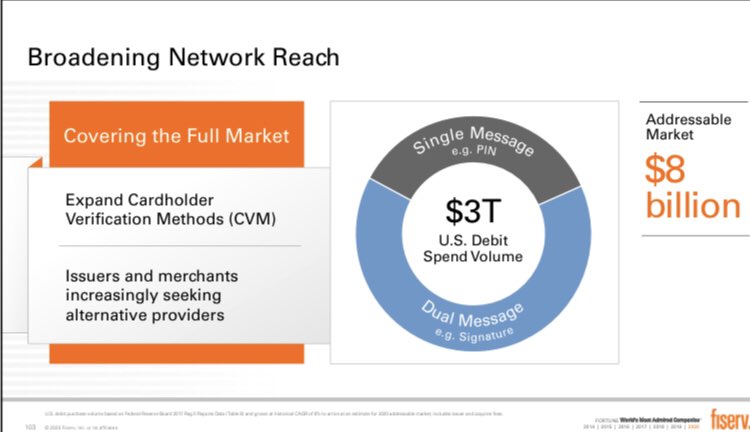

21) US debit market: $3T of GDV, $8B of network revenue

Currently 2/3 of GDV (even more of revenue) is dual-message signature debit (non-PIN) captured 100% by $V (~2/3) $MA (1/3)

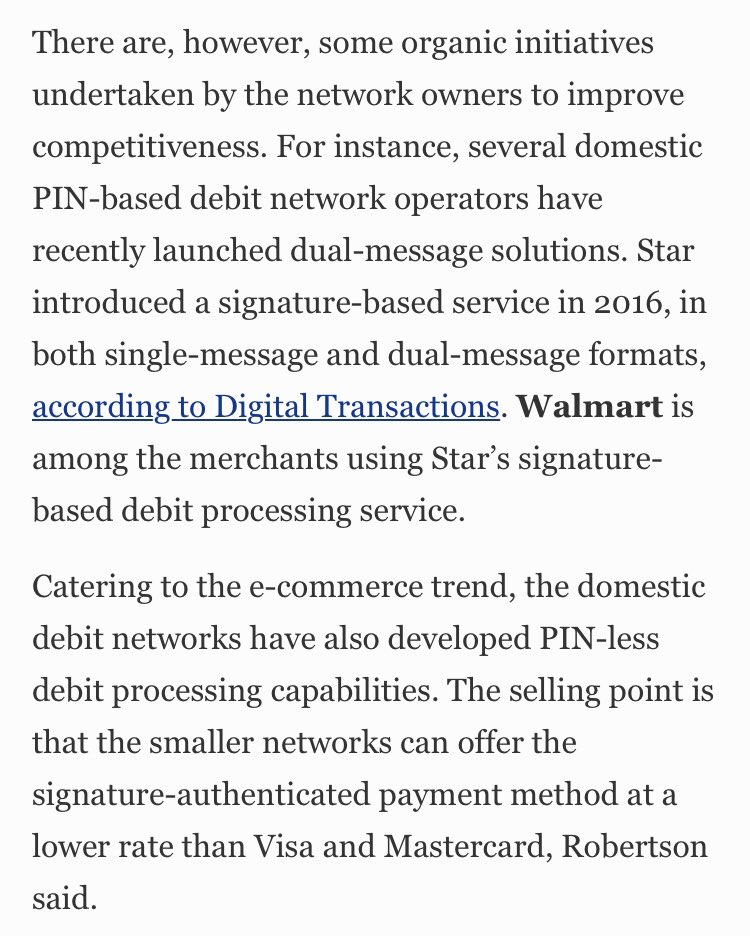

$FISV (Star/Accel) only playing in single-message PIN today but has ambitions to expand to non-PIN

Currently 2/3 of GDV (even more of revenue) is dual-message signature debit (non-PIN) captured 100% by $V (~2/3) $MA (1/3)

$FISV (Star/Accel) only playing in single-message PIN today but has ambitions to expand to non-PIN

22) As the largest non-V/MA network in this $8B revenue market, $FISV has plenty of upside and very little downside (~$700M revenue from Star/Accel today) if the status quo is shaken up a bit

Two area of growth are single message PIN-less debit for e-comm + dual message non-PIN

Two area of growth are single message PIN-less debit for e-comm + dual message non-PIN

23) Back to Durbin, who has been very vocal recently in pushing for more widespread enablement of PIN debit in a post-COVID world of increased digital retail/e-commerce

$FISV would be the #1 beneficiary of any disruption to the V/MA duopoly in US debit https://www.digitaltransactions.net/durbin-asks-fed-chairman-appropriate-enforcement-action-involving-debit-card-transaction-routing/

https://www.digitaltransactions.net/durbin-asks-fed-chairman-appropriate-enforcement-action-involving-debit-card-transaction-routing/

$FISV would be the #1 beneficiary of any disruption to the V/MA duopoly in US debit

https://www.digitaltransactions.net/durbin-asks-fed-chairman-appropriate-enforcement-action-involving-debit-card-transaction-routing/

https://www.digitaltransactions.net/durbin-asks-fed-chairman-appropriate-enforcement-action-involving-debit-card-transaction-routing/

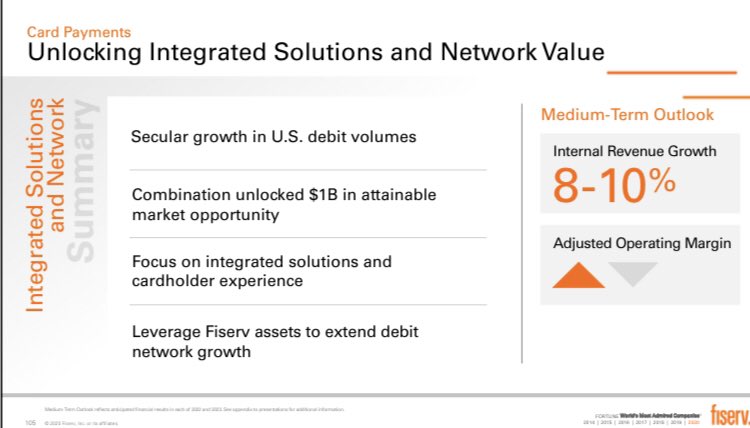

24) Putting this together, the combined Integrated Solutions and Network subsegments of $FISV have a 8-10% growth outlook, implying some ~$150M/yr in incremental revenue off a base of ~$1.6B. FISV sizes the attainable opportunity at $1B unlocked from deal synergies and new growth

25) The other 1/3 of segment revenue is what $FISV calls Digital Payments

This is essentially anything non-card, including P2 (Zelle), Bill Pay, A2A (DDA based ACH) and RTP (real-time/instant for consumer and B2B use cases) in addition to legacy check/wire payments for banks

This is essentially anything non-card, including P2 (Zelle), Bill Pay, A2A (DDA based ACH) and RTP (real-time/instant for consumer and B2B use cases) in addition to legacy check/wire payments for banks

... TBC, more later today

Read on Twitter

Read on Twitter